A summary explanation of London’s labour market in the recent recession

advertisement

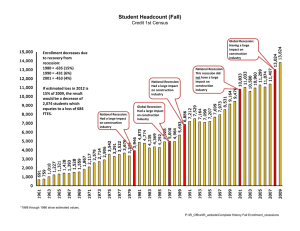

A summary explanation of London’s labour market in the recent recession Analysis by Melisa Wickham Presented by Jonathan Hoffman What the summary covers: Looking Background: forward: Possible explanations: •How might the market factorsinthat have Why has the labour the UK and How does the economy in the recent supported the labour market thus far London been more resilient during the recession, in the UK and London, compare change goingso forward? recent recession far? to that in the 1990s and 1980s recessions? •How might this make the recovery •How from has theGDP/GVA recent recession moved? different from the recovery in the 1990s and •How 1980s hasrecessions? unemployment and employment moved? Note: •It is not presumed that the full impact of the 2008 recession on the labour market has necessarily been experienced yet. •For a more detailed examination and explanations see the main report: ‘Working Paper 44: London’s labour market in the recent recession’, GLA Economics: http://www.london.gov.uk/publication/working-paper-44-londons-labourmarket-recent-recession BACKGROUND UK Background UK GDP fell faster, and further, in the 2008 recession than in the 1990s and 1980s recessions: And in the 1980s InInthe 2008, GDP 1990s fell itGDP fell by byfell 6.4% by 2.5%4.7% over over over 6 5 5 quarters quarters quarters 102 GDP index (100=GDP pre recession peak) isisequal This equal This isThis equal to toaasteady steady rate to a steady rate rate of of ofdecline decline of of decline of year 2.0% 4.3% a3.7% yearaayear 101 100 99 98 97 96 95 1980s 1990s 2008 94 93 92 0 1 2 Source: ONS, GDP chained volume measure, constant 2006 3 4 5 6 7 8 9 14 13 12 11 10 Quarter from UK GDP peak 15 But the claimant count rate has not risen as much in the 2008 recession as it did in the 1990s and 1980s recessions: 100 = claimant count rate at UK GDP peak Percentage point change from UK output peak in UK claimant count rate 107 106 105 104 103 2008 1990s 1980s The claimant rate has had But And by count the same 101 increased increased by 5.4 so far time had 100 byby only percentage increased 4.72.1 99 points inpercentage 1980s percentage points 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15recession 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 points in 1990s recession Quarter from UK output peak Note: Claimant count denominator = claimant count + 102 WFJ Source: ONS Employee jobs have also not fallen by as much in the 2008 recession as they did in the 1990s recession: Percentage change in UK employee jobs from UK output peak Employee But byjob the same numbers have timefallen fell by by 4.3% so6.1% far during in the this recession 1990s recession 2008 100 = employee jobs at UK output peak 101 100 99 98 97 1990s 96 95 94 93 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Quarter from UK GDP peak Source: WFJ, ONS London Background 100 = London GVA at time of UK GDP peak Like the UK, London’s GVA also fell faster in the 2008 recession than in the 1990s recession: ThisThis is equal is equal to a steady to arate steady of decline rate of decline of 2.8% of 4.1% a yeara year 101 1990s 2008 100 99 has fell fallen by London’sAnd output 6.1%9over 6 by 6.2% over in the quarters in quarters the 1990s recent recession recession 98 97 96 95 94 93 -2 -1 0 Source: GVA at basic prices, constant 2005 prices, Experian 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Quarter from UK GDP peak And like the UK, the claimant count has not risen as much in the 2008 recession as it did in the 1990s and 1980s recessions: 107 2008 106 1990s 105 1980s 104 103 Note: Claimant count denominator = claimant count + WFJ Source: ONS 32 30 28 26 24 12 10 8 6 4 2 0 99 22 100 20 101 18 102 16 But by the samecount The claimant by 4.1 timeAnd in the rate in 1990s London has points risen by6.5 1.7 itpercentage had risen by inpercentage the 1980s points so percentage points far in this recession recession 14 100 = London claimant count rate at UK output peak Percentage point change in London claimant count rate Quarter from UK output peak Employee jobs have also not fallen by as much in the 2008 recession as they did in the 1990s recession: But by the Has fallen by same time fell 3.5% so farinin by 11.1% this therecession 1990s recession 100 = London employee jobs at UK output peak Percentage change in London employee jobs from UK output peak 102 100 98 96 94 92 2008 1990's recession 90 88 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Quarter from UK GDP peak Source: WFJ, Nomis Background summary: Peak-to-trough output decline (%)1 London UK 2008 6.1 6.4 1990s 6.2 2.5 1980s Constant annual growth rate (over peak-to- - 2008 -4.1 -4.3 1990s -2.8 -2.0 1980s Percentage point change in claimant count Change in employee jobs numbers (%)3 London figures are derived from Experian’s regional GVA estimates. UK figures are derived from ONS GDP estimates. 2 From UK output peak to eleven quarters after. 3 For UK output peak to ten quarters after. - -3.7 2008 1.7 2.1 1990s 6.5 4.7 1980s 4.1 5.4 2008 -3.5 -4.3 1990s -11.1 -6.1 1980s 1 4.6 - - Why? Why? Summary of analysis of possible explanations: Possible explanations Likely contribution to labour market strength during the 2008 recession so far 1. Reduction in relative wages High 2. Strong corporate profitability and low rate of business failures High 3. Growth in the public sector High 4. Labour market structural change Medium 5. Reduction in working hours Medium 6. Less economic structural change Medium 7. Measurement error Low Reduction in relative wages Have workers accepted larger pay cuts/smaller pay rises to reduce their risks of unemployment? Reduction in relative wages Compared to the 1980s and 1990s recessions it does not seem that wages in the UK have fallen sufficiently to compensate for lower firm output. Real unit labour costs 100 = real unit labour cost at GDP peak 106 104 1980s 1990s 2008 102 100 98 96 94 0 1 2 3 4 5 6 7 8 9 Quarter from UK GDP peak Source: ONS (ROYJ, MGRN, MGRZ, ABML), GLA Economics calculation 10 11 12 13 14 15 Reduction in relative wages However………. Percentage change in relative unit labour costs (2007 Q1 to 2009 Q3) 10 5 0 -5 -10 Looking forward, slow employment growth during the recovery should minimise pressure on wage rises in the UK. However, Sterling is unlikely to fall much further, so further falls in the relative unit labour costs in the UK seem unlikely. -15 -20 -25 Ireland Spain Germany United States United Kingdom Source: IMF Strong corporate profitability and low rate of business failures Strong corporate profitability and low rate of business failures 1990 s peak 16 2008 peak Net rate of return (%) 15 14 13 12 11 10 9 Source: PSNFC net rate of return (%, SA), 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 8 Strong corporate profitability and low rate of business failures Actual business failures Compared to the rise in the 1980s and 1990s recessions and given the fall in GDP, the rise in company Looking forward: liquidations has been modest during the 2008 recession. •Government support is graduallyfactors: being withdrawn and this could make future Contributing liquidations a risk, however 1990s 2008 •Bank of England’s monetary policy, and •Forecast low 1980s real interest rates inpolicy the near term should continue to support business •Government survival. Note: Historic business failures are based on data for compulsory liquidations, creditors’ voluntary liquidations, administrative receiverships, administrative orders and company voluntary arrangements from The Insolvency Service Growth in public sector Exclude jobs inchange publicinadministration, Percentage UK workforcedefence, jobs excluding public administration & defence, education, and social workwork from the total education,health and health & social number of jobs in the economy…….. 102 100 = employment at cyclical peak 100 98 96 94 1978Q3-1983Q4 1989Q1-1994Q2 2007Q1-2010Q1 92 90 -5 -4 -3 Source: Workforce Jobs, ONS -2 -1 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Quater from cyclical peak in employment 16 Growth in public sector 100 = employment at UK output peak However, lot of of the this Around a 25% increase is due to the public sector employmentofincrease incorporation financial between 2008 2010 institutions (e.g.and Lloyds) wasthe in London. Around into publichas sector There been a 40% of this is due to the large rise of since UK public and private sector employment (08 Q1 to 10 Q2) reclassification 107 recession financial the institutions into 105 103 101 99 the publicthat sectorpublic sector Looking forward, the OBR estimates employment will fall by around 400,000 by 2015/16. This means thatLooking publicspecifically sector employment will at publiccompound sector employment contract at a similar rate over the next 5 Public sector employment (excluding 'Other public the 2008experienced recession: sector') years as the privateinsector between 2008 Private Sector Employment and 2010. Total public sector employment (including 'Other public sector') 97 95 0 1 2 3 4 5 6 7 Note: ‘Other public sector’ includes financial corporations. In the timeframe above, RBoS and Lloyds were included in the 3rd quarter from UK output peak (2008 Q4). Northern Rock was included prior to the GDP peak. Source: ONS 8 9 10 Quarter from UK output peak Factors that are likely to support the labour Looking forward summary market further as the economy grows: •Reduced relative wages •Strong corporate profitability and low business failures •Lower economic structural change Factors that may slow any improvement in the labour market as the economy grows: END For a more detailed examination and explanations see the main report: ‘Working Paper 44: London’s labour market in the recent recession’ by GLA Economics: http://www.london.gov.uk/publication/working-paper44-londons-labour-market-recent-recession ANY QUESTIONS