Household Projections and Development Planning (mis)Usage and (mis)Interpretation?

advertisement

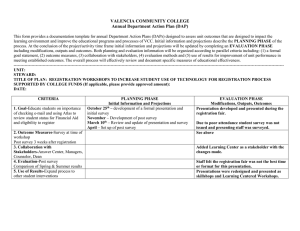

Household Projections and Development Planning (mis)Usage and (mis)Interpretation? Greg Ball BSPS meeting 16 December 2013: Gregball@orangehome.co.uk Projections and Planning • Planners mainly interested in change over time rather than future stock – More demanding in terms of accuracy as errors greater in percentage terms • Main use is to identify land for future housing development • Projections “inform” debate over number of dwellings to be provided BSPS meeting 16 December 2013: Gregball@orangehome.co.uk 25 Projected household stock 2021 (England) Only 66,000 of growth due to household representative rate change (0.3% of 2021 stock) 2011 Census confidence interval around household stock +/-0.16% Households(millions) 20 Projected household stock in 2021 is 24.3 million; 2.2 million higher than in 2011. 2011-2021 household rate changes 15 2011-21 effect of population change 2011 households 10 5 0 Households in 2021 BSPS meeting 16 December 2013: Gregball@orangehome.co.uk Representative Rates • • 2011-based household rate change much less than CLG’s “2008-based” Apply rates to same population projection* Household Change in England 2011-21 3,000 – 2011-based rates produce 356,000 fewer additional households Population main driver but issue of future rate changes remains important for development planning Thousands • 2,500 2,000 1,500 1,000 500 *Population projection is CLG’s 2008-based Source: Table 6 CLG Statistical Release, 9 April 2013 0 2008 rates 2011 rates BSPS meeting 16 December 2013: Gregball@orangehome.co.uk Status of Projections • Trend-based projections • Not forecasts - do not predict impact of – future government policies, – changing economic circumstances – or other factors on demographic behaviour. • Provide household levels and structures that would result if assumptions based on previous demographic trends in the population and rates of household formation were to be realised in practice. BSPS meeting 16 December 2013: Gregball@orangehome.co.uk Projections and Development Planning • Projections are – driven by technical judgements – afflicted by data availability and quality issues – subject to natural uncertainty and frequent revision • Local housing development policy – Governed by time consuming procedural hurdles – Unresponsive to change – Identifies development land but implementation largely driven by other agents – Delayed impact on actual development on ground • Fundamental mismatch between transient projections and an inflexible legalistic planning system that seeks to fix the future BSPS meeting 16 December 2013: Gregball@orangehome.co.uk Procedures and interests • Development plans constrained by legislation and government policy and ‘guidance’ – National planning procedures (eg NPPF) – Expressed in a statutory document (Core Strategy) • • • • Local political approval Consultation and formal objection Examination in public before a Government Inspector Growing role of the Courts • Subject to a range of conflicting interests – Local politicians and lobby groups – Government polices – Powerful development and landowning interests BSPS meeting 16 December 2013: Gregball@orangehome.co.uk Government Guidance • National Planning Policy Framework – the Strategic Housing Market Assessment [SHMA] should identify housing need which meets household and population projections • National Planning Portal (test site) – The 2011-based Interim Household Projections only cover a ten year period up to 2021, so plan makers would need to assess likely trends after 2021 to align with their development plan periods. BSPS meeting 16 December 2013: Gregball@orangehome.co.uk 2011 projections A planning consultant’s view • ... project forward what has happened in the past five years, a period characterised by – undersupply of new homes, – asking prices out of the reach of first-time buyers and – restricted mortgage finance. • projections could be rendered meaningless when the market recovers, due to the unlocking of suppressed demand. • (Philip Barnes, Newcastle office leader at consultancy Nathaniel Lichfield and Partners) Extract Planning 19.4.2013. (Italics are mine) BSPS meeting 16 December 2013: Gregball@orangehome.co.uk And another.. • Projections replicate the past five years, during which the 25-34 age group has been most keenly affected by – a lack of mortgage availability and – low levels of housebuilding. • projections should be given little weight – interim, – contain projections for only 10 years – based on earlier trends underpinned by very low levels of house building. • local authorities that use the projections to justify reductions in housing targets risk exacerbating problem of pent-up housing demand. • "The past five years have been exceptional. Is it right that they should continue?" • (Simon Macklen, director of research at Barton Willmore) quoted in Planning 19.4.2013 BSPS meeting 16 December 2013: Gregball@orangehome.co.uk A Planning Inspector’s Judgement • • • • • unwise to rely on household growth rates shown in the 2011based projections persisting beyond 2021 household formation, especially among the 25-44 age-groups, has been suppressed in the years since the global financial crisis of 2008 by reduced supply and lower effective demand. ..evidence from 2011 Census, which simultaneously demonstrated that there is a higher population and a lower number of households than had been expected from previous projections. Town and Country Planning Association paper* argues persuasively that just under half that reduction is attributable to suppressed household formation due to the state of the economy and the housing market. .... under the more favourable economic conditions expected in future years, there will almost certainly be a return to higher rates of household formation. * Alan Holmans, New estimates of housing demand and need in England, 2011 to 2031, Town and Country Planning Tomorrow Series Paper 16, September 2013 BSPS meeting 16 December 2013: Gregball@orangehome.co.uk And his recommendation • Councils to undertake further analysis to derive an objective assessment of housing need over the Plan period: – “using the latest available official population projections, combined with NLP’s “index” approach to translate those projections into future household numbers. The “index” approach uses • HRR drawn from the 2011-based household projections for the period 2011-2021, and • an index of HRR drawn from the 2008-based household projections for the rest of the Plan period. “ (STAGE 1 OF THE EXAMINATION OF THE SOUTH WORCESTERSHIRE DEVELOPMENT PLAN INSPECTOR’S INTERIM CONCLUSIONS, para 44) http://www.swdevelopmentplan.org/?page_id=5393 BSPS meeting 16 December 2013: Gregball@orangehome.co.uk Characteristics of debate • Technical arguments mask underlying interests • Value loaded and ill-defined terms such as suppressed demand & need – E.g. If previous projections of growth have not occurred does this mean that • Demand or need is not being met • Or previous projections were off-target? • Previous household projections were not challenged but 2011 are. Is this because – Trend-based method is fundamentally flawed or – Results are an inconvenient truth for powerful prodevelopment interests? BSPS meeting 16 December 2013: Gregball@orangehome.co.uk Issues for planners • How reliable are projections in technical terms? – Less reliable locally than nationally – Need indicators of sensitivity • Projections perpetuate the past into the future • Projections offer no explanation of – Drivers of past trends – Impacts of past trends, e.g. on living conditions, migration etc. • Projections dominate discussion at Examination to detriment of other considerations? BSPS meeting 16 December 2013: Gregball@orangehome.co.uk A final statistic • Difference of 356,000 additional households over 10 years between 2008 and 2011 based rates • Average price of new house is £228,000 (ONS House price Index September 2013) • About £0.8 billion at stake – Massive potential gains for landowners and developers – Stamp duty, legal fees, household furnishings – Housing’s role in Government economic strategy • Clear economic case for CLG to support research into household change – Urgent need for 2012 CLG projections to run beyond 2021 – Impacts of liberal and restrictive development policies BSPS meeting 16 December 2013: Gregball@orangehome.co.uk