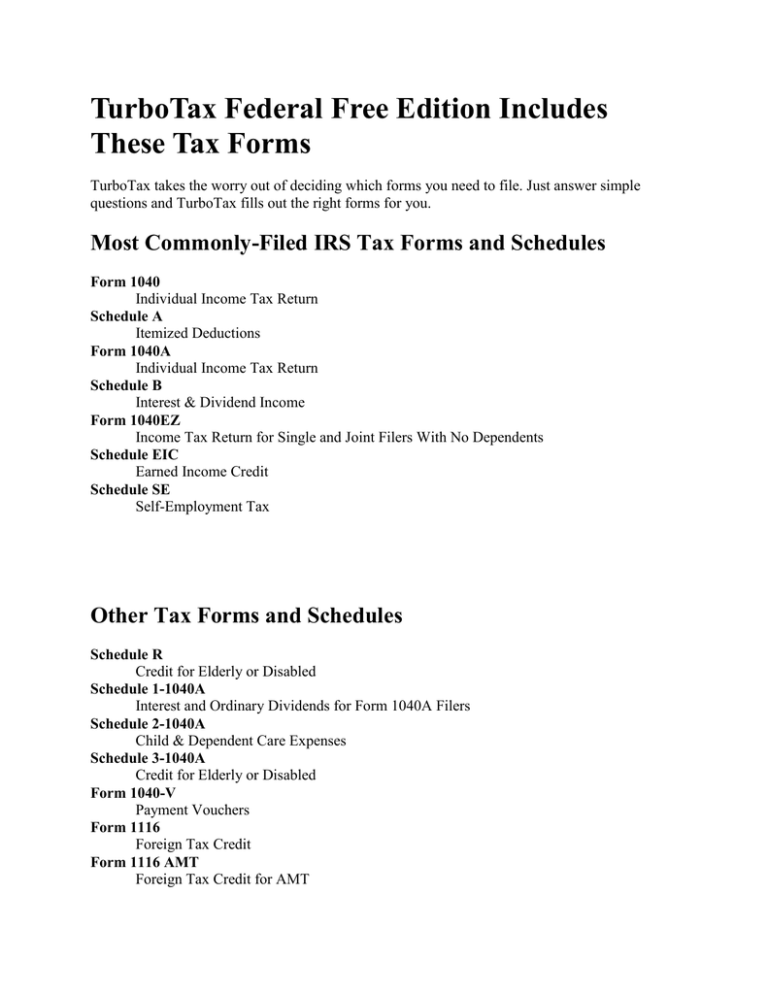

TurboTax Federal Free Edition Includes These Tax Forms

advertisement

TurboTax Federal Free Edition Includes These Tax Forms TurboTax takes the worry out of deciding which forms you need to file. Just answer simple questions and TurboTax fills out the right forms for you. Most Commonly-Filed IRS Tax Forms and Schedules Form 1040 Individual Income Tax Return Schedule A Itemized Deductions Form 1040A Individual Income Tax Return Schedule B Interest & Dividend Income Form 1040EZ Income Tax Return for Single and Joint Filers With No Dependents Schedule EIC Earned Income Credit Schedule SE Self-Employment Tax Other Tax Forms and Schedules Schedule R Credit for Elderly or Disabled Schedule 1-1040A Interest and Ordinary Dividends for Form 1040A Filers Schedule 2-1040A Child & Dependent Care Expenses Schedule 3-1040A Credit for Elderly or Disabled Form 1040-V Payment Vouchers Form 1116 Foreign Tax Credit Form 1116 AMT Foreign Tax Credit for AMT Form 1310 Statement of Person Claiming Refund Form 2106/EZ Employee Business Expenses/EZ Employee Business Expenses Short Form Form 2120 Multiple Support Declaration Form 2210/2210AI Underpayment of Tax/Annualized Income Form 2210F Underpayment of Estimated Tax by Farmers Form 2441 Child & Dependent Care Expenses Form 3903 Moving Expenses Form 4137 Tax on Unreported Tips Form 4506 Request for Copy of Tax Form Form 4562 Depreciation & Amortization Form 4684 Casualties & Theft Form 4797 Sales of Business Property Form 4852 Substitute W-2 or 1099-R Form 4868 Extension of Time to File Form 4952/AMT Investment Interest Expense Deduction/Invest Interest Expense Deduction - AMT Form 4972 Tax on Lump-Sum Distributions Form 5329 Additional Taxes on Retirement Plans Form 5695 Residential Energy Credits Form 6198 At-Risk Limitations Form 6251 Alternative Minimum Tax Form 6252 Installment Sale Income Form 8283 Non-cash Charitable Contributions Form 8332 Release of Claim to Exemption Form 8379 Injured Spouse Claim and Allocation Form 8396 Mortgage Interest Credit Form 8453-OL Tax Declaration for Online Electronic Filing Form 8606 Nondeductible IRAs Form 8615 Tax for Children Under Age 14 Form 8801 Credit for Prior Year Minimum Tax Form 8812 Additional Child Tax Credit Form 8815 Exclusion of Interest from Series EE & I Bonds Form 8822 Change of Address Form 8824 Like-Kind Exchange Form 8829 Business Use of Your Home Form 8839 Qualified Adoption Expenses Form 8853 Archer MSAs and Long-Term Care Insurance Contracts Form 8857 Innocent Spouse Relief Form 8859 DC First-Time Homebuyer Credit Form 8862 Info to Claim EIC After Disallowance Form 8863 Education Credits Form 8880 Credit for Qualified Retirement Savings Contributions Form 8881 Credit for Small Employer Pension Plan Startup Costs Form 8885 Health Coverage Tax Credit Form 8889 Health Savings Account Form 8891 Canadian Retirement Plans Form 8903 Domestic Production Activities Deduction Form 8910 Alternative Motor Vehicle Credit Form 8915 Hurricane Retirement Plan Distributions Form 8917 Tuition and Fees Deduction Form 8919 Uncollected Social Security and Medicare Tax on Wages Form 9465 Installment Agreement Request Form SS-4 Application for Employer ID Number Form TD F 90-22.1 Report of Foreign Bank Accounts Form W-4 Employee's Withholding Allowance Certificate