Gemaca II Seminar Improving their Competitiveness

advertisement

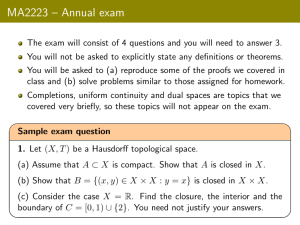

Gemaca II Seminar Economic Performance of the Major European Metro Regions Improving their Competitiveness Commercial Real Estate Development and the “City Offer” Jeremy.Kelly@eu.joneslanglasalle.com 8th February 2002 Commercial Real Estate Development and the “City Offer” – Project Approach Qualitative City Reviews Quantitative Analysis Office Completions Economic Growth Vacancy Rates Rental Growth Gross Returns Demand Analysis (Renaud Diziain IAURIF) • • • • • • Project Conclusions Development Triggers Location of Development Characteristics of Development Supply-side Constraints Development Funding Key Developers / Investors Coverage: North West Europe 8 Metro Areas Office Stock (mill sqm) Edinburgh Dublin Randstad London Dusseldorf Brussels Paris Frankfurt Paris London Randstad Brussels Frankfurt Dusseldorf Dublin Edinburgh 44.3 27.1 16.0 10.6 10.1 5.2 2.0 2.0 1. Office Development Analysis Office Completions in the 8 Metro Areas % 6 ‘000 sqm 4500 4000 3500 Completions % of Stock 3000 5 4 2500 3 2000 1500 2 1000 1 500 0 0 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 '00 '01 '02 Source: Jones Lang LaSalle, August 2001 Development Triggers: Office Completions and Economic Growth % 5 4 8 Metro Areas Completions % of stock GVA Growth 3 2 1 0 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 '00 '01 '02 -1 Source: Jones Lang LaSalle, August 2001; ERECO, July 2001 Development Triggers: Office Completions and Vacancy Rates Completions (% of Stock) 5 4 Completions Vacancy Rates 8 Metro Areas Vacancy Rate (%) 10 9 8 7 3 6 5 2 4 3 1 2 1 0 0 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 '00 '01 '02 Source: Jones Lang LaSalle, August 2001 Development Triggers: Office Completions and Prime Rental Growth Completions (% of Stock) 5 4 8 Metro Areas Rental Change (%) 30 Completions Rental Growth 20 3 10 2 0 1 -10 0 -20 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 '00 '01 '02 Source: Jones Lang LaSalle, August 2001 Development Triggers: Office Completions and Gross Returns Completions (% of Stock) 5 4 8 Metro Areas Completions Gross Returns Gross Returns (%) 30 25 20 15 3 10 5 2 0 -5 1 -10 -15 0 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 '00 '01 '02 Source: Jones Lang LaSalle, August 2001 Development Response: Peak of Cycles BRU DUS PAR LON EDI PAR FRA RAN Completions DUB PAR FRA BRU EDI DUS LON RAN 87 88 89 90 91 92 93 94 95 96 97 98 99 '00 '01 '02 Development Response: Office Completions Development Cycles Compared Dublin 4.8 Brussels 3.2 4.7 2.9 2.9 2.8 Randstad London 2.7 Frankfurt 5.0 3.1 1.9 Paris 0 1 Source: Jones Lang LaSalle,August 2001 2 98 – 02 88 - 92 3.0 2.6 Edinburgh % of Stock pa 4.4 3 9.8 3.7 2.9 Dusseldorf 9.8 4 5 6 10 Development Response: Volatility of Office Completions 1986 - 2002 6 5 DUB Least Volatile Markets 4 DUS BRU 3 RAN EDI 2 1 0.00 PAR 0.01 Source: Jones Lang LaSalle, August 2001 LON FRA 0.02 0.03 0.04 0.05 Development Triggers: Supply Responsiveness 1998 - 2002 Dublin Brussels Dusseldorf Frankfurt Paris London Edinburgh Randstad Economic Growth Vacancy Rates Rental Growth Gross Returns = = = = X = = X = na X = = X X X = = = = X Over response X Under response = Measured response Supply Responsiveness – Current Cycle (1998 – 2002) Dublin High development activity reflecting strong economic growth But analysis indicates development market may have “over-responded” Brussels Low supply-side volatility (historically) Increasing supply side response in current cycle – driven by EU demand Dusseldorf Above average supply side response, despite relatively weak economic and market fundamentals Supply Responsiveness – Current Cycle (1998 – 2002) Frankfurt London Paris Measured response in current development cycle. Reaction to stronger supply side response in last development cycle Edinburgh Measured supply-side response Randstad Relatively stable supply side response Analysis indicated “under response” in current cycle BUT increasing focus on Amsterdam Rental Evolution 1980 – 2001: Cyclical Markets Frankfurt Paris ‘80 ‘01 ‘80 London ‘80 ‘01 Dusseldorf ‘01 ‘80 ‘01 Rental Evolution 1980 – 2001: Stepped Growth Randstad ‘80 Dublin ‘01 Brussels ‘80 ‘01 ‘80 Edinburgh ‘01 ‘80 ‘01 2. City Reviews Dublin Frankfurt London Paris Dublin • Very strong supply-side response during both development cycles 12 10 8 6 4 2 0 • Response to strong economy and structural changes Dublin Europe 88-92 98-02 • Analysis indicates that market may have “over-responded” in current cycle • Relatively centralised office stock (three-quarters is located in the CBD) • Development focus : - International Financial Services Centre – development zone during both cycles - Business/Office Parks in the suburbs – feature of the current cycle – focused within the M50 - Cheaper ‘edge of prime’ district – central location important for access to labour market • Levels of refurbishment remain low – even in city centre – as sites still available in Docklands • Few constraints – apart from planning delays – outweighed by grants and tax incentives • Cautious bank lending during the current cycle – also funding by Irish institutions, property co’s • Primarily Irish investors and developers, but also UK players • Low levels of international activity reflect small size of market and lack of international grade stock Frankfurt • Measured supply-side response in the current cycle • Frankfurt aggressively establishing itself as a financial centre 5 Frankfurt Europe 4 3 2 1 0 88-92 – reflected in authorities positive stance towards development. • CBD/Banking District is the focus of development • Growth in mixed use development • Site assembly constrains development • Future re-development of Frankfurt Station • Authorities forcing developers to consider ecological impacts • Investment dominated by German funds • Increasing number of investors (funds, banks, insurance) are considering development route • Partnerships between developers/investors becoming more common • Owner-occupation (est. 50%) is higher than in other cities 98-02 London 6 5 4 3 2 1 0 London Europe • London saw very strong supply-side response in last 88-92 98-02 development cycle (1988-92) • Current supply-side response (1998-2002) is much lower, and more in line with expectations • Relatively centralised office stock (2/3rds of Greater London stock is in CBD) • Development focus: - Docklands/Canary Wharf – benefiting from improved transport - developing critical mass – attracting occupier with large requirements – more “front office” functions - City – authorities responding to competition from Canary Wharf - Rail Termini – Paddington Basin, Kings Cross, Waterloo/South Bank • Quality of stock is high (40-45% of Central London stock is Grade A) • Trend towards mixed-use development • London is very open to outside players – UK or US developers have dominated activity • Development traditionally funded/forward-sold to institutions (UK, German) • Lenders/funders have been reluctant to finance speculative development Paris • Paris saw strong supply-side response in last cycle (88-92) • During the most recent development upswing, response has been more “measured” – reflecting weak market conditions of late 1990s. Also higher levels of pre-letting. 5 Paris Europe 4 3 2 1 0 88-92 98-02 • Tightly controlled urban planning has forced new development outside the CBD • Development Focus: - Established office satellites - La Defense/Golden Crescent - Emerging zones – esp. north between CBD and CdG Airport (St Denis, Clichy, St Ouen) - Government-backed schemes - Rive Gauche – occupiers attracted by Ministry of Finance/French National Library • New office developments is of higher standard – large floorplates, high technical spec, design – but with low operating costs • Balanced mix of domestic and international developers. • US developers/funds have been very active. US funds forced into development • International developers have tended to take greater risks. Conclusions • Real Estate product & prices do play a role in city competitiveness • “Global Competitiveness” underpins many master plans • Ability to accommodate large corporate occupiers is seen as a key competitive advantage • New office development focussed on transport interchanges, CBD fringe, out-of-town • But analysis has shown that different supply side responses have not significantly affected city competitiveness • Other factors play a greater role in corporate location decision making – communications, labour force, regulation COPYRIGHT © JONES LANG LASALLE 2002 No part of this presentation may be reproduced or transmitted in any form or by any means, or stored in any database or retrieval system of any nature, without prior written permission of Jones Lang LaSalle except for any permitted fair dealing in accordance with all applicable copyright laws. Full acknowledgement must be given for any such use. This presentation is based upon materials either compiled by us through independent research or supplied to us by third parties. Whilst we have made every effort to ensure the accuracy and completeness of the data used in the presentation, we cannot offer any warranty that no factual errors are present. We take no responsibility for any direct or indirect actual or potential damage or loss suffered as a result of any inaccuracy or incompleteness of any kind in this presentation. We would, however, like to be told of any such errors in order to correct them.