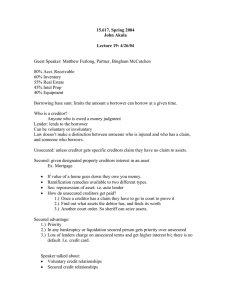

Need Notes for 9/19, 9/21, and 11/2 Commercial Law Bank Collections

advertisement