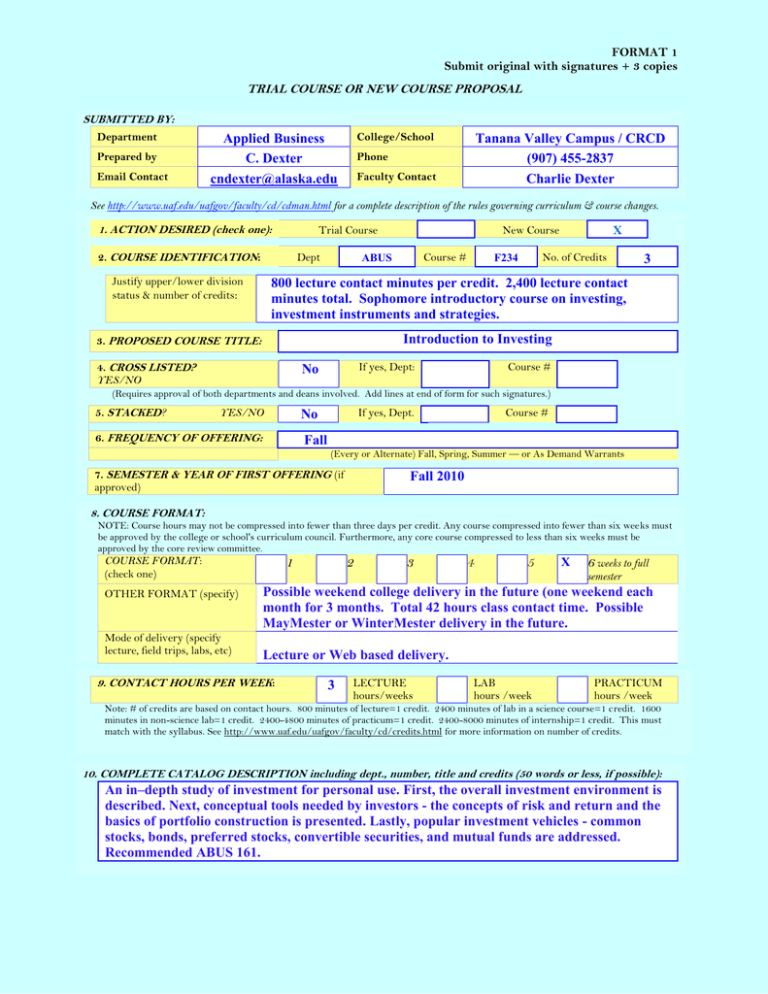

FORMAT 1

Submit original with signatures + 3 copies

TRIAL COURSE OR NEW COURSE PROPOSAL

SUBMITTED BY:

Department

Prepared by

Email Contact

Applied Business

C. Dexter

cndexter@alaska.edu

Tanana Valley Campus / CRCD

(907) 455-2837

Charlie Dexter

College/School

Phone

Faculty Contact

See http://www.uaf.edu/uafgov/faculty/cd/cdman.html for a complete description of the rules governing curriculum & course changes.

1. ACTION DESIRED (check one):

Trial Course

2. COURSE IDENTIFICATION:

Dept

Justify upper/lower division

status & number of credits:

X

New Course

Course #

ABUS

No. of Credits

F234

3

800 lecture contact minutes per credit. 2,400 lecture contact

minutes total. Sophomore introductory course on investing,

investment instruments and strategies.

Introduction to Investing

3. PROPOSED COURSE TITLE:

4. CROSS LISTED?

YES/NO

If yes, Dept:

No

Course #

(Requires approval of both departments and deans involved. Add lines at end of form for such signatures.)

5. STACKED?

If yes, Dept.

No

YES/NO

6. FREQUENCY OF OFFERING:

Course #

Fall

(Every or Alternate) Fall, Spring, Summer — or As Demand Warrants

7. SEMESTER & YEAR OF FIRST OFFERING (if

approved)

Fall 2010

8. COURSE FORMAT:

NOTE: Course hours may not be compressed into fewer than three days per credit. Any course compressed into fewer than six weeks must

be approved by the college or school's curriculum council. Furthermore, any core course compressed to less than six weeks must be

approved by the core review committee.

1

COURSE FORMAT:

(check one)

OTHER FORMAT (specify)

Mode of delivery (specify

lecture, field trips, labs, etc)

2

3

4

5

X

6 weeks to full

semester

Possible weekend college delivery in the future (one weekend each

month for 3 months. Total 42 hours class contact time. Possible

MayMester or WinterMester delivery in the future.

Lecture or Web based delivery.

9. CONTACT HOURS PER WEEK:

3

LECTURE

hours/weeks

LAB

hours /week

PRACTICUM

hours /week

Note: # of credits are based on contact hours. 800 minutes of lecture=1 credit. 2400 minutes of lab in a science course=1 credit. 1600

minutes in non-science lab=1 credit. 2400-4800 minutes of practicum=1 credit. 2400-8000 minutes of internship=1 credit. This must

match with the syllabus. See http://www.uaf.edu/uafgov/faculty/cd/credits.html for more information on number of credits.

10. COMPLETE CATALOG DESCRIPTION including dept., number, title and credits (50 words or less, if possible):

An in–depth study of investment for personal use. First, the overall investment environment is

described. Next, conceptual tools needed by investors - the concepts of risk and return and the

basics of portfolio construction is presented. Lastly, popular investment vehicles - common

stocks, bonds, preferred stocks, convertible securities, and mutual funds are addressed.

Recommended ABUS 161.

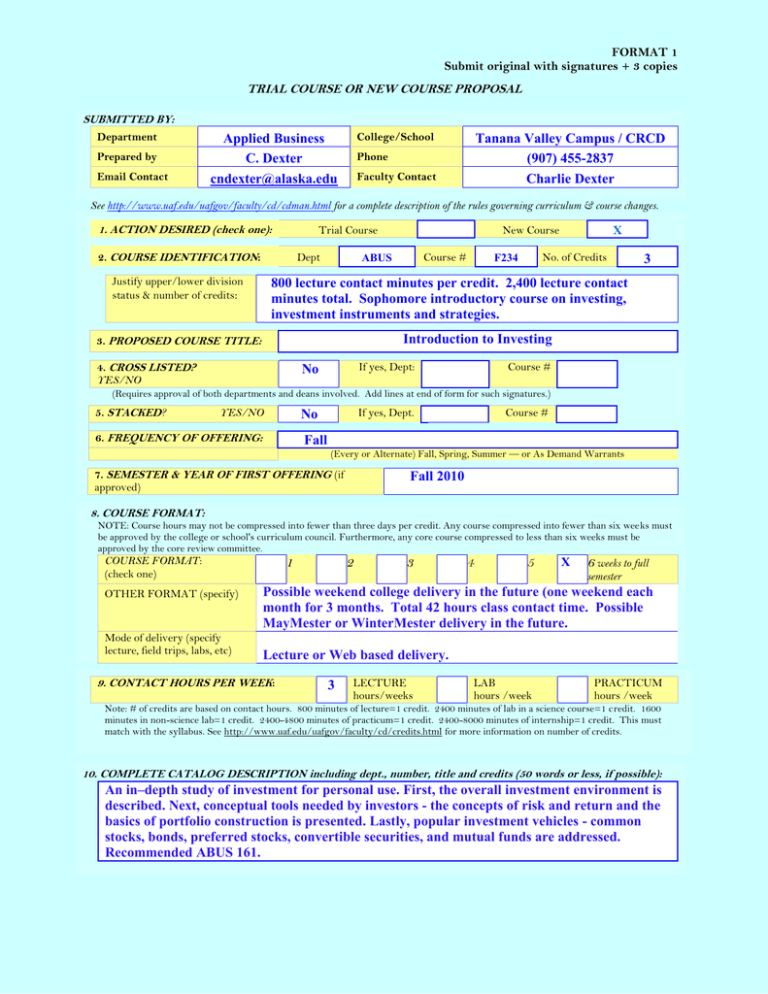

11. COURSE CLASSIFICATIONS: (undergraduate courses only. Use approved criteria found on Page 10 & 17 of the manual.

If justification is needed, attach on separate sheet.)

H = Humanities

N = Natural Science

S = Social Sciences

Will this course be used to fulfill a requirement for the baccalaureate core?

X

YES

NO

IF YES, check which core requirements it could be used to fulfill:

O = Oral Intensive, Format 6

W = Writing Intensive, Format 7

Natural Science, Format 8

12. COURSE REPEATABILITY:

Is this course repeatable for credit?

13. GRADING SYSTEM:

LETTER: X

YES

X

NO

PASS/FAIL:

RESTRICTIONS ON ENROLLMENT (if any)

14. PREREQUISITES

None

These will be required before the student is allowed to enroll in the course.

RECOMMENDED

ABUS 161 – Personal and Business Finance

Classes, etc. that student is strongly encouraged to complete prior to this course.

15. SPECIAL RESTRICTIONS, CONDITIONS

16. PROPOSED COURSE FEES

None

Has a memo been submitted through your dean to the Provost & VCAS for fee approval?

Yes/No

N/A

17. PREVIOUS HISTORY

Has the course been offered as special topics or trial course previously? Yes/No

No

18. ESTIMATED IMPACT

WHAT IMPACT, IF ANY, WILL THIS HAVE ON BUDGET, FACILITIES/SPACE, FACULTY, ETC.

No change. This course will be offered as an alternative to the degree required course ABUS

233 – Financial Management. Currently ABUS 233 is offered every semester. Beginning next

fall ABUS 233/ABUS 234 will be offered on alternative semesters fall/spring.

19. LIBRARY COLLECTIONS

Have you contacted the library collection development officer (ffklj@uaf.edu, 474-6695) with regard to the adequacy of library/media

collections, equipment, and services available for the proposed course? If so, give date of contact and resolution. If not, explain why not.

No

Yes

X

20. IMPACTS ON PROGRAMS/DEPTS

What programs/departments will be affected by this proposed action?

Include information on the Programs/Departments contacted (e.g., email, memo)

None

21. POSITIVE AND NEGATIVE IMPACTS

Please specify positive and negative impacts on other courses, programs and departments resulting from the proposed action.

Incoming students have a very poor understanding of personal and business finance (financial

management is not taught in local high schools), and students have almost no understanding of

investing. Beginning with the Fall 2010 semester all ABUS degree seeking students will be

required to take a business core course in Personal and Business Finance (new course ABUS

161). ABUS F234 will then be offered each fall for those students who wish to expand their

understanding of finances and learn about investment instruments and investing strategies. By

offering ABUS 233/234 on an alternate fall/spring cycle the enrollment in both courses should

grow. For several years the net savings of Americans as a whole has been negative. A set of

college courses like ABUS 161 and 234 will start to change that terrible trend.

JUSTIFICATION FOR ACTION REQUESTED

The purpose of the department and campus-wide curriculum committees is to scrutinize course change and new course

applications to make sure that the quality of UAF education is not lowered as a result of the proposed change. Please

address this in your response. This section needs to be self-explanatory. Use as much space as needed to fully justify the

proposed course.

See # 21 above. The development of this course and corresponding change in the ABUS

certificate and degree is a result of recommendations by the ABUS faculty and those of the

ABUS advisory board.

APPROVALS:

Date

9/28/09

Signature, Coordinator, Applied Business

Date

Signature, Chair, Tanana Valley Curriculum Council

Date

Signature, Director, Tanana Valley Campus

Date

Signature, Chair, College of Rural and Community Development, Business,

Systems, and Technology Division

Date

Signature, Chair, College of Rural and Community Development Curriculum

Council

Date

Signature, Executive Dean, College of Rural and Community Development

Date

Signature, Chair, UAF Faculty Senate Curriculum Review Committee

ALL SIGNATURES MUST BE OBTAINED PRIOR TO SUBMISSION TO THE GOVERNANCE OFFICE

University of Alaska Fairbanks

Tanana Valley Campus

ABUS F234-TE1 Introduction to Investing

Course Syllabus - Fall 2010

Professor:

Office:

Office hours:

Text:

Andy Anger

Room 224 TVCC

604 Barnett Street

Fairbanks, AK 99701

Mon- Thurs

12:00-2:00 pm

Fundamentals of

Investing: Gitman,

Joehnk

Phone: (907) 455-2862

Fax: (907) 455-2941

E-mail: ffapa@uaf.edu

Catalog Description

An in–depth study of investment for personal use. First, the overall investment environment is

described. Next, conceptual tools needed by investors - the concepts of risk and return and the

basics of portfolio construction is presented. Lastly, popular investment vehicles - common

stocks, bonds, preferred stocks, convertible securities, and mutual funds are addressed.

Recommended ABUS 161.

Course Purpose and Objectives

The purpose of this course is to provide students with a basic understanding of today’s investing

environment. This course helps students make informed investment decisions in their personal

and professional lives by providing a solid foundation of core concepts and tools. Students leave

the course with the necessary information for developing, implementing, and monitoring a

successful investment program. Upon completion of this course students will be able to:

Rationalize the investment process

Identify various investment vehicles

Differentiate between types of securities markets

Apply the concept of risk and return

Utilize time value of money calculations

Employ the portfolio concepts

Engage in stock and bond evaluations

Instructional Tasks

The material will be presented through class lectures, homework, in class and blackboard

discussions, guest lectures, a class project, two exams, and reading assignments.

Grade Requirements:

Attendance

Active discussion participation

Mid-Term Exam

Final Exam

Class Project

5%

5%

30 %

40 %

20 %

Course Grading:

90% - 100%

80% - 89%

70% - 79%

60% - 69%

below 59%

A

B

C

D

F

Attendance and Participation

Attendance and participation are vital, and are worth 10% of your grade. Many of the questions

on the exams will be taken from class lectures, discussions and material presented by guest

lecturers.

Exams

There will be two in-class exams, a mid-term and a final exam. Material will come from the

textbook, class lectures, discussions and material presented by guest lecturers. The exam will

consist of two sections. Section one will be multiple-choice questions. Section two will be short

answer questions. The exam will be open book and notes, but no discussion between class

participants is allowed. The exams must be taken on the assigned dates.

Class Project

Your class project is to manage a hypothetical portfolio of $5000 consisting of two investments

at $2500 each. You will choose your investments and track it during the class period. You can

make changes during the course of the semester, however each transaction will cost you a

hypothetical $75.

Each week you are required to summarize the performance of your investment addressing how it

performed and what influenced its performance. ~ ½ page. You are also required to keep track

of your performance data in an Excel Spreadsheet. At the end of the semester your weekly

reports and Excel Spreadsheet plus a short summary of the overall performance of your portfolio

will form your semester portfolio report.

Text

The text for this course is: Fundamentals of Investing, Lawrence Gitman & Michale Joehnk, 10

edition, 2008, Pearson / Addison Wesley Publisher.

Class Schedule

9/08

Introduction, class requirements, discussion of class project.

Chapter 1: Investment Process, Investment Vehicles, and Investment Plans.

9/15

Chapter 1: Investment Process, Investment Vehicles, and Investment Plans.

Chapter 2: Security Markets and Transactions.

9/22

Chapter 2: Security Markets and Transactions.

9/29

Chapter 3: Investment Information, Market Indexes, Investment Transactions.

10/06 Chapter 4: Risk and Return.

10/13 Chapter 4: Risk and Return.

10/20 Mid Term Exam.

10/27 Chapter 5: Portfolio Concepts, - Planning, - Evaluations

11/03 Chapter 5: Portfolio Concepts, - Planning, - Evaluations.

11/10 Chapter 13: Mutual Funds.

11/17 Chapter 13: Mutual Funds.

11/24 Chapter 6: Common Stock Investments.

12/01 Chapter 10: Fixed Income Securities.

12/08 Final Exam. Semester Portfolio Report due.

STUDENTS WITH DISABILITIES

Students with learning disabilities who may need accommodations are encouraged to contact

Disability Services (http://uaf.edu/chc/disability.html) or phone (907)474-7043. Additional

assistance can also be obtained from Student Support Services (http://www.uaf.edu/sssp/) or

phone (907) 474-6844.

OTHER STUDENT RESOURCES

An accounting/finance/math tutor is also available at no cost to students through the Applied

Business Department at TVC. Call Susan Doren at (907) 455-2852 or email msdoren@alaska.edu

STUDENT CODE OF CONDUCT

UAF will maintain an academic environment in which freedom to teach, conduct research, learn

and administer the university is protected. Students will benefit from this environment by

accepting responsibility for their role in the academic community. The principles of the student

code are designed to encourage communication, foster academic integrity and defend freedoms of

inquiry, discussion and expression across the university community.

UAF requires students to conduct themselves honestly and responsibly, and to respect the rights of

others. Conduct that unreasonably interferes with the learning environment or violates the rights of

others is prohibited. Students and student organizations are responsible for ensuring that they and

their guests comply with the code while on property owned or controlled by the university or at

activities authorized by the university.

The university may initiate disciplinary action and impose disciplinary sanctions against any

student or student organization found responsible for committing, attempting to commit or

intentionally assisting in the commission of any of the following prohibited forms of conduct:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

Cheating, plagiarism or other forms of academic dishonesty

Forgery, falsification, alteration or misuse of documents, funds or property

Damage or destruction of property

Theft of property or services

Harassment

Endangerment, assault or infliction of physical harm

Disruptive or obstructive actions

Misuse of firearms, explosives, weapons, dangerous devices or dangerous chemicals

Failure to comply with university directives

Misuse of alcohol or other intoxicants or drugs

Violation of published university policies, regulations, rules or procedures

Any other actions that result in unreasonable interference with the learning environment or

the rights of others.

This list is not intended to define prohibited conduct in exhaustive terms, but rather offers

examples as guidelines for acceptable and unacceptable behavior.