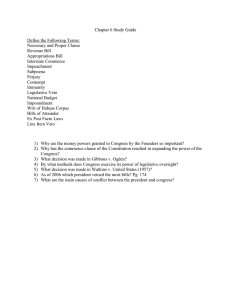

Constitutional Law

advertisement