Sri Lanka Tea Industry Hasitha De Alwis Director (Promotion) Sri Lanka Tea Board

advertisement

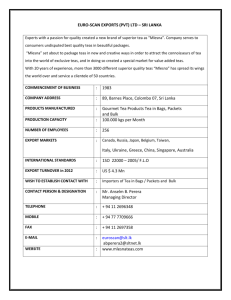

Sri Lanka Tea Industry Hasitha De Alwis Director (Promotion) Sri Lanka Tea Board Sri Lanka – Wonder of Asia Island is united ending 30 years long conflict. Multi-ethnic, multi-cultural, multi-religious and multilinguistic nation once again in harmony. Immense opportunities for sustainable growth in all sectors and tea industry is no exception. Probably the safest country today in South Asia. Peace dividends results in leap-frog development in Sri Lanka’s infra-structure & other sectors of economy. INTRODUCTION Sri Lanka tea industry proudly celebrates 145 years of commercial history in 2012. Tea industry continues to occupy a pivotal position in terms of foreign exchange earnings & employment. Tea export earnings reached USD 1.5 Billion in 2011 a historical high contributing 15% to the nation’s foreign exchange. Generating 65% of export agriculture revenue, tea industry contributes approx. 2% of island’s GDP. With 2 Million employed directly & indirectly 10% of the population of Sri Lanka depends on the industry. AGRO-CLIMATIC TEA GROWING REGIONS OF SRI LANKA SRI LANKA TEA PRODUCTION ELEVATION WISE (Mn. KGS) Year High Grown 2005 80.3 25 55.1 18 181.7 57 317.1 2006 74.7 24 51.6 17 184.5 59 310.8 2007 72.5 24 54.4 17 177.7 59 304.6 2008 84.4 26 49.0 15 185.3 59 318.7 2009 72.8 25 44.7 15 173.1 60 290.6 2010 79.1 24 56.1 17 196.2 59 331.4 2011 79.2 24 52.5 16 196.6 60 328.4 (%) Mid Grown (%) Low Grown (%) Total CATEGORY-WISE TEA PRODUCTION (Mn.KGS) 2006 (%) 2007 (%) 2008 (%) 2009 (%) 2010 (%) 2011 (%) Orthodox 288 93 283 93 297 93 271 93 310 94 303 92 CTC 18 5 16 5 17 5 16 5 18 5 22 7 Green Tea 3 1 4 1 3 1 2 1 3 1 3 1 Others 2 1 2 1 2 1 2 1 - - - - Total 311 100 305 100 319 100 291 100 331 100 328 100 AREA OF TEA PLANTED IN SRI LANKA Elevation Planted (Ha) Share High Grown 41,137 19% Mid Grown 71,018 32% Low Grown 109,814 49% 221,969 100 Total SRI LANKA TEA EXPORTS (Mn. KGS) 2006 Bulk 2007 2008 2010 2009 2011 197.8 179.9 178.0 164.6 176.8 179.9 Packets 79.4 72.7 84.3 75.5 89.8 95.8 Tea Bags 19.1 22.0 20.3 18.7 25.7 24.6 Others 18.6 19.7 18.6 21.2 1.8 2.9 ReExports 12.5 15.6 18.6 10.6 18.6 20.5 Total 327.4 309.9 319.8 290.6 305.7 323.7 Value Billion USD 0.882 1.01 1.26 1.18 1.37 1.51 RE-EXPORTS (CEYLON TEA BLENDED WITH OTHER ORIGINS) Year Qty (MT) Value (Rs. Mn) Value (USD Mn) 2005 11,456 4,154 41.33 2006 12,499 5,330 51.20 2007 15,597 6,617 59.80 2008 18,577 10,683 98.61 2009 10,574 5,089 44.27 2010 18,607 11,567 102.30 2011 20,529 13,363 118.30 Tea Imports to Sri Lanka Year Quantity (Kgs) 2007 13,683,732 3,141.6 28.56 2008 2009 2010 2011 14,598,248 9,960,129 12,172,753 11,406,044 3,754.8 2,979.4 3,768.0 3,770.4 34.13 27.08 34.25 34.28 Value (Rs. Million ) Value (USD M.) Tea Imports to Sri Lanka (Country Wise) Qty in Kgs. 2009 2010 2011 India 4,708,695 4,776,141 4,353,513 China 1,755,521 2,802,873 2,895,761 Kenya 2,867649 3,871,167 3,690,453 Vietnam 240,725 352,203 97,909 Indonesia 203,260 207,068 182,620 Malawi 129,580 143,104 150,660 33,080 10,805 23,898 Taiwan 8,888 7392 - Japan 5,600 900 - U.K 5,130 - 9980 Nepal 2,001 1100 1250 TOTAL 9,960,129 12,172,753 11,406,044 Germany MAJOR DESTINATIONS FOR CEYLON TEA Country Russia UAE Syria Iran Turkey Jordan Kuwait Iraq Japan Libya 2009 Qty. 42.4 30 29.4 27.7 15.7 13.4 10.1 9.8 9.5 8.1 % 15.1 10.7 10.5 9.9 5.6 4.8 3.6 3.5 3.4 2.9 2010 Country Qty. Russia 45.5 UAE 29.6 Iran 27.6 Syria 26.3 Turkey 18.4 Jordan 17.3 Iraq 13.6 Libya 10.9 Kuwait 10.8 Japan 10.3 2011 % 15.2 9.9 9.2 8.8 6.2 5.8 4.6 3.7 3.6 3.4 Country Russia Iran Syria Iraq UAE Turkey Azerbaijan Japan Qty % 47.3 14.8 30.8 9.6 28.5 8.9 22.2 6.9 21.5 6.7 18.9 5.9 11.8 3.7 11.3 3.5 Kuwait 9.1 2.8 Ukraine 7.8 2.4 DOMESTIC CONSUMPTION Year Qty. (Mn. Kgs) Approx. 2005 2006 2007 2008 2009 2010 2011 27.5 27.5 28.0 28.5 28.5 28.4 28.9 DISTRIBUTION CHANNELS Type Supermarkets Grocery retailing Convenience stores Tea Shops / Tea Houses Others Percentage 25% 30% 30% 5% 10% TYPE OF PRODUCTS (Domestic Market ) Domestic Market Volume 2010 2011 Value 2010 2011 Loose Tea 68% 67% 61% 59% Packet Tea Tea Bags 30% 2% 30% 3% 36% 3% 37% 4% Value Growth on Consumer Prices for Share of Throat Item Tea Coffee Share of Throat 26.5% 2.5% Value Growth (per Annum) 9% Average Price Rs. 715/Kg 22% Rs. 1,335/Kg Malt 15.5% 23% Rs.167/Ltr Soft Drinks (Carbonated) 36.0% 43% Rs.124/Ltr Others 19.5% Household Expenditure 2009/2010 (Rs. 1,750B.) Other 19% Cultural Entertainment 2% Education 3% Food & drink 40% Consumer durables 3% Transport & Comm's 10% Personal & Health care 5% Clothing & personal effects Fuel & Light 4% 3% Housing 11% Monthly Household Expenditure Rs. 32,446/- MACRO ECONOMIC FUNDAMENTALS IN SRI LANKA 2005 VS. 2011 2005 Real GDP Growth GDP (US $) GDP per capita (US $) Trade : Exports (US$ bn) Imports (US $ bn) Workers’ Remittances (US$ bn) Tourist Arrivals (‘000) Earnings from Tourism (US $ bn) FDI (US$ bn) 6.2 24.4 1,241 6.3 8.9 1.9 549 0.3 0.3 2011 (Est/Prov) 8.3 59.1 2,830 10.5 20.0 5.2 850 0.8 1.0 Thank You Hasitha De Alwis Director (Promotion) Sri Lanka Tea Board