Document 15938999

advertisement

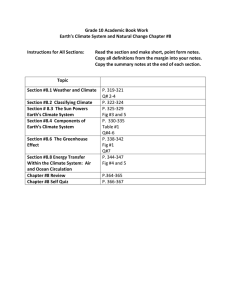

2005 INTERNATIONAL SYMPOSIUM ON KNOWLEDGE-BASED ECONOMY & GIOBAL MANAGEMENT Tainan, TAIWAN, 3-4 November 2005 R&D BASED ECONOMIC GROWTH AND WAGE GAP Gi-Shian Su, and Hsiao-Ching Chang Department of International Business, Southern Taiwan University of Technology Tainan, TAIWAN E-mail:Drsu@mail.stut.edu.tw thesmallke@yahoo.com.tw Abstract. The paper argues acceleration of technological progress contributes to widening wage gap between R&D workers and laborers along the long-run balanced growth path. We extend Jones’[1] model through incorporating an aggregate R&D workers supply function that underscores the stock of knowledge as the entry barrier of the R&D industry. Moreover, the model also narrows down the permissible ranges of the parameters in Jones’ knowledge accumulation function to generate the widening wage gap. Keywords: R&D based economic growth, entry barrier, wage gap, standing on shoulders effect, duplication effect. 1 INTRODUCTION [2][3] Since the seminal work of Solow , technological progress has been seen as the source of economic growth. But the Solow model fails to explain the technological progress itself. It was not until Romer’s work[4][5][6] that provides a formal way of modeling the process of technological progress in which emphasizes the importance of profit-seeking economic agents engaging innovation. Jones[7] rejects Romer’s knowledge accumulation assumption on the empirical front. Moreover, Jones[1] outlined a model that captures the essence of Romer’s argument and modifies the knowledge accumulation function. But Jones’ model does not take account of the wage inequality between R&D worker and raw laborer which is well documented [Blackburn[8]; Bound[9]; Juhn[10]; Katz[[11]; Levy[12]; Murphy[13]; OECD[14]; Gottschalk[15]; Wood[16]; and Esquivel[17]]. It is this drawback that motivates this paper. The paper is organized as follows: Section 2 modifies Jones’[1] model, focusing on the behavior of savings (investment) assumption to pave the way for the model presented in section 3. Section 4 derives the permissible parameters in the knowledge accumulation function, which are crucial in determining the speed of technological progress. Section 5 compares the implications of Jones’ and our model. (L) is divided into two categories: raw labor ( LY ) involving only hand and eye coordination and human capital( H A ) or R&D workers. L H A LY (1) The labor force is assumed to grow at exogenous rate of n, i.e. L n L (2) The final goods sector employ raw labor and machines ( x j ) manufactured by the intermediate sector to produce output ( Y ), which is the aggregate of consumption goods and raw capital. The production function of the final goods sector is assumed as Y L1Y A 0 xj dj (3) where A is the index of existing stock of knowledge or design available in the economy and is a parameter lies between 0 and 1. The firms in the final goods sector are price takers with operation objective of profit-maximization 2 R&D BASED MODEL OF ECONOMIC GROWTH WITH CLASSICAL SAVINGS ASSUMPTION max L1Y The economy consists of three sectors: the final goods, the intermediate goods and R&D. Labor force where p j is the price of jth intermediate goods LY , x j A 0 x j dj wY LY A 0 p j x j dj (4) Gi-Shian Su, and Hsiao-Ching Chang. (machine) and wY is the wage of raw labor. The first order conditions are We are to study steady-state solution of the model. Define the share of R&D worker ( s A ) as wY 1 sA Y LY and p j L1Y xj 1 (5) . (6) Equations (5) and (6) are the demand function of raw labor and x j respectively. The aggregate production function of the final goods sector can be shown as Y K A LY 1 HA L (12) At the steady state, the variable s A is a constant. Taking logarithm over both side of (12 and differentiating with respect to time, we have H L 0 A HA L (13) (7) Substitute (2) into (13) to obtain The firm in the intermediate sector has to get patent from R&D sector and rent raw capital from the final goods sector to produce machines. One unit of raw capital can be transformed into one unit of new machine and vice versa. The evolution of total raw capital or designed machines follows from the classical savings assumption. HA n HA (14) From (10) and (11), we have A A H A K Y sK d K K or where sK is the exogenous savings rate and d is the depreciation rate, also assumed to be exogenous. Finally, a firm with patent enjoys monopolistic profit ( ) as follows: 1 Y A (9) The R&D sector is composed of many R&D workers who utilize the existing stock of knowledge to develop new knowledge or design. Once a new idea has been developed, the R&D worker obtains patent and sells or rents it to the intermediate sector. The patent never expires. The production function of this sector is assumed as A HA where H (15) (8) (10) λ-1 A A H 1A A A (16) The growth rate of knowledge ( g A A / A ) must be a constant in the steady state. From (16) and (14), we determine the rate of technological progress as gA n 1 (17) Just as Solow’s model, the steady state is characterrized by the constancy of capital-effective labor ratio, defined as ~ K k k AL A (18) A (11) is the arrival rate of R&D effort and is the productivity of R&D workers, which is an exogenous variable. The parameter reflects the duplication effect in research and is assumed to be 0 1 in Jones model. Moreover, the parameter 0 is to capture the standing on shoulders effect, i.e. the existing knowledge is h e l p fu l i n d e v e l o p i n g n e w kno wled ge. Taking logarithm on both side of (18) and differentiating with respect to time with equation (2), the definition of g A and the growth rate of labor force in mind, we have ~ ~ k sK k 1 s A 1 d ~ gA n k ~ (19) At steady state we have k 0 . Substitute this con- ~ * dition into (20) to obtain steady-state k as Gi-Shian Su, and Hsiao-Ching Chang. s 1 s A 1 11 ~ k K d gA n (20) where is the arrival rate of R&D given in (15). The price of patent ( PA ) is the present value of future earnings generated from holding the patent. At the steady state, we have g y g A . Because y L Y , we A To determine the growth rate of per capita income y ) as growth, define output per effective labor ( ~ Y y ~ y AL A (21) From (1) and (12), we derive 0 (22) Then substitute (22) into (7) to get Y K A 1 s A L 1 (23) Substitute (23) into (21) to have ~y k~ 1 s A PA LY 1 sA L 1 (24) Substituting (20) into (24), we have 1 sK ~ y* d gA n 1 (25) e rt dt r n (29) With the help of equations (11), (9), (29), equation (30) can be written as rn ent Equating the wage of raw labor and the payoff of R&D worker, we solve for s *A , the equilibrium share of R&D workers . (30) wH PA 1 Y wY LY gA sA A conclude that the growth rate of ( Y / A ) is n . In addition, we can see from (9) that and Y / A are proportional. Therefore, the growth rate of is n . Because the patent last forever and the discount rate (interest rate) is constant (we prove that in the appendix), the price of patent is HA LY (31) Finally, substitute (1), (12), (27), and (A7) into (31) to obtain From the definition of (21), we determine steady-state income per capita, y * , as sK y* d gA n s *A 1 1 sA At (26) Income per capita is proportional to A because s A , g A , sK , , d , and n are constant. Therefore, we have n gY g A 1 To close the model, Jones assumes a person can provide raw labor or do R&D at his/her will. Therefore, the payoff of the two activities should be equal and sA can be calculated from this condition. We will modify this assumption in the next section The wage of raw labor is given in (5). The wage of R&D worker ( wH ) is governed by the following equation wH PA (28) 2 1 n d n 1 n 1 sK α λn (32) 3 (27) 1 THE MODEL The model differentiates the market of R&D workers and raw labor. Through the force of supply and demand, we determine the associated equilibrium wage and quantity from which we derive the wage ratio ( wR ) and the share of R&D workers. The demand function of R&D workers is derived from Jones’ model. Substitute (29) into (28) and take into consideration of (11) and (9) to get wH gA 1 rn Y HA Assume the supply function of R&D workers as (33) Gi-Shian Su, and Hsiao-Ching Chang. H A F wH , Y , A wH Y A2 (34) and supply of R&D workers. Solving (33) and (34) simultaneously, we determine the momentary equilibrium wage of as H A is positively related with wH because people tend to be attracted to high- pay jobs. The higher the existing knowledge level is, the higher the barrier of entry because it is necessary to study the existing stock of knowledge before the person can start to innovate. Therefore, H A and A are negatively correlated. This is why A appears in the denominator in (34). Finally, a bigger economy should be able to supply more R&D workers ceteris paribusi. Another rationale in formulating the supply function as equation (34) as follows: rewrite (34) as and the momentary equilibrium number of R&D workers w Y HA H A A g 1 s*A A rn (35) From the experience gain from Jones’ model, Y / A and L should grow at the same rate at steady state. To have steady-state solution, H A should be related with the growth rate of L. This is why ( Y / A ) appears in the right hand side of (35). The first A appears in the denominator to reflect the entry barrier of R&D sector. Methodologically speaking, we directly impose the assumption of aggregate supply function of R&D workers in (34). In other words, we do not provide micro foundation of (34). This should not be the drawback of the model. Many prominent economists do not attach much importance on providing micro foundation in formulating macroeconomic model. In a sequence of interviews conducted by Snowdon[18]ii , several economists were asked the following question “How important do you think it is for macroeconomic models to have choice-theoretic micro foundations?” To give an example, we quote the reply from Gregory Mankiw: ”It is certainly true that all macro phenomena are the aggregate of many micro phenomena; in that sense macroeconomics is inevitably founded on microeconomics. Yet I am not sure that all macroeconomics necessarily has to start off with microeconomic building-blocks. We have a lot of models like the IS-LM model which are very useful, even though those models don’t start off with the individual unit and build up from there .”(p.332 italics added) Next, we consider the interaction of the demand i Two possibilities for the case of bigger economy: (1) the greater is the population, the more people can become R&D workers and (2) the higher the average income, the more affordable to become an R&D worker. ii In addition to Gregory Mankiw, the authors also interviewed Stanley Fischer (p34), James Tobin (p129), David Laidler (p180) and Robert Lucas (p221). They all carried similar attitude. * H w 1 g 1 A rn g 1 H A* A rn 2 (36) A 1 2 (37) Y A Substitute (37) into (12), we have 1 2 Y AL (38) Finally, we solve the steady-state share of R&D * * worker, s A . At the steady state, s A must be a constant. Following the logic presented in section 1, we conclude gY g A n 1 (27) , exactly the same as Jones’ model. Substituting equations (17), (21), and (25) into equation (38), we have s*A 1 1 λn 1 1 λn 2 n d 1 n sK 2 sK λn n d 1 1 1 λn 1 1 λn 2 n d 1 n sK 2 sK λn nd 1 1 (39) Next , we determine the equilibrium wage and the quantity of raw labor. Under the assumption of full employment, the quantity of raw labor is simply the labor force minus the equilibrium number of R&D workers: L*Y L 1 s*A (40) Solving (5) and (40) simultaneously to determine the equilibrium wage of raw labor as Gi-Shian Su, and Hsiao-Ching Chang. w*Y y 1 α 1 s*A (41) * and d into (44), we obtain the functional relation wR and ( , ) demonstrated in Fig. 1. Define the wage ratio between R&D worker and raw labor ( wR ) as wR wH wY (42) Substitute the equilibrium wage described by (36) and (41) into (42) to get wR 1 s ~ y Fig.1 the relation between wR* and ( , ) 1 2 gA r n 1 * A (43) where ~y is given in (12). Using (17) and (25), equation (43) gives the steady-state wage ratio as From Fig. 1 we infer wR* is an increasing function of and . Therefore, the permissible ranges should lie within the upper contour set UC f (wr' 1) where the contour is defined as λn nd 1 wR* sK 1 λnα λn 2 n d 1 n 1 1 sK 1 2 1 2 0.015317 λ 3 0.015317 0.1 1 1 0 . 181 2 0 . 4 * 0 . 015317 λ 0.15317 λ 0.4 2 0.015317 0 . 1 1 0.15317 1 0.41 0.181 (45a) (44) or According to (44), wR* is a function of parameters only and hence is a constant. Therefore, wH and wY should grow at the same speed. In fact, (36) demonstrates that wH should grow at the rate of g A and (41) reveals that the growth rate of wY is g y . Here we obtain the same result as Jones' model, specifically, equation (27). 4 THE PERMISSIBLE RANGES OF AND Jones’ model already points out the range of parameters and must be 0 1 and 0 1 . Our model adds another feature—wage differentials and hence the range of parameters should be narrower. The existence of wage gap implies the 12.414108586945368896 1 (45b) Combining the restriction from Jones’ model, we deduce the permissible ranges lie within the triangle area in Fig. 2 enclosed by the two north-east borders of the box and the straight line which is the locus of (45b).The slope of the straight line is negative. The smaller the duplication effect (associated with larger ) is, the faster technological progress is, which * * causes wR to increase. To keep wR 1 , (standing on shoulders effect) has to decline. * wage ratio wR must be greater than 1. Due to the complexity of (44), we use computer simulation to pin down the permissible range of parameters. The data is adopted from Barro & Sala-i-Martin[19]. n 1.5317 % is the U.S. average population growth rate between 1890 and 1990. sK 18.1 % is the average gross savings rate from 1870 to1989. 0.4 and d 0.1 . Substituting the values of n , sK , , Fig. 2 the permissible ranges of and Gi-Shian Su, and Hsiao-Ching Chang. 5 COMPARATIVE STEADY STATE We focus on the effect of a change in the parameters on the endogenous variables s *A and wR* and compare our model with Jones’ model. An increase in i.e. the smaller the number of R&D workers simultaneously engaging the same research (duplication effect) will accelerate the speed of technological progress and hence raise the entry barrier of doing research. Therefore s *A is lower. This fact is demonstrated in Fig.3. A decrease in s *A pushes up the wage of R&D workers and causes wR* to increase, as reported in Fig. 4. These are the implication of our model. Fig. 5 relation between and s *A in Jones’ model The value of parameters are n 0.015317 , d 0.1 , 0.98 , sK 0.181 , 0.4 and 0.01 ~ 0.99 . An increase in (greater standing on shoulders effect) accelerates the accumulation of knowledge and consequently increases the entry barrier of R&D industry. This, in turn, reduces the number of R&D workers and s *A as described in Fig. 6. Just as Fig. 4. a decrease in s *A pushes up the wage of R&D workers and causes wR* to increase, as reported in Fig. 7.. Fig. 3 relation between and s *A Fig. 6 relation between and s A * Fig.4 relation between and wR* The value of parameters are n 0.015317 , d 0.1 , 0.99 , sK 0.181 , 0.4 and 0.124 ~ 0.99 。 In contrast, Jones’ model assumes no wage inequality since there is no entry barrier in R&D * industry. Therefore wR is always equal to 1. An increase in also boosts the wage of R&D workers and attracts more people doing research. Therefore, s *A increases as reported in Fig. 5. Fig. 7 relation between and wR* The value of parameters are n 0.015317 , d 0.1 , sK 0.181 , 0.4 and 0.99 Jones’ model reveals different implication again because there is no entry barrier. An increase in induces faster wage increases in R&D that attracts more people engaging research and hence increases s *A as depicted in Fig. 8 Gi-Shian Su, and Hsiao-Ching Chang. Fig. 8 relation between and s *A in Jones’ model The values of parameters are n 0.015317 , d 0.1 , sK 0.181 , 0.4 and 0.99 . An increase in the population growth rate n raises the speed of the increase in the number of R&D workers, quickens the process of knowledge accumulation and eventually heightens the entry barrier that causes s *A to decline as demonstrated in Fig. 9. As explained previously, a decrease in s *A causes wR* to increase (see Fig. 10) Fig. 9 relation between n and s *A Fig. 10 relation between n and wR* Fig. 11 relation between model n and s *A in Jones’s The values of the parameters are n 0.01 ~ 0.1, d 0.1 , 0.98 , sK 0.181 , 0.4 and 0.5 。 We are in a position to draw the main conclusion of this paper. An increase in the population growth rate, an increase in the standing on shoulders effect and a decrease in the duplication effect contribute to a faster technological progress [see equation (27)]. These changes also increase wage inequality, as evident from Fig. 4, 7, and 10. Therefore, our model predicts that a faster technological progress goes hand in hand with wage inequality because of the change in underlying forces of population growth and the improvement in the efficiency in knowledge accumulation. Our conclusion is consistent with the empirical findings of Esquivel[[17]] and Bound[[9]] who argue wage differential is driven by technological change. Finally, an increase in the savings rate sK raises the size of the economy. A bigger economy will churn out more R&D workers and hence increase s *A . This fact is reported in Fig. 12. From previous experience, an increase in s *A depressed wR* as demonstrated in Fig. 13. The impact of sK on s *A in Jones’s model is the same as our model (see Fig. 14). But the underlying adjustment mechanism is different. An increase in sK raises the raw capital to labor ration, which in turn cheapen the price of raw capital. Lower price of raw capital increases the profitability of intermediate goods sector and eventually the value of patent (and the wage of R&D workers). Higher pay attracts more people join the R&D sector and in equilibrium, raises s *A . The values of the parameters are n 0.01 ~ 0.1, d 0.1 , 0.98 , sK 0.181 , 0.4 and 0.5 。 However, Jones’ model also generates different result from our model. As argued above, an increase in population growth rate hastens technological progress and boosts the wage of R&D workers. Because there is no entry barrier, the number of researchers increases and raises s*A . This result can be found in Fig. 11. Fig. 12 relation between s K and s *A Gi-Shian Su, and Hsiao-Ching Chang. APPENDIX : THE PROOF OF INTEREST RATE R IS A CONSTANT From the text, we have (with suppression of subscript j) p L1Y x 1 (A1) and it can be shown that Fig. 13 relation between s K and wR* The values of the parametersare n 0.015317 , d 0.1 , 0.96 , sK 0.01 ~ 0.6 , 0.4 and 0.8 。 p 1 r (A2) Combining (A1)and (A2), we have r 2 L1Y x 1 (A3) With (7) and the fact that x K A , we have Fig. 14 relation between model sK and s *A in Jones’ The values of the parameters are n 0.015317 , d 0.1 , 0.99 , sK 0.01 ~ 0.6 , 0.4 and 0.99 . 6 CONCLUDING REMARKS We extend Jones’ model to generate wage differentials by emphasizing the existence of entry barrier in the R&D sector and consequently narrows down the ranges of key parameters ( and ) in the knowledge accumulation function. We also demonstrate that faster technological progress induced by faster population growth, less duplication in R&D effort and/or more efficient use of the existing knowledge in R&D could widen the wage gap between skilled(R&D) and unskilled workers(raw laborer). Our model is subject to the following limitations: 1. The technological progress is assumed to be horizontal innovation not vertical innovation i.e. technological progress only increases the variety of intermediate durable goods instead of raising the productivity of it. 2. Since the return of old patent does not decrease because of the advent of new one, the model fails to capture Schumpeterian-style process of creative destruction[20]. 1 K 1 r 2 L1Y 2 ALY K 1 A ALY 1 K 2 Y 2 K K (A4) From (8), we obtain K d K Y K sK (A5) ~ From k constant , we derive K A L K A L (A6) Substitute (A5) and (A6) into (A3) to have r 2 n g A d (A7) sK REFERENCES [1] Jones, Charles I., 1995. R & D-Based Models of Economic Growth. Journal of Political Economy, 103(4):759-84. [2] Solow, Robert M., 1956. A Contribution to the Theory of Economic Growth. Quarterly Journal of Economics, 70(1):65-94. [3] Solow, Robert M., 1957. Technical Change and Gi-Shian Su, and Hsiao-Ching Chang. the Aggregate Production Function. Review of Economics and Statistics, 39(3):312-20. [4] Romer, Paul M., 1986. Increasing Returns and Long-Run Growth. Journal of Politica l Economy, 94(5):1002-37. [5] R o m e r , P a u l M . , 1 9 9 0 . E n d o g e n o u s Technological Change. Journal of Political Economy, 98(5):S72-102. [6] Ro mer, P aul M., 1 9 9 4 . T he Or igins o f Endogenous Growth. Journal of Economic Perspectives, 8(1):3-22. [7] Jones, Charles I, 1995b. Time Series Tests of Endogenous Growth Models. Quarterly Journal of Economics, 110(2):495-525. [8] Blackburn, McKinley, Bloom D., and Freeman R.B., 1990. The Declining Position of Lessskilled American Males. In: Burtless, G. (Ed.), A Future of Lousy Jobs?. Brookings Institution, Washington, DC:31-67. [9] Bound, J. and Johnson G., 1992. Changes in the Structure of Wages in the 1980s: an Evaluation of Alternative Explanations. Am erican Economic Review, 82(3):371-92. [10] Juhn, C., Murphy K., and Pierce B., 1993. Wage Inequality and the Rise in Return to Skill. Journal of Political Economy, 101(3):410-42. [11] Katz, L., and Revenga A.,1989. Changes in the Structure of Wages: the United States vs. Japan. Journal of Japanese and International Economies, 3(4):522-53. [12] Levey, F., and Murnane R.J., 1992. U.S . Earnings Levels and Earnings Inequality: a Review of Recent Trends and Propose d Explanations. Journal of Economic Literature, 30(3):1333-81. [13] Murphy , K., and Welch F., 1991. The Role of International Trade in Wage Differentials. In Kosters, M. (Ed.), Workers and Their Wages, AEI Press:39-69. [14] OECD, 1997 Trade, earnings and employment: assessing the impact of trade with emerging economies on OECD labor markets, Employment Outlook. OECD, Paris [15] Gottschalk, P.,and Smeeding T., 1997. CrossNational Comparisons of Earning and Income Inequality. Journal of Economic Literature, 35(2):633-87. [16] Wood, A., 1997. Openness and Wage Inequality in Developing Countries: the Latin American Challenge to the East Asian Conventional Wisdom. World Economic Review, 11(1):3357. [17] Esquivel, G., and Rodriguez-Lopez J., 2003. Technology, Trade, and Wage Inequality in Mexico Before and After NAFTA. Journal of Development Economics, 72(2):543-65. [18] Snowdon, B., Vane H. and Wynarczyk P., 1994. A Mo d ern Guid e to Ma cro eco no m ics , Cheltenham, UK: Edward Elgar. [19] Barro, J., and Xavier Sala-i-Martin, 2004. Economic Growth, Cambridge, MA: MIT Press. [20] Schumpeter, J. A., 1934. The Theory of Economic Development, Cambridge, MA: Harvard University Press.