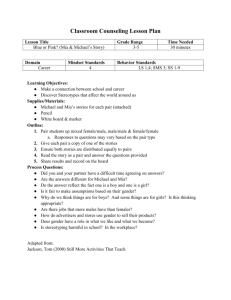

PPC Meeting Highlights August 18, 2010 Audit and Liquidator Licensing Framework 1.

advertisement

PPC Meeting Highlights August 18, 2010 1. Audit and Liquidator Licensing Framework The meeting was informed on the following: a) Further works need to be done on the proposed new audit licensing framework, prior to submission to PPC. b) The liquidator licensing framework will only be drafted after the courtesy visit to Malaysian Department of Insolvency (MDI) on August 25, 2010. 2. Revised Practice Review (PR) Framework The Audit Practice Sub-committee (APC) has submitted the revised PR framework to Practice Review Committee (PRC) for deliberation during its meeting on Aug 23. 3. Revised Bank Confirmation Letter The meeting was informed that the revised template has been submitted to Auditing and Assurance Standards Board (AASB) for approval. However, the AASB has yet to meet and approve the template due to the fact that its present Chairman has since resigned. Member also raised concern on the increasing expectations of lawyers’ responsibility in providing external confirmation under the clarified ISAs. The PPC decided to arrange for a meeting with Bar Council (jointly with members from AASB) to consider some forms of guidance notes / template to assist lawyers in issuing confirmation letters. 4. Letter by SSM to Company Director The meeting was informed that SSM has taken cognizance of the issues raised and the questionnaires will be redrafted. SSM also clarified that this exercise only involved auditors who were frequently requested to resign or being terminated by their clients. 5. Provision of secretariat support to IPAM The meeting was informed that the EGM of IPAM has been postponed to early next year. The IPAM will only request for secretariat support from MIA after the EGM. 6. The Expansion of the Coverage of the Pembangunan Sumber Manusia Berhad (PSMB) ACT 2001 to the Profession The Secretary reported that he has attended the PSMB briefing on July 16 and was informed that the coverage of PSMB Act 2001 will be expanded to cover the accounting and auditing industries, effective from 1 April 2011. The meeting deliberated and decided on the following: a) MIA will submit a memorandum to PSMB on its own, based on the past experience of handling the same issue. Feedback from member firms on the difficulties they encountered when dealing with PSMB and some statistics on the training expenses will be obtained from member firms to support the position of MIA. b) On top of that, MIA will seek support from other professional services industries to consider a joint submission to the Ministry of Human Resource through the Professional Services Development Corporation (PSDC). 7. Merger and Affiliation (M&A) Seminar The M&A Task Force met on August 11 after the approval of EXCO (for the formation of task force) and Nomination Committee (for the appointment of task force members) in May 2010. As the terms of reference revolved around the e-merger portal, the task force members deliberated and identified some areas for improvements such as removing onerous information requirements for online registration, categorising the database to make it more presentable and user-friendly, etc. However, the revision of e-portal might take some times to develop in view of the current workload of MIA IT Department. The task force meeting also proposed to conduct M&A seminars in 5 locations, i.e. KL, JB, Penang, Kota Kinabalu and Kuching, in order to create awareness for the M&A e-portal. 8. Capital Market Working Group (CMWG) and the Proposed Revision to the Terms of Reference The meeting duly approved the revised terms of reference for CMWG, following the first meeting of CMWG on July 20: a) To serve as key liaison between the Institute and regulators on capital market related matters; b) To consider practical problems faced by members relating to the application and compliance with the regulations of the capital market and made recommendations to the relevant authorities; c) To formulate and provide guidance notes for the Council to be issued to members on the application of auditing and accounting standards in various aspects of capital market practice but mainly limited to the submission of documents to the authorities of the Capital Market; d) To consider and recommend principles of good practice on issues not covered by Auditing & Assurance Standards Board (AASB), Financial Reporting Standards Implementation Committee (FRSIC) and the Ethics Committee; e) Matters related to auditing standards and its principles (excluding any derivative materials to be developed) will still fall under the domain of the AASB. The meeting was informed that the exposure draft for 3 issues raised by SC has been issued out to MIA members and the deadline for comment is 31 August 2010. Any comments received will be dealt with by the CMWG and thereafter a circular on the accounting treatment of the 3 issues will be issued out to all members of MIA as a guideline. 9. MEMBERS ENGAGEMENT SESSIONS (MES) 2010 AND THE AUDIT ROUNDTABLE Members Engagement Sessions (MES) 2010 The Chairperson reported that the MES in Kota Bharu and Penang have been conducted on August 9 and 13 respectively. The MES in KL will be held on September 22 and she requested a second email blast on the MES in KL since the number of participants is not encouraging. For MES in Sabah and Sarawak, the meeting decided to hold the M&A seminars in conjunction with MES. The Secretary was requested to revise the budget by taking into account the M&A Seminar for MIA CEO’s approval. The incremental cost should not be too prohibitive. MIA-ACCA Audit Roundtable Sept 22 The meeting was informed that panellists have been fixed and MIA is in the midst of inviting the remaining guests. Marketing Campaign for the Clarity Project Member raised concern on the awareness level of auditors as well as the general public on the clarified ISAs. Given the importance of understanding the clarified ISAs, the meeting decided to launch an awareness campaign to ensure MIA members and the general public be educated appropriately inter alia, the impact of clarified ISAs on the quality of auditors’ works and the subsequent impact on the audit fee due to the higher responsibilities of auditors. Among activities that could be organised are dialogues with members, press conference, articles in Accountants Today, publication of clarified ISAs in CDRom format and briefing on clarified ISAs for the media, etc. The PPC will propose to council for the appointment of the following council members to champion the Clarity Project: a) En Mohamed Raslan bin Abdul Rahman – as he is also a member of AASB, who is well-versed in the clarified ISAs; b) Mr Billy Kang – as he is also a Chair of APC and a good representative for SMPs. 10. Report from Sub-committee Chairs Audit Practice Sub-committee (APC) a) Audit Licensing Framework: the APC has deliberated on the proposed new audit licence application framework. However, further works need to be done prior to submission to PPC. b) Awareness Campaign: the committee agreed that an awareness campaign on Clarity Project need to be championed by MIA to create awareness on ISAs among auditors and the general public. c) External confirmations: meetings shall be scheduled with ABM and Bar Council on the rising expectation of bankers / lawyers’ roles in providing external confirmation, in line with the new clarified ISAs. Taxation Practice Sub-committee (TPC) a) Submission of Memorandum to MOF on recognition of post budget seminars organised by MIA: this has been done on July 15. b) Collaboration with CTiM for thought leadership programme: TPC members shall email the possible topics to the Secretariat for consideration; c) Tax Practice Guidance Notes: the TPC is considering the issuance of sample engagement letter, professional clearance letter and a guide for charging of fee. d) Appeal on the extension of tax return submission deadline: the MIA Taxation Committee jointly with MICPA and MAICSA Taxation Committee will appeal to IRB on granting of 7 days grace period after the official deadline of July 31. Insolvency Practice Sub-committee (IPC) a) Next Joint meeting: Sept 1, 2010 where there will be some updates from SSM on the changes to Companies Act and the relevant licensing framework. b) Courtesy visit to Malaysian Insolvency Department: this has been scheduled on Aug 25, 2010 to meet up with Datuk Karim, CEO of MDI. c) Closing of Business meeting with MDI: the meeting on creditors’ voluntary liquidation and court sanctioned liquidation has been postponed to some other date due to lack of responses received from MIA members. 10. Malaysia-India Comprehensive Economic Co-operation Agreement (CECA) and its Impact on the Accounting Firms The Malaysia-India CECA is expected to be signed by the end of this year. This will open up trade opportunities between the two countries. One of the areas member firms might want to think of is the impact of CECA on their practices. A circular will be sent to all member firms on any difficulties they encountered when trying to set up offices offering accounting and other related services in India, so that the MIA can bring up such issues for discussion or for Malaysia to draw up a request to India based on members’ respective issues during the ongoing trade negotiation. The issues might be on entry barriers for foreign professionals in all segments of professional practice. It should cover areas such as licensing for foreigners, equity shareholdings, asset ownership, business visa etc. Different treatments, if any between national and foreign professional can also be highlighted for negotiation. Concern was raised on the reciprocal rights for Malaysia in the above deal. Professional qualification of Institute of Chartered Accountants of India (ICAI) is recognised by Malaysia but this is not reciprocated by India. As an example, our Malaysian’s Qualifying Examination (QE) is not recognised by ICAI. 11. Any other matters Human Capital Issues Members raised concern on the human capital issues as there is an alarming attrition rate in the number of auditors / accountants to countries like Singapore, China and Australia. This exodus will leave a vacuum of experience that will lead to issues of succession in the profession and developmental opportunities cost for the nation. The meeting agreed to propose to council that a council member should be appointed to look into the above issue. Among the activities that could be organised are interviews with users on the reason why the local graduates are not employer-ready. Funding from MAREF can also be considered. A council paper will be prepared to get the Institute to agree on the course to be taken. IFRIC 15 The meeting was informed that the endorsement of IFRIC 15 ‘Agreements for the Construction of Real Estate’ has been deferred due to its potential conflicts with the Revenue Standards IAS 18. Besides that, other countries like Singapore, Taiwan and Belgium are also complaining about the same issue pending convergence. Practice Management Guide The Chairperson informed that the SMP Committee of the IFAC has issued the ‘Guide to Practice Management for SMPs’, which provides guidance on how this sector can better manage their practices and ultimately operate in a professional manner. Members are urged to download the publication from the IFAC website.