Qualifying the Buyer Lesson 8: Financing Residential Real Estate

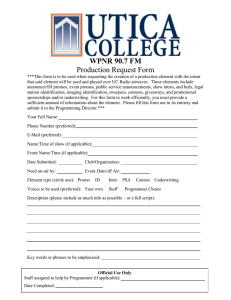

advertisement

Financing Residential Real Estate Lesson 8: Qualifying the Buyer Introduction In this lesson we will cover: the underwriting process, automated underwriting, credit reports and credit scores, income analysis, net worth, other factors in underwriting, subprime lending, and risk-based loan pricing. Introduction Loan underwriting involves evaluation of: 1. Loan applicant’s overall financial situation. Is buyer likely to make the payments on time? 2. Value of the property (collateral). If buyer did default, would foreclosure sale proceeds cover the debt? The Underwriting Process Underwriting involves: reviewing loan application; The Underwriting Process Underwriting involves: reviewing loan application; obtaining additional information about applicant from other sources; The Underwriting Process Underwriting involves: reviewing loan application; obtaining additional information about applicant from other sources; verifying information applicant provided; The Underwriting Process Underwriting involves: reviewing loan application; obtaining additional information about applicant from other sources; verifying information applicant provided; applying lender’s qualifying standards; The Underwriting Process Underwriting involves: reviewing loan application; obtaining additional information about applicant from other sources; verifying information applicant provided; applying lender’s qualifying standards; evaluating property appraisal; and The Underwriting Process Underwriting involves: reviewing loan application; obtaining additional information about applicant from other sources; verifying information applicant provided; applying lender’s qualifying standards; evaluating property appraisal; and making recommendation. The Underwriting Process Qualifying standards Qualifying standards: minimum standards used in underwriting. Draw line between acceptable and unacceptable risks. The Underwriting Process Qualifying standards Although lenders can set their own standards, most use Fannie Mae/Freddie Mac standards for conventional loans. FHA and VA standards must be used for FHA and VA loans. The Underwriting Process Automated underwriting Automated underwriting system (AUS): computer program that analyzes loan applications. Used in conjunction with traditional underwriting. Traditional underwriting now called manual underwriting. Automated Underwriting AU and secondary market Most widely used AU systems: Desktop Underwriter® (Fannie Mae) Loan Prospector® (Freddie Mac) Either may be used to underwrite conventional, FHA, or VA loans. Automated Underwriting AU and secondary market Most widely used AU systems: Desktop Underwriter® (Fannie Mae) Loan Prospector® (Freddie Mac) Either may be used to underwrite conventional, FHA, or VA loans. Although Fannie Mae and Freddie Mac encourage lenders to use AU, they will still buy manually underwritten loans. The Underwriting Process AU programming Programming of secondary market agency AU systems based on performance of millions of loans. Loan performance: whether payments are made as agreed. Analysis of performance statistics highlights factors that make default either more likely or less likely. The Underwriting Process AU programming Fannie Mae/Freddie Mac computer analysis of loan performance is ongoing. Both agencies use latest information to adjust their AU systems and underwriting standards. Adjustments have nationwide impact on underwriting practices. The Underwriting Process How AU works Information from loan application entered into AU system. AUS obtains applicant’s credit information from credit reporting agencies. AUS issues report with recommendations. The Underwriting Process How AU works Three main categories of recommendations in AU report: Risk classification Level of documentation Property appraisal or inspection The Underwriting Process How AU works Risk classification AU report indicates level of scrutiny application should receive. Approve/Accept = meets all qualifying standards. Approve/Ineligible = meets credit risk standards, but other aspects of loan make it ineligible for purchase by agency. Refer/Caution = doesn’t meet all standards, should be reviewed. The Underwriting Process How AU works Risk classification If application requires further review, underwriter looks at application in traditional way (manual underwriting). The Underwriting Process How AU works Risk classification If application requires further review, underwriter looks at application in traditional way (manual underwriting). Some lenders reject Refer/Caution loans without further review. The Underwriting Process How AU works Risk classification If application requires further review, underwriter looks at application in traditional way (manual underwriting). Some lenders reject Refer/Caution loans without further review. Fannie Mae or Freddie Mac may buy manually underwritten Refer/Caution loan, but it will be treated as A-minus loan. The Underwriting Process How AU works Level of documentation AU report indicates how much documentation is needed to verify information on application. The Underwriting Process How AU works Level of documentation AU report indicates how much documentation is needed to verify information on application. Before mortgage crisis, three basic levels: standard streamlined (“low-doc”) minimal (“no doc” ) The Underwriting Process How AU works Level of documentation AU report indicates how much documentation is needed to verify information on application. Before mortgage crisis, three basic levels: standard streamlined (“low-doc”) minimal (“no doc” ) Now just standard or streamlined; “no doc” loans no longer widely available. The Underwriting Process How AU works Level of documentation Refer/Caution loans: Standard documentation (and manual underwriting) generally required. Approve/Accept loans: Streamlined documentation permitted. The Underwriting Process How AU works Appraisal recommendation AU report also indicates which of these is appropriate: full appraisal drive-by inspection report on property’s likely value (with no inspection) The Underwriting Process Advantages of AU Advantages of automated underwriting over manual underwriting: streamlines process; The Underwriting Process Advantages of AU Advantages of automated underwriting over manual underwriting: streamlines process; increases objectivity; and The Underwriting Process Advantages of AU Advantages of automated underwriting over manual underwriting: streamlines process; increases objectivity; and improves underwriting accuracy. Summary The Underwriting Process Underwriting standards Automated underwriting Manual underwriting Loan performance Risk classification Standard documentation Streamlined documentation (low-doc) Minimal documentation (no doc) Drive-by inspection Evaluating Creditworthiness Buyer considered creditworthy if overall financial situation indicates she can be expected to make payments on time. Evaluating Creditworthiness Buyer considered creditworthy if overall financial situation indicates she can be expected to make payments on time. Qualification of buyer involves evaluation of three main components of creditworthiness: Credit reputation Evaluating Creditworthiness Buyer considered creditworthy if overall financial situation indicates she can be expected to make payments on time. Qualification of buyer involves evaluation of three main components of creditworthiness: Credit reputation Income Evaluating Creditworthiness Buyer considered creditworthy if overall financial situation indicates she can be expected to make payments on time. Qualification of buyer involves evaluation of three main components of creditworthiness: Credit reputation Income Net worth (assets) Evaluating Creditworthiness Credit reputation Of the three main components of creditworthiness, many consider credit reputation most important. To evaluate loan applicant’s credit reputation, lender relies on credit reports prepared by national credit rating agencies. Credit Reputation Credit reports A personal credit report covers 7 years of information about an individual’s: revolving credit accounts, installment debts, and previous mortgages. Utility bills, medical bills, etc., aren’t listed unless turned over to collection agency. Credit Reputation Credit reports Credit reporting agencies are private companies. Three major credit agencies in U.S.: Equifax Experian (formerly TRW) TransUnion Credit Reputation Credit reports Reports prepared by the three agencies don’t always match. Lender may use reports from all three, or “tri-merge” report that combines them. Credit Reputation Credit reports Credit information important in underwriting: length of credit history payment record derogatory credit incidents credit scores Credit Reputation Length of credit history “Credit history” widely used as synonym for “credit reputation.” Narrower definition used in underwriting. Credit history = duration of applicant’s experience with credit. Credit Reputation Length of credit history General requirements: credit history at least one year in duration with three or more active accounts Alternative for applicant without established credit history: provide records of utility bill payments, rent payments. Credit Reputation Payment record For each account listed, credit report gives detailed payment record showing whether payments have been made on time. Late payments shown as 30 days, 60 days, or 90 days overdue. Credit Reputation Payment record Underwriters view chronic late payments as sign applicant is financially overextended and/or irresponsible. But spotless payment record not essential. Credit Reputation Major derogatory incidents Negative information on credit report may include: charge-offs collections repossessions judgments foreclosures bankruptcies Credit Reputation Major derogatory incidents Charge-off: Uncollected debt treated as loss for tax purposes. Tax code allows creditor to write off debt after no payment in 6 months. Doesn’t relieve debtor of liability. Credit Reputation Major derogatory incidents Collections Creditor may turn delinquent bill over to collection agency that presses debtor for payment. Debt held by collection agency appears on credit report, even if original bill did not. Credit Reputation Major derogatory incidents Repossessions If someone buys personal property on credit and fails to make the payments, creditor may have right to repossess the collateral property. Credit Reputation Major derogatory incidents Judgments When someone loses a lawsuit, court may order her to pay money (damages) to the person who sued. Credit Reputation Major derogatory incidents Foreclosures Not surprisingly, foreclosure on applicant’s credit report is a matter of special concern to mortgage lender. Credit Reputation Major derogatory incidents Bankruptcy Bankruptcy on applicant’s credit report also taken very seriously. Credit Reputation Major derogatory incidents Under Fair Credit Reporting Act, derogatory incidents can remain on individual’s credit report for no more than seven years. Exception: Bankruptcy – ten years. Mortgage loan underwriters focus mainly on previous two years. Foreclosures and bankruptcies are serious concerns for longer. Credit Reputation Credit scores Credit score: Figure calculated by credit reporting agency using established scoring model. Takes into account all information on credit report. Indicates individual’s likelihood of default. Three main credit reporting agencies may calculate different scores for same person. Credit Reputation Credit scores Scoring models are based on statistical analysis of large numbers of mortgages. Most widely used: FICO scores. Range from under 400 to over 800. High FICO score = unlikely to default Credit Reputation Credit scores Underwriters use credit scores to determine level of review applied to applicant’s credit history. Good scores: basic review Mediocre or poor scores: in-depth review Credit Reputation Credit scores Aside from major derogatory incidents, other factors that have negative impact on credit scores: Chronic late payments Maintaining high balance on credit card, even if payments on time Applying for too much credit Credit Reputation Obtaining credit information Prospective buyers should look at their credit reports and scores before applying for mortgage. Some information may be incorrect. Fair Credit Reporting Act requires credit reporting agencies to investigate in response to complaint and correct errors. Credit Reputation Explaining credit problems If underwriter is convinced that past problems don’t reflect applicant’s attitude towards credit, loan may be approved. Credit Reputation Explaining credit problems Letter to lender explaining negative credit report should: state reason for problem; point out that it occurred during specific period; show problem no longer exists; highlight good credit before and since; provide documentation from third parties; and not blame creditors. Summary Credit Reputation Creditworthiness Credit report Credit history Charge-offs Collections Foreclosure Bankruptcy Credit scores (FICO scores) Fair Credit Reporting Act Evaluating Creditworthiness Income analysis Second main component of creditworthiness: income. Even if buyer has excellent credit reputation, loan won’t be approved unless buyer can afford payments. Buyer’s income is starting point in determining: maximum loan amount price range for houses Income Analysis Characteristics of income Income has three dimensions: Quantity Enough monthly income to afford monthly mortgage payment Quality From dependable sources Durability Likely to continue for at least three years Income Analysis Stable monthly income Income that meets tests of quality and durability is stable monthly income. May include: wages or salary retirement income bonuses alimony commissions child support overtime public assistance part-time earnings self-employment income investment income Stable Monthly Income Employment income Permanent employment is major income source for most home buyers. Positive employment history: consistency (usually 2 years in same job or field) opportunities for advancement special training or education Stable Monthly Income Employment income Commissions, overtime and bonuses Considered stable if consistent part of applicant’s overall earnings pattern. Stable Monthly Income Employment income Part-time work Considered stable if applicant has held job for at least two years. Seasonal work Considered stable if established earnings pattern exists. Stable Monthly Income Employment income Self-employment income Includes income from personal business, freelance work, or consulting work. Underwriters consider earnings trend, training and experience, and nature of business. Generally regarded as risky income source: amount of income unpredictable small businesses often fail Stable Monthly Income Employment income Employment verification: Verification form sent to employer, or W-2 forms for 2 years plus pay stubs for 30 days, with phone call to employer. Lender may also request income tax returns for previous two years to verify earnings. Stable Monthly Income Retirement income Pension and social security payments are usually dependable and durable. Lenders can’t discriminate on basis of age. Life expectancy can be considered. Stable Monthly Income Investment income Dividends or interest may be counted as part of stable monthly income. Underwriter calculates average investment income for previous two years. Stable Monthly Income Rental income If a stable pattern can be verified, rental income is considered stable monthly income. Applicant may have to show gross earnings and operating expenses for previous two years. Stable Monthly Income Rental income Many unpredictable factors affect rental income: Emergency repairs Vacancies Tenants who don’t pay Underwriter includes only a percentage of verified income to leave a margin for error. Negative rental income treated as liability. Stable Monthly Income Maintenance, alimony, child support Considered stable income sources if it appears payments will be made reliably. Depends on: whether payments required by court decree how long payments have been made financial/credit status of ex-spouse ability to compel payment Stable Monthly Income Maintenance, alimony, child support Lenders usually require: copy of court decree proof of receipt of payments Child support no longer counts when child reaches mid-teens. Stable Monthly Income Maintenance, alimony, child support Applicants may not want to list these as sources of income if ex-spouse is hostile or uncooperative. Equal Credit Opportunity Act prohibits lenders from asking if applicants are divorced or requiring them to disclose alimony or child support. Income won’t be counted if not listed, of course. Stable Monthly Income Public assistance Equal Credit Opportunity Act also prohibits lenders from discriminating against an applicant because part or all of his income is from a public assistance program. But public assistance won’t count if eligibility will terminate in near future. Stable Monthly Income Unacceptable types of income These usually don’t count as stable monthly income: Wages from temporary job Unemployment compensation Contributions from family members Stable Monthly Income Temporary employment Income from temporary work not durable by definition. But steady series of temporary jobs may be treated as freelance work (self-employment income). Stable Monthly Income Unemployment compensation Unemployment benefits end after a specified number of weeks (ordinarily 26 weeks). But unemployment benefits paid to seasonal worker for a certain number of weeks every year could be considered stable monthly income. Stable Monthly Income Income from family members Usually only earnings of head of household are counted in underwriting. But if borrower’s family member is listed as a co-borrower, that person’s income is also considered. Calculating Stable Monthly Income Monthly figures All income payments must be converted into monthly figures. Example: Gwen is paid $14.50/hour. She works 40 hours per week. $14.50 × 40 = $580 $580 × 52 = $30,160 $30,160 ÷ 12 = $2,513 Calculating Stable Monthly Income Gross income Gross income figures are used when calculating stable monthly income. Payroll taxes aren’t subtracted. Calculating Stable Monthly Income Gross income Gross income figures are used when calculating stable monthly income. Payroll taxes aren’t subtracted. Qualifying standards take into account that: buyer will have to pay taxes, and only after-tax amount will be available for expenses. Calculating Stable Monthly Income Nontaxable income Certain types of income are exempt from taxation: Child support Disability payments Some public assistance Full amount of payments available for expenses. Calculating Stable Monthly Income Nontaxable income Certain types of income are exempt from taxation: Child support Disability payments Some public assistance Full amount of payments available for expenses. Underwriter may “gross up” nontaxable income. For example, might add 25% to child support payments received. Income Analysis Income ratios To measure adequacy of applicant’s monthly income, underwriters use income ratios. Rationale: Borrower may have difficulty making payments if: Monthly Expenses > X% of Monthly Income Income Analysis Income ratios Two types of income ratios: Debt to income ratio Measures proposed monthly mortgage payment and any other regular debt payments against monthly income. Income Ratios Two types of ratios Two types of income ratios: Debt to income ratio Measures proposed monthly mortgage payment and any other regular debt payments against monthly income. Housing expense to income ratio Measures monthly mortgage payment alone against monthly income. Income Ratios PITI Proposed monthly mortgage payment used in calculating income ratios is PITI payment. Includes impounds for property taxes and hazard insurance. Also mortgage insurance and/or homeowners association dues, if applicable. Income Ratios Maximum ratios Qualifying standards set maximum income ratios. Example: Borrower’s monthly housing expense should not exceed 31% of stable monthly income. Income Ratios Maximum ratios Qualifying standards set maximum income ratios. Example: Borrower’s monthly housing expense should not exceed 31% of stable monthly income. Maximum ratios are generally treated as guidelines, not hard-and-fast limits. Lender may approve loan if sufficient compensating factors make up for weakness in income. Income Analysis Cosigners Cosigner helps borrower qualify by sharing responsibility for loan. Primary borrower and cosigner have joint and several liability for loan. Court can order either one of them to pay loan balance. Income Analysis Cosigners Cosigner must have acceptable income, assets, and credit reputation. Income Analysis Cosigners Cosigner must have acceptable income, assets, and credit reputation. Cosigner’s stable monthly income added to applicant’s. Cosigner’s monthly debts and housing expense combined with applicant’s. Then income ratios are calculated. Income Analysis Cosigners Cosigner must have acceptable income, assets, and credit reputation. Cosigner’s stable monthly income added to applicant’s. Cosigner’s monthly debts and housing expense combined with applicant’s. Then income ratios are calculated. Applicant’s separate income ratios are also calculated; shouldn’t be too far over limits. Summary Income Analysis Quantity, quality, and durability of income Stable monthly income Income ratios Debt to income ratio Housing expense to income ratio Cosigner Joint and several liability Evaluating Creditworthiness Net worth Net Worth = Assets – Liabilities Evaluating Creditworthiness Net worth Net Worth = Assets – Liabilities Significance of net worth in underwriting: Substantial net worth indicates ability to manage financial affairs. Evaluating Creditworthiness Net worth Net Worth = Assets – Liabilities Significance of net worth in underwriting: Substantial net worth indicates ability to manage financial affairs. Also, buyer must have enough liquid assets to close transaction. Net Worth Funds for closing Liquid assets: cash and assets that can be easily converted into cash. Applicant must have enough to cover: downpayment closing costs Net Worth Reserves Also, desirable for buyer to have reserves left over after closing. In case of financial emergency, can draw on reserves to keep paying mortgage. Net Worth Reserves Also, desirable for buyer to have reserves left over after closing. In case of financial emergency, can draw on reserves to keep paying mortgage. In some cases, lender may require applicant to have enough reserves to cover a certain number of mortgage payments. Net Worth Reserves Also, desirable for buyer to have reserves left over after closing. In case of financial emergency, can draw on reserves to keep paying mortgage. In some cases, lender may require applicant to have enough reserves to cover a certain number of mortgage payments. Even if not required, reserves strengthen application. Net Worth Assets Almost any assets may help a loan applicant: real estate automobiles furniture jewelry stocks/bonds life insurance policy Assets Bank accounts To verify funds applicant has in bank accounts: verification of deposit form sent to bank(s), or applicant provides bank statements for 2 or 3 months. Assets Bank accounts Reviewing verification information: Does it match statements in loan application? Does applicant have enough cash for closing? Has bank account been opened only recently (last 3 months)? Is present balance much higher than average balance? If account is supposed to be source of good faith deposit, is balance high enough? Assets Bank accounts Underwriter’s concern: Did applicant borrow funds? Lenders generally want borrower to use own funds for downpayment and reserves. Assets Bank accounts Underwriter’s concern: Did applicant borrow funds? Lenders generally want borrower to use own funds for downpayment and reserves. Borrowed funds would defeat purpose of lender’s requirements. Assets Bank accounts Underwriter’s concern: Did applicant borrow funds? Lenders generally want borrower to use own funds for downpayment and reserves. Borrowed funds would defeat purpose of lender’s requirements. Exception: loan secured by asset (other than home being purchased) Assets Bank accounts Underwriter’s concern: Did applicant borrow funds? Lenders generally want borrower to use own funds for downpayment and reserves. Borrowed funds would defeat purpose of lender’s requirements. Exception: loan secured by asset (other than home being purchased) Affordable housing programs more flexible about borrowed funds. Assets Real estate for sale If applicant selling another property to raise cash, net equity in property can count as liquid asset. Net Equity = Market Value – (Liens + Selling Expenses) Assets Real estate for sale If equity is main source of money for purchase of new home, lender won’t fund loan until old home sold. Copy of settlement statement usually required as verification. Assets Real estate for sale If equity is main source of money for purchase of new home, lender won’t fund loan until old home sold. Copy of settlement statement usually required as verification. If new home ready to close before old home sold, buyers may apply for swing loan. Assets Other real estate Some applicants own real estate they aren’t planning on selling. Should be listed as asset in loan application. But only equity contributes to net worth. Net Worth Liabilities Applicant’s personal liabilities are subtracted from total value of assets to calculate net worth. Liabilities include: credit card and charge account balances installment debts taxes owed liens against real estate owned Net Worth Gift funds Rules regarding gift funds usually limit how much of downpayment and closing costs may be covered by gift funds. Borrower must invest some of her own funds. Net Worth Gift funds Rules regarding gift funds usually limit how much of downpayment and closing costs may be covered by gift funds. Borrower must invest some of her own funds. Donor must sign letter stating that the gift funds don’t have to be repaid. Funds must be deposited into applicant’s bank account for verification. Other Factors in Underwriting Loan type Type of loan (fixed-rate, adjustable-rate, partially amortized, etc.) affects underwriting. Borrowers default more on ARMs and other loans that involve changes in payment amount. Other Factors in Underwriting Repayment period Length of repayment period affects size of monthly payment. Shorter repayment period, larger payment. More difficult to qualify for larger payment. Other Factors in Underwriting Repayment period Length of repayment period affects size of monthly payment. Shorter repayment period, larger payment. More difficult to qualify for larger payment. But lender may be slightly more inclined to approve loan with shorter repayment period. Lender’s funds are tied up for less time. Other Factors in Underwriting Owner-occupancy Investor loans have much higher default rate than loans to owner-occupants. Because of additional risk, investor loans are subject to stricter LTV requirements, additional fees, and higher interest rates. Other Factors in Underwriting Property type Regular single-family homes appreciate much more, and more reliably, than: manufactured homes condominium units some other types of residential property Nontraditional property type is treated as additional risk factor in underwriting. Summary Net Worth and Other Factors Liquid assets Reserves Assets Liabilities Net equity Swing loan Gift funds Owner-occupant Investor loan