The Influence of Present and Prior Alternatives on Risk Aversion

advertisement

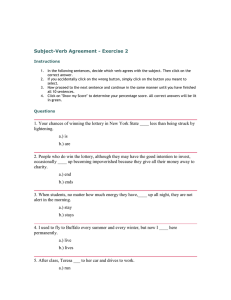

The Influence of Present and Prior Alternatives on Risk Aversion Adelson Piñón and Martin Weber* Abstract In a series of decision problems the influence of present and past options involving potential gains and potential losses was tested. This was done in two financial contexts (lottery vs. portfolio) eliciting individual preferences by means of several mixed gambles. No reduction of risk aversion was found when an option with higher expected value was included in a high probability of loosing set. Nevertheless, it was found such reduction when the probability of winning was high mediated by frame. In the lottery treatment, the higher the probability of winning the higher the anchor effect of the added option. In the between-trial condition, when subjects focused on gains (losses) they were less risk averse after a high risk background with high probability of winning (loosing). In the portfolio treatment, neither within-trial nor betweentrial effects were found, showing that a small frame manipulation was successful in making individuals context-independent. Activation and salience may explain how particular information tend to induce predictable patterns of choice under risk. Keywords: Behavioral Finance, Decision Making, Risk Aversion, Frame, Anchoring. *Adelson Piñón is from the Lehrstuhl für Bankbetriebslehre, Universität Mannheim, L 13, 15 68131 Mannheim, and Department of Psychology, Madrid Autonomous University. E-Mail: pinon@bank.bwl.uni-mannheim.de. Martin Weber is from the Lehrstuhl für Bankbetriebslehre, Universität Mannheim, L 5, 2 68131 Mannheim, and CEPR, London. E-Mail: weber@bank.bwl.uni-mannheim.de. We would like to thank Hilda Gambara, Jens Grunert, Christoph Heumann, Orfelio León, and Ignacio Montero for assistance on running the experiment, as well as Anders Anderson, Silvia Elsland, Lars Nordon, Pablo Quintá, Sava Savov, and Frank Welfens for valuable comments. Financial support from the Marie Curie RTN European Network for the Advancement of Behavioral Economics (ENABLE) is gratefully acknowledged. 1. Introduction In classical decision theory, choice was believed to reveal a person’s preference. Individuals made rational decisions in order to maximize their utility function, which was assumed to be concave and based on total wealth. Nevertheless, an extensive amount of experimental and empirical evidence has demonstrated the falsehood of these assumptions. Preference between options may change under two normatively equivalent conditions when different formulations are used (Tversky & Kahneman, 1981). For instance, the concept of framing effect has been applied to financial decisions such as dollar-cost averaging (e.g. Kahneman & Riepe, 1998; Statman 1995). Psychological studies demonstrate that decisions may also be biased in the direction of a salient comparison value denominated anchor, a notion first introduced to explain preference reversals (Slovic, 1967; Slovic & Lichtenstein, 1968; Lichtenstein & Slovic, 1971). Anchoring effects are remarkably robust and have been proposed as an explanation in a multitude of domains (e.g. Bleichrodt, 2001; Epley & Gilovich, 2005). The idea that preferences may be elicited by the context is receiving increased attention (Frederick, 2002; Slovic, 2000; Usher & McClelland, 2004). Although frame and anchor effects have been initially considered independent, both may be seen as instances of a broader family of accessibility effects, a conception compatible with more recent theoretical treatments of judgment and decision making (Kahneman & Frederick, 2005). This conception is worth exploring because it is consistent with so much psychological evidence, and to our knowledge, it has not been applied before to analyze how individuals make sequential and non-sequential choices, two situations by which decision-makers may assess options at any particular point. We created an experimental setting with hypothetical choices presenting mixed gambles with asymmetric payoffs in two financial domains: lottery and portfolio. We selected that type of gambles because there is an abundance of instruments in the financial markets that deliver such 2 payoffs, and there has been little research on their effect on preferences (Taleb, 2004; Wu, Zhang, & Gonzalez, 2004). We know that the reliance on hypothetical choices may raise questions about the validity of the results, but other methods have also limitations. Real choices can be investigated either in the field, or in the laboratory. Field studies do not allow neither adequate measurements of probabilities, nor the manipulation of options that decision makers are taking into account. Laboratory experiments typically involve very small stakes, and large number of repetitions that bias the results and restrict their generality. We agree with Kahneman and Tversky (1979) that the method of hypothetical choices emerges as the simplest procedure to investigate choice behavior. The method relies on the assumption that people often know how they would choose in actual situations, and on the further assumption that subjects have no special reason to mask their true preferences. If people are reasonably accurate in predicting their choices, the presence of particular patterns in hypothetical problems provides presumptive evidence for actual situations of choice. Our main results can be summarized as follows. No reduction of risk aversion was found when an option with higher expected value was included in a high probability of loosing set. Nevertheless, it was found such reduction when the probability of winning was high mediated by frame. In the lottery treatment, the higher the probability the higher the anchor effect of the added option. In the between-trial condition, when subjects focused on gains (losses) they were less risk averse after a high risk background with high probability of winning (loosing). In the portfolio treatment, neither within-trial nor between-trial effects were found, showing that a small frame manipulation was successful in making individuals context-independent. The results are consistent with our predictions. The activation and salience of certain information tend to induce differential systematic choices. 3 The rest of the paper is organized as follows. We first briefly summarize the literature on context dependency in mixed gambles. Section 3 describes the hypotheses. Next we report on the results of three experiments. The last section discusses the findings and concludes the article. 2. Literature Review A large body of evidence in decision making has shown that context influences risky choice behavior. In our view, three theoretical approaches may be suggested to accommodate the literature about the topic. A first approach defends the notion that in making their risky choices, subjects focus on reaching a special outcome called the aspiration level (e.g. Lopes, 1996; Lopes & Oden, 1999; Marley, 1997; Payne, Laughhunn, & Crum, 1980, 1981). Outcomes below the aspiration level are perceived as failures, whereas outcomes above that level are perceived as successes. Once a certain amount (i.e. the aspiration level) has been subtracted from each consequence, the resulting gambles are evaluated in terms of some classical choice theory. This approach presents one fundamental problem: aspiration level theories are unable to predict or explain how the aspiration level is determined (Luce, 2000). Regret theory models suggested that people take into account the potential regret or elation of each alternative under consideration (e.g. Bell, 1982, 1985; Loomes, Starmer, & Sugden, 1991; Loomes & Sugden, 1982; 1986). The influence of other options on the representation of a particular alternative is explained as violations of monotonicity and transitivity due to anticipated emotions. Unfortunately, regret cannot be used to predict risk behavior since it can play a role in dissuading or motivating individuals to decide a particular option. Furthermore, most of the phenomena argued to be consistent with regret theory models are also claimed as indications for prospect theory (Yates, 1990). 4 The third approach accommodates the context effects within the heuristics and biases paradigm (e.g. Fennema & Van Assen, 1998; Fennema & Wakker, 1997; Tversky & Kahneman, 1992). Cumulative prospect theory is an extension of the most prominent descriptive model of risky choice (Kahneman & Tversky, 1979). It has four important features: (1) the value function is defined over gains and losses relative to a reference point; (2) the gain function is concave and the loss function is convex; (3) losses loom larger than gains (i.e. loss aversion), and (4) prospects include mixed gambles with multiple risk or uncertain outcomes. Also this model is limited and incomplete (Payne, 2005) given that decision making is partially driven by factors related with the task. The list of factors includes among others: the presence of an anchor (e.g. Epley & Gilovich, 2005), the domain in which the task is presented (e.g. Shafir, Simonson, & Tversky, 1993), or different elicitation procedures (e.g. Hsee, Loewenstein, Blount, & Bazerman, 1999; Tversky, Slovic, & Kahneman, 1990; Tversky & Thaler, 1990). Although this influence is also recognized by other approaches (Luce, 2000), recent treatments within this paradigm provide a unifying theoretical structure, viewing preference changes as the product of memory representations and memory processes (Kahneman, 2003; Kahneman & Frederick, 2005; Weber & Johnson, 2006). The next section explains the predictions based on this framework. 3. Hypotheses & Experimental Design Focusing on the role of memory in decision making suggests several testable predictions. The attractiveness of current options may be changed when the salience of particular attributes is manipulated (Shafir & LeBouef, 2005) or due to the influence of background knowledge (Morrison, 2005; Novick & Bassok, 2005). If individuals focus more on gains (losses), they will tend to select options with high (low) expected values, and changes of preference (i.e. reduction 5 of risk aversion) are more likely to be observed when the probability of winning is high (low) because this attribute is more salient and receive more weight in the decision. Risk aversion is defined as a preference for the prospect with lower expected value. Confronted with the null hypothesis of no reduction of risk aversion in any condition, we propose, Hypothesis 1 (Within-trial condition): the addition of an alternative with higher expected value and higher risk in the choice set will reduce risk aversion when the probability of winning is high (low) if participants focus on gains (losses). Hypothesis 2 (Between-trial condition): previous options with high expected value and high risk will reduce risk aversion when the probability of winning is high (low) if participants focus on gains (losses). Given that different frames imply different cognitive representations of the same information (Piñón & Gambara, 2005), different effects should be observed (Weber & Zuchel, 2005): Hypothesis 3 (Frame): The size of within-trial and between-trial effects depends on the frame (lottery vs. portfolio) provided. The participants in the studies reported in this article were undergraduate students. We conducted three studies involving 8 groups of mixed gambles in a class setting. We did not provide any monetary incentives, because allowing subjects to win or lose the amounts of money involved is not possible. Figure 1 provides a graphic idea of the design used in all the studies. In the within-trial condition, we compared a group choosing between the gambles (G1, G2) with a group choosing between the same set plus an additional gamble with high expected value 6 (G1, G2, G3). In the between-trial condition, we compared how the decision in the target set (G1, G2) was influenced by a previous choice involving higher risk and expected values (BT1, BT2) or by a previous background involving lower risk and expected values (BT3, BT4). Individual valuations were elicited using a questionnaire with hypothetical gambles involving gains and losses. We used four asymmetric payoffs (80%-90% chances of winning or loosing) and two frames (lottery vs. portfolio). [Figure 1 about here] Study 1 A. Objectives & Subjects We examine within-trial and between-trial conditions with two opposite asymmetric payoffs (80% chance of winning vs. 80% chance of loosing) in a lottery frame. Each of the 456 subjects were asked to fill out a questionnaire. The participants were undergraduate students of business administration from the University of Mannheim. Their mean age was 21.7 years (SD = 1.7). Two hundred sixty four (61%) were men, 172 women1. B. Operationalization & Procedure Table 1 and 2 show the lotteries presented to the subjects. Two probability levels implying either potential gains or potential losses with the same expected values were used in the experimental design adopted. All lotteries employed had positive expected values. Comparisons 1 23 participants did not report age. 20 did not report gender. 7 were made in a between-subject basis. The questionnaires were presented to the participants in a completely randomized order. One example of questionnaire2 is provided as follows: Which of these lotteries do you prefer? Lottery 1 0.8 0.2 91€ - 250€ Lottery 2 0.8 0.2 144€ - 355€ High and low probability of winning groups received lotteries that vary in expected value and risk (i.e. potential loss)3. The dependent variable was aggregated choices in the low risk option (Lottery 1 in both conditions). Respondents in groups 1-4 (within-trial condition) made one choice in the set of lotteries presented. Group 1 and 3 chose between two lotteries, whereas Group 2 and 4 had to choose between the same lotteries plus an additional one with higher expected value and higher risk. Respondents in groups 5-8 (between-trial condition) first made one choice between lotteries in the background set, followed by one choice between lotteries in the target set. All subjects received the same target set but half of them chose between lotteries with high differences in expected value and low differences in high risk. The other half chose between lotteries with lower differences in expected value and higher differences in risk. [Table 1 and 2 about here] 2 3 Translated from German. See Appendix A for further details. 8 C. Results & Discussion Table 3 shows the results obtained in the within-trial condition. Participants exposed to the high probability of winning lotteries were indifferent between the lotteries presented, and a within-trial effect was found when an additional option with high expected value was added to the choice set (z = 1.946; p = 0.0258). When the probabilities of loosing were high, respondents were risk seeking (z = 3.016; p = 0.0013) and there was no reduction of risk aversion when the new option was added (z = -0.378; p = 0.6475). Figure 2 illustrates the effects found. [Table 3 about here] [Figure 2 about here] Table 4 and Figure 3 show the results of the between-trial condition. As may be seen, at both probability levels independently of the background, individuals tend to be risk seeking (p < .05). In lotteries involving high probability of loosing, there were no significant differences between choices in the target set (z = -0.960; p = 0.1686). When the lotteries involved a high probability of winning, 29% of the individuals chose the less risky option in the target set after the high risk background, whereas 41% of the participants chose the same option in the low risk background (z = -1.296; p = 0.0975). [Table 4 about here] [Figure 3 about here] Participants in the high probability of winning gambles showed within-trial and between-trial effects. We interpret these results in terms of accessibility: focusing on gains (i.e. selecting 9 gambles with high expected value, and therefore being more risk seeking) make respondents more context dependent when potential gains with high probability are available. The addition of a new option in the choice set as well as previous choices involving high probability of winning acted as an anchor, inducing individuals to be less risk averse. This interpretation implies that different anchor effects (i.e. within-trial and between-trial effects) should be observed if we vary the factors related with the anchor: the quantitative information provided to participants (i.e. probability levels and outcomes), and the qualitative information used (i.e. frame). In the next study we vary probability levels and outcomes maintaining the expected values constant. By increasing the potential losses involved, we are inducing participants to weight losses more heavily than gains (i.e. be more risk averse). The manipulation of the frame is addressed in Study 3. Study 2 A. Objectives & Subjects We examine between-trial and within-trial effects under the same frame as the previous study but with different outcomes involving different probability levels (90% chances of winning vs. 90% chances of loosing). Each of the 362 subjects were asked to fill out a questionnaire. The participants were undergraduate students of psychology from Madrid Autonomous University. The mean age was 19.2 (SD = 3.7). Two hundred thirty eight (73%) were women, 86 men4. B. Operationalization & Procedure Table 5 and 6 show the lotteries presented to the subjects. We used the same expected values as in Study 1. Comparisons were made in a between-subject basis. The questionnaires were 4 38 participants did not report gender. 46 did not report age. 10 presented to the participants in a completely randomized order. For each pair or triad, subjects had to report they preferred lottery. [Table 5 and 6 about here] C. Results & Discussion We found higher within-trial and between-trial effects. Tables 7-8 and figures 4-5 show the results. Participants in group 1 are indifferent between the lotteries. Nevertheless, preference for lottery 1 decreases in group 2 (z = 2.791; p = 0.0026). When the probability of winning is low individuals are more risk seeking (z = 1.774; p = 0.0381) but the addition of a new option with high expected value and higher risk does not change risk aversion (z = 0.102; p = 0.4593). [Table 7 about here] [Figure 4 about here] In the between-trial condition, participants had a general tendency to be highly risk averse (in 3 out of 4 groups p < .01). Individuals are influenced by previous decisions when the probability of loosing is high (z = -1.534; p = 0.0625), but not when this probability is low (z = 0; p = 0.5). [Table 8 about here] [Figure 5 about here] The experimental manipulation was partially successful (it did not induce risk aversion in the within-trial condition). Participants in the between-trial condition focused on losses (i.e. selected 11 gambles with low expected values), and as predicted by hypothesis 2, they were less risk averse when the probability of loosing was high. The anchor effect related with prior decisions is now observed for potential losses as expected. We finally vary the frame of the options in the next study in order to check how this manipulation may affect choices. Study 3 A. Objectives & Subjects We examine between-trial and within-trial conditions under a portfolio frame, with the same outcomes and probability levels used in Study 1. Each of the 357 subjects were asked to fill out the questionnaire. The participants were undergraduate students of business administration of Mannheim University. Their mean age was 21.7 years (SD = 2.4). Two hundred and eight (61%) were men, 131 women5. B. Operationalization & Procedure It was presented the same questionnaires as in Study 1, but with the word “portfolio” instead of “lottery”, as follows: Which of these portfolios do you prefer? Portfolio 1 0.8 0.2 91€ - 250€ Portfolio 2 0.8 0.2 144€ - 355€ As in the previous studies, comparisons were made in a between-subject basis. The questionnaires were presented to the participants in a completely randomized order. 5 29 participants did not report age. 18 did not report gender. 12 C. Results & Discussion No effects were found under this frame. Neither in the within-trial condition, probability 0.80 (z = -0.498; p = 0.3091), probability 0.20 (z = 0.560; p = 0.2879), nor in the between-trial condition, probability 0.8 (z = -1.038; p = 0.1498), probability 0.2 (z = 0.442; p = 0.3293). [Table 9 about here] [Figure 6 about here] Tables 9-10, and Figures 6-7 show the findings under this experimental manipulation. Participants are risk seeking but the portfolio frame seems to reduce the weight attributed to gains, making them immune to the anchor effects of prior and present alternatives. [Table 10 about here] [Figure 7 about here] 3. General Discussion Several issues have been addressed in this paper: how present and past alternatives available may modify risk aversion, and what is the impact of outcomes, probability level, and frame in the different effects observed. Neither aspiration level, nor regression theory models can adequately explain our results. The first cannot explain the apparently contradictory finding of reduction of risk aversion after prior decisions involving potential gains and after prior decisions involving potential losses. The second assumes that people must be so extremely sensitive that even in hypothetical choices they take potential regret or disappointment into account. 13 We interpreted the results obtained in terms of accessibility. The activation and salience of particular information tend to induce predictable choices. It was not found a reduction of risk aversion when an option with higher expected value was included in a high probability of loosing set due to a higher weight of gains that made losses less salient. Nevertheless, it was found within-trial effects when the probability of winning was high mediated by frame. In the lottery treatment, the higher the probability the higher the anchor effect of the added option. In the between-trial condition, when subjects focused on gains (losses) they were less risk averse after a high risk background with high probability of winning (loosing). It can be argued that our experimental design induced within-trial effects, given that if one group of participants selected one of two options randomly (i.e. 50%) and another group decide between three options randomly (i.e. 33%) a reduction of risk aversion should be always observed. We believe that this is not the case for two reasons. First, we only observed within-trial effects in 2 of 6 conditions. Second, a higher within-trial effect for higher potential gains was found in Study 2. These results exclude the alternative explanation of random selection, and provide support for the expected finding that the addition of a third alternative induce respondents to focus on gains only in particular frames when the probability of winning is high. In the portfolio treatment, neither within-trial nor between-trial effects were found. Although the same cognitive overload (if any) is elicited by both type of frames, participants are more prone to reduce cognitive effort (i.e. be more context dependent) when a lottery frame is offered. Given that our respondents in Study 3 are students of business administration, we speculate that a lottery frame may lead to representations associated with less controllability (“gamble”), whereas a portfolio frame is associated with more perceived control (“inversion”). We argue that our results are consistent with other studies. Changes in preferences are extensively documented and cannot be attributed to lack of motivation, since the same general 14 effects are observed under greater incentives (LeBouef & Shafir, 2005). Our general finding that risk aversion depends on the size of payoffs, the probability levels, and frame has been reported by Kühberger, Schulte-Mecklenbeck, and Perner (1999). Higher risk aversion with increasing payout magnitudes and larger probabilities has been found in several studies (e.g. Hogarth & Einhorn, 1990; Prelec & Loewenstein, 1991; Weber & Chapman, 2005). There is a massive amount of literature about the effect of prior outcomes in decision making (e.g. Arkes & Blumer, 1985; Karlsson, Gärling, & Bonini, 2005; Neilson, 1998; Thaler & Johnson, 1990). These researchers found reduction of risk aversion after prior losses (i.e. sunk cost effect, escalation of commitment), and after prior gains (i.e. house money effect). Our results can be considered as an extension of these previous works, in the sense that risk aversion is not only affected by prior outcomes, but also by prior decisions involving potential losses or potential gains. Our findings are relevant for financial advisors and decision analysts. Financial advisors normally use lottery formats for eliciting clients’ risk attitudes. We have shown that preferences may be modified by the particular options and the order they are provided to investors when a lottery frame is used. We believe that consultants should keep in mind this fact, and take also into account that a portfolio format does not influence risk aversion and may help people to make better decisions. For decision analysts, being able to increase or reduce risk aversion means that we understand something about its causes. We believe that the heuristic value of the used framework is undeniable, and has two main advantages. First, focusing on the role of memory representation and memory processes on decision making provide not only explanations for the observed results analyzed here, but also other interesting predictions for choices under risk not considered in previous frameworks (Weber & Johnson, 2006). Second, it is parsimonious to use a unified set of 15 principles that may explain multitude of phenomena in several domains. The famous Ockam’s razor (do not multiply entities beyond necessity) is one of the golden rules of science, and this new promising approach may facilitate the search for basic principles that underlie decision making. References Arkes, H. R. and C. Blumer, 1985. The psychology of sunk costs. Organizational Behavior and Human Decision Processes, 35(1), 124-140. Bell, D. E., 1982. Regret in decision making under uncertainty. Operations Research, 30, 961981. Bell, D. E., 1985. Disappointment in decision making under uncertainty. Operations Research, 33, 1-27. Bleichrodt, H. 2001. Probability weighting in choice under risk : An empirical test. The Journal of Risk and Uncertainty, 23(2), 185-198. Epley, N. and T. Gilovich, 2005. When effortful thinking influences judgmental anchoring: differential effects of forewarning and incentives on self-generated and externally provided anchors. Journal of Behavioral Decision Making, 18, 199-212. Fennema, H. & A. L. M. van Assen, 1999. Measuring the utility of losses by means of the tradeoff method. Journal of Risk and Uncertainty, 17(3), 277-295. Fennema, H. and P. Wakker, 1997. Original and cumulative prospect theory: A discussion of empirical differences. Journal of Behavioral Decision Making, 10, 53-64. Frederick, S. 2002. Automated choice heuristics. In T. Gilovich, D. Griffin, D. Kahneman (Eds.). Heuristics and Biases. The psychology of intuitive judgment. UK: Cambridge University Press. 16 Hogarth, R. and H. Einhorn, 1990. Venture theory: A model of decision weights. Management Science, 36(7), 780-803. Hsee, C. K., G. F. Loewenstein, S. Blount, and M. H. Bazerman, 1999. Preference reversals between joint and separate evaluations of options: A review and theoretical analysis. Psychological Bulletin, 125(5), 576-590. Kahneman, D. 2003. A perspective on judgment and choice: Mapping bounded rationality. American Psychologist, 58, 697-720. Kahneman, D. and S. Frederick, 2005. A model of heuristic judgment. In K. J. Holyoak and R. G. Morrison (Eds.). The Cambridge Handbook of Thinking and Reasoning. NY: Cambridge University Press. Kahneman, D. and M. W. Riepe, 1998. Aspects of investor psychology. Journal of Portfolio Management, 24, 52-65. Kahneman, D. and A. Tversky, 1979. Prospect theory: an analysis of decision under risk. Econometrica, 47, 263-291. Karlsson, N., T. Gärling, and N. Bonini, 2005. Escalation of commitment with transparent future outcomes. Experimental Psychology, 52(1), 67-73. Kühberger, A., M. Schulte-Mecklenbeck, and J. Perner, 1999. The effects of framing, relfection, probability, and payoff on risk preference in choice tasks. Organizational Behavior and Human Decision Processes, 78, 204-231. LeBouef, R. A. and E. B. Shafir, 2005. Decision Making. In K.J. Holyoak, & R. G. Morrison (Eds.). The Cambridge Handbook of Thinking and Reasoning (pp 243-266). New York: Cambridge University Press. Lichtenstein, S. and P. Slovic, 1971. Reversals of preference between bids and choices in gambling decisions. Journal of Experimental Psychology, 89, 46-55. 17 Loomes, G., Starmer, C. and R. Sugden, 1991. Observing violations of transitivity by experimental methods. Econometrica, 59, 425-439. Loomes, G. and R. Sugden, 1982. Regret theory: An alternative theory of rational choice under uncertainty. Economic Journal, 92, 805-824. Loomes, G. and R. Sugden, 1986. Disappointment and dynamic consistency in choice under uncertainty. Review of Economic Studies, 53, 271-282. Lopes, L., 1996. When time is of the essence: Averaging, aspiration, and the short run. Organizational Behavior and Human Decision Processes, 65, 179-189. Lopes, L., and G. C. Oden, 1999. The role of aspiration level in risky choice: a comparison of cumulative prospect theory and SP/A theory. Journal of Mathematical Psychology, 43, 286-313. Luce, R. D., 2000. Utility of gains and losses: measurement-theoretical and experimental approaches. Lawrence Erlbaum Publishers, London. Marley, A. A. J., 1997. Probabilistic choice as a consequence of nonlinear (sub) optimization. Journal of Mathematical Psychology, 41, 382-391. Morrison, R. G. 2005. Thinking in working memory. In K. J. Holyoak and R. G. Morrison (Eds.). The Cambridge Handbook of Thinking and Reasoning (pp. 457-474). New York: Cambridge University Press. Neilson, 1998. Reference wealth effects in sequential choice. Journal of Risk and Uncertainty, 17(1), 27-47. Novick, L. R., and M. Bassock, 2005. Problem Solving. In K. J. Holyoak and R. G. Morrison (Eds.). The Cambridge Handbook of Thinking and Reasoning (pp. 321-350). New York: Cambridge University Press. 18 Payne, J. W. 2005. It is whether you win or lose : The importance of the overall probabilities of winning or losing in risky choice. Journal of Risk and Uncertainty, 30(1), 5-19. Payne, J. W., D. J. Laughhunn, and R. L. Crum, 1980. Translation of gambles and aspiration level effects in risky choice behavior. Management Science, 26, 1039-1060. Payne, J. W., D. J. Laughhunn, and R. L. Crum, 1981. Further tests of aspiration level effects in risky behavior. Management Science, 27, 953-958. Piñón, A. and H. Gambara, 2005. A meta-analytic review of framing effect: risky, attribute, and goal framing. Psicothema, 17(2), 325-331. Prelec, D., and L. Loewenstein, 1991. Decision making over time and under uncertainty: A common approach. Management Science, 37, 770-786. Shafir, E. and R. A. LeBouef, 2005. Conflict and context in multi-attribute choice. In Blackwell Handbook of Judgment and Decision Making (p). Shafir, E., I. Simonson, and A. Tversky, 1993. Reason-based choice. Cognition, 49, 11-36. Simonson, I., T. Kramer and M.J. Young, 2004. Effect propensity. Organizational Behavior and Human Decision Processes, 95, 156-174. Slovic, P. 1967. The relative influence of probabilities and payoffs upon perceived risk of a gamble. Psychonomic Science, 9, 223-224. Slovic, P., 2000. The construction of preference. In D. Kahneman and A. Tversky (Eds). Choices, values, and frames. UK: Cambridge University Press. Slovic, P. and S. Lichtenstein, 1968. Relative importance of probabilities and payoffs in risktaking. Journal of Experimental Psychology Monograph, 78(3), 1-18. Statman, M. 1995. A behavioral framework for dollar-cost averaging. Journal of Portfolio Management, 22, 70-78. 19 Taleb, N. N., 2004. Bleed of Blowup? Why do we prefer asymmetric payoffs? The Journal of Behavioral Finance, 5(1), 2-7. Thaler, R. H. and E. J. Johnson, 1990. Gambling with the house money and trying to break even: The effects of prior outcomes on risky choice. Management Science, 36(6), 643-660. Tversky, A. and D. Kahneman. 1974. Judgment under uncertainty: heuristics and biases. Science, 185, 1124-1131. Tversky, A. and D. Kahneman. 1981. The framing effect of decisions and the psychology of choice. Science, 185, 1124-1131. Tversky, A. and D. Kahneman. 1992. Advances in prospect theory: cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297-323. Tversky, A. and I. Simonson. 1993. Context-dependent preferences. Management Science, 39(10), 1179-1189. Tversky, A., Slovic, P. and D. Kahneman, 1990. The causes of preference reversal. The American Economic Review, 80(1), 204-217. Tversky, A. and R. H. Thaler, 1990. Anomalies: Preference Reversals. Journal of Economic Perspectives, 4(2), 201-211. Usher, M. and J.L. McClelland. 2004. Loss aversion and inhibition in dynamical models of multialternative choice, Psychological Review, 111(2), 757-769. Weber, B. J. and G. B. Chapman, 2005. Playing for peanuts: Why is risk seeking more common for low-stakes gambles? Organizational Behavior and Human Decision Processes, 97, 3146. Weber, E. U. and E. J. Johnson, 2006. Constructing preferences from memory. Working Paper. Weber, M. and H. Zuchel, 2005. How do prior outcomes affect risk attitude? Comparing escalation of commitment and the house-money effect. Decision Analysis, 2(1), 30-43. 20 Wu, G., J. Zhang, and R. Gonzalez, 2004. Decision under Risk. Harvey, N. and D. Koehler. (Eds.). Blackwell Handbook of Judgment and Decision Making. Blackwell. MA, 399423. Yates, J. F. 1990. Judgment and Decision Making. New Jersey: Prentice Hall. 21 Appendix A We assigned one arbitrary expected value and risk to a particular gamble. The values assigned to other gambles were based on this one as reference, using the figures provided by Tversky and Simonson (1993)6. Within-trial condition Gamble 1: EV = 23; R = -50 Gamble 2: EV = 44; R = -71 Gamble 3: EV = 50; R = -92 Between-trial condition Gamble BT1: EV = 110; R = -130 Gamble BT2: EV = 150; R = -150 Gamble BT3: EV = 35 ; R = -20 Gamble BT4: EV = 55 ; R = -60 Gamble 1: EV = 70 ; R = -80 Gamble 2: EV = 100 ; R = -110 6 Given the results of a pilot study, in the between-trial condition we used lotteries with higher expected values in the target set. 22 Figure 1 EV Within-trial Condition EV Between-trial Condition (BT1, BT2) G3 G2 G2 G1 G1 (BT3, BT4) Risk Risk 23 Table 1. Within-trial Condition (Probability 0.80 vs. 0.20) Group 1 Lottery 1 Lottery 2 0.8 0.2 0.8 0.2 Group 2 91€ - 250€ 144€ - 355€ Lottery 1 Lottery 2 Lottery 3 Group 3 Lottery 1 Lottery 2 0.2 0.8 0.2 0.8 0.8 0.2 0.8 0.2 0.8 0.2 91€ - 250€ 144€ - 355€ 178€ - 460€ Group 4 365€ - 63€ 575€ - 89€ Lottery 1 Lottery 2 Lottery 3 24 0.2 0.8 0.2 0.8 0.2 0.8 365€ - 63€ 575€ - 89€ 710€ - 115€ Table 2. Between-trial Condition (Probability 0.80 vs. 0.20) Group 5 Lottery BT1 Lottery BT2 Lottery 1 Lottery 2 Group 6 0.8 0.2 0.8 0.2 300€ - 650€ 375€ - 750€ Lottery BT3 0.8 0.2 0.8 0.2 188€ - 400€ 263€ - 550€ Lottery 1 Lottery BT4 Lottery 2 Group 7 Lottery BT1 Lottery BT2 Lottery 1 Lottery 2 0.8 0.2 0.8 0.2 69€ - 100€ 144€ - 300€ 0.8 0.2 0.8 0.2 188€ - 400€ 263€ - 550€ Group 8 0.2 0.8 0.2 0.8 1200€ - 163€ 1500€ - 188€ Lottery BT3 0.2 0.8 0.2 0.8 750€ - 100€ 1050€ - 138€ Lottery 1 Lottery BT4 Lottery 2 25 0.2 0.8 0.2 0.8 275€ - 25€ 575€ - 75€ 0.2 0.8 0.2 0.8 750€ - 100€ 1050€ - 138€ Table 3. Choices in Within-trial Condition (Lottery Frame: 0.80 vs. 0.20) Probability Levels 0.80 Group 1 (n = 60) Lottery 1 Lottery 2 0.44 0.56 0.20 Group 2 (n = 60) Lottery 1 Lottery 2 Lottery 3 0.27 0.38 0.35 Group 3 (n = 46) Lottery 1 Lottery 2 26 0.20 0.80 Group 4 (n = 66) Lottery 1 Lottery 2 Lottery 3 0.23 0.33 0.44 Figure 2. Within-trial Effect (Lottery Frame: 0.80 vs. 0.20) 0.44 0.27 0.23 0.2 0.8 0.2 27 Table 4. Choices in Between-trial Condition (Lottery Frame: 0.80 vs. 0.20) Probability Levels 0.80 Group 5 (n = 55) 0.20 Group 6 (n = 51) Group 7 (n = 67) Background Set Lottery BT1 Lottery BT2 0.38 0.62 Lottery BT3 Lottery BT4 Background Set 0.52 0.48 Lottery BT1 Lottery BT2 Target Set Lottery 1 Lottery 2 0.29 0.71 Lottery 1 Lottery 2 Group 8 (n = 51) 0.15 0.85 Lottery BT3 Lottery BT4 0.44 0.56 Target Set 0.41 0.59 Lottery 1 Lottery 2 28 0.16 0.84 Lottery 1 Lottery 2 0.23 0.77 Figure 3. Between-trial Effect (Lottery Frame: 0.80 vs. 0.20) 0.41 0.29 0.23 0.16 0.8 0.2 29 Table 5. Within-trial Condition (Probability 0.90 vs. 0.10) Group 1 Lottery 1 Lottery 2 0.9 0.1 0.9 0.1 Group 2 81€ - 500€ 117€ - 710€ Lottery 1 Lottery 2 Lottery 3 Group 3 Lottery 1 Lottery 2 0.1 0.9 0.1 0.9 0.9 0.1 0.9 0.1 0.9 0.1 81€ - 500€ 117€ - 710€ 158€ - 920€ Group 4 730€ - 56€ 1050€ - 79€ Lottery 1 Lottery 2 Lottery 3 30 0.1 0.9 0.1 0.9 0.1 0.9 730€ - 56€ 1050€ - 79€ 1420€ - 102€ Table 6. Between-trial Condition (Probability 0.90 vs. 0.10) Group 5 Lottery BT1 Lottery BT2 Lottery 1 Lottery 2 Group 6 0.9 0.1 0.9 0.1 267€ - 1300€ 333€ - 1500€ Lottery BT3 0.9 0.1 0.9 0.1 167€ - 800€ 233€ - 1100€ Lottery 1 Lottery BT4 Lottery 2 Group 7 Lottery BT1 Lottery BT2 Lottery 1 Lottery 2 0.9 0.1 0.9 0.1 61€ - 200€ 117€ - 600€ 0.9 0.1 0.9 0.1 167€ - 800€ 233€ - 1100€ Group 8 0.1 0.9 0.1 0.9 2400€ - 144€ 3000€ - 167€ Lottery BT3 0.1 0.9 0.1 0.9 1500€ - 89€ 2100€ - 122€ Lottery 1 Lottery BT4 Lottery 2 31 0.1 0.9 0.1 0.9 550€ - 22€ 1050€ - 67€ 0.1 0.9 0.1 0.9 1500€ - 89€ 2100€ - 122€ Table 7. Choices in Within-trial Condition (Lottery Frame: 0.90 vs. 0.10) Probability Levels 0.90 Group 1 (n = 44) Lottery 1 Lottery 2 0.52 0.48 0.10 Group 2 (n = 43) Lottery 1 Lottery 2 Lottery 3 0.23 0.54 0.23 Group 3 (n = 42) Lottery 1 Lottery 2 32 0.31 0.69 Group 4 (n = 47) Lottery 1 Lottery 2 Lottery 3 0.30 0.40 0.30 Figure 4. Within-trial Effect (Lottery Frame: 0.90 vs. 0.10) 0.52 0.31 0.3 0.23 0.9 0.1 33 Table 8. Choices in Between-trial Condition (Lottery Frame: 0.90 vs. 0.10) Probability Levels 0.90 Group 5 (n = 49) 0.10 Group 6 (n = 49) Group 7 (n = 48) Background Set Lottery BT1 Lottery BT2 0.51 0.49 Lottery BT3 Lottery BT4 Background Set 0.51 Lottery BT1 0.49 Lottery BT2 Target Set Lottery 1 Lottery 2 0.65 0.35 Lottery 1 Lottery 2 Group 8 (n = 40) 0.44 0.56 Lottery BT3 Lottery BT4 0.60 0.40 Target Set 0.65 0.35 Lottery 1 Lottery 2 34 0.54 0.46 Lottery 1 Lottery 2 0.70 0.30 Figure 5. Between-trial Effect (Lottery Frame: 0.90 vs. 0.10) 0.7 0.65 0.65 0.54 0.9 0.1 35 Table 9. Choices in Within-trial Condition (Portfolio Frame) Probability Levels 0.80 Group 1 (n = 42) Portfolio 1 Portfolio 2 0.20 Group 2 (n = 47) 0.31 Portfolio 1 0.69 Portfolio 2 Portfolio 3 Group 3 (n = 48) 0.36 Portfolio 1 0.36 Portfolio 2 0.28 36 Group 4 (n = 45) 0.27 Portfolio 1 0.73 Portfolio 2 Portfolio 3 0.22 0.31 0.47 Figure 6. Within-trial Effect (Portfolio Frame) 0.36 0.31 0.27 0.22 0.8 0.2 37 Table 10. Choices in Between-trial Condition (Portfolio Frame) Probability Levels 0.80 Group 5 (n = 43) 0.20 Group 6 (n = 43) Group 7 (n = 43) Background Set Portfolio BT1 0.28 Portfolio BT2 0.72 Background Set Portfolio BT3 0.50 Portfolio BT4 0.50 Portfolio BT1 0.19 Portfolio BT2 0.81 Target Set Portfolio 1 Portfolio 2 0.34 Portfolio 1 0.66 Portfolio 2 Group 8 (n = 46) Portfolio BT3 0.48 Portfolio BT4 0.52 Target Set 0.45 Portfolio 1 0.55 Portfolio 2 38 0.26 Portfolio 1 0.74 Portfolio 2 0.22 0.78 Figure 7. Between-trial Effect (Portfolio Frame) 0.45 0.34 0.26 0.22 0.8 0.2 39