Week 5 In Class Exercise – Consumer Price Index... 1. Which of the following is correct?

advertisement

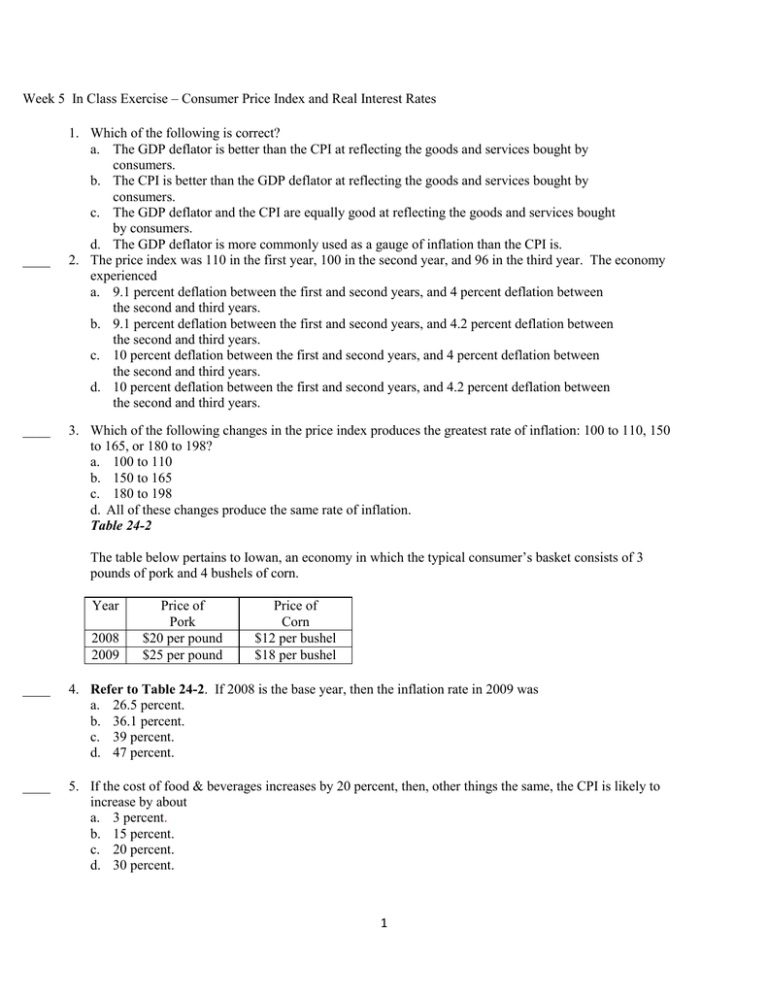

Week 5 In Class Exercise – Consumer Price Index and Real Interest Rates ____ ____ 1. Which of the following is correct? a. The GDP deflator is better than the CPI at reflecting the goods and services bought by consumers. b. The CPI is better than the GDP deflator at reflecting the goods and services bought by consumers. c. The GDP deflator and the CPI are equally good at reflecting the goods and services bought by consumers. d. The GDP deflator is more commonly used as a gauge of inflation than the CPI is. 2. The price index was 110 in the first year, 100 in the second year, and 96 in the third year. The economy experienced a. 9.1 percent deflation between the first and second years, and 4 percent deflation between the second and third years. b. 9.1 percent deflation between the first and second years, and 4.2 percent deflation between the second and third years. c. 10 percent deflation between the first and second years, and 4 percent deflation between the second and third years. d. 10 percent deflation between the first and second years, and 4.2 percent deflation between the second and third years. 3. Which of the following changes in the price index produces the greatest rate of inflation: 100 to 110, 150 to 165, or 180 to 198? a. 100 to 110 b. 150 to 165 c. 180 to 198 d. All of these changes produce the same rate of inflation. Table 24-2 The table below pertains to Iowan, an economy in which the typical consumer’s basket consists of 3 pounds of pork and 4 bushels of corn. Year 2008 2009 Price of Pork $20 per pound $25 per pound Price of Corn $12 per bushel $18 per bushel ____ 4. Refer to Table 24-2. If 2008 is the base year, then the inflation rate in 2009 was a. 26.5 percent. b. 36.1 percent. c. 39 percent. d. 47 percent. ____ 5. If the cost of food & beverages increases by 20 percent, then, other things the same, the CPI is likely to increase by about a. 3 percent. b. 15 percent. c. 20 percent. d. 30 percent. 1 ____ 6. The consumer price index tries to gauge how much incomes must rise to maintain a. an increasing standard of living. b. a constant standard of living. c. a decreasing standard of living. d. the highest standard of living possible. ____ 7. Ruben earned a salary of $60,000 in 2001 and $80,000 in 2006. The consumer price index was 177 in 2001 and 221.25 in 2006. Ruben's 2006 salary in 2001 dollars is a. $20,000; thus, Ruben's purchasing power increased between 2001 and 2006. b. $20,000; thus, Ruben's purchasing power decreased between 2001 and 2006. c. $64,000; thus, Ruben's purchasing power increased between 2001 and 2006. d. $64,000; thus, Ruben's purchasing power decreased between 2001 and 2006. ____ 8. If the nominal interest rate is 1.5 percent and the rate of inflation is -0.5 percent, then the real interest rate is a. -4 percent. b. -2 percent. c. 1 percent. d. 2 percent. 9. Maxine deposits $100 in a bank account that pays an annual interest rate of 20%. A year later, after Maxine has accumulated $20 in interest, she withdraws her $120. Maxine’s purchasing power a. did not change if the inflation rate was 0%. b. decreased if the inflation rate was -2%. c. increased if the inflation rate was 5%. d. More than one of the above is correct. ____ 2