A comparison on GARCH parameter estimation: SVR versus ML Ramya Ramakrishnan

advertisement

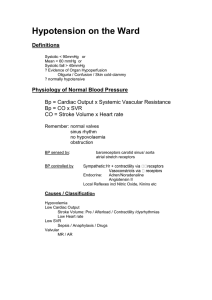

A comparison on GARCH parameter estimation: SVR versus ML Ramya Ramakrishnan Advanced Machine Learning Overview • GARCH is a well known method in the financial community for modeling and predicting the conditional volatility of market returns – Assumes data is normally distributed and parameter estimates are based on ML procedures – Financial data is rarely normally distributed: leptokurtic • We use Support Vector Regression (SVR) to estimate the parameters of GARCH – SVR does not assume that there is a probability density function over the return series and it adjusts the parameters based on empirical risk minimization – SVR defines an insensitivity zone that results in its ability to deal with any pdf • Results on simulation and experimental data show – GARCH models can be accurately estimated using SVR – SVR estimates have higher predictive ability that those obtained using ML methods Methodology Implement SVR using IRWLS methodology Compare Estimation Results for SVR and ML using Simulated Data Compare Estimation Results for SVR and ML using Empirical Data Understanding GARCH(1,1) Generalized Autoregressive Conditional Heteroskedasticity • GARCH – “heteroskedasticity”: variances of the error terms is not equal – the error terms may be expected to be larger for some points/ranges of the data than for others – “conditional heteroskedasticity”: heteroskedasticity that is not random and has autocorrelation • time varying volatility or volatility clustering. a process yt follows a GARCH(1,1) model if yt = μ + σtεt σt2 = ω + αyt-12 + βσt-12 εt is an uncorrelated process with zero mean and unit variance μ ≈ 0 without affecting model performance Forecast : yt,predict2 = ωpredict + (αpredict+βpredict)yt-1,actual2 Importance of GARCH in Finance • Financial returns series often clearly exhibit conditional heteroskedasticity (volatility clustering) • Being able to accurately forecast volatility is especially important in finance for risk analysis, portfolio selection, and derivative pricing • Goal of GARCH models is to provide a volatility measure Log Returns of S&P 500: Jan 02 - Dec 04 0.08 0.06 0.04 0.02 0 -0.02 -0.04 -0.06 Understanding SVR Iterated Re-Weighted Least Squares • Problem formulation min Lp = 0.5||w||2 – 0.5∑(aiei2 + ai*(ei*)2) where: ei = ε – yi + Ф(xi)w + b ai = 2αi / ei ei* = ε + yi + Ф(xi)w + b ai* = 2αi / ei* • Basic Procedure 1. Fixing ai and ai* minimize Lp 2. Recalculate ai and ai* from the solution in step 1 3. Repeat until convergence • Project Parameters RBF kernel : exp(-||xi-xj||2/2σ2) σ and ε terms selected by cross validation Simulation Results Relative R-squared = (R2SVR – R2ML)/ R2ML As kurtosis increases, SVR estimates provide better predictive results Performance for normal distribution varies by sample size – 1000 samples: ML does marginally better – 500 samples: SVR does better than ML Simulation Results Relative R-squared • • • 100% 80% 60% 1000 s am ples 40% 20% 0% -20% 500 s am ples 3 4 5 6 Kurtosis 10 independent trials 7 8 9 Empirical Results on S&P 100 Returns ML SVR ω 1.460 E -6 9.20 E -6 α 9.998 E -2 0.0461 β 0.888 0.0956 Kurtosis (yt/σt,predict) 5.37 5.86 3.631 0.6028 3.661 0.599 7.63% 5.29% 10.394% 13.338% LB Statistic (yt/σt,predict)2 p-value R2 for forecast in sample out of sample Conclusions • SVR based estimates of GARCH parameters produce more accurate predictions of financial volatility than ML estimates • ML tries to fit the residuals to a Gaussian distribution but if this is not the case it will increase the error by forcing the residuals to be Gaussian. • SVR tries to get the best fit with the data, not relying on prior knowledge and focuses on minimizing the prediction error with a given machine complexity