2010 Budget

2010 Budget

Challenged with an economic climate that is impacting the City’s revenue streams, the approved budget focuses on continuing to fund programs and services to meet the expectations of residents while deferring spending, where possible, to future years.

1

Summary

Similar to 2009, 2010 will be a difficult year

The current economic climate, meeting provincial growth targets and other budget drivers places a significant strain on the City’s finances, revenue streams, development charges, and investment income

To address these issues, we have curtailed spending where possible and made prudent use of the City’s reserve funds.

Our goal is to insulate taxpayers while maintaining service levels and preserving the City’s physical assets

2

2010 Budget Plan

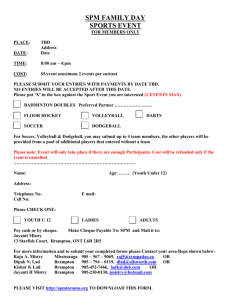

% of Total Residential Tax Bill

EDUCATION

CITY of

BRAMPTON

20%

40%

40%

REGION

3

Focus on Core Services

3,100 lane kilometers of road

4,149 acres of parkland

• Including sports fields, playgrounds, boulevards and buffers, pathways and trails, flowers and shrub beds.

74 corporate buildings

65 recreation and community facilities including arenas, pools, theatres, etc.

11 fire stations

4

Gross Expenditures by Dept.

$408.2 million

5

2010 Budget Priorities

Construction of Fire Station 212 in southwest

Brampton

Implementation of the Züm bus rapid transit system

Planning and design of new Works Yards

Widening and construction of City roads

Improvements for Parks and Recreation

Federal / Provincial infrastructure stimulus funded projects

Continued asset repair & replacement program

Improvements to customer service – launch of City web portal

6

2010 Capital Budget Summary by Program

$241.4 million

PLANNING, DESIGN AND

DEVELOPMENT

$0.3M

0.1% COMMUNITY SERVICES

$70.6M

29.3%

FINANCE

$7.7M

3.2%

BUILDINGS AND

PROPERTY MANAGEMENT

$4.0M

1.7%

BRAMPTON PUBLIC

LIBRARY

$4.2M

1.7%

OTHER DEPARTMENTS

$0.1M

0.02%

WORKS AND

TRANSPORTATION

$154.6M

64.0%

7

2010 Current Budget Summary

($ millions)

2009 2010

Budget Budget Variance

Total Expenditures $400.6

$408.2

$ 7.6

Revenues ($400.6) ($400.9) $ 0.3

Net $ 0.0 $7.3

$ 7.3

Since the City cannot budget for a deficit, net revenue shortfall of $7.3 million to be funded from increase in tax levy

The $7.3 million increase is less than 50% of the $14.8 million budget increase in 2009

8

2010 Budget Plan

(for illustration only)

CITY

REGION

EDUCATION

TOTAL TAX

BILL

2009

TAX BILL

$1,445

% BUDGET

INCREASE

2.9%

$1,489

$753

$3,687 tbd tbd

2010

TAX BILL

*

$1,487

$ CHANGE % CHANGE

IN TOTAL

$42 1.1%

$1,489

$753

$3,729 tbd tbd

$42 tbd tbd

1.1%

* Based on average residential assessment value of $310,000

Note:

• City portion of total tax bill is approximately 40%

• 2.9% tax increase on the City portion of the residential tax bill translates into a 1.1% tax increase or $42 (approx.) on the total residential tax bill

9

YOUR 2010 TAX BILL

• There are three components (Region, City and

Education) to the overall tax bill of which the City of

Brampton’s portion is 40%.

• For 2010, the City requires a budget increase of approximately 2.9% over 2009 levels to meet its operating and capital commitments, less than half of the increase approved last year.

• This means that, based on the City’s percentage of the overall tax bill, the City of Brampton is increasing taxes by 1.1% or an approximate $42 tax increase on an average residence assessed at $310,000.

10