Debt Management for the Real World Kim Siwarski Colleen MacDonald

advertisement

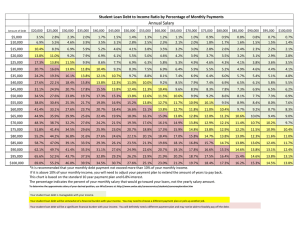

Debt Management for the Real World Kim Siwarski Access Group and Colleen MacDonald SimpleTuition Agenda • Starting Debt Management at Enrollment – Helping the Responsible Borrower – Helping the Not so Responsible Borrower • The Importance of Creating a Budget • Understanding How Decisions of Today Alter Your Financial Future • Beyond Exit Counseling Debt Management for the Real World Debt Management Early and Often • Financial worries distract from education • Average undergrad student loan debt is now $20,000+ • 1 in 3 recent grads have additional credit card debt of $ 10,000 or more • Poor credit scores contribute to much higher payments on private student loans, decreased employment opportunities Source: Decision Partners Financial Literacy 101 webinar (2009) Debt Management for the Real World Do you currently provide your students debt management Information? Yes 75.6% No 24.4% Debt Management for the Real World When do you provide Debt Management information? Debt Management for the Real World Types of Students Debt Management for the Real World Student Borrowing Breakdown Loan Type Total Outstanding Debt Prior Borrowing History Perkins Loan Total Paid Amount paid over life of in interest loan (includes interest) only $0 $0 $0 $0 Stafford Loans $41,000 $472 $56,620 $15,620 Grad PLUS $48,214 $598 $71,734 $23,520 $0 $0 $0 $0 $89,214 $1,070 $128,354 $39,140 $0 $0 $0 $0 Stafford Loans $20,500 $271 $32,481 $11,981 Grad PLUS/Private Anticipated Totals for 10-11 $13,970 $169 $20,251 $6,281 $34,470 $440 $52,732 $18,262 $123,684 $1,510 $181,086 $57,402 Private Totals to date Perkins Loan 2010-11 Anticipated Loan Debt Current est. monthly payment New Total Repayment Debt Management for the Real World Student Borrows 100% of Loans Offered On Award Letter Income Budgeted Income Source Student Loans $ Job 1 $ Total income Notes 1,818.00 - $ 1,818.00 Expenses #REF! Budgeted Finance Payments Notes Credit card $ 48.00 Auto loan $ - $ 48.00 Total finance payments Budgeted Fixed Expenses Avg. UG Student Credit Card Debt was $2200* Notes Rent $ 675.00 Auto insurance $ - Medical insurance $ 158.00 Cable TV $ 45.00 Telephone $ 70.00 Internet $ 30.00 Investments/Savings $ - Utilities $ 50.00 $ 1,028.00 Total fixed expenses 21816 Monthly Budget at Graduation Income Budgeted Income Source Job 1 Total income Notes $ 8,333.00 $ 8,333.00 #REF! Expenses #REF! Budgeted Income Tax Withholdings Notes 1,676.00 0-$4,750=0%, $4,751-$7,000=10%, >$7,000=15% Federal income tax $ State income tax $ 626.50 0-$3,070=0%, $3,071-$5,960=1%, >$5,960=2% FICA $ 637.48 6.2 % of Gross Wages Medical See FICA Social Security See FICA SDI Total withholdings 1.45% of Gross Wages $ 91.66 $ 3,031.64 Budgeted Finance Payments Notes Credit card $ 200.00 Auto loan $ 479.00 Student Loans $ 1,060.00 $ 1,739.00 Total finance payments Budgeted Fixed Expenses 1.18 % of Gross Wages Student's outstanding credit card debt is $2500* $17K Sub, $24K Unsub, $39,724Grad PLUS Notes Rent $ 1,860.00 Auto insurance $ 108.83 Medical insurance $ 68.00 Cable TV $ 45.00 Telephone $ 75.00 Internet $ 30.00 Investments/Savings $ 250.00 3% of gross earnings Student Creates Personal Budget and Borrows Only What She Needs Income Income Source Budgeted Notes Student Loans $ 800.00 Job 1 $ 900.00 $ 1,700.00 Total income Student works 15 hours per week @ $15/hour 20400 #REF! Expenses #REF! Finance Payments Budgeted Notes 48.00 Average Grad Student Credit Card Debt was $2200* Credit card $ Auto loan $ - $ 48.00 Total finance payments Fixed Expenses Budgeted Notes Rent $ 675.00 Auto insurance $ - Medical insurance $ 158.00 Cable TV $ 45.00 Telephone $ 70.00 Internet $ 30.00 Investments/Savings $ - Utilities $ 50.00 $ 1,028.00 Total fixed expenses Budget after Graduation 2 Income Income Source Job 1 Total income Budgeted Notes $ 8,333.00 $ 8,333.00 #REF! Expenses #REF! Income Tax Withholdings Budgeted Notes 1,676.00 0-$4,750=0%, $4,751-$7,000=10%, >$7,000=15% Federal income tax $ State income tax $ 626.50 FICA $ 637.48 Medical See FICA Social Security See FICA SDI Total withholdings 6.2 % of Gross Wages 1.45% of Gross Wages $ 91.66 $ 3,031.64 Finance Payments 0-$3,070=0%, $3,071-$5,960=1%, >$5,960=2% Budgeted 1.18 % of Gross Wages Notes Credit card $ 200.00 Average Grad Student Credit Card Debt was $2500* Auto loan $ 479.00 Student Loans Total finance payments $ 808.00 $ 1,487.00 Fixed Expenses Budgeted Notes Rent $ 1,860.00 Auto insurance $ 108.83 Medical insurance $ 68.00 Cable TV $ 45.00 Telephone $ 75.00 Internet $ 30.00 Investments/Savings $ 250.00 Utilities $ 50.00 $ 2,486.83 Total fixed expenses $17K Sub, $24K Unsub, $21400 Grad PLUS 3% of gross earnings Beyond Exit Counseling • Market workshops to your students – It’s all in the Title • Money Attitude (Towson University) • Dollars and Sense (Cal State- Northridge) • Red to Black (Texas Tech) • Cash Course (State University at Buffalo) • How to Make School Cheaper (Monterey Institute) – Communicating benefits – Survey students to find out what is important • What are you doing? Debt Management for the Real World Make It Meaningful: Use Salaries • Why to use them – Helps students with their financial realities – May affect job choice • Where to get them – – – – Career Development Office’s Employment Report www.careeroverview.com/salary-benefits.html www.salary.com www.payscale.com/research/US/All_People_in_ All_Surveys/Salary Debt Management for the Real World Examples Earnings with Repayment First Year Public Sector Lawyer’s Salaries (Non-federal) Median Salary* Payment Loan Civil Legal Services $36,000 $240 $20,851 Public Defenders $43,300 $288 $25,022 Local Prosecutors $43,900 $292 $25,369 State Attorneys Gen’l $46,400 $309 $26,846 Public Interest Orgs. $40,000 $266 $23,110 Occupation Source: NALP 2007 Public Sector and Public Interest Attorney Salary report. http://www.nalp.org/press/details.php?id=63. Loan payment based on 6.8% term for 10 years at 8% of gross salary Debt Management for the Real World Examples Earnings with Repayment First Year Salaries For Associates at Private Firms Firm Size 2-25 26-50 51-100 101-250 251-500 501+ Median Salary* $68,000 $81,000 $90,000 $105,000 $115,000 $145,000 Payment Loan $453 $540 $600 $700 $766 $966 $39,357 $46,916 $52,129 $60,817 $66,551 $83,927 Source: NALP 2007 Public Sector and Public Interest Attorney Salary report. http://www.nalp.org/press/details.php?id=63. Loan payment based on 6.8% term for 10 years at 8% of gross salary Debt Management for the Real World Starting Salaries after Graduation A Glimpse at the Future School Name Berklee College of Music Location School Type Boston, MA Arts & Design Private Research Stanford, CA Universities Stanford University Davidson College Davidson, NC Liberal Arts University of Georgia (UGA) Athens, GA Social Iowa State University Ames, IA State Schools Source: http://www.payscale.com/best-colleges/top-colleges.asp Debt Management for the Real World Starting Mid-Career Median Salary Median Salary $37,300 $66,300 $60,200 $119,000 $42,100 $101,000 $42,100 $78,400 $44,900 $83,500 Relating to Archetypes • Discuss Loan Repayment options by Types of Jobs Post Enrollment – May lessen the anxiety by depersonalizing choices – Draws from shared experiences & uses common themes Debt Management for the Real World Standard Repayment Extended Repayment • Pays based on the lender/servicer payment schedule. • May benefit from borrower incentives, but did not count on them. • Plans to pay on time, assuming minimum monthly payment over the entire life of loan • Wants to pay the least amount of interest as possible • Is willing to request extended repayment. • A Person who will prepay • Understands prepayment on highest interest rate loans first. Examples Careers General Manager General Practitioner History Professor Boutique Small Firm Lawyer Debt Management for the Real World Examples Careers Investment Banker Surgeon Economics Professor Corporate Lawyer Graduate Repayment • A Person who needs the lowest payment possible at the beginning. • Assumes their income will increase dramatically within 5 years of graduation. • Is willing to consolidate to minimize monthly repayment. • If ever in a position to prepay, will plan to at that time. Income Based Repayment • Qualifies based on 15% of his or her household AGI above 150% of the poverty line for his or her family size. • Assumes they will meet the criteria for Loan Forgiveness because they will work qualifying employer for 10 years. • Knows that they are good at annual paperwork and documentation. Examples Careers Entrepreneur Private Practice Biotech Academic Researcher Sole Proprietor Private Practice Lawyer Debt Management for the Real World Examples Careers Non-profit Manager Doctors without Borders State Historian Public Interest Lawyer Compare the Options $60,000 Stafford Loan Balance Options Monthly Payment Repayment Period TOTAL PAID Standard Repayment Graduated Repayment $340 (2 yrs) $812 (8 yrs) Extended Repayment 10 years 10 years 25 years $82,858 $86,118 $124,933 $690 $416 Assumptions: 6.80% fixed interest rate and No payment incentives Debt Management for the Real World Questions????? Kim Siwarski Director, External Sales and School Services: ksiwarski@accessgroup.org Colleen MacDonald Assistant VP School Channel Sales: cmacdonald@simpletuition.com