Factors Affecting the Economic Potential of West London Robert Huggins

advertisement

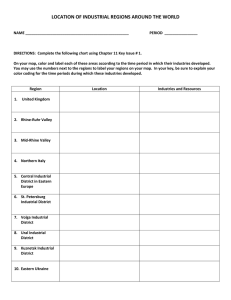

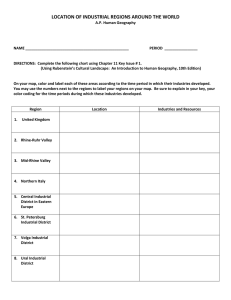

Factors Affecting the Economic Potential of West London Robert Huggins Enterprise and Regional Development Unit The Management School University of Sheffield r.huggins@sheffield.ac.uk M1 M11 West London – boroughs of Hammersmith and Fulham, Hillingdon, Hounslow, Harrow, Brent and Ealing Hertfordshire Buckinghamshire Essex M25 M40 Oxfordshire London West London West M4 Greater London Berkshire M20 M3 Surrey Hampshire Kent West London - Some Perceived Strengths Heathrow - the world’s busiest international airport - excellent export and import access through its international connectivity. A significant creative industries cluster, embodied by the BBC studios and surrounding audio-visual cluster in White City and Park Royal. West London is home to some of the biggest blue chip organisations in the world, many of which have their headquarters located there. These include GlaxoSmithKline - Diageo - Cisco - British Airways IBM - BBC - United Biscuits - BSkyB - Kodak - Bechtel - Carphone Warehouse. A significant concentration of employment within the transport and logistics sector, particularly within air transport. The main road and rail links to all parts of Britain and particularly between central London and the Thames Valley and the west of England. Relatively strong skills base. West London - Some Perceived Weaknesses West London lags behind the rest of London in terms of per capita output – approximately 9% lower. A higher unemployment rate than the UK average and relatively high levels of long-term unemployment - over one in every four claimants within Brent has been claiming benefit for one year or more. Business start-up rates in west London lag the regional average by some way – there has been a large differential since the late 1990s. Localities with significant multiple deprivation. West London is perceived to have suffered as a result of East London’s development, which has been boosted by the of the Docklands area and the financial businesses on its western fringe. Standard Deviation of Sub-Regional GDP per Capita for UK Regions Gross Weekly Pay (Workplace Based) 2003 £800 £721 £678 £700 £578 £564 £476 £512 £497 South London £500 £550 North London £600 £589 £400 £300 £200 £100 Source: New Earnings Survey Thames Valley West London East London Central London Surrey Buckinghamshire Great Britain £0 21% 20% 13% 5% 4% Source: Annual Business Inquiry 6% Other services 1% 0% 26% 25% Public administration,education & health 20% Banking, finance and insurance, etc 0% 8% Transport and communications 5% Great Britain West London Distribution, hotels and restaurants 10% Construction 15% Manufacturing 25% Energy and water 30% Agriculture and fishing Employment by Sector (as a proportion of total employment) 25% 18% 14% 5% 7% 1% 0% 0% 0% 0% 0% 0% 5% 3% 21% 20% 15% 6% 8% Other services 23% Public administration,education & health London West London Banking, finance and insurance, etc 8% Transport and communications 25% Distribution, hotels and restaurants 10% Construction Manufacturing 30% Energy and water 35% Agriculture and fishing Employment by Sector (as a proportion of total employment) 32% 26% 21% 18% 14% 7% 7% 4% Employment Growth (Compound Annual Growth Rate) 1998-2002 West London Air transport 6.0% Hotels and restaurants 5.2% Real estate activities 5.1% Recreational, cultural and sporting 4.7% Other service activities 3.7% Manufacture of other transport equipment 3.6% Education 3.4% Source: Annual Business Inquiry Proportion of Total Employment in High-Tech Manufacturing 2.6% Thames Valley 1.5% London West London South 1.1% London North 1.1% 0.5% London East 0.3% London Central 2.0% Surrey 3.9% Buckinghamshire 2.1% Great Britain Source: Annual Business Inquiry 0% 1% 2% 3% 4% 5% Proportion of Total Employment in High-Tech Services Thames Valley 26.6% London West 18.5% 19.9% London South London North 14.5% London East 38.5% 26.4% London Central Surrey 22.6% Buckinghamshire 18.4% 15.2% Great Britain 0% Source: Annual Business Inquiry 10% 20% 30% 40% 50% Employment (as a proportion of total employment) in selected service sectors Business/management consultancy Digital Media IT and Communication Buckinghamshire 2.6% 5.5% 5.3% Surrey 1.6% 6.0% 5.9% London Central 2.4% 6.0% 4.0% London East 1.3% 4.0% 4.1% London North 0.8% 3.3% 3.0% London South 1.7% 4.5% 4.3% London West 1.2% 7.6% 4.4% Thames Valley 1.4% 11.8% 12.5% Area Source: Annual Business Inquiry Employment within Knowledge-Based Businesses Dacorum Dacorum Watford WatfordHertsmere Hertsmere Three Three Rivers Rivers Chiltern Chiltern South South Oxfordshire Oxfordshire St.Albans St.Albans Wycombe Wycombe Hillingdon Hillingdon Harrow Harrow Barnet Barnet Brent Brent South South Bucks Bucks Ealing Ealing Hammersmith Hammersmith and and Fulham Fulham Windsor Windsor and and Maidenhead Maidenhead Newbury Newbury Wokingham Wokingham Hounslow Hounslow Spelthorne Spelthorne Bracknell Bracknell Forest Forest Elmbridge Elmbridge Epsom Epsom and and Ewell Ewell Woking Woking Basingstoke Basingstoke and and Deane Deane Hart Hart Rushmoor Rushmoor % employment within knowledge-based businesses 27.1 to 77.7 21.9 to 27.1 15.4 to 21.9 5.5 to 15.4 Guildford Guildford Reigate Reigate and and Banstead Banstead Mole Mole Valley Valley Source: SEEDA West London – Economic Structure West London is largely differentiated from other neighbouring sub-regional economies due to its high level of employment in transport and communications, and the distribution, hotels & restaurants sector. West London employs a small proportion of its workforce (in comparison with neighbouring sub-regions) within banking, finance and insurance. It also has a relatively small proportion of employment in public sector activities, compared with surrounding areas. West London possesses a real strength in the digital media sector. However, comparing west London with the Thames Valley we find that there is a considerable differential in IT and communications sector (which includes software development) employment. West London is under-represented in comparison with a number of its neighbours in the business and management consultancy sector. Only north London has a lower proportion of its employment within this sector. Growth Constraints Perhaps a key constraint to business growth in west London is the apparent lack of economic connectivity with neighbouring areas such as Central London and the Thames Valley. It has an obvious strength in the transport and communications sectors, but lacks a critical mass of other tradable specialisms in the knowledge-based sectors (with the exception of the creative industries). Business start-up rates in west London lag the regional average, and are not occurring in those sectors that have a high growth potential. There is little evidence that current business support mechanisms are creating the level of business growth required in west London, particularly for high value-added businesses, where market failures are often more difficult to address. Concluding Remarks In order to develop the west London economy, the sub-region should also seek to integrate itself more with its surrounding subregional economies. Whilst the Thames Valley, Surrey, Buckinghamshire and Central London have a large density of knowledge-based employment, the same cannot be said of west London – which is wedged between these sub-regions. The proximity of central London, as well as its proximity to the Thames Valley and other high-performing South East England subregions, means that West London is within the centre of the UK’s most competitive regions. Given its location and transport links, west London has an opportunity to capitalise upon the opportunities on offer as a result of its location by increasing interaction and acting as a ‘bridge’ between central London and the Thames Valley.