Chapter 14 – Risk from the Shareholders’ Perspective

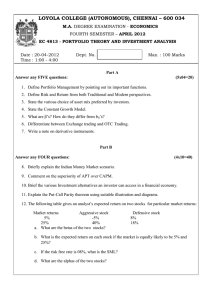

advertisement

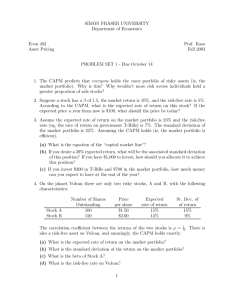

Chapter 14 – Risk from the Shareholders’ Perspective Focus of the chapter is the mean-variance capital asset pricing model (CAPM) Goal is to explain the relationship between risk and required return CAPM is a simple model of a complex reality The Key CAPM Relationship In an equilibrium market (Ra) = Rf + a,m[E(Rm) - Rf] Where: E(Ra) = expected return for an asset Rf = Risk-free interest rate a,m= Beta of the asset with regard to the market portfolio E(Rm) = Expected return for the market portfolio Key Assumptions Underlying CAPM Investors choose portfolios based on expected return and standard deviation Investors agree on expected returns, standard deviations, and correlation for all assets Investors can borrow and lend at risk-free rate Frictionless markets: no taxes or transaction costs, all investments completely divisible, no single investor large enough to affect price Uses of the CAPM Relationship Cost of capital calculations for a company Performance of a fully diversified stock or portfolio. Expected relationship: [Rp - Rf]/p = [Rm - Rf]/ m Performance of a portfolio that is not fully diversified, such as a sector fund: (Rp - Rf)/p,m = Rm - Rf Usefulness of the CAPM CAPM is a simple model of a complex reality Standard for evaluation is not perfection in explaining observed returns, Standard for evaluation is sufficient combination of accuracy and simplicity for practical use Accuracy of the CAPM Hundreds of tests have been conducted Explains differences in return between assets, but does not explain all differences Factors other than beta appear to affect returns: Variance for the asset Stocks of small firms tend to provide higher returns Time-of-year effects Beta explains a relatively small portion of differences in returns among stocks Most differences appear to be company-specific rather than systematic Application to Capital Budgeting CAPM provides risk-adjusted required return on equity for the company CAPM can be applied if the risk-free rate, market risk premium, and systematic risk of the asset remain constant over time Typically assume a holding period equal to the average life of the proposed project. Application to Capital Budgeting Beta may be estimated using Historical returns for the company Betas for comparable companies Other methods such as state of nature models Application to Capital Budgeting Must estimate expected return on the market portfolio Long-term historical returns are commonly used Other methods such as analyst forecasts are also used There is still substantial debate as to the long-term expected return for the market portfolio Historical returns may over-estimate expected returns because a decrease in required return results in an increase in realized return Application to Capital Budgeting Risk-free rate Typically assume a long-term risk-free rate, matching the average life of the asset. Use in Capital Budgeting CAPM is widely used to estimate the required return on equity for capital budgeting Firms frequently look at other risk measures as well: Total project risk Impact of the project on company risk International Investments The international application to capital budgeting is often simplified to: Ke = Rf + G[E(RG) – Rf] Where Rf = U.S. dollar-denominated risk-free rate G = dollar denominated returns for the proposed investment in relation to dollar-denominated returns on the global market index E(RG) = expected dollar-denominated return on the global market index