The burden of old-age benefits. Facts and Perceptions

advertisement

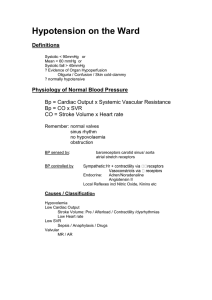

The burden of old-age benefits. Facts and Perceptions Paper prepared for the Conference of the British Society for Population Studies Manchester, 10-12 September 2008 by Lieve Vanderleyden lieve.vanderleyden@dar.vlaanderen.be SVR Outline of the presentation • Employment rates at higher ages: an overview. • Reasons for leaving the labour market • Preferred, expected and effective age of retirement. • Old-age benefits: are people worried? • Opinion about governments’ way to ensure old-age benefits in the future. • Conclusions - recommendations. SVR Employment rates: age 55-64 EU-15 and Flemish Region – 1999-2007 % 60 50 55,3 47,3 43,8 38,1 40 30 33,6 27,0 24,7 20 10 14,0 0 1999 2000 2001 2002 2003 2004 2005 2006 Men age 55-64 - Flemish Region Women age 55-64 - Flemish Region Men age 55-64 - EU-15 Women age 55-64 - EU-15 SVR 2007 Some results • Employment rate is lower in Flemish Region than in de EU-15 for both men and women in the age of 55-64. • Flemish men nearing EU-average quicker than women. • The increasing employment rate is for the most part the result of the rise of the rate for people in the age group 5559. SVR Decomposition of increase in employment rate (55-64) • Evolution of employment rate between year (t) and year (t-1) = total effect • Total effect = demographic effect + net effect • Demographic effect = internal change in age composition of the group 55-64 • Net effect = change in pattern of participation SVR Decomposition of increase in employment rate (55-64) Demographic effect: employment rate year (t) with age composition year t employment rate year (t) with age composition year (t-1) --------------------------------------------------Net effect = employment rate year (t) with age composition year (t-1) employment rate year (t-1) with age composition year (t-1) SVR Results of Decomposition (Flemish region) Effect Total population Men Women 20012002 20022003 20032004 20042005 20052006 Total effect 1.07 0.92 2.94 1.06 0.83 Demographic effect 0.54 0.72 0.16 0.10 -0.47 Net effect 0.54 0.20 2.78 0.96 1.30 Total effect 0.22 1.21 2.58 1.79 -0.61 Demographic effect 0.75 1.01 -0.01 0.39 -0.84 Net effect -0.53 0.19 2.59 1.40 0.23 Total effect 1.86 0.61 3.15 0.40 2.25 Demographic effect 0.34 0.40 0.22 -0.16 -0.11 Net effect 1.52 0.20 2.93 0.55 2.36 Source: Department Work and Social Economy SVR Demographic versus net effect (in percent points) – men and women 2,94 2,78 1,3 1,07 1,06 0,92 0,96 0,72 0,83 0,54 0,54 0,2 2001-2002 2002-2003 0,16 0,1 2003-2004 2004-2005 2005-2006 -0,47 Total effect SVR Demographic effect Net effect Men 3,5 3 2,5 2 1,5 1 0,5 0 -0,5 -1 -1,5 2,58 2,59 1,79 1,4 1,21 1,01 0,75 0,22 0,39 0,19 2001-2002 2002-2003 -0,53 Total effect 2003-2004 -0,01 3,15 3 Women 2,5 2 1,5 2005-2006 -0,61 -0,84 Net effect 2,93 2,25 1,86 2,36 1,52 1 0,5 2004-2005 Demographic effect 3,5 0,23 0,34 0,61 0,4 0,2 0,22 0,4 0,55 0 -0,5 SVR 2001-2002 2002-2003 Total effect 2003-2004 2004-2005 -0,16 Demographic effect Net effect 2005-2006 -0,11 Interpretation • 2001-2002: total effect in increase of employment rate in the age group 55-64 of men and women: 50 percent is demographic; 50 percent is net. • From 2003-2004 on: demographic effect decreases, being negative in 2005-2006. • Forecast demographic effect (men and women): 2006-2007: -0.58 2007-2008: -0.29 2008-2009: -0.13 2009-2010: -0.05 SVR Some facts • Belgium = one of the European countries with a very low employment rate at the age of 5564. • Feminization of labour force = later than in other European countries. • Exit from the labour market by different exit routes like early retirement programmes, generous unemployment and disability arrangements. SVR • The likelihood to retire earlier: the theory of social comparison (Festinger, 1954) as one possible explanation. • People tend and expect from themselves to perform as do other similar people (reference group); constant social pressure on the individual to behave similar with the others. • In case of the existence in a country of a strong early retirement culture: most people tend to follow this pattern and do retire early from the labour market (also due to (too) generous exit schemes). SVR Early retirement in Flanders: Reasons for leaving the labour market • On the individual level: people do want to retire earlier than the statutory age of retirement in order to enjoy life and to do the things they like (60 percent very important or important). • Second: work is becoming too heavy. • Third: to make room for younger people. SVR Early retirement in Flanders: Reasons for leaving the labour market: some figures 100% 80% 60% 40% 20% very important / important SVR not important / not unimportant care for others people leave at a certain age no financial incentive enterprise restructuring health reasons to make room for younger people work (too) heavy more freedom 0% unimportant / not at all important Policy measures • Governments’ awareness of the necessity to change • Generation pact of 2005 with 4 goals: Abolishment of early retirement schemes (from the age of 58 now to 60). Higher availability for the labour market. Substitution of an age approach by a life course approach. Extension of the admission for pensioners to work after retirement age (which will be 65 for men and women in 2009 - actually 64 for women). SVR Preferred, expected and effective age at retirement (Belgium) 63 6 62 5,8 61 5,6 5,4 age 59 5,2 58 5 57 56 4,8 4,7 4,6 55 4,8 4,6 4,4 54 4,4 53 4,2 52 4 2003 SVR 5,2 2004 2005 2006 expected age of retirement effective age of retirement preferred age of retirement difference (in years) between exp and pref age 2007 difference in years 60 Results • Little evolution in the preferred age of retirement between 2003 and 2006 (remains more or less stable around the age of 56). Between 2006 and 2007 the increase is more outspoken. • Expected age of retirement is rising: people do realize that they will have to work longer. • Effective age of retirement: increase between 2003 and 2005, relapse in 2006 but increase again in 2007. • Difference between preferred and expected age of retirement remains (4.7 years in 2003; 4.8 years in 2007). SVR Unsustainability of the pension system? • Is it a real problem? • Is the pension allowance sufficient for those who retire? • Are people worried about the future? SVR Some answers • Pensions in Belgium are among the lowest of the industrialized countries (OECD, 2007). • According to a recent study, the legal pension in Belgium is insufficient to guaranty the standard of living before retirement. • This is due to a simple mechanism: wages increase annual with 2.25 percent on average, pensions only with 0.5 percent (are not entirely linked to wage progress). • Conclusion: many questions with regard to first pillar system (legal pension). • Only few data on 2nd and 3rd pillar (own dataset for 2008, not yet ready for analysis). Important to know: how many people are covered by those pillar schemes (additional pension; private pension savings)? SVR Are people afraid of the future? • Data stem from survey in 2001-2002, Flemish region, with respondents 55–90 years of age. • Question was: are you afraid that government will not be able to pay pensions in the future? • Results: 12 percent are really worried, 16 percent a little bit, 24 percent slightly and 46 percent not at all. • Analysis: logistic regression was applied in order to detect the most important determinants. SVR Worrying on payment of pensions in relation to some characteristics of respondents Odds-ratio Worried (ref. not much or not worried at all) Age (ref. age 80 and over) Age 55-59 3.304* Age 60-64 2.625* Age 65-69 1.276 Age 70-74 1.450 Age 75-79 1.329 Education (ref. primary education Higher education 1.411*** or less) Secondary education 1.180 Perception of the income (ref. Very difficult or difficult 3.872* easy or very easy) Rather difficult 2.476* Rather easy 1.450** Most important source of income Other income than mentioned 1.565 (ref. Self-employed remuneration 4.291* Own pension, family pension or 3.221** income from saving or property) investment, pension of the partner Unemployment allowance or other social security allowance SVR 3.609** Worrying on payment of pensions in relation to some characteristics of respondents (cont’d) Loneliness (ref. never lonely) Often or sometimes 1.314*** Prefer more vertical contacts Yes 1.569** contacts Yes 1.355 non-familial Yes 1.174 Self-rated health (ref. bad or Very good or good 1.327 very bad) Fair 1.140 Health status compared to 5 Worse 1.526*** years ago (ref. better) The same 1.071 (ref. no) Prefer more lateral (ref. no) Prefer more contacts (ref. no) Model Chi² 235.140 p<0.001 Nagelkerke R² * p<0.001 SVR **p<0.01 0.161 ***p<0.05 Interpretation • Perception of income = most important determinant for worrying on the payment of the pensions in the future. If the income situation is regarded as (very) difficult ► likelihood to worry is 4 times higher. • The same applies to the source of income: those with a allowance are much more worried than people who have an income from capital, savings or property. SVR Interpretation (cont’d) • By controlling for economic status: impact of social conditions remains. Health status compared with some years ago ► more relevant than self-rated health of the moment: those who evaluate their health worse than 5 years ago may fear some financial consequences. Those who are lonely or less supported by their environment are more worried. SVR Interpretation (cont’d) • Bivariate effect of marital status and household composition disappears. • Remarkable finding: having or not having children has no impact on the attitude of elderly persons (confirms the thesis that elderly do not want to be a burden for their offspring). SVR How to ensure old-age benefits in the future? • • • SVR Policy measures: - Raise the retirement age - Raise monthly taxes - Lower monthly benefit payment to pensioners - Force children to support their parents - Abolish early retirement programmes - Make old-age benefits dependent on number of children Preference: 1. Abolishment of early retirement programmes 2. Raising monthly taxes Dislike / oppose: 1. Force children to support their aged parents 2. Lower monthly payment to pensioners Conclusions • Government became aware of necessity to adapt to changed circumstances (low employment rate, too large numbers in early retirement, …) • People do agree on the necessity to work longer, however their beliefs and attitudes do not necessarily reflect their precise behaviour (still important gap between effective age at retirement and the preferred/expected age). • Productivity gain as compensation for shorter working careers? SVR Conclusions (cont’d) • People do not worry that much about the payment of pensions in the future but some are more worried. • Public opinion is in favour of measures such as abolishment of early retirement schemes but at the same time …. • Raising monthly taxes (second most preferable measure) is not very realistic in Belgium. This strategy is out of the question (too much burden on GDP already) SVR Conclusions (cont’d) • Less people at working age in the future: how to keep people active as long as possible: financial incentives for extra working years, better working conditions, more flexibility,… . • There is still need for further action to increase female labour market participation. SVR Thanks for your attention SVR