13 Oligopoly and Strategic Behavior

advertisement

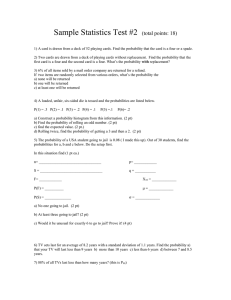

13 Oligopoly and Strategic Behavior Duopoly • Collusion – Agreement among rivals specifying prices or quantities – Firms ask: “What would a monopoly do?” and then do that action • Cartel – Two or more firms acting in unison to form a joint monopoly Mutual Interdependence • Mutual interdependence – A market situation in which the actions of one firm have an impact on the price and output of its competitors – AT-Phone’s response depends on the actions of Horizon, and Horizon’s response depends on the actions of AT-Phone – Note the difference between interdependence and independence Nash Equilibrium • Nash Equilibrium – An economic decision maker has nothing to gain by changing its own strategy without collusion – Nobody wants to change their strategy given that the other firm does not change their strategy – A “stable” outcome where nobody wants to move from their current position – Often discussed with game theory, and easier to see when games are drawn in matrix form Game Theory • Game theory – Branch of mathematics that economists use to analyze the strategic behavior of decision makers – Can help us determine what level of cooperation is most likely among players in a game • Basic components of a game – Players – Strategies – Payoffs Strategic Behavior and the Dominant Strategy • Prisoner’s dilemma – Two suspects are interrogated separately – They each have the option to confess or keep quiet • Possible outcomes of prisoner’s dilemma – If both suspects keep quiet, each suspect will serve only a small time in jail – If both confess, both will serve 10 years in jail – If one suspect confesses and the other remains quiet, the suspect who confesses goes free, while the suspect who kept quiet serves 25 years in jail Presenting The Prisoner’s Dilemma Players Strategies Payoffs Thelma Confess 10 years in jail Confess 10 years in jail Louise Keep Quiet Keep Quiet 25 years in jail goes free goes free 25 years in jail 1 year in jail 1 year in jail Analyzing The Prisoner’s Dilemma • Louise • Thelma – Best to Confess or Keep Quiet? – Best for Louise to Confess no matter what Thelma does! – Best to Confess or Keep Quiet? – Best for Thelma to Confess no matter what Louise does! Thelma Confess 10 years in jail Confess 10 years in jail Louise Keep Quiet Keep Quiet 25 years in jail goes free goes free 25 years in jail 1 year in jail 1 year in jail Analyzing The Prisoner’s Dilemma • Louise • Thelma – Best to Confess or Keep Quiet? – Best for Louise to Confess no matter what Thelma does! – Best to Confess or Keep Quiet? – Best for Thelma to Confess no matter what Louise does! Thelma Confess 10 years in jail Confess 10 years in jail Louise Keep Quiet Keep Quiet 25 years in jail goes free goes free 25 years in jail 1 year in jail 1 year in jail Interesting Result of this Game Nash equilibrium Payoffs that will result Thelma Confess 10 years in jail Confess 10 years in jail Louise Keep Quiet Keep Quiet 25 years in jail goes free goes free 25 years in jail 1 year in jail 1 year in jail Outcome with the overall best sum of payoffs Game Theory • Dominant strategy – A best response for a player to choose no matter what the other player chooses – Not all games or players in a game have a dominant strategy • Nash equilibrium implications? – If both players have a dominant strategy, the intersection of those dominant strategies will be the Nash equilibrium. – Neither player will want to unilaterally deviate. Duopoly and the Prisoner’s Dilemma AT-Phone Low Low Horizon High High $27,000 $27,000 $30,000 $22,500 $22,500 $30,000 $24,000 $24,000 An outcome that is better for both players Nash equilibrium payoffs that will result Advertising and the Prisoner’s Dilemma Coca-Cola Advertises Does Not Advertise $100 M $75 M Advertises $100 M $150 M Pepsico Does Not Advertise $150 M $75 M Nash equilibrium payoffs that will result $125 M $125 M An outcome that is better for both players Intuition of Advertising Prisoner’s Dilemma • Advertising – Costly – Purpose: increase product demand – If both firms advertise, expenses go up, but demand increases; each cancels other out – “Arms race” of advertising Cigarette Advertising on TV • In 1970, Congress enacted a law making cigarette advertising on TV illegal – Reasoning: too many ads being seen by children and teens – Goal: reduce smoking among all ages • Unintended consequence – This actually increased the economic profits of cigarette makers – The law ended their prisoner’s dilemma of advertising Escaping the Prisoner’s Dilemma in the Long Run • The Nash equilibrium in prisoner dilemma games may give the best short run payoffs • However, – Many games are repeated – This repetition occurs over a longer time span – Dominant strategies may not consider longrun benefits of cooperation Escaping the Prisoner’s Dilemma in the Long Run • Tit for tat – A long run strategy designed to create cooperation among participants – Strategy: mimic the decision your opponent made in the previous round. – Changes the incentives and encourages cooperation – Useful because interactions in life occur over the long run. Relationships between people and businesses involve mutual trust. Caution About Game Theory • Not all games are like the prisoner’s dilemma – Not all games have a dominant strategy – Not all games have a pure strategy like the Nash equilibrium • Think about Paper, Rock, Scissors – Your best response is different, depending on what your opponent throws. There is no dominant hand to play. No Dominant Strategy Oligopoly Policy: Antitrust • Antitrust policy – Government efforts that attempt to prevent oligopolies from behaving like monopolies • Sherman Act of 1890 – “Every person who shall monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several States, or with foreign nations, shall be deemed guilty of a felony.” Oligopoly Policy: Antitrust • Clayton Act of 1914 added a few more items that were considered detrimental – Price discrimination that lessens competition – Exclusive dealings that restrict the ability of a buyer to deal with competitors – Tying arrangements (similar to bundling) – Mergers that lessen competition – Prevents a person from serving as a director on more than one board in the same industry Predatory Pricing • Predatory pricing – Firms set prices below AVC with the intent of driving rivals from the market – Illegal, but difficult to prosecute – Often difficult to distinguish between predatory pricing and intense market competition • Examples: – Wal-Mart is often assumed to be a predator but is never prosecuted – Microsoft was prosecuted eventually for tying, but not for predatory pricing Predatory Pricing Scheme $ Incumbent Firm’s Price AVC,MC Competitor Enters Competitor Leaves Time Network Externalities • Network externality – Occurs when the number of customers who purchase a good influences the quantity demanded – Often is a factor in whether the resulting market structure is oligopoly – Classic examples include technologies such as cell phones and fax machines • A new technology has to reach “critical mass” before it is effective for consumers • How useful would a fax machine be if only 10 people had the machine? Network Externalities • Positive network externalities – Bandwagon effect – Individual preferences for a good increase as the number of people buying the good increases – Internet, social networks, cell phones, fax machines, MMORPGs, video game consoles, fads, night clubs Network Externalities • Negative network externalities – Snob effect – Individual preferences for a good decrease as the number of people buying the good increases – Exotic pets and sports cars – Hipsters – Services that are prone to “congestion.” Pool, beach, student union gets “too crowded,” and you don’t want to go. Network Externalities • Switching costs – Costs that are incurred by a consumer when he switches suppliers – Another advantage to a firm having a large network – Demand for existing product becomes more inelastic if costs of switching to a new product are higher • Example: cellphone providers – Early termination fees – Free in-network calls – FTC reduced switching costs in 2003 by requiring phone companies to allow a consumer to take their old phone number to a new provider Price Taking Perfect Competition 1. Many firms Price Making Monopolistic Competition 1. Many firms Oligopoly Monopoly 1. Few firms 1. One firm 2. Extremely high barriers to entry. The firm has significant control over price. 2. Atomistic assumption—firms are so small that no single buyer or seller has ANY control over price 2. Each firm has some control over price 2. Medium to high entry barriers to entry. The firm has more control over price. 3. Firms are so small that no single buyer or seller has ANY control over price 3. Product differentiation 3. Mutual interdependence 3. The firm IS the industry 4. Easy entry/exit 4. Long run economic profit possible 4. Long run economic profit probable 4 Homogeneous output 5. There is perfect information about product price and quantity 6. Easy entry/exit 5. Output can be homogenous or differentiated More Game Theory in Media • This link provides further examples of game theory in media and contains links to video clips Conclusion • Oligopoly – A market structure in which there are a small number of firms – Firms interact strategically – Can be competitive (results closer to monopolistic competition) – Can be collusive (results closer to monopoly) • Antitrust policies – Restrain excessive market power – Give incentives to compete instead of collude – Each industry examined on a case-by-case basis Summary • Oligopoly: a small number of firms sell a differentiated product in a market with significant barriers to entry. The small number of sellers in oligopoly leads to mutual interdependence. – An oligopolist is like a monopolistic competitor in that it sells differentiated products. – It is also like a monopolist in that it enjoys significant barriers to entry. • Oligopolists have a tendency to collude and to form cartels in hope of achieving monopolylike profits. Summary • Oligopolistic markets are socially inefficient since P > MC. The result under oligopoly will fall somewhere between the competitive and monopoly outcomes. • Game theory helps determine when cooperation among oligopolists is most likely. – In many cases, cooperation fails to materialize because decision-makers have dominant strategies that lead them to be uncooperative. – This causes firms to compete with price, advertising, or R & D when they could potentially earn more profit by curtailing these activities. Summary • A dominant strategy ignores the long run benefits of cooperation and focuses solely on the short run gains – Whenever repeated interaction exists, decisionmakers fare better under tit for tat, an approach that maximizes the long run profit • Antitrust laws are complex and cases are hard to prosecute, but they provide firms an incentive to compete rather than collude • The presence of significant positive network externalities causes small firms to be driven out of business or to merge with larger competitors Practice What You Know Which of the following is most likely to become an oligopoly industry? A. An industry without entry barriers B. An industry where economies of scale are very small C. An industry with sizeable network effects D. An industry with hundreds of competitors Practice What You Know Which of the following is true about oligopoly? A. Oligopolies are illegal in the United States B. All oligopoly industries will try to collude C. Oligopoly industries generally have a high concentration ratio D. Firms in an oligopoly act independently from other firms in the oligopoly Practice What You Know Why do cartel deals tend not to last? A. Each firm in the cartel has a dominant strategy to be uncooperative and defect from the cartel agreement B. Cartel profits are lower than competitive profits C. Cartels create more competition D. Firms know that cartels are often illegal so they break the deal to escape Practice What You Know What is an example of a good with a positive network effect? A. An online multiplayer game B. A fast-food burger C. A dry-cleaning service D. A cable TV subscription Practice What You Know How can a pure strategy Nash equilibrium be accurately described? A. It is always the overall best outcome B. It’s an outcome in which neither player wants to change strategies C. It can only be reached by collusion D. One exists in all games