Computer Output for Question 1 Regression A

advertisement

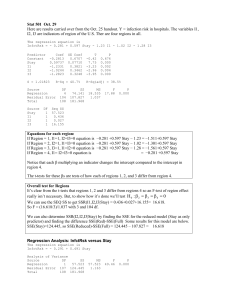

252y0641s1 12/6/06 Computer Output for Question 1 Regression A Data description C1 Price - Price of property in $thousands C2 Livsqft – Living area in thousands of square feet C3 Lotsqft – Lot size in thousands of square feet. C4 Loc1 – A dummy variable, 1 if property is in Area 1 of 3 C5 Loc2 – A dummy variable, 1 if property is in Area 2 of 3 C6 Baths – Number of baths in house. C7 Lot 1 – An interaction variable, the product of Lotsqft and Loc1. C8 Lot 2 - An interaction variable, the product of Lotsqft and Loc2. C9 Liv 1 – An interaction variable, the product of Livsqft and Loc1. C10 Liv 2 - An interaction variable, the product of Livsqft and Loc2. C11 Libsqsq – The living area squared. This is a regression suggested by Leonard J Kazmier. The dependent variable is the price of the property. The remainder of the variables listed above are candidates for explanatory variables. Since there are only 30 observations the number of independent variables needed to explain the values of the price variable should be relatively small. The data set and descriptive statistics appear at the end. ————— 12/4/2006 8:36:27 PM ———————————————————— Welcome to Minitab, press F1 for help. MTB > WOpen "C:\Documents and Settings\RBOVE\My Documents\Minitab\252x06041021.MTW". Retrieving worksheet from file: 'C:\Documents and Settings\RBOVE\My Documents\Minitab\252x06041-021.MTW' Worksheet was saved on Mon Dec 04 2006 Results for: 252x06041-021.MTW MTB > regress c1 10 c2 c3 c4 c5 c6 c7 c8 c9 c10 c11; SUBC> vif. 1)Regression Analysis: price versus livsqft, lotsqft, ... The regression equation is price = - 783 + 705 livsqft - 2.90 lotsqft + 569 loc1 + 423 loc 2 + 18.1 baths + 5.78 lot1 - 1.07 lot2 - 349 liv1 - 197 liv2 - 125 livsqsq Predictor Coef SE Coef Constant -782.8 265.1 livsqft 704.6 213.8 lotsqft -2.900 3.283 loc1 569.4 190.3 loc 2 423.3 139.0 baths 18.121 4.392 lot1 5.775 4.709 lot2 -1.071 5.196 liv1 -349.3 117.8 liv2 -196.54 79.91 livsqsq -125.48 39.56 S = 6.49288 R-Sq = 97.5% T P VIF -2.95 0.008 3.30 0.004 8142.7 -0.88 0.388 76.1 2.99 0.007 5725.1 3.05 0.007 3054.2 4.13 0.001 2.3 1.23 0.235 520.6 -0.21 0.839 997.7 -2.96 0.008 4382.0 -2.46 0.024 3414.8 -3.17 0.005 4606.9 R-Sq(adj) = 96.2% Analysis of Variance Source DF SS Regression 10 31197.6 Residual Error 19 801.0 Total 29 31998.6 MS 3119.8 42.2 F 74.00 P 0.000 1 252y0641s1 Source livsqft lotsqft loc1 loc 2 baths lot1 lot2 liv1 liv2 livsqsq DF 1 1 1 1 1 1 1 1 1 1 12/6/06 Seq SS 29642.7 126.4 2.9 492.5 472.4 4.2 27.5 0.0 4.7 424.2 Unusual Observations Obs livsqft price Fit SE Fit Residual St Resid 29 2.50 199.40 190.70 5.36 8.70 2.37R R denotes an observation with a large standardized residual. MTB > regress c1 9 c3 c4 c5 c6 c7 c8 c9 c10 c11; SUBC> vif. 2)Regression Analysis: price versus lotsqft, loc1, ... The regression equation is price = 85.2 + 2.12 lotsqft - 48.5 loc1 - 20.4 loc 2 + 11.0 baths - 1.73 lot1 - 4.13 lot2 + 23.3 liv1 + 29.2 liv2 + 4.16 livsqsq Predictor Coef SE Coef T P VIF Constant 85.16 36.25 2.35 0.029 lotsqft 2.121 3.552 0.60 0.557 59.7 loc1 -48.47 39.41 -1.23 0.233 164.5 loc 2 -20.39 41.96 -0.49 0.632 186.5 baths 11.012 4.675 2.36 0.029 1.7 lot1 -1.728 5.036 -0.34 0.735 398.9 lot2 -4.127 6.247 -0.66 0.516 965.9 liv1 23.32 40.44 0.58 0.571 345.9 liv2 29.22 50.24 0.58 0.567 904.3 livsqsq 4.156 5.025 0.83 0.418 49.8 S = 7.93322 R-Sq = 96.1% R-Sq(adj) = 94.3% Analysis of Variance Source DF SS Regression 9 30739.9 Residual Error 20 1258.7 Total 29 31998.6 Source lotsqft loc1 loc 2 baths lot1 lot2 liv1 liv2 livsqsq DF 1 1 1 1 1 1 1 1 1 MS 3415.5 62.9 F 54.27 P 0.000 Seq SS 26347.5 61.3 3609.1 509.1 8.0 47.0 59.8 55.1 43.0 Unusual Observations Obs lotsqft price Fit SE Fit Residual St Resid 29 20.0 199.40 186.60 6.37 12.80 2.71R R denotes an observation with a large standardized residual. 2 252y0641s1 12/6/06 MTB > regress c1 7 c3 c4 c5 c6 c9 c10 c11; SUBC> vif. 3)Regression Analysis: price versus lotsqft, loc1, ... The regression equation is price = 99.0 + 0.67 lotsqft - 58.7 loc1 - 28.3 loc 2 + 11.4 baths + 15.1 liv1 - 0.2 liv2 + 6.04 livsqsq Predictor Coef SE Coef T P VIF Constant 99.01 24.22 4.09 0.000 lotsqft 0.671 2.072 0.32 0.749 21.9 loc1 -58.68 33.91 -1.73 0.098 131.1 loc 2 -28.32 37.49 -0.76 0.458 160.2 baths 11.441 4.105 2.79 0.011 1.4 liv1 15.12 21.04 0.72 0.480 100.7 liv2 -0.22 19.15 -0.01 0.991 141.4 livsqsq 6.044 3.435 1.76 0.092 25.0 S = 7.64800 R-Sq = 96.0% R-Sq(adj) = 94.7% Analysis of Variance Source DF SS Regression 7 30711.8 Residual Error 22 1286.8 Total 29 31998.6 Source lotsqft loc1 loc 2 baths liv1 liv2 livsqsq DF 1 1 1 1 1 1 1 MS 4387.4 58.5 F 75.01 P 0.000 Seq SS 26347.5 61.3 3609.1 509.1 2.4 1.3 181.1 Unusual Observations Obs lotsqft price Fit SE Fit Residual St Resid 29 20.0 199.40 184.53 5.16 14.87 2.63R R denotes an observation with a large standardized residual. MTB > regress c1 5 c3 c6 c9 c10 c11; SUBC> vif. 4)Regression Analysis: price versus lotsqft, baths, liv1, liv2, livsqsq The regression equation is price = 68.4 + 2.73 lotsqft + 10.6 baths - 19.9 liv1 - 13.3 liv2 + 5.10 livsqsq Predictor Coef SE Coef T P VIF Constant 68.38 15.84 4.32 0.000 lotsqft 2.731 1.726 1.58 0.127 14.6 baths 10.568 4.157 2.54 0.018 1.4 liv1 -19.906 5.390 -3.69 0.001 6.3 liv2 -13.334 3.662 -3.64 0.001 5.0 livsqsq 5.105 3.425 1.49 0.149 23.9 S = 7.80489 R-Sq = 95.4% R-Sq(adj) = 94.5% Analysis of Variance Source DF SS Regression 5 30536.6 Residual Error 24 1462.0 Total 29 31998.6 Source lotsqft baths liv1 liv2 livsqsq DF 1 1 1 1 1 MS 6107.3 60.9 F 100.26 P 0.000 Seq SS 26347.5 168.4 123.9 3761.5 135.3 3 252y0641s1 12/6/06 Unusual Observations Obs lotsqft price Fit SE Fit Residual St Resid 29 20.0 199.40 186.61 5.12 12.79 2.17R R denotes an observation with a large standardized residual. MTB > regress c1 4 c6 c9 c10 c11; SUBC> vif. 5)Regression Analysis: price versus baths, liv1, liv2, livsqsq The regression equation is price = 86.8 + 11.1 baths - 17.0 liv1 - 10.1 liv2 + 9.92 livsqsq Predictor Coef SE Coef Constant 86.77 11.08 baths 11.090 4.267 liv1 -16.988 5.214 liv2 -10.148 3.149 livsqsq 9.915 1.622 S = 8.03608 R-Sq = 95.0% T P VIF 7.83 0.000 2.60 0.015 1.4 -3.26 0.003 5.6 -3.22 0.004 3.5 6.11 0.000 5.1 R-Sq(adj) = 94.1% Analysis of Variance Source DF SS Regression 4 30384.2 Residual Error 25 1614.5 Total 29 31998.6 MS 7596.0 64.6 Source baths liv1 liv2 livsqsq DF 1 1 1 1 F 117.62 P 0.000 Seq SS 8914.5 8231.0 10825.9 2412.9 Unusual Observations Obs baths price Fit SE Fit Residual St Resid 3 2.00 87.90 102.84 3.19 -14.94 -2.03R 27 3.00 195.85 209.28 5.08 -13.43 -2.16R 29 3.00 199.40 182.01 4.34 17.39 2.57R R denotes an observation with a large standardized residual. MTB > BReg c1 c6 c9 c10 c11 ; SUBC> NVars 1 4; SUBC> Best 2; SUBC> Constant. 6)Best Subsets Regression: price versus baths, liv1, liv2, livsqsq Response is price Vars 1 1 2 2 3 3 4 R-Sq 91.9 45.3 92.6 92.2 93.6 92.9 95.0 R-Sq(adj) 91.6 43.3 92.1 91.6 92.9 92.0 94.1 Mallows C-p 14.3 245.3 12.5 14.7 9.8 13.4 5.0 S 9.6448 25.013 9.3441 9.6171 8.8812 9.3746 8.0361 b a t h s l i v 1 l i v 2 l i v s q s q X X X X X X X X X X X X X X X X 4 252y0641s1 12/6/06 MTB > regress c1 10 c2 c3 c4 c5 c6 c7 c8 c9 c10 c11 7)Regression Analysis: price versus livsqft, lotsqft, ... The regression equation is price = - 783 + 705 livsqft - 2.90 lotsqft + 569 loc1 + 423 loc 2 + 18.1 baths + 5.78 lot1 - 1.07 lot2 - 349 liv1 - 197 liv2 - 125 livsqsq Predictor Coef SE Coef Constant -782.8 265.1 livsqft 704.6 213.8 lotsqft -2.900 3.283 loc1 569.4 190.3 loc 2 423.3 139.0 baths 18.121 4.392 lot1 5.775 4.709 lot2 -1.071 5.196 liv1 -349.3 117.8 liv2 -196.54 79.91 livsqsq -125.48 39.56 S = 6.49288 R-Sq = 97.5% T P -2.95 0.008 3.30 0.004 -0.88 0.388 2.99 0.007 3.05 0.007 4.13 0.001 1.23 0.235 -0.21 0.839 -2.96 0.008 -2.46 0.024 -3.17 0.005 R-Sq(adj) = 96.2% Analysis of Variance Source DF SS Regression 10 31197.6 Residual Error 19 801.0 Total 29 31998.6 MS 3119.8 42.2 Source livsqft lotsqft loc1 loc 2 baths lot1 lot2 liv1 liv2 livsqsq DF 1 1 1 1 1 1 1 1 1 1 F 74.00 P 0.000 Seq SS 29642.7 126.4 2.9 492.5 472.4 4.2 27.5 0.0 4.7 424.2 Unusual Observations Obs livsqft price Fit SE Fit Residual St Resid 29 2.50 199.40 190.70 5.36 8.70 2.37R R denotes an observation with a large standardized residual. MTB > regress c1 8 c2 c3 c4 c5 c6 c9 c10 c11 8)Regression Analysis: price versus livsqft, lotsqft, ... The regression equation is price = - 637 + 574 livsqft - 0.24 lotsqft + 463 loc1 + 351 loc 2 + 14.9 baths - 247 liv1 - 174 liv2 - 103 livsqsq Predictor Coef SE Coef Constant -636.8 241.4 livsqft 573.8 187.6 lotsqft -0.241 1.789 loc1 462.9 173.0 loc 2 350.9 128.0 baths 14.910 3.674 liv1 -247.23 87.63 liv2 -173.97 59.10 livsqsq -103.43 35.91 S = 6.51098 R-Sq = 97.2% T P -2.64 0.015 3.06 0.006 -0.13 0.894 2.68 0.014 2.74 0.012 4.06 0.001 -2.82 0.010 -2.94 0.008 -2.88 0.009 R-Sq(adj) = 96.2% 5 252y0641s1 12/6/06 Analysis of Variance Source DF SS Regression 8 31108.4 Residual Error 21 890.3 Total 29 31998.6 Source livsqft lotsqft loc1 loc 2 baths liv1 liv2 livsqsq DF 1 1 1 1 1 1 1 1 MS 3888.5 42.4 F 91.73 P 0.000 Seq SS 29642.7 126.4 2.9 492.5 472.4 2.5 17.3 351.6 MTB > regress c1 7 c2 c4 c5 c6 c9 c10 c11 9)Regression Analysis: price versus livsqft, loc1, ... The regression equation is price = - 634 + 570 livsqft + 461 loc1 + 349 loc 2 + 14.8 baths - 247 liv1 - 173 liv2 - 103 livsqsq Predictor Coef SE Coef Constant -633.6 234.9 livsqft 569.6 180.8 loc1 461.3 168.7 loc 2 349.5 124.7 baths 14.822 3.534 liv1 -246.77 85.58 liv2 -173.49 57.66 livsqsq -102.93 34.92 S = 6.36403 R-Sq = 97.2% T P -2.70 0.013 3.15 0.005 2.74 0.012 2.80 0.010 4.19 0.000 -2.88 0.009 -3.01 0.006 -2.95 0.007 R-Sq(adj) = 96.3% Analysis of Variance Source DF SS Regression 7 31107.6 Residual Error 22 891.0 Total 29 31998.6 MS 4443.9 40.5 Source livsqft loc1 loc 2 baths liv1 liv2 livsqsq DF 1 1 1 1 1 1 1 F 109.72 P 0.000 Seq SS 29642.7 10.8 597.7 484.7 3.3 16.4 352.0 6 252y0641s1 12/6/06 MTB > regress c1 7 c2 c4 c5 c6 c9 c10 c11; SUBC> vif. 10)Regression Analysis: price versus livsqft, loc1, ... The regression equation is price = - 634 + 570 livsqft + 461 loc1 + 349 loc 2 + 14.8 baths - 247 liv1 - 173 liv2 - 103 livsqsq Predictor Coef SE Coef Constant -633.6 234.9 livsqft 569.6 180.8 loc1 461.3 168.7 loc 2 349.5 124.7 baths 14.822 3.534 liv1 -246.77 85.58 liv2 -173.49 57.66 livsqsq -102.93 34.92 S = 6.36403 R-Sq = 97.2% T P VIF -2.70 0.013 3.15 0.005 6060.8 2.74 0.012 4682.2 2.80 0.010 2559.1 4.19 0.000 1.5 -2.88 0.009 2406.6 -3.01 0.006 1851.0 -2.95 0.007 3736.4 R-Sq(adj) = 96.3% Analysis of Variance Source DF SS Regression 7 31107.6 Residual Error 22 891.0 Total 29 31998.6 MS 4443.9 40.5 Source livsqft loc1 loc 2 baths liv1 liv2 livsqsq DF 1 1 1 1 1 1 1 F 109.72 P 0.000 Seq SS 29642.7 10.8 597.7 484.7 3.3 16.4 352.0 MTB > Stepwise c1 c2 c3 c4 c5 c6 c7 c8 c9 c10 c11; SUBC> AEnter 0.15; SUBC> ARemove 0.15; SUBC> Best 0; SUBC> Constant. 11)Stepwise Regression: price versus livsqft, lotsqft, ... Alpha-to-Enter: 0.15 Alpha-to-Remove: 0.15 Response is price on 10 predictors, with N = 30 Step Constant 1 13.59 2 16.80 3 59.44 4 53.49 livsqft T-Value P-Value 62.8 18.77 0.000 62.2 19.15 0.000 45.9 6.17 0.000 38.0 5.53 0.000 -0.40 -1.76 0.090 -1.22 -3.03 0.005 -1.51 -4.21 0.000 -21.6 -2.39 0.024 -25.8 -3.27 0.003 lot2 T-Value P-Value loc1 T-Value P-Value baths T-Value P-Value 11.8 3.18 0.004 7 252y0641s1 12/6/06 S 9.17 8.85 8.17 7.03 R-Sq 92.64 93.39 94.58 96.14 R-Sq(adj) 92.37 92.90 93.96 95.53 Mallows C-p 29.9 26.1 19.1 9.3 More? (Yes, No, Subcommand, or Help) SUBC> y No variables entered or removed More? (Yes, No, Subcommand, or Help) SUBC> n Correlations: livsqft, lot2, loc1, baths lot2 loc1 livsqft -0.109 0.565 lot2 -0.735 0.000 -0.497 0.005 loc1 baths 0.472 0.136 -0.405 0.009 0.475 0.026 Cell Contents: Pearson correlation P-Value MTB > Save "C:\Documents and Settings\RBOVE\My Documents\Minitab\252x06041021.MTW"; SUBC> Replace. Saving file as: 'C:\Documents and Settings\RBOVE\My Documents\Minitab\252x06041-021.MTW' Existing file replaced. MTB> describe c1-c11 Descriptive Statistics: price, livsqft, lotsqft, loc1, loc 2, baths, lot1, ... Variable price livsqft lotsqft loc1 loc 2 baths lot1 lot2 liv1 liv2 livsqsq N 30 30 30 30 30 30 30 30 30 30 30 N* 0 0 0 0 0 0 0 0 0 0 0 Variable price livsqft lotsqft loc1 loc 2 baths lot1 lot2 liv1 liv2 livsqsq Maximum 199.40 3.0000 22.000 1.0000 1.0000 3.0000 15.00 17.00 1.600 2.000 9.000 Mean 134.23 1.9200 15.267 0.3333 0.3333 2.0333 4.00 5.07 0.467 0.610 3.937 SE Mean 6.06 0.0929 0.585 0.0875 0.0875 0.0756 1.07 1.34 0.124 0.161 0.378 StDev 33.22 0.5088 3.205 0.4795 0.4795 0.4138 5.84 7.33 0.677 0.882 2.069 Minimum 87.90 1.2000 10.000 0.0000 0.0000 1.0000 0.00 0.00 0.000 0.000 1.440 Q1 109.45 1.5000 12.000 0.0000 0.0000 2.0000 0.00 0.00 0.000 0.000 2.250 Median 124.20 1.8500 15.000 0.0000 0.0000 2.0000 0.00 0.00 0.000 0.000 3.425 Q3 164.25 2.4000 18.000 1.0000 1.0000 2.0000 10.50 15.00 1.225 1.725 5.760 8 252y0641s1 12/6/06 MTB > print c1 - c11 Data Display Row 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 price 102.20 103.95 87.90 110.00 97.00 95.70 113.60 109.60 110.80 90.60 109.00 133.00 134.00 120.30 137.00 122.40 121.70 126.00 128.00 117.50 158.70 186.80 172.40 151.20 179.10 182.30 195.85 168.00 199.40 163.00 Row 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 livsqsq 2.25 1.44 1.44 2.56 1.96 1.44 2.56 2.25 2.25 1.69 2.56 3.61 3.24 4.00 4.00 2.89 3.24 3.61 4.00 2.56 5.76 6.76 5.29 4.84 7.84 7.29 9.00 5.76 6.25 5.76 livsqft 1.5 1.2 1.2 1.6 1.4 1.2 1.6 1.5 1.5 1.3 1.6 1.9 1.8 2.0 2.0 1.7 1.8 1.9 2.0 1.6 2.4 2.6 2.3 2.2 2.8 2.7 3.0 2.4 2.5 2.4 lotsqft 12 10 10 15 12 10 15 12 12 12 13 15 15 17 17 15 15 16 16 13 18 18 16 16 20 20 22 18 20 18 loc1 1 1 1 1 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 loc 2 0 0 0 0 0 0 0 0 0 0 1 1 1 1 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 baths 2 2 2 2 1 2 2 2 2 1 2 2 2 2 3 2 2 2 2 2 2 2 2 2 2 2 3 2 3 2 lot1 12 10 10 15 12 10 15 12 12 12 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 lot2 0 0 0 0 0 0 0 0 0 0 13 15 15 17 17 15 15 16 16 13 0 0 0 0 0 0 0 0 0 0 liv1 1.5 1.2 1.2 1.6 1.4 1.2 1.6 1.5 1.5 1.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 liv2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.6 1.9 1.8 2.0 2.0 1.7 1.8 1.9 2.0 1.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 9 252y0641s1 12/6/06 Regression B Data description C1 Sq.ft – Number of square feet C2 Sqftsq – The square of the previous variable. C3 Assessed – Assessed value in $1000s C4 Market – Market value in $1000s – The dependent variable. C5 Low – A dummy variable; indicates an inferior property. C6 Med - A dummy variable; indicates a normal property. C7 High - A dummy variable; indicates a superior property. C9 AL – An interaction variable; the product of Assessed and Low. C10 AM – An interaction variable; the product of Assessed and Med. C11 AH – An interaction variable; the product of Assessed and High. This is a regression mentioned in the Minitab handbook and the data comes from the Minitab website maintained by the publisher. The dependent variable is the market price of the property. The remainder of the variables listed above are candidates for explanatory variables. Since there are only 60 observations the number of independent variables needed to explain the values of the price variable should be relatively small. The data and some descriptive statistics appear at the end. ————— 12/4/2006 10:28:02 PM ———————————————————— Welcome to Minitab, press F1 for help. MTB > WOpen "C:\Documents and Settings\RBOVE\My Documents\Minitab\252x06041022.MTW". Retrieving worksheet from file: 'C:\Documents and Settings\RBOVE\My Documents\Minitab\252x06041-022.MTW' Worksheet was saved on Mon Dec 04 2006 Results for: 252x06041-022.MTW MTB > regress c4 7 c1 c2 c3 c5 c6 c9 c10; SUBC> vif. 12)Regression Analysis: Market versus Sq.ft, Sqftsq, ... The regression equation is Market = 9.9 + 0.0438 Sq.ft - 0.000015 Sqftsq + 0.129 Assessed - 6.2 Low - 5.9 Med - 0.012 AL + 0.176 AM Predictor Coef SE Coef T P Constant 9.87 15.05 0.66 0.515 Sq.ft 0.043807 0.008169 5.36 0.000 Sqftsq -0.00001476 0.00000370 -3.99 0.000 Assessed 0.1289 0.4909 0.26 0.794 Low -6.16 14.12 -0.44 0.664 Med -5.87 14.11 -0.42 0.679 AL -0.0122 0.5023 -0.02 0.981 AM 0.1762 0.4985 0.35 0.725 S = 2.72518 R-Sq = 81.5% R-Sq(adj) = 79.1% Analysis of Variance Source DF SS Regression 7 1706.22 Residual Error 52 386.18 Total 59 2092.40 Source Sq.ft Sqftsq Assessed Low Med AL AM DF 1 1 1 1 1 1 1 MS 243.75 7.43 F 32.82 VIF 31.3 29.6 64.9 257.6 314.7 133.8 265.9 P 0.000 Seq SS 1173.10 231.97 177.38 107.14 3.57 12.13 0.93 10 252y0641s1 12/6/06 Unusual Observations Obs Sq.ft Market Fit SE Fit Residual St Resid 2 538 19.400 26.297 1.433 -6.897 -2.98R 3 544 25.200 30.544 1.188 -5.344 -2.18R 10 712 42.400 34.179 0.696 8.221 3.12R 30 923 30.000 32.106 1.752 -2.106 -1.01 X 57 1298 45.200 44.904 2.670 0.296 0.54 X 59 1602 47.400 46.162 2.032 1.238 0.68 X 60 1804 45.400 44.330 2.309 1.070 0.74 X R denotes an observation with a large standardized residual. X denotes an observation whose X value gives it large influence. MTB > regress c4 5 c1 c2 c3 c9 c10; SUBC> vif. 13)Regression Analysis: Market versus Sq.ft, Sqftsq, Assessed, AL, AM The regression equation is Market = 3.69 + 0.0443 Sq.ft - 0.000015 Sqftsq + 0.337 Assessed - 0.230 AL - 0.0289 AM Predictor Coef SE Coef T P Constant 3.691 4.390 0.84 0.404 Sq.ft 0.044273 0.007962 5.56 0.000 Sqftsq -0.00001498 0.00000360 -4.16 0.000 Assessed 0.33686 0.07850 4.29 0.000 AL -0.22961 0.07316 -3.14 0.003 AM -0.02893 0.05321 -0.54 0.589 S = 2.67918 R-Sq = 81.5% R-Sq(adj) = 79.8% Analysis of Variance Source DF SS Regression 5 1704.79 Residual Error 54 387.61 Total 59 2092.40 Source Sq.ft Sqftsq Assessed AL AM DF 1 1 1 1 1 MS 340.96 7.18 F 47.50 VIF 30.7 29.1 1.7 2.9 3.1 P 0.000 Seq SS 1173.10 231.97 177.38 120.21 2.12 Unusual Observations Obs Sq.ft Market Fit SE Fit Residual St Resid 2 538 19.400 26.200 1.322 -6.800 -2.92R 3 544 25.200 30.488 1.156 -5.288 -2.19R 10 712 42.400 34.150 0.636 8.250 3.17R 45 1060 44.800 43.631 1.471 1.169 0.52 X 59 1602 47.400 46.627 1.681 0.773 0.37 X 60 1804 45.400 44.247 2.253 1.153 0.80 X R denotes an observation with a large standardized residual. X denotes an observation whose X value gives it large influence. 11 252y0641s1 12/6/06 MTB > BReg c4 5 c1 c2 c3 c9 c10; SUBC> NVars 1 4; SUBC> Best 2; SUBC> Constant. 14)Best Subsets Regression: Market versus Sq.ft, Sqftsq, Assessed, AL, AM Response is Market Vars 1 1 2 2 3 3 4 4 5 R-Sq 56.1 44.9 67.9 67.2 75.6 75.5 81.4 78.1 81.5 R-Sq(adj) 55.3 44.0 66.7 66.0 74.3 74.2 80.0 76.5 79.8 Mallows C-p 72.1 104.6 39.7 41.8 19.0 19.4 4.3 13.9 6.0 S 3.9812 4.4582 3.4347 3.4725 3.0176 3.0242 2.6620 2.8867 2.6792 S q . f t X S q f t s q A s s e s s e A A d L M X X X X X X X X X X X X X X X X X X X X X X X X MTB > regress c4 7 c1 c2 c3 c5 c6 c9 c10 15)Regression Analysis: Market versus Sq.ft, Sqftsq, ... The regression equation is Market = 9.9 + 0.0438 Sq.ft - 0.000015 Sqftsq + 0.129 Assessed - 6.2 Low - 5.9 Med - 0.012 AL + 0.176 AM Predictor Coef SE Coef T P Constant 9.87 15.05 0.66 0.515 Sq.ft 0.043807 0.008169 5.36 0.000 Sqftsq -0.00001476 0.00000370 -3.99 0.000 Assessed 0.1289 0.4909 0.26 0.794 Low -6.16 14.12 -0.44 0.664 Med -5.87 14.11 -0.42 0.679 AL -0.0122 0.5023 -0.02 0.981 AM 0.1762 0.4985 0.35 0.725 S = 2.72518 R-Sq = 81.5% R-Sq(adj) = 79.1% Analysis of Variance Source DF SS Regression 7 1706.22 Residual Error 52 386.18 Total 59 2092.40 Source Sq.ft Sqftsq Assessed Low Med AL AM DF 1 1 1 1 1 1 1 MS 243.75 7.43 F 32.82 P 0.000 Seq SS 1173.10 231.97 177.38 107.14 3.57 12.13 0.93 Unusual Observations Obs Sq.ft Market Fit 2 538 19.400 26.297 3 544 25.200 30.544 10 712 42.400 34.179 30 923 30.000 32.106 57 1298 45.200 44.904 SE Fit 1.433 1.188 0.696 1.752 2.670 Residual -6.897 -5.344 8.221 -2.106 0.296 St Resid -2.98R -2.18R 3.12R -1.01 X 0.54 X 12 252y0641s1 12/6/06 59 1602 47.400 46.162 2.032 1.238 0.68 X 60 1804 45.400 44.330 2.309 1.070 0.74 X R denotes an observation with a large standardized residual. X denotes an observation whose X value gives it large influence. MTB > let c11 = c3 - c9 -c10 MTB > regress c4 7 c1 c2 c5 c6 c9 c10 c11 16)Regression Analysis: Market versus Sq.ft, Sqftsq, Low, Med, AL, AM, AH The regression equation is Market = 9.9 + 0.0438 Sq.ft - 0.000015 Sqftsq - 6.2 Low - 5.9 Med + 0.117 AL + 0.305 AM + 0.129 AH Predictor Coef SE Coef T P Constant 9.87 15.05 0.66 0.515 Sq.ft 0.043807 0.008169 5.36 0.000 Sqftsq -0.00001476 0.00000370 -3.99 0.000 Low -6.16 14.12 -0.44 0.664 Med -5.87 14.11 -0.42 0.679 AL 0.1167 0.1085 1.08 0.287 AM 0.30502 0.09290 3.28 0.002 AH 0.1289 0.4909 0.26 0.794 S = 2.72518 R-Sq = 81.5% R-Sq(adj) = 79.1% Analysis of Variance Source DF SS Regression 7 1706.22 Residual Error 52 386.18 Total 59 2092.40 Source Sq.ft Sqftsq Low Med AL AM AH DF 1 1 1 1 1 1 1 MS 243.75 7.43 F 32.82 P 0.000 Seq SS 1173.10 231.97 202.81 8.68 9.22 79.92 0.51 Unusual Observations Obs Sq.ft Market Fit SE Fit Residual St Resid 2 538 19.400 26.297 1.433 -6.897 -2.98R 3 544 25.200 30.544 1.188 -5.344 -2.18R 10 712 42.400 34.179 0.696 8.221 3.12R 30 923 30.000 32.106 1.752 -2.106 -1.01 X 57 1298 45.200 44.904 2.670 0.296 0.54 X 59 1602 47.400 46.162 2.032 1.238 0.68 X 60 1804 45.400 44.330 2.309 1.070 0.74 X R denotes an observation with a large standardized residual. X denotes an observation whose X value gives it large influence. MTB > regress c4 6 c1 c2 c5 c6 c9 c10 17)Regression Analysis: Market versus Sq.ft, Sqftsq, Low, Med, AL, AM The regression equation is Market = 13.6 + 0.0436 Sq.ft - 0.000015 Sqftsq - 9.80 Low - 9.49 Med + 0.117 AL + 0.305 AM Predictor Coef SE Coef T P Constant 13.615 4.740 2.87 0.006 Sq.ft 0.043570 0.008047 5.41 0.000 Sqftsq -0.00001464 0.00000364 -4.03 0.000 Low -9.796 2.671 -3.67 0.001 Med -9.494 2.818 -3.37 0.001 AL 0.1166 0.1075 1.08 0.283 AM 0.30473 0.09207 3.31 0.002 S = 2.70113 R-Sq = 81.5% R-Sq(adj) = 79.4% 13 252y0641s1 12/6/06 Analysis of Variance Source DF SS Regression 6 1705.71 Residual Error 53 386.69 Total 59 2092.40 Source Sq.ft Sqftsq Low Med AL AM DF 1 1 1 1 1 1 MS 284.28 7.30 F 38.96 P 0.000 Seq SS 1173.10 231.97 202.81 8.68 9.22 79.92 Unusual Observations Obs Sq.ft Market Fit SE Fit Residual St Resid 1 521 26.000 23.454 1.617 2.546 1.18 X 2 538 19.400 26.309 1.419 -6.909 -3.01R 3 544 25.200 30.561 1.176 -5.361 -2.20R 10 712 42.400 34.182 0.690 8.218 3.15R 30 923 30.000 32.099 1.737 -2.099 -1.01 X 59 1602 47.400 45.846 1.621 1.554 0.72 X 60 1804 45.400 44.406 2.271 0.994 0.68 X R denotes an observation with a large standardized residual. X denotes an observation whose X value gives it large influence. MTB > regress c4 5 c1 c2 c5 c6 c10 18)Regression Analysis: Market versus Sq.ft, Sqftsq, Low, Med, AM The regression equation is Market = 14.0 + 0.0430 Sq.ft - 0.000014 Sqftsq - 7.70 Low - 9.55 Med + 0.306 AM Predictor Coef SE Coef T P Constant 13.997 4.735 2.96 0.005 Sq.ft 0.042970 0.008041 5.34 0.000 Sqftsq -0.00001441 0.00000364 -3.96 0.000 Low -7.704 1.849 -4.17 0.000 Med -9.551 2.823 -3.38 0.001 AM 0.30594 0.09221 3.32 0.002 S = 2.70550 R-Sq = 81.1% R-Sq(adj) = 79.4% Analysis of Variance Source DF SS MS F P Regression 5 1697.14 339.43 46.37 0.000 Residual Error 54 395.26 7.32 Total 59 2092.40 Source Sq.ft Sqftsq Low Med AM DF 1 1 1 1 1 Seq SS 1173.10 231.97 202.81 8.68 80.57 Unusual Observations Obs Sq.ft Market Fit SE Fit Residual St Resid 2 538 19.400 25.240 1.022 -5.840 -2.33R 3 544 25.200 30.655 1.175 -5.455 -2.24R 10 712 42.400 34.222 0.690 8.178 3.13R 59 1602 47.400 45.856 1.623 1.544 0.71 X 60 1804 45.400 44.434 2.274 0.966 0.66 X R denotes an observation with a large standardized residual. X denotes an observation whose X value gives it large influence. 14 252y0641s1 12/6/06 MTB > Stepwise c4 c1 c2 c3 c5 c6 c9 c10; SUBC> AEnter 0.15; SUBC> ARemove 0.15; SUBC> Best 0; SUBC> Constant. 17)Stepwise Regression: Market versus Sq.ft, Sqftsq, ... Alpha-to-Enter: 0.15 Alpha-to-Remove: 0.15 Response is Market on 7 predictors, with N = 60 Step Constant 1 20.508 2 26.164 3 10.370 4 4.939 Sq.ft T-Value P-Value 0.0184 8.60 0.000 0.0137 7.13 0.000 0.0445 5.10 0.000 0.0450 5.61 0.000 -6.4 -5.55 0.000 -5.3 -4.84 0.000 -4.1 -3.82 0.000 -0.00001 -3.60 0.001 -0.00001 -4.11 0.000 Low T-Value P-Value Sqftsq T-Value P-Value Assessed T-Value P-Value 0.229 3.34 0.002 S R-Sq R-Sq(adj) Mallows C-p 3.98 56.06 55.31 67.8 3.24 71.48 70.48 26.3 2.94 76.84 75.60 13.2 2.71 80.75 79.35 4.2 More? (Yes, No, Subcommand, or Help) SUBC> y No variables entered or removed More? (Yes, No, Subcommand, or Help) SUBC> n MTB > corr c1 c2 c3 Correlations: Sq.ft, Sqftsq, Assessed Sq.ft Sqftsq 0.981 0.000 Assessed 0.347 0.333 0.007 0.009 Cell Contents: Pearson correlation P-Value Sqftsq MTB > print c1 c2 c3 c4 c5 c6 c7 c9 c10 Data Display Row 1 2 3 4 5 6 7 8 9 10 11 12 Sq.ft 521 538 544 577 661 662 677 691 694 712 721 722 Sqftsq 271441 289444 295936 332929 436921 438244 458329 477481 481636 506944 519841 521284 Assessed 7.8 28.2 23.2 22.2 23.8 19.6 22.8 22.6 28.0 21.2 21.6 7.4 Market 26.0 19.4 25.2 26.2 31.0 34.6 36.4 33.0 37.4 42.4 32.8 25.6 Low 1 1 0 1 1 0 0 1 0 0 0 1 Med 0 0 1 0 0 1 1 0 1 1 1 0 High 0 0 0 0 0 0 0 0 0 0 0 0 AL 7.8 28.2 0.0 22.2 23.8 0.0 0.0 22.6 0.0 0.0 0.0 7.4 AM 0.0 0.0 23.2 0.0 0.0 19.6 22.8 0.0 28.0 21.2 21.6 0.0 15 252y0641s1 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 743 760 767 780 787 802 814 815 825 834 838 858 883 890 899 918 920 923 926 931 965 966 967 1011 1011 1024 1033 1040 1047 1051 1052 1056 1060 1060 1070 1075 1079 1100 1106 1138 1164 1171 1237 1249 1298 1435 1602 1804 12/6/06 552049 577600 588289 608400 619369 643204 662596 664225 680625 695556 702244 736164 779689 792100 808201 842724 846400 851929 857476 866761 931225 933156 935089 1022121 1022121 1048576 1067089 1081600 1096209 1104601 1106704 1115136 1123600 1123600 1144900 1155625 1164241 1210000 1223236 1295044 1354896 1371241 1530169 1560001 1684804 2059225 2566404 3254416 26.2 26.6 22.2 22.6 22.4 25.4 14.8 14.4 28.2 18.0 25.6 22.4 25.8 20.2 23.2 32.2 20.8 4.6 18.2 24.6 14.6 30.2 26.0 28.0 26.0 27.0 25.2 22.4 30.0 26.4 20.2 25.8 29.2 24.0 22.8 30.4 24.2 30.0 31.6 25.6 29.4 32.2 17.0 22.0 23.6 21.4 31.0 30.6 34.8 35.8 33.6 31.0 39.2 36.0 34.8 34.4 38.0 34.6 35.6 35.8 39.6 35.0 37.6 41.2 31.2 30.0 37.4 38.0 37.2 44.0 44.2 43.6 38.4 42.2 40.4 40.4 43.6 41.4 39.6 41.8 44.8 38.4 43.6 42.8 40.6 41.6 42.8 39.0 41.8 48.4 39.8 47.2 45.2 38.8 47.4 45.4 0 0 1 1 0 0 0 0 0 1 0 1 0 0 0 0 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 1 0 0 1 1 1 1 1 0 1 0 1 1 1 1 0 0 1 1 1 1 1 1 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 0 1 1 1 0 1 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 0 0 0 0 0 0 0 1 0 0 0 1 0 1 0 0.0 0.0 22.2 22.6 0.0 0.0 0.0 0.0 0.0 18.0 0.0 22.4 0.0 0.0 0.0 0.0 20.8 4.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 26.2 26.6 0.0 0.0 22.4 25.4 14.8 14.4 28.2 0.0 25.6 0.0 25.8 20.2 23.2 32.2 0.0 0.0 18.2 24.6 14.6 30.2 26.0 28.0 26.0 27.0 25.2 22.4 30.0 26.4 20.2 25.8 0.0 24.0 22.8 30.4 24.2 30.0 31.6 25.6 0.0 32.2 17.0 22.0 0.0 21.4 0.0 30.6 MTB > describe c1 c2 c3 c4 Descriptive Statistics: Sq.ft, Sqftsq, Assessed, Market Variable Sq.ft Sqftsq Assessed Market N 60 60 60 60 N* 0 0 0 0 Variable Sq.ft Sqftsq Assessed Market Maximum 1804.0 3254416 32.200 48.400 Mean 941.7 944851 23.560 37.800 SE Mean 31.4 67432 0.752 0.769 StDev 242.8 522330 5.824 5.955 Minimum 521.0 271441 4.600 19.400 Q1 770.3 593317 21.450 34.650 Median 924.5 854703 23.900 38.400 Q3 1060.0 1123600 27.750 42.100 16