© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

www.cfefund.org

Financial Empowerment Center

Counselor Training Curriculum

Overview: Financial Empowerment

www.cfefund.org

Cities for Financial Empowerment (CFE)

With support from the CFE Fund, CFE Coalition brings

together pioneering municipal governments from across

the country to use their power and positions to advance

innovative financial empowerment initiatives. By working

with key partners in the public, private, and nonprofit

sectors, the CFE Coalition leverages its 12 member cities

collective power to advance the financial empowerment

agenda on a state and national level.

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: www.cfefund.org

www.cfefund.org I 3

CFE Coalition

• Founded by New York City Mayor Michael R.

Bloomberg and San Francisco Mayor Gavin Newsom.

• Member Cities: Chicago, Hawai'i County, Los Angeles,

Louisville, Miami, Newark, New York, Providence,

San Antonio, San Francisco, Savannah,

and Seattle.

Source: www.cfefund.org

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

www.cfefund.org I 4

CFE Fund

The CFE Fund's mission is to leverage municipal

engagement to improve the financial stability of

households by embedding financial empowerment

strategies into local government infrastructure. The

Fund will work with mayoral administrations and those

interested in supporting them to actually “pull triggers

-- and will measure its success accordingly.”

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: www.cfefund.org

www.cfefund.org I 5

SUPERVITAMIN EFFECT:

Integrating Financial Empowerment

Just as certain vitamins are beneficial at

varying stages of development, financial

empowerment strategies can and should be adapted to

serve unique client needs at important transition

points.

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: http://cfed.org/assets/pdfs/BuildingEconomicSecurityInAmericasCities.pdf

www.cfefund.org I 6

SUPERVITAMIN EFFECT:

Professional Financial Counseling

All Financial Empowerment Center (FEC)

counselors are required to take and pass

City University of New York (CUNY) Consumer and

Personal Finance course. Class sessions cover a range of

12 topics.

Material is intended for inclusion in counseling and

educational sessions.

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: NYC_FECOperations Manual

www.cfefund.org I 7

SUPERVITAMIN EFFECT:

Integrating Professional Financial Counseling

New York City

Denver

Lansing

San Antonio

Philadelphia

Nashville

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

www.cfefund.org I 8

SUPERVITAMIN EFFECT: FEC’s

New York City’s FEC’s are the first manifestation of this

new, professional approach to financial education and

counseling.

At the Centers clients get free one-on-one financial

counseling delivered by professionals, all of whom

have taken and passed the City-designed course

developed by CUNY.

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: http://cfed.org/assets/pdfs/BuildingEconomicSecurityInAmericasCities.pdf

www.cfefund.org I 9

SUPERVITAMIN EFFECT: The FEC Approach

1. Triages consumers’ financial situations, sets goals, and

establishes a specific plan of action with each client.

2. Delivers services at scale because they are embedded

in existing multiservice organizations to provide

on-site opportunities for cross-referrals.

3. Systematically tracks data and outcomes for client

management and evaluation.

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: http://cfed.org/assets/pdfs/BuildingEconomicSecurityInAmericasCities.pdf

www.cfefund.org I 10

SUPERVITAMIN EFFECT: The FEC Approach

4. Integrates counseling into a range of City and nonprofit

service delivery mechanisms to make interventions more

effective

5. Leverages infrastructure, established relationships, and

resources from the City and nonprofit lead entities

6. Establishes an ongoing coaching/mentoring relationship

with the client

7. Provides linkages to strategic referrals, including benefits

access, legal assistance, and tax assistance

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: http://cfed.org/assets/pdfs/BuildingEconomicSecurityInAmericasCities.pdf

www.cfefund.org I 11

SUPERVITAMIN EFFECT:

Financial Counseling Session Defined

• Providing information that increases the recipient’s

knowledge and ability to take self-improving action in

areas of money management, financial planning,

savings, debt and credit, and affordable banking

products and services.

• Conducted with the goal of achieving financial

outcomes for the client.

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: http://cfed.org/assets/pdfs/BuildingEconomicSecurityInAmericasCities.pdf

www.cfefund.org I 12

SUPERVITAMIN EFFECT:

Financial Counseling Session

Client Intake:

1. Authorization – signed Client Service Agreement.

2. Financial Health Assessment - the initial session.

3. Service Plans - four major financial areas in which

clients can make improvements to become

financially empowered.

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: NYC FEC Operations Manual, Version 1, June 14, 2012

www.cfefund.org I 13

Evaluation and Performance Tracking

FEC’s are evaluated using an outcome driven client

management system that tracks numerous data points

for clients based on customized service plans suited to

their particular needs.

At each financial counseling session, milestones or

action steps are taken and recorded toward the

financial outcomes.

Sources: http://cfed.org/assets/pdfs/BuildingEconomicSecurityInAmericasCities.pdf

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

NYC FEC Operations Manual, Version 1, June 14, 2012

www.cfefund.org I 14

Integrating Financial Empowerment

Focus is on outcomes where clients achieve specific

numerical increases in the following measures of

financial stability:

• Banking and Financial Services Access/Affordability

• Improved Budgeting and Money Management

• Improved Credit History and Access

• Debt Reduction

• Establish or Increase Savings

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: NYC FEC Operations Manual, Version 1, June 14, 2012

www.cfefund.org I 15

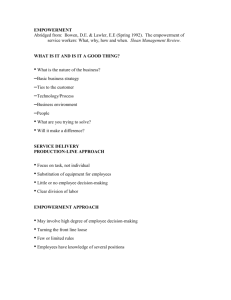

SUPERVITAMIN EFFECT: FEC MODEL

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

www.cfefund.org I 16

SUPERVITAMIN EFFECT: FEC MODEL

REFERRAL

SOURCES

CITY FUNDED

PROGRAMS

2-1-1/PUBLIC

AWARENESS

CLIENT

FINANCIAL

PARTNERS NETWORK

OTHER SOCIAL

SERVICE

PROVIDERS

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

SERVICE PLANS

FINANCIAL

EMPOWERMENT

CENTER

SAVINGS

CREDIT

DEBT

BANKING

BUDGETING

LINKAGES to TAX

PREP, BENEFITS,

LEGAL & OTHER

SERVICES

EXAMPLES OF

MILESTONES

CREATE SAVINGS PLAN

REVIEW CREDIT REPORT

ADDRESS DEBT

OPEN BANK ACCOUNT

DEVELOP BUDGET

IMPROVEMENT IN

OTHER SOCIAL

SERVICES

OUTCOMES

INCREASED SAVINGS

INCREASED CREDIT

SCORE

REDUCED DEBT

USE & MAINTAIN BANK

ACCOUNT

IMPROVED FINANCIAL

STABILITY

SUCCESS IN OTHER

SOCIAL SERVICE

PROGRAMS

Source: NYC FEC Operations Manual, Version 1, June 14, 2012

www.cfefund.org I 17

SUPERVITAMIN EFFECT:

Professionalizing a Field of Service

The professionalization of a field of service

requires not only setting a very high bar for quality

services but also a high degree of standardization of

service provider training, service delivery metrics,

performance outcomes, and impact measurement.

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: http://cfed.org/assets/pdfs/BuildingEconomicSecurityInAmericasCities.pdf

www.cfefund.org I 18

THE SUPERVITAMIN EFFECT:

National Standards and National Certification

Ultimately, national standards and certification will

facilitate a growing body of clear, measurable evidence

about the quality of financial education and counseling

for federal agencies, funders, service providers, and

consumers alike.

© January 23, 2013

Cities for Financial Empowerment Fund

All rights reserved.

Source: http://cfed.org/assets/pdfs/BuildingEconomicSecurityInAmericasCities.pdf

www.cfefund.org I 19