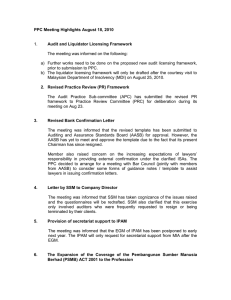

PPC Meeting Highlights October 13, 2010

advertisement

PPC Meeting Highlights October 13, 2010 1. Capital Market Working Group The meeting was informed that the circular on three SC issues was circulated on Sept 22 to all members of MIA. 2. Members Engagement Session (MES) 2010 The MES has been completed in 5 locations from August to October 2010. Some of the feedback received during the MES is request on training at very minimum cost on clarity standards & ISQC 1 and other macro issues such as the limited liability partnership (LLP), audit exemption and the provision of value-added services by practitioners. 3. Awareness Campaign for the Clarity Project PPC managed to secure RM 18,000 for the purpose of the awareness campaign for the Clarity Project. The meeting requested the Secretariat to arrange for a meeting between the project champions, i.e. En Mohd Raslan and Mr Billy Kang, latest by Oct 22 for a preliminary discussion on the campaign strategy. The project champions shall take into consideration the lessons learnt from the Singapore’s outreach programme on Clarity Project. 4. Malaysia-India Comprehensive Economic Co-operation Agreement (CECA) The meeting was informed that no members have provided any feedback on difficulties encountered when setting up offices in India, although the circular was sent out to all member firms on 25 August 2010. 5. Human Capital Issues The council paper prepared by the secretariat was not tabled for the council meeting due to insufficient supporting information and data. The meeting was also informed that the MIA will be invited to participate in one of the workshops conducted by the Government, subsequent to the Institute’s submission of a proposal on “Positioning Malaysia as the Regional Hub for Accountancy Education and Training”. The meeting discussed on the quality of local graduates where the local universities produce graduates who are not employer-ready. The meeting agreed to arrange for a meeting between MIA, MASB, MQA and Heads of Accounting Faculty in 11 Universities that fall under Part I of the First Schedule of the Accountants Act, 1967 to discuss on the matter. 6. Updates on the Proposed Audit and Liquidator Licensing Framework The Audit Practice Sub-committee (APC) has deliberated on the eligibility for applying the audit licence, rather than an overall review of the audit licensing framework. The proposal is based on the assumption that audit and liquidator licence are not de-coupled. Some salient points of the proposed changes in the eligibility criteria, as opposed to the current system: a) Post-MIA membership experience: it is proposed to be reduced from 3 years to 1 year; b) Requirement for Public Practice Programme, Practising Certificate and interview session will be retained; c) Audit experience: 3 years of audit experience remained unchanged, but the new proposal will require a minimum of 5 years public practice experience with at least 3 years in audit and 1 year (out of the 3 years in audit) must be in supervisory role. This is to ensure applicants have certain level of maturity and leadership skills prior to application; d) Continuous versus Accumulative: the present system requirement is 3 years continuous audit experience. The APC proposed to change from 3 years continuous to 3 years accumulative of audit experience; e) Gap in audit experience: the current gap allowed is 1 year. The APC proposed a 3 years gap in public practice (instead of audit practice). If an applicant leave public practice more than 3 years ago, he or she will have to work back 1 more year in public practice (and it must be in audit). The secretariat shall work on a detailed paper with some refinements (such as to include the definition of public practice) for PPC members’ comment, prior to submission to Council. 7. Updates on the Practice Review Framework The proposed PR framework was being distributed to all PPC members and the meeting agreed that the members shall review the documents and provide comments to Billy for further improvement on the proposed framework, prior to re-submission to PRC for their consideration. The meeting agreed that the revised PR framework shall cover the following: a) All 6 elements of ISQC 1 shall be included in the revised practice review; b) The practice review processes must be transparent and made known to all; c) The appeal processes should be in place. The meeting agreed that the revised PR framework will also look at the appropriateness of the Form M1(A), since they are inter-related. 8. Updates on the Progress of Merger and Affiliation e-portal The revised e-portal was presented for members’ information. The revised version is more user friendly as it reduces the amount of information required. The meeting agreed to pilot test the revised e-portal among the council members on the relevance of information and the user-friendliness before activation. The meeting was informed that the RM 5,000 sponsorship has been secured and the task force will kick off the Merger and Affiliation seminar in KL. 9. The Expansion of the Coverage of the Pembangunan Sumber Manusia Berhad (PSMB) ACT 2001 to the Profession The meeting was briefed on the outcomes of the meeting with PSMB on September 28: a) The PSMB was informed that the Institute and the accounting profession are of the view that the imposition of a blanket mandatory scheme to contribute to PSMB as proposed may not be necessary for our industry, in view of the rationale of expansion is already in line with the objective of MIA and our commitment to training and development; b) PSMB has been invited to visit MIA and other accounting firms in order to find out more about the Continuing Professional Education (CPE) system in place at member firms and the enforcement processes of MIA on CPE compliance; c) PSMB has requested for some hard facts such as CPE structure and statistics on CPE courses from MIA for the purpose of convincing the Minister of Human Resources that the profession has already in place various structured training and monitoring process for staff development at member firms. The meeting deliberated on the concern for smaller member firms that might not have any system in place for staff development and agreed that MIA’s monitoring and enforcement process could play a role in this area. The meeting decided to send a letter to PSMB to follow-up on the proposed visit to MIA. 10. Proposed Preface to Insolvency Guidance Notes (IGNs) The meeting deliberated on the need for amending the foreword of IGNs to include the consequences of non-compliances of the IGNs. The meeting agreed to highlight to Council at the next council meeting on whether there is a need to include the additional paragraph in the existing foreword of IGNs: “In determining the acts of members in the performance of their respective duties, the Council may take into consideration the recommended practices as contain in these IGNs”. 11. Report from Sub-committee Chairs Taxation Practice Sub-committee (TPC) a) No TPC meeting since the sub-committee members last met in Aug 2010; b) Memorandum to MOF on recognition of post budget seminars organised by MIA: a follow-up letter will be sent to MOF and the chair person shall get the MIA CEO to call MOF after the Budget peak period; c) Proposed scaled fee: The recommended practice guide (RPG) 7 has been circulated to all TPC members; the detailed on scaled fee for Tax agents will be discussed at the next TPC meeting; d) Sample of engagement and professional clearance letter: this will be in collaboration with CTiM. A meeting will be arranged between CTiM and MIA’s TPC members. e) Topics for thought leadership programme: Thought leadership programmes at other professional bodies will be compiled by secretariat for ease of identifying possible topics to be organised by MIA. 12. Any other matters Brainstorming session Mr Subramaniam Sankar requested the PPC to allocate time to discuss the other motions adopted at the AGM. The meeting agreed to propose for a one-day brain-storming session among council members for an overall holistic deliberation on the issues and re-position the profession as a whole. Mr Subramaniam Sankar also requested for a copy of the comparison of legislations in various professions. The meeting requested Ms Ho to circulate the comparison prior to the proposed brain-storming session. SMP Forum 2011, Istanbul, Turkey, March 21-22 The forthcoming IFAC SMP Forum 2011 will be held at Istanbul, Turkey on March 21-22.