THE UNIVERSITY OF TOLEDO PURCHASING CARD MANUAL

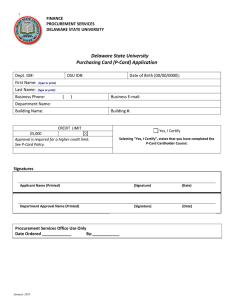

advertisement