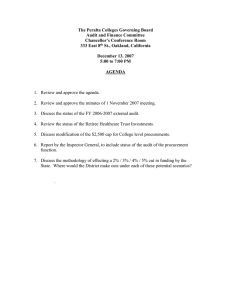

C D A M

advertisement