Document 15799726

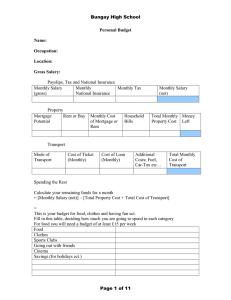

advertisement

Getting Around Transport You need to decide how you are going to travel to and from work and out and about. Your choices are: 1. Public Transport 2. Running a Car 3. Self propelled (bike or walk) Which? Discuss the advantages and disadvantages of each: Buying a Car You are going to investigate the cost of running a car You will need to consider (a) Car loan (b) Car tax (c) Insurance (d) Running costs Use the car sales board to find a car you like and complete the car loans and alternative transport pages of the booklet to find out if you can afford it. Car Loans Car loans are typically offered with repayment schemes of between 2 to 5 years. Calculated at 5.6% per year To find the total monthly repayment amount for the loan use the table below and find out if you can afford the cost of a car. Price of car Total amount of repayments. Multiply (a) by 1.056 Loan period in months (number of years multiplied by 12) Monthly repayments (b) divided by (c) (a) (b) Notice that the actual amount the car is costing you goes up if you take a longer loan period. Petrol The amount petrol costs you, depends on the price set by the petrol companies and the government tax upon that (combining to make the price you pay at he pumps) and length of the journey travelled in the car. The cost also depends on the size and efficiency of the engine in the car. Currently petrol prices are approximately 99p per litre (but it is rising and very changeable). As a guide we have provided approximate weekly costs for petrol dependant on the type of car. Complete this table to work out the monthly cost of motoring; Monthly Cost Car Loan Petrol Insurance Tax Parking Total Now you can fill in the transport section of your personal budget. Make a Decision! 1. Decide if you wish to travel by car, bike or public transport and complete your transport section of your personal budget. Personal Budget Name: Occupation: Location: Gross Salary: Payslips, Tax and National Insurance Monthly Salary Monthly Monthly Tax (gross) National Insurance Monthly Salary (net) Property Mortgage Potential Rent or Buy Monthly Cost of Mortgage or Rent Household Bills Total Monthly Money Property Cost Left Transport Mode of Transport Cost of Ticket (Monthly) Cost of Loan (Monthly) Additional Costs; Fuel, Car-Tax etc… Total Monthly Cost of Transport Spending the Rest Calculate your remaining funds for a month = [Monthly Salary (net)] – [Total Property Cost + Total Cost of Transport] = This is your budget for food, clothes and having fun ect. Fill in this table, deciding how much you are going to spend in each category For food you will need a budget of at least £15 per week Food Clothes Sports Clubs Going out with friends Cinema Savings (for holidays ect.) Spending it all Now you have paid for your accommodation and sorted out your transport the rest of the money is yours to spend as you wish. Don’t forget: (a) Food (minimum £15 a week but you will be hungry) (b) Clothing (c) Savings (for emergencies or holidays) (d) Pensions Review How do you feel about your budget? Has it changed what you want to do? How can you make things easier for yourself? Fill in the “what would I do differently” sheet. Did we miss anything out?