Programme Specification: MSc Accounting and Finance 1. Awarding Body

advertisement

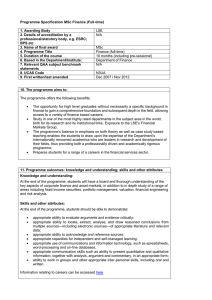

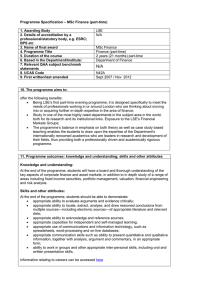

Programme Specification: MSc Accounting and Finance 1. Awarding Body 2. Details of accreditation by a professional/statutory body, e.g. ESRC; BPS etc 3. Name of final award 4. Programme Title 5. Duration of the course 6. Based in the Department/Institute: 7. Relevant QAA subject benchmark statements 8. Application Code 9. First written/last amended LSE Recognised for individual exemptions by the Association of Chartered Certified Accountants (‘ACCA’). MSc Accounting and Finance Full-time 9 months; part-time 21 months Department of Accounting N/A N4U1 Nov 2001 / November 2012 10. The programme aims to: Offer the following benefits: The opportunity to study in one of the most highly-rated Departments in the subject area in the world, both for its research and its institutional links; Exposure to world-class social scientists, business leaders, politicians, and modern thinkers who visit and/or teach at LSE; Research-led teaching in accounting and finance, bringing students to the forefront of practice and theory in their selected areas of study; A strong international and interdisciplinary orientation, covering conceptual and technical developments of major contemporary significance; Specialisation along alternative designated ‘pathways’ in finance, international accounting and finance, and accounting and financial management; Preparation for a variety of challenging careers in a range of countries. Typically, students are employed in the fields of finance and accounting, strategic consulting and/or general management. Many have gone on to achieve outstanding success in business, governmental and academic careers; Appropriate exemptions from professional accountancy and finance examinations. 11. Programme outcomes: knowledge and understanding; skills and other attributes Knowledge and understanding: Students may focus on international accounting and finance, accounting and financial management or finance in their choice of specialisation. At the end of the programme, students will have a thorough understanding of the key aspects of: Financial reporting in capital markets and/or Management accounting, strategy and organisational control plus will have selected from: a range of specialist courses in aspects of accounting and reporting, international accounting and finance, and advanced topics in theoretical and empirical finance, investment and financing decisions, market microstructure and intermediation, valuation and risk analysis, quantitative analysis methods, or other social science disciplines Subject specific skills: At the end of the programme, and to the appropriate extent indicated by their level of award, students should demonstrate: appropriate ability to communicate knowledge and understanding of several of the major contexts within which accounting operates (both outside and within organisations), based on a critical evaluation of related theoretical and conceptual frameworks and of empirical evidence as to its effects; appropriate ability to communicate knowledge and understanding of, and appropriate ability to use and critically evaluate, current and major alternative technical languages and practices of accounting, together with appropriate ability to apply them; appropriate ability to manipulate financial and other numerical data and appropriate understanding of and ability to apply mathematical and statistical concepts; appropriate ability to analyse business strategies and activities and perform relevant financial analyses and projections in appropriate contexts of planning, decision making and control; and to recognize the limitations of these techniques; appropriate ability to communicate knowledge and understanding of financial management, risk and the operation of financial markets, based on critical evaluation of theories and empirical evidence; Cognitive abilities and non-subject specific skills: At the end of the programme, students should be able to demonstrate: appropriate ability to evaluate arguments and evidence critically; appropriate ability to locate, extract, analyse, and draw reasoned conclusions from multiple sources—including electronic sources—of appropriate literature and relevant data; appropriate ability to acknowledge and reference sources; appropriate capacities for independent and self-managed learning; appropriate use of communications and information technology, such as spreadsheets, word-processing and on-line databases; appropriate communication skills such as ability to present quantitative and qualitative information, together with analysis, argument and commentary, in an appropriate form; ability to work in groups and other appropriate inter-personal skills, including oral and written presentation skills. Information relating to careers can be accessed here 12. Teaching, learning and assessment strategies to enable outcomes to be achieved and demonstrated Teaching and learning strategies: This programme provides research-led teaching which aims to bring students to the forefront of practice and theory in their selected areas of specialisation. The teaching is of an advanced nature and covers internationally significant conceptual and technical developments in accounting, finance and financial management. Students acquire their detailed knowledge and understanding of the course, and their subject specific skills, through a combination of lectures, problem classes and progression to guided independent study, reinforced by the opportunity to meet teachers and their supervisors one-to-one in office hours. Course reading lists include not only leading textbooks but references to current research literature and primary sources, including relevant examples from current practice, official and professional policy documents, websites and other electronic data sources. Academic teaching staff are leading researchers who give students an insight into current thinking and recent developments in their fields. Several teachers and supervisors are also involved in policy advice and formation and give students insights into real-world developments in accounting and finance and the forces that shape them. Professionals working in the field contribute as part-time lecturers and class teachers. Students have the opportunity to acquire hands-on experience of CIT as well as familiarity with electronic data sources and databases. Assessment strategies: Summative assessment of knowledge and understanding and of subject-specific skills is primarily by 3hr unseen examinations at the end of each year. For some options coursework project assessment amounts to 25%-40% of the final course grade. Formative assessment is through class assignments, including numerical and computer-based exercises, critical essays and commentaries, and individual and group presentations, for example on case studies and mini-projects or in ‘role-plays’. Cognitive and non-subject specific skills are developed in parallel with the development of—and through the same teaching and assessment structures that are designed to achieve the appropriate levels of—the knowledge and understanding and subject specific skills described above. Students are also encouraged to participate in the Departmental MSc annual residential weekend for staff and postgraduate students and in the activities of the Departmental MSc Society. 13. Programme structures and requirements, levels, modules and awards See further information on MSc Accounting and Finance Additional information 14. Criteria for admission to the programme Entrants should usually have a good upper second class honours degree in accounting and finance or a related subject from a UK university, or have reached a similar standard in an overseas degree. Other qualifications, such as membership of a recognised accountancy body, will also be considered; A GMAT score in excess of 650 points is necessary for all applicants to the programme unless in possession of a UK degree; Non-English speakers: also have to meet the School’s standard requirement for English language for all graduate programmes - IELTS 6.5, TOEFL 603 in the paper test, 250 in the computer based test. 15. Indicators of quality Applications for places: 1487 for 178 places in 2012; RAE rating (2008): Business and Management Studies: 70% of research outputs graded at 3* or 4* and ranked in top 5 UK HEIs; The Department of Accounting is responsible for the management the Centre for Analysis of Risk and Regulation (‘CARR’); The academic staff include several professionally-qualified accountants who hold or have held senior positions in their professional bodies; A large proportion of the professors of accounting in the UK are former members of staff and/or former graduates of this programme. Current and former members of staff, and/or former students, have won nearly all the awards for ‘Distinguished academic of the year’ awarded by the British Accounting Association (‘BAA’); The Department is recognised as an FT+3 research training outlet by the ESRC Professional accreditation by ACCA; The LSE Careers Centre website provides data on career destinations of LSE graduates. 16. Methods for evaluating and improving the quality and standard of teaching and learning The Department’s quality evaluation procedures are coordinated through its Teaching Quality Enhancement Panel. Primary responsibility lies with individual course leaders, course lecturers, class teachers, and supervisors and their own self-evaluation is focussed primarily through the Department’s annual course reviews and peer-teaching observations, the course teaching survey (conducted by TQARO) and the School’s mentoring and staff appraisal processes. Other Departmental structures and processes include: ad hoc reviews such as the recent review of all our MSc degrees and the review of postgraduate finance courses, which has led to the designation of the different specialist pathways and a wider choice of half-unit modules in response to student demand; the annual Departmental Examination Sub-Board meetings and the External Examiners’ reports; the termly Departmental meeting; the responsibilities of the Programme Director for the MSc Accounting and Finance programmes and of the MSc Co-ordinating Committee; student feedback and consultation through the MSc Accounting staff-student committee (SSC). School quality assurance processes include: regular staff appraisal and review; improvements in teaching technique are effected by the Teaching and Learning Centre (TLC) through observations, advice and further training; induction programme and mentoring scheme for new members of staff; Staff/student liaison committee; centrally administered student satisfaction questionnaires by the Teaching Quality Assurance and Review Office; an improved system for ensuring that External Examiner’s comments/recommendations are fed through to Departments and acted upon; the School’s Teaching, Learning and Assessment Committee (TLAC) which regulates all aspects of teaching quality; annual monitoring of courses and periodic reviews every 3-5 years. The outcomes of the annual reviews are presented to TLAC; the School’s Undergraduate Studies Sub Committee and Graduate Studies Sub Committee which oversee all taught programmes and ensure that significant changes to programmes and courses pass through a sequence of formal stages to ensure that curricular changes are appropriate and compatible with other developments.