Econ 201 Lecture 7.2 Summer 2009 Regulation:

advertisement

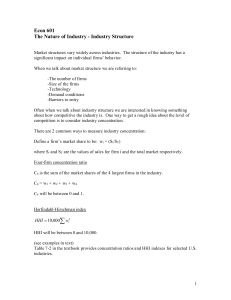

Econ 201 Lecture 7.2 Summer 2009 Regulation: Anit-Competitive Behavior 1 Government Regulation • Major categories – Anti-competitive behavior • Price Discrimination • Collusion • Mergers/acquisitions – Natural Monopolies – Externalities • Pollution • Fishing, forestry, mining, oil drilling 2 Government Regulation • Tools available – Statutory • Prohibitive – E.g. Price fixing/restricting output, cartels, collusive behavior • Fines, breakup (divestiture) – Deregulation • Removing regulation – Airlines, Banking • Incentive mechanisms – Managed competition – Incentive design 3 Promoting Efficiency • Goals of regulation – Promote Technological Innovation – Efficiency in Production – Efficiency in Allocation 4 Efficiency in Production • Produce Goods at Least Cost – Firms to operate at the minimum of their Long Run Average Cost Curve 5 Efficiency in Allocation • Marginal value consumers place on last (marginal unit) produced to equal the resource “opportunity” costs – MV = MC at the marginal unit 6 Government Regulatory Agencies Administrative Agencies • Federal Trade Commission (1914) Act – “empowered to pursue abuses of trade that could lessen competition” • Department of Justice (DOJ) – – – – Jointly charged with FTC for overseeing and enforcing antitrust policy Established by the Judiciary Act of 1789 1870 Act: handle the legal business of the United States. control over all criminal prosecutions and civil suits in which the United States had an interest • Federal Communications Commission (FCC) – established by the Communications Act of 1934 – charged with regulating all non-Federal Government use of the radio spectrum (including radio and television broadcasting), and all interstate telecommunications (wire, satellite and cable) as well as all international communications that originate or terminate in the United States. 7 What Happens in Different Markets? • Monopoly/Oligopoly – Single-price monopolist/cartel (collusive) – Price Discrimination • Block pricing – 2nd degree • Third degree: different prices for different WTP – Income, sex, age, geography • Monopolistic Competition – “branding” for market power • advertising – Geographic pricing, • e.g., Madison Park shell, CD grocery stores – Price points and product proliferation • Perfect Competition – Compete by reducing costs 8 Perfect Competition • Standard of comparison for all market models (optimal) – Productive efficient • Firms operate at min of LRAC or exit – Technological innovate • Innovate or die – Allocative efficient • Consumers value marginal unit at MV – Equals firm’s cost of producing marginal unit • No deadweight loss 9 Monopoly • Not Efficient in Production – Never operate at min of LRAC – Underutilized capacity and resources • Not Technologically Innovative – No incentive to invest in/develop new technology when you’re the only firm • Not Efficient in Allocation – P (=MV) > MR = MC – Deadweight loss 10 Monopolistic Competition • Not Efficient in Production – Never operate at min of LRAC – Underutilized capacity and resources • Technologically Innovative – Competition with other firms provides incentive • Not Efficient in Allocation – P (=MV) > MR = MC – Deadweight loss (but not as great as Monopoly) 11 How Has the Government Sought to Regulate Markets? • Punishing Anti-Competitive Behavior – Pricing/market tactics • Collusion – Price-fixing, restricting output • Price Discrimination • Predatory Pricing – Impose fines for AC tactics • Preventing Anti-competitive Behavior – Mergers and Acquisitions • Review by appropriate administrative agency – Divestiture/breakups • Regulating Natural Monopolies • Deregulation(sic) of Selected Industries 12 Punishing AC Behavior • Punishing firms for behaving like a monopoly – Sherman anti-trust Act (1890) • “conspiring to fix prices or restrict output” – Clayton Act (1914) • More sophisticated price discrimination • Tie-in sales – requiring the purchase of 2nd good • Stock purchases/acquisitions – Robinson-Patman(1936) • 3rd degree price discrimination • Amendment to Clayton Act 13 Reviewing Mergers • Primarily aimed at preventing mergers or acquisitions that reduce competition – FCC regulates communications media (newspapers, tv, telecomm, radio) – FTC and DOJ regulate the rest 14 Where We’re Going • How do we tell if a merger is anti-competitive? – Market Concentration • CR4: market share for the 4 largest firms • Herfindahl Index (HHI): computed from the squares of the market shares • Strategic behavior (how do they behave in the market place) – Collusive: act together – Non-collusive: act separately and/or stratgeicially 15 How do we tell? • Market concentration refers to the size and distribution of firm market shares and the number of firms in the market. • Economists use two measures of industry concentration: – Four-firm Concentration Ratio – The Herfindahl-Hirschman Index 16 Four-Firm Concentration Ratio • The four-firm concentration ratio (CR4) measures market concentration by adding the market shares of the four largest firms in an industry. – If CR4 > 60, then the market is likely to be oligopolistic. 17 Example Firm Nike Market Share 62% New Balance 15.5% Asics 10% Adidas 4.3% CR 4 = 62 15.5 10 4.3 91.8 18 The Herfindahl-Hirschman Index • The Herfindahl-Hirschman index (HHI) is found by summing the squares of the market shares of all firms in an industry. – Advantages over the CR4 measure: • Captures changes in market shares • Uses data on all firms 19 Example Firm Market Share Nike 62% New Balance 15.5% Asics 10% Adidas 4.3% HHI 62 15.5 10 4.3 4,202.74 2 2 2 2 20 Example (cont’d) What happens if market shares are evenly distributed? Firm Market Share Nike 22.95% New Balance 22.95% Asics 22.95% Adidas 22.95% HHI 22.95 2 22.95 2 22.95 2 22.95 2 2,106.81 CR 4 91.8 21 How do they determine whether a merger reduces competition? • Herfindahl-Hirschman Index or HHI, – measure of the size of firms in relationship to the industry – Meant to be an indicator of the amount of competition – sum of the squares of the market shares of each individual firm. • decreases in the Herfindahl index generally indicate a loss of pricing power and an increase in competition, whereas increases imply the opposite • DOJ guidelines – Mergers resulting in HHI > 1800 can be challenged 22 Figure 12.11 Four-Firm Concentration Ratio (CR4) for Selected Industries in 1997 23 Are All Mergers Equal? • Conglomerate – Merger of firms in unrelated industries • Vertical Merger – Merger of firms upstream/downstream from each other in production stream • FCC: ownership of more than 1 media type • Microsoft • Horizontal Mergers – Firms in the same industry • Telecomm industry – AT&T divestiture – Verizon/GTE merger; RBOC mergers • Would the HHI be a valid measure of competitiveness? 24