Twenty First Session of FAO/IGG ON TEA

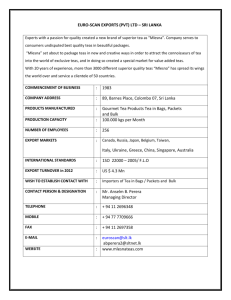

advertisement

Twenty First Session of FAO/IGG ON TEA 1 SRI LANKA TEA INDUSTRY MARKET REVIEW Bandung, Indonesia, 5 - 7 November 2014 Janaki Kuruppu Chairperson - Sri Lanka Tea Board World Tea Production (Mkgs) Country - total World total 2500 6000 5000 2000 4000 1500 3000 1000 2000 500 1000 0 0 2006 Sri Lanka 2007 2008 China 2009 India 2010 Kenya 2011 2012 Vietnam 2013 Turkey World Source : ITC Report, London World Tea Production (Mkgs) Country Sri Lanka YOY % China 2006 2007 1028.1 2009 2010 2011 2012 2013 318.7 291.1 331.4 327.5 328 340 4.6 -8.6 13.8 -1.2 -1.5 3.6 1140 1257.6 1358.6 1475.1 1550 1790 1924 310.8 304.6 -2 2008 -2 India 981.8 986.4 980.8 979 966.4 988.3 1126 1200 Kenya 310.6 369.6 345.8 314.2 399 377.9 370 432 Vietnam 142.5 148.3 166.4 175 170 178 190 180 145 147 149 4217.1 4624.62 4907 Turkey 142 178 155 153 148 World 3579 3795 3863.5 3944.4 4162.5 6 1.8 2 5.5 YOY% 1.3 9.6 6.1 Source : ITC Report, London th 20 Session of FAO - IGG on Tea At the 20th session in Colombo under the Chairmanship of Sri Lanka, 3 new working groups were proposed: Working Group on Organic Tea Working Group on climate change Working group on Small Holder Farmers 5 So why an International Tea Producer Forum? 7 Vision and Mission of the ITPF Vision To position tea as the most acceptable, natural and healthy beverage globally Mission To position tea as the most preferred beverage universally through stimulating its consumption by facilitating and execution of generic promotional campaigns and raising awareness of the health and life style benefits of tea Objectives of ITPF a. Safe guard interests of tea producer countries. b. Deliberate and evolve collective solutions on problems affecting producers. c. Provide technical co-operation, sharing of technology and expertise by member countries. d. Stimulate demand for tea by promoting consumption of tea. e. To undertake market studies, surveys, research projects aimed at addressing any specific issues f. To undertake and facilitate programs for providing training to members or their executives in various aspects of marketing tea. Progress So Far • 2012: Signing a Resolution in Colombo, Sri Lanka at the 20th Session of FAO/IGG to form an ITPF. • 10 Countries namely India, Kenya, Sri Lanka, Indonesia, Bangladesh, Malawi, Rwanda, Tanzania, Iran & Burundi signed that MOU. • Proposal by Sri Lanka as the current Chair of FAO/IGG on Tea to host a Ministerial Forum. • 2013: Historical gathering in Colombo on 21st January 2013 and ITPF was formally established. • Seven countries signed the MOU and the constitution (Sri Lanka, India, Kenya, Indonesia, Malawi, Rwanda, Iran) Country 2008 2012 2013 2014 India Obtained Govt. Signed Resolution approval Founder member Obtained cabinet approval and completed the process Sri Lanka Obtained Govt. Signed Resolution approval Founder member Obtained cabinet approval and completed the process Kenya Obtained Govt. Signed Resolution approval Founder member Response is awaited Malawi Obtained Govt. Signed Resolution approval Founder member Response is awaited Rwanda Pending Signed Resolution Founder member Response is awaited Indonesia Signed Resolution Founder member Response is awaited Iran Signed Resolution Founder member Response is awaited Consent of Producer Countries Bangladesh Pending Signed Resolution Consented to be founder member Tanzania Pending Signed Resolution Consented to be founder member Burundi Pending Signed Resolution --- Zimbabwe Pending Signed Resolution --- 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Millions KGS Sri Lanka Tea Production 400 350 300 250 200 150 100 50 0 Total tea production Tea Production – Elevation Wise 400 350 250 200 150 100 50 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Millions Mkgs 300 High Grown Medium Grown Low Grown Source : Sri Lanka Tea Board Year High Grown (%) Mid Grown (%) Low Grown (%) Total 2006 74.7 24 51.6 17 184.5 59 310.8 2007 72.5 24 54.4 17 177.7 59 304.6 2008 84.4 26 49.0 15 185.3 59 318.7 2009 72.8 25 44.7 15 173.1 60 290.6 2010 79.1 24 56.1 17 196.2 59 331.4 2011 79.2 24 52.5 16 196.6 60 328.4 2012 73.6 22 52.6 16 202.1 62 328.4 2013 75.5 22 56.2 16 208.4 61 340.2 Source : Sri Lanka Tea Board AREA OF TEA PLANTED IN SRI LANKA Elevation High Grown 41,137 Share (100%) 19% Mid Grown 71,018 32% Low Grown 109,814 49% 221,969 100 Total Planted (Ha) Source : Sri Lanka Tea Board SRI LANKA TEA EXPORTS (Mn. KGS) 2008 Bulk 2010 2009 2011 2012 2013 178.0 164.6 176.8 179.9 130.25 130.09 Packets 84.3 75.5 89.8 95.8 153.8 157.0 Tea Bags 20.3 18.7 25.7 24.6 21.4 24.07 Others 18.6 21.2 1.8 2.9 0.54 1.98 ReExports 18.6 10.6 18.6 20.5 14.6 8.51 319.8 290.6 305.7 323.7 320.7 321.65 1.26 1.18 1.37 1.51 1.44 1.55 Total (Mn Kgs) Value Billion USD Source : Sri Lanka Customs 17 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 US$ Millions Sri Lanka Tea Exports earning 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 Earnings Ceylon Tea Exports FOB unit price Rs./Kg 700 US$/Kg 6 600 5 500 4 400 3 300 2 200 1 0 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 100 Rs./Kg US$/Kg Source : Sri Lanka Customs DOMESTIC CONSUMPTION Year Qty. (Mn. Kgs) Approx. 2006 2007 2008 2009 2010 2011 2012 2013 27.5 28.0 28.5 28.5 28.4 28.9 27.8 27.5 Source : ITC Report, London DISTRIBUTION CHANNELS Type Supermarkets Grocery retailing Convenience stores Tea Shops / Tea Houses Others Percentage 25% 30% 30% 5% 10% Tea Industry’s Role in Sri Lanka’s Economy Tea export earnings reached USD 1.55 Billion in 2013 a historical high contributing 15% to the nation’s foreign exchange. Of the 322 Mn Kgs exported over 55% was in value added form Tea generates 65% of export agriculture revenue Tea industry contributes approx. 2% of the island’s GDP With 2 Million employed directly and indirectly 10% of the population of Sri Lanka depends on the industry. Sri Lankan Tea Industry’s Role in the Global Tea Economy Sri Lanka remains the world’s largest orthodox tea producer and the world’s largest orthodox tea exporter with 17% market share 2013 production placed Sri Lanka as the 4th largest producer of tea with 9% share of the global tea crop. As per 2013 export volume Sri Lanka has been able to sustain the position of 3rd largest exporter exporting to more than 150 countries. Sri Lanka also succeeded in maintaining her position as world’s largest pre-packed tea exporter and the number one in value added earnings (60%) Ethical & Sustainable Practices Strict adherence of ISO 3720 Minimum quality Standard across entire supply chain Ensuring certification on Ethical Tea Partnership, Fair Trade Labeling , Rain Forest Alliance etc. Clean as ever in pesticide residues Compatibility with CODEX, FAO, EU & Japanese standards for Maximum Residue Limits Drive for re planting and in-filling to increase productivity and reduce cost of production Support Forest Garden Tea Growers to protect biodiversity & commitment for ecological sensitivity 24 Commitment to Sustainable Business business PURITY & FOOD SAFETY ETHICAL BUSINESS Committed to the Ten Principles in • Human Rights ISO 22000:2005 HACCP • Labour Standards • Environment • Anti – corruption Ethical Tea Partnership ENVIRONMENT SOCIETY Rainforest Alliance Certification GLOBAL GAP Certification Forest Stewardship Council Agricultural Standards Beyond the TRI & RRI Guidelines Committed to CEO Water Mandate Signatory to the ‘Caring for Climate’ Preservation of Biodiversity Living Environment Health & Nutrition Community Capacity Building Empowerment of Youth 25 OZONE FRIENDLY CEYLON TEA Accolade from Montreal Protocol in Canada for first ever Ozone Friendly tea in the world. Sri Lanka tea industry was awarded Ozone friendly status in 2007 for non usage of Methyl Bromide an Ozone depleting substance. Ozone friendly Ceylon tea supports the reduction of global warming. Environmentally friendly & ecologically pure tea. Helps an earth caring community to free the planet from pollution. 26 Issues Facing Sri Lankan Tea Industry Exported to over 150 countries: No uniformity in standards applied by importing countries Lack of knowledge of consumer countries about good quality tea Low quality teas exploiting Ceylon Tea name Price War: undercutting Climate change Consequences – Extreme weather Dependent – EL NINO/LA NINA Phenomena play havoc 32 THANK YOU. SRI LANKA TEA BOARD E-mail: promotion@pureceylontea.com a.com 33