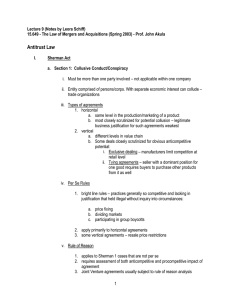

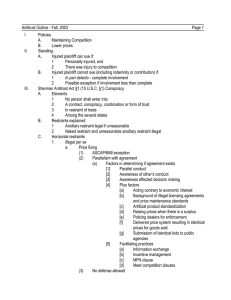

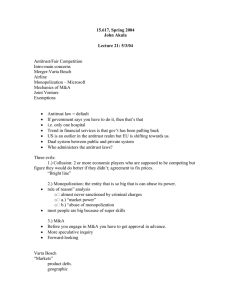

A. Principal Antitrust Statutes 1.

advertisement