ECON 201 1 OLIGOPOLIES & GAME THEORY

advertisement

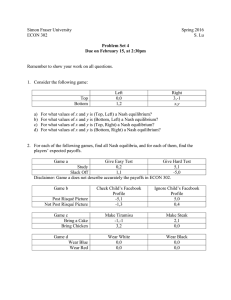

ECON 201 1 OLIGOPOLIES & GAME THEORY 2 EQUILIBRIUM IN A CENTRALIZED CARTEL DUOPOLY What are the strategic options and the payoffs? • Form a cartel • Forego additional profits from increasing output beyond assigned quota • Cheat on the Cartel • Increase production unilaterally (output effect) • If only you increase output, price doesn’t fall too much (price effect) • Compete on price • Final equilibrium moves towards competitive market price 3 • No monopoly rents (or + economic profits) GAME THEORY Game theory is a methodology that can be used to analyze both cooperative and non-cooperative oligopolies. • Recognizes the interdependence of the firms’ actions Using a payoff matrix to describe options (strategies) and payoffs 4 • Firms are profit maximizers! 5 FIGURE 12.7 XBOX AND PLAYSTATION DOMINANT STRATEGY NASH EQUILIBRIUM • Nash equilibrium a solution to a non-cooperative game involving two or more players • each player is assumed to know the equilibrium strategies of the other players • no player has anything to gain by changing only his own strategy unilaterally 6 Hence, a Nash equilibrium will be stable (once you get there!) DETERMINING THE DOMINATE STRATEGY (SINGLE NASH) A dominant strategy occurs when one strategy is best for a player regardless of the rival’s actions. (rival’s actions don’t matter) • Dominant strategy equilibrium—neither player has reason to change their actions because they are pursuing the strategy that is optimal under all circumstances. Here the dominant strategy is for each firm to advertise (it is also a Nash Equilibrium) 7 BUT there is no incentive for the firms to collude – hence no Anti-trust violation! (at least on the cooperation side; maybe still on anti-competitive pricing) 8 FIGURE 12.7 XBOX AND PLAYSTATION DOMINANT STRATEGY MULTIPLE EQUILIBRIA Sometimes there are come cases where there are multiple Nash equilibria. • In this case, the outcome is uncertain. • Firms will have an incentive to collude. An example: • Sony/Microsoft can add one of two new features 9 • One feature appeals only to YOUTH market • Other feature appeals only to TEEN market • Incentive to reach agreement on both firms offering the same new (one only) feature PAYOFF TABLE MULTIPLE NASH EQUILIBRIA 10 Requires collusion – agree no to compete in each other’s market PRISONER'S DILEMMA 11 A prisoner’s dilemma occurs when the dominant strategy leads all players to an undesired outcome. FIGURE 12.9 PRISONERS’ DILEMMA But: if one does remains silent and the other does confess -> not optimal. Hence each will choose to confess -> sub-optimal 12 Optimal - each would prefer to serve minimal time. Each has to “not confess” BEST OUTCOME Neither confesses • But without collusion/agreement – how do you guarantee this outcome? • Enforcement issues (price, output, quotas) • In our duopoly game: • Each firm pursues “cheating” (here confessing) as can’t rely on other firm not to cheat • Supoptimal (from firm’s perspective) -> competitive equilibria • Law & Order 13 • Why we keep suspects separated! • Prevent collusive agreements • In Economics – wiretaps, e-mail and Sherman Antitrust Act AN ECONOMIC APPLICATION OF GAME THEORY: THE KINKED-DEMAND CURVE: PRISONER’S DILEMMA (SUB-OPTIMAL) Above the kink, demand is relatively elastic because all other firm’s prices remain unchanged. Below the kink, demand is relatively inelastic because all other firms will introduce a similar price cut, eventually leading to a price war. Therefore, the best option for the oligopolist is to produce at point E which is the equilibrium point 14 Prisoner’s Dilemma NASH EQUILIBRIUM If firm facing kinked demand curve tries to raise price: • Other firms do not • As demand is highly elastic and other firms are “close” substitutes • Loses market share and revenues If firm lowers price 15 • Competitors match price decreases GAME THEORY: KINKED DEMAND CURVE AND NASH EQUILIBRIUM Firm A (You) Raise Price Don’t Change Lower Price (-5%) (-1%->+5%) (-2%->+1%) Raise Price (A) -5% (A) -5% (A)-5% (-5%) (B) -5% (B) +5% (B)+1% Don’t Change (A) +5% (A) 0 (A)-1% (-1%->+5%) (B) -5% (B) 0 (B)+1% Lower Price (A) +1% (A)+1% (A) -2% (-2%->+1%) (B) -5% (B) -1% (B) -2% 16 Firm B (Competitor) FEATURES OF A NASH EQUILIBRIUM In a non-cooperative oligopoly, each firm has little incentive to change price. This represents a Nash Equilibrium, where each firm’s pricing strategy remains constant given the pricing strategy of the other firms. 17 • Firms have no incentive to change their strategy. NON-COOPERATIVE CARTELS Either Some degree of price competition • Firms engage in highly competitive pricing • Similar outcome as perfect competition • Firms have some market power • Resembles monopolistic competition • Bilateral monopoly with price competition or Stable prices prevail 18 • Non-collusive • Firms choose not to compete because of kinked demand curve NON-COOPERATIVE OLIGOPOLIES Competitive/psuedo-competitive behavior (non-cooperative) • Perfect Competition (almost): firms undercut each other’s prices • competition between sellers is fierce, with relatively low prices and high production • Outcome may be similar to PC or Monopolistic Competition • Nash equilibrium 19 • Firms avoid “ruinous” price competition by keeping prices stable and avoiding price competition (undercutting each others prices) • May lead to product proliferation and/or extensive advertising (non-price competition) 20 U.S. 2003 ADVERTISING-TO-SALES RATIO FOR SELECTED PRODUCTS AND INDUSTRIES GAME THEORY MODELS OF OLIGOPLOY 21 Stackelberg's duopoly. In this model the firms move sequentially (see Stackelberg competition). Cournot's duopoly. In this model the firms simultaneously choose quantities (see Cournot competition). Bertrand's oligopoly. In this model the firms simultaneously choose prices (see Bertrand competition). Monopolistic competition. A market structure in which several or many sellers each produce similar, but slightly differentiated products. Each producer can set its price and quantity without affecting the marketplace as a whole.