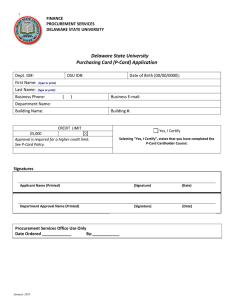

THE UNIVERSITY OF TOLEDO PURCHASING CARD MANUAL

advertisement