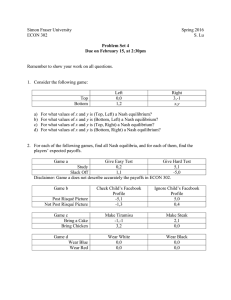

Econ 201 Oligopolies & Game Theory 1

advertisement

Econ 201 Oligopolies & Game Theory 1 Figure 12.4 Duopoly Equilibrium in a Centralized Cartel 2 Duopoly • What are the strategic options and the payoffs? – Form a cartel • Forego additional profits from increasing output beyond assigned quota – Cheat on the Cartel • Increase production unilaterally (output effect) – If only you increase output, price doesn’t fall too much (price effect) – Compete on price • Final equilibrium moves towards competitive market price – No monopoly rents (or + economic profits) 3 Game Theory • Game theory is a methodology that can be used to analyze both cooperative and non-cooperative oligopolies. – Recognizes the interdependence of the firms’ actions • Using a payoff matrix to describe options (strategies) and payoffs – Firms are profit maximizers! 4 Figure 12.7 Xbox and PlayStation 2 Payoff Matrix for Advertising 5 Nash Equilibrium • Nash equilibrium a solution to a non-cooperative game involving two or more players • each player is assumed to know the equilibrium strategies of the other players • no player has anything to gain by changing only his own strategy unilaterally Hence, a Nash equilibrium will be stable (once you get there!) 6 Determining the Dominate Strategy (Single Nash) • A dominant strategy occurs when one strategy is best for a player regardless of the rival’s actions. (rival’s actions don’t matter) – Dominate strategy equilibrium—neither player has reason to change their actions because they are pursuing the strategy that is optimal under all circumstances. • Here the dominant strategy is for each firm to advertise (it is also a Nash Equilibrium) 7 Multiple Equilibria • Sometimes there are come cases where there are multiple Nash equilibria. – In this case, the outcome is uncertain. – Firms will have an incentive to collude. • An example: – Sony/Microsoft can add one of two new features • One feature appeals only to YOUTH market • Other feature appeals only to TEEN market • Incentive to reach agreement on both firms offering the same new (one only) feature 8 Payoff Table Multiple Nash Equilibria 9 Prisoner's Dilemma • A prisoner’s dilemma occurs when the dominate strategy leads all players to an undesired outcome. 10 Figure 12.9 Prisoners’ Dilemma 11 Best Outcome • Neither confesses – But without collusion/agreement – how do you guarantee this outcome? • Enforcement issues (price, output, quotas) – Law & Order • Why we keep suspects separated! – Prevent collusive agreements 12 An Economic Application of Game Theory: the Kinked-Demand Curve • Above the kink, demand is relatively elastic because all other firm’s prices remain unchanged. Below the kink, demand is relatively inelastic because all other firms will introduce a similar price cut, eventually leading to a price war. Therefore, the best option for the oligopolist is to produce at point E which is the equilibrium point 13 Game Theory: Kinked Demand Curve and Nash Equilibrium Firm B (Competitor) Firm A (You) Raise Price Don’t Change Lower Price (-5%) (-1%->+5%) (-2%->+1%) Raise Price (A) -5% (A) -5% (A)-5% (-5%) (B) -5% (B) +5% (B)+1% Don’t Change (A) +5% (A) 0 (A)-1% (-1%->+5%) (B) -5% (B) 0 (B)+1% Lower Price (A) +1% (A)+1% (A) -2% (-2%->+1%) (B) -5% (B) -1% (B) -2% 14 Nash Equilibrium • If firm facing kinked demand curve tries to raise price: – Other firms do not – As demand is highly elastic and other firms are “close” substitutes – Loses market share and revenues • If firm lowers price – Competitors match price decreases 15 Nash Equilibrium • If firm facing kinked demand curve tries to raise price: – Other firms do not – As demand is highly elastic and other firms are “close” substitutes – Loses market share and revenues • If firm lowers price – Competitors match price decreases 16 Features of a Nash Equilibrium • In a non-cooperative oligopoly, each firm has little incentive to change price. • This represents a Nash Equilibrium, where each firm’s pricing strategy remains constant given the pricing strategy of the other firms. – Firms have no incentive to change their strategy. 17 Non-Cooperative Cartels Either • Some degree of price competition – Firms engage in highly competitive pricing • Similar outcome as perfect competition – Firms have some market power • Resembles monopolistic competition – Bilateral monopoly with price competition • or Stable prices prevail – Non-collusive – Firms choose not to compete because of kinked demand curve 18 Non-cooperative Oligopolies • Competitive/psuedo-competitive behavior (noncooperative) – Perfect Competition (almost): firms undercut each other’s prices • competition between sellers is fierce, with relatively low prices and high production – Outcome may be similar to PC or Monopolistic Competition – Nash equilibrium • Firms avoid “ruinous” price competition by keeping prices stable and avoiding price competition (undercutting each others prices) • May lead to product proliferation and/or extensive advertising (non-price competition) 19 Figure 12.3 U.S. 2003 Advertising-toSales Ratio for Selected Products and Industries 20 Game Theory Models of Oligoploy • Stackelberg's duopoly. In this model the firms move sequentially (see Stackelberg competition). • Cournot's duopoly. In this model the firms simultaneously choose quantities (see Cournot competition). • Bertrand's oligopoly. In this model the firms simultaneously choose prices (see Bertrand competition). • Monopolistic competition. A market structure in which several or many sellers each produce similar, but slightly differentiated products. Each producer can set its price and quantity without affecting the marketplace as a whole. 21