ROMANIA WEEKLY UPDATE The World Bank Office, Romania

advertisement

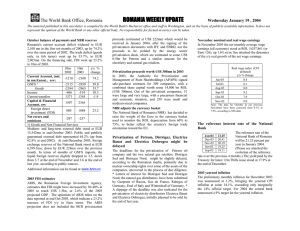

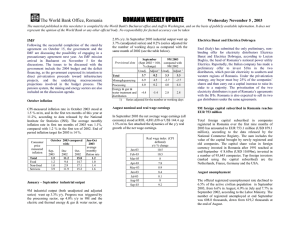

The World Bank Office, Romania ROMANIA WEEKLY UPDATE Wednesday March 17 , 2004 The material published in this newsletter is compiled by the World Bank's Bucharest office and staff in Washington, and on the basis of publicly available information. It does not represent the opinion of the World Bank or any other official body. No responsibility for factual accuracy can be taken Romania and WB launch USD 34.34mn Forestry Development Project The Government of Romania and the World Bank officially launched in Brasov the Forestry Development Project, which aims to improve the sustainable management of state and private forests. The total cost of the Forest Development Project is $34.34 million, consisting of a US$25 million World Bank loan, $2.3 million from the Romanian Government, and $4.59 million from local sources. The project has five components: Establishing systems to ensure sustainable management of private forest lands, Mitigating the consequences of restitution on management of state forest land, Supporting increased productivity and competitiveness of forest industries, Building public support for sustainable forest management and Managing and monitoring the project. “This project is designed to improve the management of production forests, with key roles for the Ministry of Agriculture, Forestry and Rural Development (MAFRD) and the National Forest Administration (NFA)”, explained Owaise Saadat, World Bank Country Manager for Romania. February inflation The monthly CPI-measured inflation rate in February 2004 stood at 0.6 % m/m, according to data released by the National Institute for Statistics (INS). Consumer pricemeasured inflation Total Food Non-food Services February 2004 compared with: Monthly average inflation rate during 1 I – 29 II Jan2004 0.6 0.8 0.5 0.5 Dec2003 1.7 1.2 2.3 1.7 2004 0.9 0.6 1.2 0.9 2003 1.1 1.6 0.9 -0.1 The Government forecasts a 9% end-of-period inflation this year. Price hikes of food products continued to decelerate in February to 0.8% m/m. In 2002-2003, the food prices have constantly increased at a slower rate than the headline inflation, while services prices have increased at a steeper pace. The Statistics Office has announced a new basket for computing the CPI, based on the households' consumption in 2002. Romania negotiates new arrangement with IMF The talks with the IMF on a new SBA have started later than planned and the outcome is not certain yet. The conclusion of a new SBA, likely of a precautionary type, depends on the country’s ability to embark upon a large set of reforms, including tighter wage policies, justice reforms and governance matters. The Fund mission that has been in Bucharest over the last few weeks presented to the Government the draft evaluation report on the impact of the macrostabilization programs negotiated over the last 14 years, which is to be debated by IMF's Managing Board on March 22. The Fund's draft report on the country's transition since 1989 reportedly criticizes the slow structural reforms. The IMF is expected to decide on a new agreement in the coming weeks and would send a new mission to Bucharest for final talks on the Memorandum of Understanding in April. The EU expects Romania to smoothly continue its relations with the IMF and a failure of the Government to seal a new arrangement, irrespective of the reasons, would negatively impact upon the accession talks. A negative Fund's report on the past year's reforms would most likely sink the Government's hopes for completing the talks with the EU this year and bringing the country into the Union in 2007. International reserves of NBR reach EUR 6,429.4 mn At end-February 2004, foreign exchange reserves of the National Bank of Romania ran at EUR 6,429.4 million The EUR 78.3 million increase in February 2004 was the result of the following: EUR 63.4 million worth of purchases by the central bank on the forex market; EUR 21.4 million worth of incomes from international reserve management; EUR 57.2 million worth of principal repayments and payment of interest on external public debt, direct and bearing the guarantee of the Ministry of Public Finance; EUR 50.7 million in other net inflows (change in the foreign-exchange required reserves deposited by commercial banks, surrenders to official forex reserves, bank fees and commissions, membership quotas, etc.). By end-2004, payments due on external public debt, direct and bearing the guarantee of the Ministry of Public Finance, amount to EUR 1,293 million. Additional information can be found at www.bnro.ro BCR employees to purchase 8% of bank's shares The employees of BCR will start negotiations for purchasing 8% of the bank's shares immediately after they log a formal request, according to Romanian media sources. After the deal, the Privatization Agency will remain with 36% of the shares. On another plane, EBRD and IFC are close to take over 25% of the bank's shares for USD 222mn. The price thus paid by the two foreign investors is USD 1.13 per share against a USD 0.33 face value. State-run companies turned into shares debts of USD 240 million The state-run companies got rid last year of budgetary debts of ROL 7,651 bn (USD 240 mn) by turning into shares their debts held by AVAB, according to the AVAB’s 2003 report. More than a third in the total of transformed debts represent Oltchim RamnicuValcea’s debt. According to Law 137/2002 on stepping up privatization, AVAB is compelled to turn into shares the debts of the companies under privatization.