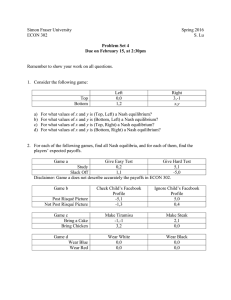

ECON 201 Oligopolies & Game Theory 1

advertisement

1 ECON 201 Oligopolies & Game Theory An Economic Application of Game Theory: the Kinked-Demand Curve • Above the kink, demand is relatively elastic because all other firm’s prices remain unchanged. Below the kink, demand is relatively inelastic because all other firms will introduce a similar price cut, eventually leading to a price war. Therefore, the best option for the oligopolist is to produce at point E which is the equilibrium point 2 3 Figure 12.4 Duopoly Equilibrium in a Centralized Cartel 4 Duopoly • What are the strategic options and the payoffs? • Form a cartel • Forego additional profits from increasing output beyond assigned quota • Stable prices – don’t ever change (kinked demand curve) • Cheat on the Cartel • Increase production unilaterally (output effect) • If only you increase output, price doesn’t fall too much (price effect) • Hope competitor doesn’t change strategy • Compete on price • Final equilibrium moves towards competitive market price • No monopoly rents (or + economic profits) 5 Game Theory • Game theory is a methodology that can be used to analyze both cooperative and non-cooperative oligopolies. • Recognizes the interdependence of the firms’ actions • Using a payoff matrix to describe options (strategies) and payoffs • Firms are profit maximizers! 2 Jack and Jill’s Oligopoly Game Jack’s decision High production: 20M Barrels Jack gets $1,600 profit High production: Jill’s Decision 13M Barrels Low production: 7M Barrels Low production: 13M Barrels Jill gets $1,600 profit Jack gets $1,500 profit Jill gets $2,000 profit Jack gets $2,000 profit Jill gets $1,500 profit Jack gets $1,800 profit Jill gets $1,800 profit In this game between Jack and Jill, the profit that each earns from selling oil depends on both the quantity he or she chooses to sell and the quantity the other chooses to sell. 6 Nash Equilibrium • Nash Equilibrium – An economic decision maker has nothing to gain by changing its own strategy without collusion – Nobody wants to change their strategy given that the other firm does not change their strategy – A “stable” outcome where nobody wants to move from their current position – Often discussed with game theory, and easier to see when games are drawn in matrix form Nash Equilibrium • If firm facing kinked demand curve tries to raise price: – Other firms do not – As demand is highly elastic and other firms are “close” substitutes – Loses market share and revenues • If firm lowers price – Competitors match price decreases 8 An Economic Application of Game Theory: the Kinked-Demand Curve • Above the kink, demand is relatively elastic because all other firm’s prices remain unchanged. Below the kink, demand is relatively inelastic because all other firms will introduce a similar price cut, eventually leading to a price war. Therefore, the best option for the oligopolist is to produce at point E which is the equilibrium point 9 10 Figure 12.7 Xbox and PlayStation Dominant Strategy 11 Nash Equilibrium • Nash equilibrium a solution to a non-cooperative game involving two or more players • each player is assumed to know the equilibrium strategies of the other players • no player has anything to gain by changing only his own strategy unilaterally Hence, a Nash equilibrium will be stable (once you get there!) A Dominant Strategy is one type of a Nash equilibrium – (a) no player has any incentive to change – BUT (b) does not require collusion 12 Determining the Dominate Strategy (Single Nash) • A dominant strategy occurs when one strategy is best for a player regardless of the rival’s actions. (rival’s actions don’t matter) • Dominant strategy equilibrium—neither player has reason to change their actions because they are pursuing the strategy that is optimal under all circumstances. • Here the dominant strategy is for each firm to advertise (it is also a Nash Equilibrium) • BUT there is no incentive for the firms to collude – hence no Anti-trust violation! (at least on the cooperation side; maybe still on anti-competitive pricing) 13 Figure 12.7 Xbox and PlayStation Dominant Strategy 14 Multiple Equilibria • Sometimes there are come cases where there are multiple Nash equilibria. • In this case, the outcome is uncertain. • Firms will have an incentive to collude. • An example: • Sony/Microsoft can add one of two new features • One feature appeals only to YOUTH market • Other feature appeals only to TEEN market • Incentive to reach agreement on both firms offering the same new (one only) feature 15 Payoff Table Multiple Nash Equilibria Requires collusion – agree no to compete in each other’s market 16 Prisoner's Dilemma • A prisoner’s dilemma occurs when the dominant strategy leads all players to an undesired outcome. 17 Figure 12.9 Prisoners’ Dilemma Optimal - each would prefer to serve minimal time. Each has to “not confess” But: if one does remains silent and the other does confess -> not optimal. Hence each will choose to confess -> sub-optimal 18 Best Outcome • Neither confesses • But without collusion/agreement – how do you guarantee this outcome? • Enforcement issues (price, output, quotas) • In our duopoly game: • Each firm pursues “cheating” (here confessing) as can’t rely on other firm not to cheat • Supoptimal (from firm’s perspective) -> competitive equilibria • Law & Order • Why we keep suspects separated! • Prevent collusive agreements • In Economics – wiretaps, e-mail and Sherman Anti-trust Act 19 An Economic Application of Game Theory: the Kinked-Demand Curve: Prisoner’s dilemma (sub-optimal) • Above the kink, demand is relatively elastic because all other firm’s prices remain unchanged. Below the kink, demand is relatively inelastic because all other firms will introduce a similar price cut, eventually leading to a price war. Therefore, the best option for the oligopolist is to produce at point E which is the equilibrium point Prisoner’s Dilemma 20 Nash Equilibrium • If firm facing kinked demand curve tries to raise price: • Other firms do not • As demand is highly elastic and other firms are “close” substitutes • Loses market share and revenues • If firm lowers price • Competitors match price decreases 21 Game Theory: Kinked Demand Curve and Nash Equilibrium Firm B (Competitor) Firm A (You) Raise Price Don’t Change Lower Price (-5%) (-1%->+5%) (-2%->+1%) Raise Price (A) -5% (A) -5% (A)-5% (-5%) (B) -5% (B) +5% (B)+1% Don’t Change (A) +5% (A) 0 (A)-1% (-1%->+5%) (B) -5% (B) 0 (B)+1% Lower Price (A) +1% (A)+1% (A) -2% (-2%->+1%) (B) -5% (B) -1% (B) -2% 22 Features of a Nash Equilibrium • In a non-cooperative oligopoly, each firm has little incentive to change price. • This represents a Nash Equilibrium, where each firm’s pricing strategy remains constant given the pricing strategy of the other firms. • Firms have no incentive to change their strategy. 23 Non-Cooperative Cartels Either • Some degree of price competition • Firms engage in highly competitive pricing • Similar outcome as perfect competition • Firms have some market power • Resembles monopolistic competition • Bilateral monopoly with price competition • or Stable prices prevail • Non-collusive • Firms choose not to compete because of kinked demand curve 24 Non-cooperative Oligopolies • Competitive/psuedo-competitive behavior (non- cooperative) • Perfect Competition (almost): firms undercut each other’s prices • competition between sellers is fierce, with relatively low prices and high production • Outcome may be similar to PC or Monopolistic Competition • Nash equilibrium • Firms avoid “ruinous” price competition by keeping prices stable and avoiding price competition (undercutting each others prices) • May lead to product proliferation and/or extensive advertising (non-price competition) 25 U.S. 2003 Advertising-to-Sales Ratio for Selected Products and Industries 26 Game Theory Models of Oligoploy • Stackelberg's duopoly. In this model the firms move sequentially (see Stackelberg competition). • Cournot's duopoly. In this model the firms simultaneously choose quantities (see Cournot competition). • Bertrand's oligopoly. In this model the firms simultaneously choose prices (see Bertrand competition). • Monopolistic competition. A market structure in which several or many sellers each produce similar, but slightly differentiated products. Each producer can set its price and quantity without affecting the marketplace as a whole.