Tax Aspects of Private Development Assistance NYU School of Law

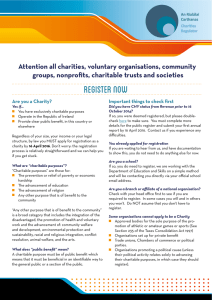

advertisement

NYU School of Law Conference on the Privatization of Development Assistance Tax Aspects of Private Development Assistance Eric M. Zolt Michael H. Schill Professor of Law UCLA School of Law Policy Question • If have $50 billion in U.S. government funds available each year to support charitable activities, how should those funds be used? Efficiency Concerns • Encourage activities with the greatest social returns. Compare costs of lost tax revenue with benefits from gains from charitable activity – Worthiness of purpose – Efficiency in performance • Behavioral effects—target tax incentives to increase the level of marginal giving – Little to gain for providing tax benefits to those who would give anyhow • Compare tax expenditures for charitable contributions with other uses of tax revenues to achieve similar or other objectives (including lower taxes) • Types of tax benefit—compare use of the charitable tax deduction with other tax instruments (e.g. targeted credits) that may encourage the level of charitable activities Fairness Concerns • Who decides how funds should be spent? – Alternatives • • • • Government bureaucracy Band of experts Equal votes among citizens Greater voice to those taxpayers who give more (“Upsidedown subsidy”) – Tensions • Value of democratic accountability in the use of public resources • Value of engaging private actors in increasing the level of collective goods and services Key Questions • Should tax benefits support charitable activities outside the United States? • Should the tax system treat foreign charities differently from domestic charities? • Should the tax system extend tax benefits to for-profit charities, including foreign entities? Tentative Conclusions • Cannot meaningfully distinguish among types of activities without some type of framework for determining comparative worthiness • Questions cannot be answered by simply looking at existing theories justifying tax deductions for charitable activities and determining whether there is an adequate basis for distinguish between types of activities or providers – Between domestic charitable activities and foreign charitable activates – Between domestic charities and foreign charities – Between non-profit charities and for-profit charities U.S. Tax Provisions Governing Charitable Activities • Exemption from federal income tax • Eligibility to receive tax-deductible charitable contributions – Income tax deductions – Gift and estate tax deductions • Access to tax-exempt financing • State and local income, sales, and property tax benefits Restrictions on Funding Foreign Charitable Activities • Place of organization restrictions – Donee must be “created or organized in the US or in any possession thereof….” Section 170 (c)(2)(A) • Place of use restrictions – Few limitations for use of funds outside the US by domestic charities – Corporate donor limitations • Foreign recipient must be corporation, not a trust, partnership • Limitations for determining foreign source income for foreign tax credit limitations – Private foundation restrictions for grants to foreign grantees Distribution of Federal Income Tax Burden Question 1: Charitable Deductions for Foreign Charitable Activities • Judge Richard Posner blogs against allowing U.S. taxpayers to claim tax deductions for gifts to domestic charities that donate or operate abroad. His opposition does not rest on the grounds of – U.S. government foreign aid projects more efficient than private activities – Nor challenge the external benefits of charitable deductions in overcoming free-rider problems • Posner contends that denying deductions for foreign charitable activities will: – Increase funds available for domestic charitable activates (“substitution effect”) – Decrease the level of the overall subsidy for charitable activities (“revenue effect”) – Greater utility for domestic giving as foreign charitable activities reduce the pressure for political, economic and social reforms (“Mugabe effect”) Insights from Tax Scholarship • Donor focused theories; Income measurement – Andrews: • Not acts of personal consumption—no “private preclusive use” • Create common goods “whose enjoyment is not confined to contributors nor apportioned among contributors according to amounts of contributions” – Bittker • Equitably accounts for loss of welfare by donor • Donations derive from perceived moral obligations • Rewards selfless acts Subsidy Theories • Treasury efficiency – Tax subsidies encourage the private sector to fund activities that might otherwise have to be financed with public funds • Gains from additional contributions greater than lost revenue • Gains from additional contributions as compared to alternative uses of lost revenue • Market failures – Level of public goods and services (non-rival, non-excludable) undersupplied as rational self-interested individuals will choose to free ride on the charitable activities of others – Most goods and services provided by governments (or charities) are rival and excludable—but they can generate positive externalities not captured by market participants • Government failures – If leave spending decisions solely to political process, then the level of collective goods and services decided by majority rule – Tax subsidy allows a minority of taxpayers to receive government support as long as they are willing also to contribute to the cost – Decentralized approach allows for greater diversity, innovation and other benefits Application of Subsidy Theories to Foreign Charitable Activities • Theories do not provide a basis for distinguishing between domestic and foreign charitable activities – – • Greater government and market failure in developing countries Theories provide little guidance as to which types of activities to support, how much, and within which countries. Failure to address issues in cross-border activity – – Assumes single society: preferences of majority trumping interests of the minority; but not consider interests of other groups Assumes three sector society: U.S.-centric view of government, private sector, and non-profit sector; larger group of actors in developing countries Question 2: Charitable Deductions for Foreign Charities • Statutory restrictions and legislative history • Consequences of extending tax benefits to foreign charities • Enforcement and compliance concerns • Implementation alternatives Legislative History of Revenue Act of 1938 • The exemption from taxation of money or property devoted to charitable or other purposes is based upon the theory that the Government is compensated for the loss of revenue by its relief from financial burdens which would otherwise have to be met by appropriations from public funds and by benefits resulting from the promotion of general welfare. The United States derives no such benefit from gifts to foreign institutions, and the proposed limitation is consistent with the above theory. (HR Rep. No. 75-1860, at 19-20 (1938). Consequences of Extending Full Tax Benefits to Foreign Charitable Activities and Foreign Charities • • Effects on quantity and quality – Recruit private monitors – Access to information, lower operating expenses – Political challenges and corruption issues – Support development of non-profit sector in developing countries Interaction with other providers – • Supplementary , complementary, or adversarial Substitution away from domestic charities – Domestic charities engaged in domestic activities – Domestic charities engaged in foreign activities Enforcement and Compliance Concerns • Section 170 requires contributions to be used exclusively for charitable purposes and no private inurnment – Important to have a U.S. intermediary, especially where the IRS lacks the ability or authority to audit activities outside the U.S. • Added oversight concerns in post-September 11, 2001 world • Little effective private monitoring of cross-border charitable activities Implementation Alternatives if Allow Foreign Charities • Application process – Allow foreign charities to apply not only for “taxexempt” status but also the right to receive tax deductible contributions • Approved charity list – Canadian and Irish approach of allowing deductions to listed charities • Approved country list – Substantial equivalency regimes • Expand treaty provisions – Current treaties with Canada, Israel and Mexico allow US residents to reduce foreign source income by Question 3: Charitable Deductions for Contributions to For-profit Charities • Theory – Gap in providing essential collective goods – Non-profits not the only (or even the best) game in town • Malani and Posner – Existing theories do not provide adequate rationale for denying tax benefits to for-profit charities – Can “contract away” non-distribution constraint for all or a part of profits from activities – Real efficiency gains from cost-minimization and incentives for managers • Critiques – Can eliminate inefficiencies with more limited proposal (Kane) – Costs and challenges of compliance and monitoring – May need to redefine tax-exempt activities in for-profit charity regime Logic of Malani and Posner • Basic approach 1. The leading theories for allowing tax-deductible charitable contributions are A, B, and C; 2. Theories A, B, and C do not distinguish based on for-profit and non-profit status; 3. Therefore, the leading theories do not provide a basis for distinguishing between for-profit and non-profit charities; and 4. Therefore, we should allow deductions for contributions made to for-profit charities • Two possible outcomes 1. Leading theories provide adequate justification for charitable deduction (1 and 2 are true and support conclusions 3 and 4) 2. Leading theories do not provide adequate justification for charitable deduction (1 and 2 are true, provides support for conclusion 3 but not necessarily for conclusion 4) For-profit Charities Potential gains • Include social enterprise or fourth sector organizations in group of potential donees • Increase pool of potential providers of collective goods and services – Increased competition for contributions may lead to more efficient operations – Greater diversity • Incentive gains from rewarding entrepreneurial managers Potential challenges • Potential for abuse – Scope of “charitable purpose” may take a broader meaning than generally accepted in a “non-distribution” world – Potential transfer-pricing concerns between related entities engaged in charitable and noncharitable activities – Monitoring costs Alternatives for Increasing For-profit Charitable Activities • Targeted credits • Public/private partnerships • Matching grants for specific activities • Awards and prizes