Econ 201 Ch. 6 & 8 Government Policy & Economic Welfare

advertisement

Econ 201

Ch. 6 & 8

Government Policy &

Economic Welfare

Evaluating the Impact of

Government Intervention

• Policy Instruments Available

– Taxes

• Typically: per-unit tax on output

• Others: lump-sum, value added (VAT)

– Subsidies

• Rebate on per-unit produced

– Price Floors

• Minimum price that can be charged (e.g., minimum wage)

– Price Ceilings

• Limit on the maximum price that can be charged (WIN)

– Quotas

• Limits on amounts produced/imported

• Infant industry/protectionism

How Do We Analyze the Effects of

Taxes and Subsidies

• The efficient ideal market

– “perfectly competitive” market

• Consumers and suppliers are price-takers, i.e. have no

market power

Application:

Taxes and Competitive Equilibrium

• Consider a per-unit tax, which adds a fixed

dollar amount to each unit of a good sold.

– Graphically, the imposition of the tax is shown

by a leftward shift of the supply curve.

Figure 6.4 The Effect of a Per-Unit

Tax on Laptop Sales

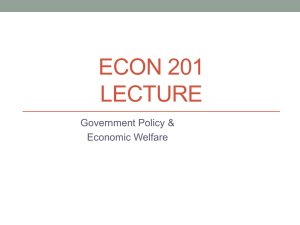

Deadweight Loss

Price Consumers

Pay

Pre-tax price

Price Sellers

Receive

Reduction in

Qty sold

Deadweight Loss

Retained CS

Tax Rev

From CS

Tax Rev

From CS

Retained PS

Application:

Taxes and Competitive Equilibrium

• This example illustrates three key ideas related

to taxes:

– Incidence of a tax on consumers:

• The increase in price that consumers pay

– Incidence of a tax on producers:

• The decrease in price producers receive

– Deadweight loss:

• Losses in consumer and producer surplus that are not

transferred to the government as revenue

Elasticity and Tax Incidence

• The incidence of a tax will be determined

by the elasticities of demand and supply.

Figure 6.5(a)

Elasticity and Tax Incidence

Figure 6.5(b)

Elasticity and Tax Incidence

Tax Incidence and Demand

Elasticity

• If demand is inelastic, the majority of

the tax incidence falls on consumers.

• If demand is elastic, the majority of the tax

incidence falls on producers.

• As demand elasticity increases, the

deadweight loss increases.

Figure 6.5(c)

Elasticity and Tax Incidence

Figure 6.5(d)

Elasticity and Tax Incidence

Tax Incidence and Supply

Elasticity

• If supply is inelastic, the majority of the tax

incidence falls on producers.

• If supply is elastic, the majority of the tax

incidence falls on consumers.

• As supply elasticity increases, the

deadweight loss increases.

Deadweight Loss and Tax Revenue

6

How deadweight loss and tax revenue vary with the

size of a tax (a, b, c)

(b) Medium tax

(a) Small tax

Price

Price

Deadweight

loss

Deadweight

loss

Supply

Supply

PB

PB

Tax

revenue

Tax

revenue

PS

Deadweight

loss

Demand

Demand P

S

Supply

Tax revenue

Price

PB

(c) Large tax

Demand

PS

0

Q2 Q1

Quantity

0

Q2

Quantity

Q1

0 Q2

Q1

Quantity

The deadweight loss is the reduction in total surplus due to the tax. Tax revenue is the amount

of the tax times the amount of the good sold. In panel (a), a small tax has a small deadweight

loss and raises a small amount of revenue. In panel (b), a somewhat larger tax has a larger

deadweight loss and raises a larger amount of revenue. In panel (c), a very large tax has a

very large deadweight loss, but because it has reduced the size of the market so much, the

tax raises only a small amount of revenue.

17

Balancing DWL and Tax

Revenues

• Intuition:

– If tax rates are too low or too high, revenue

will be low.

– There is an optimal tax rate to be found.

• The Laffer curve (Arthur Laffer, USC)

– This is the parabolic relationship between

tax rates and tax revenue.

– Underlying rational for supply-side economics

and cutting taxes to promote economic growth

6

How deadweight loss and tax revenue vary with the

size of a tax (d, e)

(d) From panel (a) to panel (c),

deadweight loss continually increases

Deadweight

loss

(e) From panel (a) to panel (c), tax

revenue first increases, then decreases

Tax

Revenue

Laffer curve

0

Tax size

0

Tax size

Panels (d) and (e) summarize these conclusions. Panel (d) shows that as the size of a tax

grows larger, the deadweight loss grows larger. Panel (e) shows that tax revenue first rises

and then falls. This relationship is sometimes called the Laffer curve.

19

The Laffer curve and supply-side

economics

• 1974, economist Arthur Laffer

– Laffer curve

– Supply-side economics

– Tax rates were so high

• Reducing them would actually raise tax

revenue

• Ronald Reagan - ran for president in 1980

– From experience in film industry

• High tax rates - caused less work

• Low tax rates - caused more work

20

The Laffer curve and supplyside economics

• Ronald Reagan - ran for president in 1980

– Argument

• Taxes were so high that they were discouraging hard work

• Lower taxes would give people the proper incentive to work

– Raise economic well-being

– Perhaps increase tax revenue

• Economists continue to debate Laffer’s argument

• General lesson:

– Change in tax revenue from a tax change

– Depends on how the tax change affects people’s behavior

21

Quotas

• Quota—A maximum quantity of a good or

service that can be traded over a specific

period of time.

– Used when the government determines

the equilibrium quantity would not be in

society's best interest

• For example: International trade

Figure 6.9 The Effect of a Quota

on the Market for Laptop

Computers

MV to Consumers

DWL from CS

DWL from PS

MC of resources

Quota Restriction

Equilibrium Qs

The Effects of a Quota

• Quotas result in:

– A transfer of surplus from consumers

to producers

– Deadweight loss (DWL)

• DWL is due to less being produced than would be

in an unrestricted (competitive) market

• Resources are underutilized and inefficiently

allocated

– Consumers place a higher MV on good than MC of using

resources to produce the good

The UW and Quotas

• The UW has recently announced that it will not

accept any transfers for spring quarter

– Restriction on number of students being admitted <->

quota

• Assume that the market had previously been

efficient (Qs= Qd at current tuition fee)

– A) what would be the economic consequences of the

transfer “freeze”?

– B) what would be the impact of raising tuition, instead

of “freezing” transfers

– C) In real-life, how are the students admitted to the

UW determined (by what kind(s) of allocation

schemes?

Something to Think About

• It is estimated that illegal immigrants

account for about 25% of construction

labor in the US housing market

– A) what would be the impact a ban on illegal

immigrants on the labor market for US

housing construction, i.e., hourly wage rates?

– B) what would be the impact of this ban on

the price of newly constructed houses?

Total Social Welfare

•

Ideally the impact of a program should be

evaluated as: {Pareto efficient}

–

–

–

•

1) can at least one person’s welfare be improved

2) without making anyone worse off

http://en.wikipedia.org/wiki/Pareto_efficiency

More realistically: Could the winners

compensate the losers? {Pigouvian}

–

–

Is the deadweight loss of the taxed good less than

the surplus gain from the subsidized good?

http://en.wikipedia.org/wiki/Pigovian_tax