Econ 201 Lecture 8.1a May 26, 2009 Monopolistic Competition

advertisement

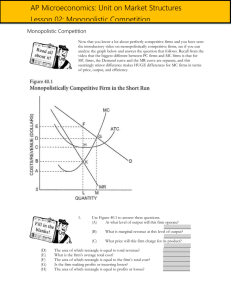

Econ 201 Lecture 8.1a May 26, 2009 Monopolistic Competition Part II 1 Characteristics of Monopolistic Competition • Similar to Perfect Competition – There are many producers in a given market. – There are few barriers to entry and exit – No extensive economies of scale • No dominant firm or firms • Differs from Perfect Competition – goods and services are heterogeneous • Consumers have clearly defined preferences and sellers attempt to differentiate their products from those of their competitors • means that producers have some degree of control over price 2 Overview • Monopolistic Competition – Market Demand is downward sloping • Result of product differentiation – So is firm demand, but it is smaller and more elastic than Market Demand – Firm sets price like a monopolist, but with less market power (more elastic) • Faces competition (cross-price elasticity) • Sets Price on the D curve where MR = MC 3 Overview • Monopolistic Competitive firm – Prices like a monopolist • Chooses Qs @ MR = MC • Price > MC – However • Price for MC will be less than Monopolist – Closer to PC than M • Qty Supplied for Monop Compet Industry > Monopoly – Closer to PC than M 4 Overview • Monopolistic Competition – Also resembles Perfect Competition • No economies of scale + free/ entry & exit – Market characterized by a many firms – Will drive long term economic profits to 0 • Competitors produce “close” substitutes – Even with product differentiation – firms have only limited market (pricing) power (similar to “competitive fringe”) – Differs from Perfect Competition • Is not as efficient – Does not operate at min of LRAC – Allocatively inefficient (MV > MC) • “Excess Capacity” (too many firms/too much capital) • Does produce greater product variety 5 MC in the Short-Run • Qs set where MR = MC • Earns + economic profit (monopoly rent) 6 MC in the Long-run • SR economic profits -> promote entry by new firms • Price will be “competed” down to LRAC – So no economic profit in LR – Firms will still not operate at min LRAC (unlike PC mkt) – More entry (unstable equilibria) & DWLoss 7 Characteristics of MC Markets • Departures from perfect competition – Differences in cost • Don’t operate at min of LRAC • Each firm may operate at different SRAC – Unstable equilibrium • Short-run (+) economic profits -> induce entry (minimal barriers) -> compete profits away • As newer, efficient firms enter -> older, less efficient exit -> “constructive” destruction (high rate of “turnover” like PC) • In the long-run, – Factors that differentiate products are duplicated by competing firms. » drives price down and, » monopolistically competitive firm will make zero economic profit (i.e. a rate of return equal to the rate required to compensate debt and equity holders for the risk of investing in the firm). • Unlike in perfect competition, the monopolistically competitive firm does not produce at the lowest attainable average total cost. 8 Examples of MC Markets • restaurants, cereal, clothing, shoes and service industries in large cities 9 Role of Advertising • Basic Taxonomy of Advertising – From an economist’s perspective – 1) Informational • Product quality, pricing, availability – “good gas at a good price” – 2) Persuasive • Attempts to alter tastes and preferences with subjective information • No product or pricing info 10 Advertising • Critics of monopolistic competition – fosters advertising and the creation of brand names. • advertising induces customers into spending more on products because of the name associated with them rather than because of rational factors. – Refuted by defenders of advertising • (1) brand names can represent a guarantee of quality, and • (2) advertising helps reduce the cost to consumers of weighing the tradeoffs of numerous competing brands. 11 Should We Regulate MC Markets? • Monopolistically competitive firms are inefficient, however: – usually the case that the costs of regulating prices for every product that is sold in monopolistic competition by far exceed the benefits; • the government would have to regulate all firms that sold heterogeneous products – Consumers value variety, i.e., product differentiation 12