EDHEC Institutional Days 2008 Registration Request Form – 1 of 2 12

advertisement

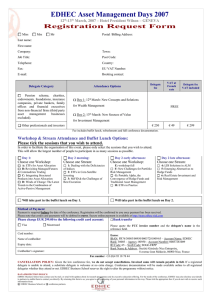

EDHEC Institutional Days 2008 12th – 13th June, 2008 – CNIT Paris La Défense Registration Request Form – 1 of 2 IMPORTANT NOTICE: Paris attracts many tourists and hosts many city-wide conventions, so EDHEC-Risk has reserved rooms in hotels in different price categories. Most of the hotels are located near the CNIT Conference centre, or within walking distance of the Metro Line 1 or the RER A, less than a 10-minute transfer to the Conference venue. Hotel reservations will be made on a first-come, first-served basis. Please address all inquiries directly to Lafayette Travel. https://asp.artegis.com/lp/Participant/eid2008?1=1 Delegate fee VAT at French rate Delegate fee VAT included Standard rate € 550.00 € 107.80 € 657.80 CFA Member rate: please indicate CFA membership #: € 330.00 € 64.68 € 394.68 Pension schemes and funds, charities, endowments, trusts, foundations, insurance companies (third party asset management businesses excluded), single family offices and financial executives from non-financial companies. FREE Fee includes buffet lunch, refreshments and full conference documentation. CANCELLATION POLICY: Given the low conference fee, we do not accept cancellations. Invoiced sums will remain payable in full. If a registered delegate is unable to attend, a substitute delegate is welcome at no extra charge. Conference documentation will be made available online to all registered delegates whether they attend or not. EDHEC Business School reserves the right to alter the programme without notice. Full Name (First Name & Last Name): Ms Mr Job Title / Position: Organisation: Pension fund/Charity/Foundation Custodian/Back Office Provider/Administrator Consultancy Private Banker/Multi-family office Non-financial company Broker/Dealer Third-party asset manager Single family office Investment Bank Insurance Co. (3rd party AM excl.) Other: EU VAT Number: Email: Telephone: Booking Contact (Personal Assistant if any): Email: Telephone: Contact Address: Billing Address (if different): To allow the largest number of people to participate in as many sessions as possible, please indicate on page 2 planned attendances by ticking the appropriate boxes for each delegate. Since enrolment in workshops and stream sessions is limited, attendees for whom no selection information is available will be given access to availability. Your registration will be effective only when confirmed via email by the EDHEC team. DATA PROTECTION POLICY: EDHEC Business School may contact you by mail, or email with updates about its research programmes and its executive education offering. For the needs of the conference, EDHEC may also disclose your details to partners to enable them to contact you directly. By returning this form to us, you agree to our processing of your personal information in this way. Please tick the appropriate box if you do not wish to receive such information from: EDHEC Business School; or conference partners. Please fax / email pages 1 & 2 - Fax number +33 (0)4 93 18 45 54 – Email: eid2008@edhec-risk.com -1- EDHEC Institutional Days 2008 12th – 13th June, 2008 – CNIT Paris La Défense Registration Request Form – 2 of 2 Conference Day 1 – Thursday, June 12 11:15 – only one choice please: 16:30 – only one choice please: Using ETFs and dynamic risk budgeting to achieve absolute returns – ETF Summit Combiner stratégies actives et indicielles – ETF Summit Commodities investment – Seminar Intelligent ETFs: from beta to alpha generation – ETF Summit Novel approaches to inflation hedging – Seminar New forms of indices and benchmarks – Pension Fund Conference/ETF Summit A thematic global approach for alpha generation in equities – ALT Forum Emerging markets: Stock picking in a world of lower expected returns – ALT Forum 14:30 – only one choice please: ETFs 2.0 – The next frontier for ETFs – ETF Summit Latest innovations in ETFs – ETF Summit Analyzing ETFs as an asset allocation tool – ETF Summit Une analyse critique des ETFs – ETF Summit Scanning the European institutional investment scene – Pension Fund Conference Exploiting the relationship between profitability and valuation – ALT Forum Will take part in the buffet lunch on Day 1 Conference Day 2 – Friday, June 13 Step 1: Please choose Stream or Master Class or Seminar MASTER CLASS - L’Etat de l’Art de la Gestion Institutionnelle Réservée aux caisses de retraite, fondations, entreprises non financières et compagnies d’assurance (gestion pour compte de tiers exclue) SEMINAR (Step 1 only) - Stratégies Alternatives 2008 STREAMS : Morning – please choose your Forum Afternoon – only one choice please EDHEC-Wall Street Journal Europe Institutional Investor Forum – 8:45-11:00 Do short term prudential constraints endanger long term investment objectives? Integrating regulatory constraints into European pension fund management – Pension Fund Conference – 16:15-17:45 Dynamic risk budgeting in Asset-Liability Management – Pension Fund Conference – 16:15-17:45 ALT Forum La construction d’alpha en gestion actions européennes – 9:00-10:00 Emerging markets in 2008 and beyond – Still room to run? – 10:30-11:30 The sources of alpha are many – ALT Forum – 16:15-17:15 Step 2: Please choose your Pension Fund Conference Workshops (except if Step 1 choice is Seminar) 12:00 – only one choice please 14:30 – only one choice please Forming return expectations for asset allocation decisions Adding value in a strategic asset allocation Managing liabilities: the need to go beyond LDI to achieve performance The use of hedge fund indices in the context of the UCITS Directive – case study Identifying execution venues best practices Post MiFID Using futures on listed real estate to diversify a portfolio Immobilier : quelle offre pour quelle place dans une allocation d’actifs ? Pension funds: Adopting commodities as part of a strategic asset allocation strategy Assessing hidden risks in traditional and alternative asset classes Cross asset class risk budgeting for institutional investors: new paradigm? Hunting returns with quantitative asset management Optimisation de l’allocation d’actifs par les momentums Volatility: Total Return, Decorrelation and Overlay Les impacts de la réglementation sur la gouvernance des institutionnels et la normalisation du reporting Will take part in the buffet lunch on Day 2 Method of Payment Payment is required before the date of the conference. Registration will be confirmed to you once payment has been received. Please note that credit card payments will be debited in euros. Secure online payment is available at http://store.edhec-risk.com Please charge: EUR 657.80 (standard rate) EUR 394.68 (CFA rate) Visa Mastercard Card number: Expiry date: Security Code (last 3 digits at the back of the card): to the following credit card account: Bank transfer in EUROS Please quote the invoice number that you will receive subsequently and the delegate’s name in the reference field. Thank you. IBAN: FR 76 30003 00950 00037281009 65 – Account name: EDHEC Bank: 30003 – Branch code: 00950 – Account number: 00037281009 ID code: 65 – Swift code: SOGEFRPP Bank name & address : Société Générale Nice Entreprises, 8 avenue Jean Médecin – 06000 Nice – France Name of cardholder: Cardholder’s signature: Please fax / email page 1 & 2 - Fax number +33 (0)4 93 18 45 54 – Email: eid2008@edhec-risk.com -2-