Education in the Age of Financialization Michael A. Peters University of Waikato

advertisement

Education in the Age

of Financialization

Michael A. Peters

University of Waikato

University of Illinois

2013

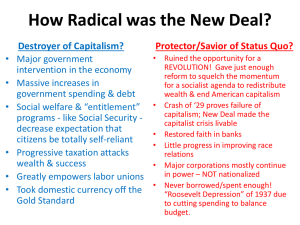

Neoliberalism and finance

capitalism

The shadow economy

Neoliberalism and finance

capitalism

• The rise of neoliberalism is explained by the growing

role and power of finance in the political economy of

capitalism

• "...neoliberalism is the expression of the desire of a

class of capitalist owners and the institutions in which

their power is concentrated, which we collectively call

'finance,' to restore ... the class's revenues and

power...” -- Dumenil and Levy (2004, 1-2)

• Financialization is result of neoliberal restructuring but

has deeper roots -- David M. Kotz (2008)

Finance Capitalism

• Not just quantitative expansion but change in

nature of financial institutions that jettisoned

its traditional loan-making functions to

pursue the creation and sale of its own

financial instruments

• Neoliberalism, beginning 1980 in US,

encourage a shift from state-regulated

capitalism to deregulated neoliberal

capitalism

Financialisation is a systematic

transformation of capitalism

1.

the massive expansion of the financial sector where finance companies have

taken over from banks as major financial institutions and banks have moved

away from old commercial banking practices to operate directly in capital

markets as investment bankers;

2.

large previously non-financial multinational corporations have acquired new

financial capacities to operate and gain leverage as investors in financial

markets;

3.

domestic households have become players in financial markets (the

ascendancy of shareholder capitalism) taking on debt and managing assets;

4.

in general, this change represents the dominance of financial markets and

institutions over a relative declining production of the traditional industrial,

productive or real economy

5.

Financialisation is a cultural change in ideology about unregulated markets

that infuses all policies

New Forms of Capitalism

Cultural, algorithmic, symbolic, bioinformational, educational

New forms of Capitalism

‘Cybernetic capitalism’ is a term we use in order to

distinguish a group of theories, or, better, positions, on the

Left that attempt to theorize the nature of the new

capitalism under neoliberalism. These are "models" that

can be characterized by associated literatures.

1.Informational capitalism

2.Cultural capitalism

3.Cognitive capitalism

4.Finance capitalism

5.Biocapitalism

1. Informational capitalism

The nature of information/knowledge ‘Informational’, ‘Digital’, ‘Virtual’, ‘Cyber’,

‘Fast’, ‘High-tech’ Castells, Shiller, Morris-Suzuki, Schmiede, Fuchs

•

•

•

Informational capitalism: Castells sees informationalism as a new

technological mode of development characterized by “information

generation, processing, and transmission” that have become “the

fundamental sources of productivity and power” (Castells 2000: 21).

Morris-Suzuki (1997) and Schmiede (2006a, b) have used this term and

Christian Fuchs (2007) also writes of an informational capitalism of selfregulation.

Digital capitalism: Dan Schiller and Robert McChesney employ a

traditional Marxist political economy applied out of communication

theory to questions of ownership of global communications: “networks

are directly generalizing the social and cultural range of the capitalist

economy as never before” (Schiller 2000: xiv). See also Peter Glotz,

(1999).

Cyber-Capitalism: Dyer Witheford, N. Cyber-Marx. Cycles and Circuits

of Struggle in high Technology Capitalism (1999)

1. Informational capitalism

•

Knowledge Capitalism: Michael A. Peters & Tina Besley, Building

Knowledge Cultures: Education and Development in the Age of

Knowledge Capitalism (2006); Sheila Slaughter & Gary

Rhoades, Academic Capitalism and the New Economy (2004).

Fast capitalism: Ben Agger (1989; 2004) – Also see the journal

website of the same title.

•

Virtual capitalism: the “combination of marketing and the new

information technology will enable certain firms to obtain higher

profit margins and larger market shares, and will thereby

promote greater concentration and centralization of capital”

(Dawson & Foster, 1998, p. 63).

•

High-tech capitalism (Haug 2003), or informatic capitalism

(Fitzpatrick 2002) – to focus on the computer as a guiding

technology that transformed the productive forces of capitalism

and has enabled a globalized economy.

2. Cultural capitalism

The change of culture ‘new culture’, ‘knowing capitalism’, ‘new spirit’, ‘cultural

economy’

• New culture of capitalism: This strand emerges from

work in the ‘new geography’ and sociology and is

epitomized by Richard Sennett’s (2007) The Culture of

New Capitalism.

• Knowing Capitalism – Epitomized by Nigel Thrift’s

(2006) Knowing Capitalism.

• The New Spirit of Capitalism, Boltanski, L. and E.

Chiapello (2005)

• Cultural economy, Michael Pryke and Paul du Gay

(2002)

3. Cognitive Capitalism

Immaterial Labor , ‘Cognitive capitalism’, ‘affective capitalism’’

• Cognitive Capitalism – ‘Affective Labour is a key

feature of the new mode of cognitive capitalism based

on immaterial labour. It is a key aspect of a strategy

based on autonomous peer production.

- Yann Moulier Boutang Le capitalisme cognitif : La

Nouvelle Grande Transformation, (2007);

- Vercellone C. (ed), Capitalismo cognitivo, (2006);

- De Angelis, M. and D. Harvie (2006) ‘Cognitive

Capitalism and the Rat Race: How capital measures

ideas and affects in UK higher education’

3. Cognitive capitalism

•

•

•

Immaterial Labor: Based on Deleuze and Guattari’s Anti-Oedipus:

Schizophrenia and Capitalism (1999); Negri & Hardt (2000: 290) argue that

contemporary society is an Empire that is characterized by a singular global

logic of capitalist domination that is based on immaterial labour.

With the concept of immaterial labour Negri and Hardt introduce ideas of

information society discourse into their Marxist account of contemporary

capitalism. Immaterial labour would be labour “that creates immaterial

products, such as knowledge, information, communication, a relationship, or

an emotional response” (Hardt/Negri 2005: 108; cf. also 2000: 280-303), or

services, cultural products, knowledge (Hardt/Negri 2000: 290).

Affective Capitalism - Massumi, B. (n.d.) ‘The Future Birth of the Affective

Fact’; Immaterial and affective labor, Emma Dowling, Rodrigo Nunes and Ben

Trott (Ephemera, 2007); Juan Martín Prada, ‘Economies of affectivity’ and

Michael Hardt ‘Affective Labor’ Semio-capitalism - Precarious Rhapsody.

Semio-capitalism and the Pathologies of the Post-Alpha Generation, Franco

Bernadi (forthcoming)

4. Finance Capitalism

‘Financialization’

• Rudolf Hilferding, Finance

Capital. A Study of the Latest

Phase of Capitalist

Development. Ed. Tom

Bottomore (Routledge & Kegan

Paul, London, 1981)

• Hilferding's Finance Capital

(Das Finanzkapital, Vienna:

1910) was "the seminal Marxist

analysis of the transformation

of competitive and pluralistic

'liberal capitalism' into

monopolistic 'finance capital'"

Rudolf Hilferding

Rudolph Hilferding Finance Capital: A Study of the Latest

Phase of Capitalist Development

Chapter 25, The proletariat and imperialism.

http://www.marxists.org/archive/hilferding/1910/finkap/ch25.htm

• "The socializing function of finance capital

facilitates enormously the task of

overcoming capitalism. Once finance capital

has brought the most importance branches

of production under its control, it is enough

for society, through its conscious executive

organ – the state conquered by the working

class – to seize finance capital in order to

gain immediate control of these branches of

production.”

“Contradictions of Finance Capitalism”

Richard Peet, Monthly Review, 63, 2011

• “Over the last thirty years, capital has abstracted upwards,

from production to finance; its sphere of operations has

expanded outwards, to every nook and cranny of the globe;

the speed of its movement has increased, to milliseconds;

and its control has extended to include ‘everything.’ We now

live in the era of global finance capitalism.”

• “Financialization has involved increasingly exotic forms of

financial instruments and the growth of a shadow-banking

system, off the balance sheets of the banks. The repeal of

the Glass-Steagall Act in 1999 symbolized the almost

complete deregulation of a financial sector that has become

complex, opaque, and ungovernable.”

5. Biocapitalism & Biopolitics

"bioinformationalism"

• Biocapitalism: Based lososely on Foucault’s work on

governmentality and biopower, and Deleuze &

Guattari’s Anti-Oedipus: Schizophrenia and Capitalism

(1999);

• Rajan, K.S. Biocapital: The Constitution of

Postgenomic Life (2006);

• Eric Cohen (2006) “Biotechnology and the Spirit of

Capitalism”

•

http://www.thenewatlantis.com/publications/biotechnol

ogy-and-the-spirit-of-capitalism

“Bio-informational capitalism”June 2012 vol. 110 no. 1

98-111

•

•

•

This essay builds on the literatures on ‘biocapitalism’ and

‘informationalism’ (or ‘informational capitalism’) to develop the concept

of ‘bio-informational capitalism’ in order to articulate an emergent form

of capitalism that is self-renewing in the sense that it can change and

renew the material basis for life and capital as well as program itself.

Bio-informational capitalism applies and develops aspects of the new

biology to informatics to create new organic forms of computing and

self-reproducing memory that in turn has become the basis of

bioinformatics.

The paper begins with a review of the successes of the ‘new biology’,

focusing on Craig Venter’s digitizing of biology and, as he remarks, the

creation of new life from the digital universe. The paper then provides a

brief account of bioinformatics before brokering and discussing the

term ‘bioinformational capitalism’.

Algorithmic Capitalism

http://truth-out.org/news/item/8887-algorithmic-capitalism-and-educational-futuresinformationalism-and-the-googlization-of-knowledge

•

•

•

“Algorithmic capitalism and its dominance of the market increasingly

across all asset classes has truly arrived.

It is an aspect of informationalism (informational capitalism) or

"cybernetic capitalism," a term that recognizes more precisely the

cybernetic systems similarities among various sectors of the postindustrial capitalist economy in its third phase of development - from

mercantilism, industrialism to cybernetics - linking the growth of the

multinational info-utilities (e.g., Goggle, Microsoft, Amazon) and their

spectacular growth in the last twenty years, with developments in

biocapitalism and the informatization of biology, and fundamental

changes taking place with algorithmic trading and the development of

so-called financialization.”

"Algorithmic Capitalism and Educational Futures: Informationalism and the Googlization

of Knowledge"

Algorithmic Trading and

Cloud Capitalism - May 6, 2010

•

"At 2:32 p.m., against this backdrop of unusually high volatility and

thinning liquidity, a large fundamental5 trader (a mutual fund complex)

initiated a sell program to sell a total of 75,000 E- Mini contracts (valued

at approximately $4.1 billion) as a hedge to an existing equity position (p.

2). The report indicates that liquidity crises ensued because a large

trader used an automated execution algorithm ('Sell Algorithm') that was

programmed to trade large volume (E-Mini contracts) with regard only to

volume rather than price or time and the Sell Algorithm was executed

rapidly in the period of twenty minutes resulting in one the three largest

single-day price movements in the history of the stock market. Under the

heading 'Lesson Learned' the Report suggests that 'under stressed

market conditions, the automated execution of a large sell order can

trigger extreme price movements, especially if the automated execution

algorithm does not take prices into account. Moreover, the interaction

between automated execution programs and algorithmic trading

strategies can quickly erode liquidity and result in disorderly markets.'"

6. New Forms of Educational

Capitalism

•

•

•

Privatization, corporatization and commericalization of education with emulation of

private sector management and global education as tradeable services (WTO;

TRIPPS).

Informatization & the postmodernization of education, the cultural archive &

production/consumption of knowledge.

Investment in human capital, key competencies and generic skills (since the

1960s, after Gary Becker's (1964) Human Capital.

• Emergence of the entrepreneurial self with investments at critical points in the

•

education career cycle - "responsibilization"

Distributed knowledge systems lessen costs of sharing of intellectual capital

(research), academic publishing (dissemination), courseware (instruction).

• Emergence of global online ‘borderless education’, rise of corporate virtual

education providers, and online courses for public universities.

New Forms of Educational

Capitalism (2)

•

Growth of charter schools, UK academies, home-schooling, informal and

24/7 professional education.

•

Emergence of the paradigm of social production (Benkler, 2006) where

co-production & co-creation characterizes ‘active learner-consumers’ and

‘citizen-consumers.’

•

Design principle best illustrated through maxim that ‘architecture is

politics’ and communication systems are a complex three tiers of

content, code and infrastructure where each level might be controlled

and owned or free.

•

Convergence of open source, open access and open education.

• Radical interpenetration of public and private educational spaces and

increasing dependency on technological fix.

•

•

•

•

•

Some Further Explorations of these

themes (1)

Peters, M.A. & Reveley, J. "Retrofitting Drucker: Knowledge Work Under

Cognitive Capitalism", Culture & Organization, 2012: iFirst, 1-17

Peters, M.A. "Manifesto for Education in the Age of Cognitive Capitalism:

Freedom, Creativity and Culture", Economics, Management, and Financial

Markets, 6(1), 2011, pp. 63–92.

Peters, M.A. "Bioinformational capitalism", Thesis Eleven, 110, 2012: 98111.

Peters, M.A. "Three Forms of the Knowledge Economy: Learning, creativity

and openness", Economics, Management and Financial Markets, 5(4),

2011: 63-92.

Peters, M.A. & Venkatesan, P. "Biocapitalism and the Politics of Life",

Geopolitics, History and International Relations, 2011, 2(2).

Some Further Explorations of these

themes (2)

• Peters, M.A.

& Venkatesan, P. "Bioeconomy and the Third Industrial

Revolution in the Age of Synthetic Life," Contemporary Readings in Law

and Social Justice, 2011, 2(2).

• Peters, M.A. and Bulut, E. (Eds.) Cognitive Capitalism, Education and the

Question of Digital Labor. New York, Peter Lang, 2011.

• Peters, M.A. Neoliberalism and After? Education, Social Policy and the

Crisis of Capitalism. New York, Peter Lang, 2011.

• Peters, M.A., Britez, R.

& Bulut, E. Cybernetic Capitalism,

Informationalism, and Cognitive Labor, Geopolitics, History and

International Relations, 1 (2), 2010: 11-40.

• Peters,M.A. Educational, Science and Knowledge Capitalism. New York,

Peter Lang, 2013

Cognitive Capitalism, Education and Digital Labor

Edited Michael A. Peters & Ergin Bulut (2011)

• “Algorithmic Capitalism

and Educational Futures:

Informationalism and the

Googlization of

Knowledge”

• “Educational futures require

a global transnational public

investment in infrastructures

that stand against both the

monopolization and

privatization of knowledge

and education.”

TruthOut

Truthout works to spark action by revealing systemic injustice and providing a platform for

transformative ideas, through in-depth investigative reporting and critical analysis.

•

Speed, Power and the Physics of Finance Capitalism

•

Will Global Financialization and the Eurozone Debt Crisis Defeat European

Cosmopolitan Democracy?

•

In a Risk Society, Is Consumption Our Only Tool to Influence Our World?

•

Breaking Open the Digital Commons to Fight Corporate Capitalism

•

Greening the Knowledge Economy: A Critique of Neoliberalism

•

Knowledge Capitalism and the "Academic Spring"

•

Freedom, Openness and Creativity in the Digital Economy

Dimensions of Finance

Capitalism

Securitization and Derivatives

Financial and real wealth

McKinsey Global

Institutehttp://regulation.revues.org/docannexe/image/7729/img1.jpg

McKinsey Global Institute

$1.2 Quadrillion Derivatives Market

Dwarfs World GDP (2010)

•

One of the biggest risks to the world's financial health is the $1.2

quadrillion derivatives market. It's complex, it's unregulated, and it

ought to be of concern to world leaders that its notional value is 20

times the size of the world economy.

•

But traders rule the roost -- and as much as risk managers and

regulators might want to limit that risk, they lack the power or

knowledge to do so.

•

A quadrillion is a big number: 1,000 times a trillion.

•

Yet according to one of the world's leading derivatives experts,

Paul Wilmott, who holds a doctorate in applied mathematics from

Oxford University, $1.2 quadrillion is the so-called notional value of

the worldwide derivatives market.

•

To put that in perspective, the world's annual gross domestic

Videos

• http://www.youtube.com/watch?v=Q4b_Dt1Mq-k

Real News - $1,200 Trillion Derivatives Market Dwarfs

World GDP

• http://www.youtube.com/watch?v=Aq-FSI9x6fo

LIFE HIDDEN TRUTH 2013 GLOBAL FINANCIAL

CRISIS

• http://www.youtube.com/watch?v=bx_LWm6_6tA

The Crisis of Credit Visualized - HD

WALL STREET AND THE FINANCIAL CRISIS:

Anatomy of a Financial Collapse, April 13, 2011

“In the fall of 2008, America suffered a

devastating economic collapse. Once

valuable securities lost most or all of

their value, debt markets froze, stock

markets plunged, and storied financial

firms went under. Millions of

Americans lost their jobs; millions of

families lost their homes; and good

businesses shut down. These events

cast the United States into an

economic recession so deep that the

country has yet to fully recover.”

•

High Risk Lending

•

Regulatory Failure

•

Inflated Credit Ratings

US Senate

Housing Bubble

Housing Bubble

Globalisation of finance

• Some scholars suggest that neoliberalism and

globalization are themselves expressions of finance,

closely tied to the development of derivatives markets

and the evolution of an international financial system

where the international rentiers have managed to

significantly increase their share of national income

often on the basis of systematic fraud, corruption and

widespread criminalisation of financial practices. The

current financial crisis is a systemic crisis of the entire

capitalistic system based on interconnected global

financial markets.

Global interconnectedness of

finance

• There is a clear sense that the new technologies and

the financial instruments and techniques they have

made possible, have strengthened interdependencies

between markets and market participants, both within

and across national boundaries. As a result, a

disturbance in one market segment or one country is

likely to be transmitted more rapidly throughout the

world economy than was evident in previous eras

(Greenspan, 1998, p. 244).

Financialization of public

sphere

• This is a fundamental shift that represents the

financialization of the reproductive sphere of life itself.

Under this regime the monopolization and privatization

of knowledge and education has proceeded rapidly.

One of the effects of financialisation and the economic

crisis has been to popularize a debate on budget cuts

and "austerity politics" across the board for public

services provided at the state level with massive cuts to

education in all aspects, attacks on collective

bargaining, and the sacking of thousands of teachers.

Charlie Rose Interviews Charles Ferguson on his

documentary 'Inside Job’

Origins of “Credit Crunch”

(RBNZ)

• In 2007-08 the United States, followed by the rest of the

world, experienced a ‘credit crunch’ that, by late 2008, had

developed into the worst worldwide economic crisis since

the Second World War. Although New Zealand was in a

relatively good position, with a healthy banking system and

sound economic fundamentals, the country still entered a

prolonged recession

• Financial markets – places where loans and investments

could be traded as a commodity – became highly

sophisticated and expanded in depth during the last

decades of the twentieth century. By this time they were

computerised and linked world-wide, meaning that any

incident or event could be swiftly transmitted internationally.

(2)

• By mid-2007 it had become clear that the full value of many

of these loans was not recoverable. Loss of confidence in

sub-prime mortgages in the United States triggered a wave

of doubt regarding many of the loans, creating dysfunction

through the whole financial system. Terms like ‘toxic debt’

became commonplace, and countries such as Iceland

experienced very severe difficulties

• From mid-2008 the Bank also initiated sharp reductions in

the Official Cash Rate (OCR), the rate that anchors interest

rates for New Zealand. This had been sitting at slightly over

8 percent, but by early 2009 had dropped to around 2.5

percent, a very rapid rate of easing of interest rates

compared to normal standards

Marazzi, C. (2010) The Violence of Financial Capitalism

trans. K. Lebedeva. New York: Semiotext(e).

• This global crisis is a new type of crisis, “it is the

capitalist way of transferring to the economic order the

social and potentially political dimension, the dimension

of the resistances ripened during the phase leading up

to the cycle” (85). It is the first systemic and global

crisis of neo-liberal financial capitalism that began with

the crisis of the Fordist model of accumulation and the

consequent deregulation of the banking system during

the 1970s.

Financialization of Education

Student debt, charter schools, investment university

The Chain of Charter Schools

Charter schools

UK "Freedom" Academies

• http://www.youtube.com/watch?v=yMl2q-lfzvE

• Michael Gove invites all schools to apply to become

academies

• http://www.youtube.com/watch?v=X8wNCMTisc0

• Sponsored Academies in the UK - A Form of

Education Public Private Partnership

• http://www.youtube.com/watch?v=E145YmDDJec&list

=PL0EA60F5417D47E52

• Academies Funding part 1, from 2013

• http://www.youtube.com/watch?v=k2uiGwaRojE

Michael Gove unveils sweeping school

reforms

•

•

•

•

•

Education white paper will shake up league tables, transform teacher

training and recruitment and 'shorten and simplify' rules for removing

incompetent teachers

http://www.guardian.co.uk/education/2010/nov/24/michael-govesweeping-school-reforms

The education secretary, Michael Gove, has outlined plans to transform

teacher training and recruitment, shake up school league tables to focus

more on children's performance in academic subjects, and make it easier

for headteachers to remove poor teachers and exclude disruptive

children.

In a schools white paper published today ministers said government

funding would cease for graduates who did not have at least a 2:2

degree from September 2012, while the government would explore

paying off the student loans of graduates in shortage subjects who

wished to enter teaching.

For Michael Gove, the Pol Pot of education,

every year is Year Zero

•

•

Matthew Norman, http://www.independent.co.uk

http://www.independent.co.uk/voices/comment/matthew-norman-formichael-gove-the-pol-pot-of-education-every-year-is-year-zero8683331.html

• All intensive research unearths, in fact, is a pair of trifling putative tweaks

to the system. One is lengthening the school day and shortening the

holidays, to bring education into line with working life. The other,

revealed by this newspaper yesterday, is to outsource the running of

schools to profit-making businesses.

• In the utopian future that is Goveworld, the two might dovetail exquisitely.

The nation’s 11-year-olds would reach their desks at 6.30am and put in

two hours of Call Centre Studies, handling complaints about faulty

satellite dishes from angry account holders in Mumbai, before

conventional lessons begin. This has obvious appeal. Apart from the

financial benefits to the venture capitalists who have superceded the

board of governors, this would prepare children for the shifting balance of

economic power in the world they will inherit.

Everything you need to know about the student

borrowing bubble in 17 charts. By Matt

Phillipshttp://qz.com/78889/student-borrowing-bubble-in-17-charts/ $1 trillion in students loans

outsanding

, mortgagaes are the only form of debt Americans have more of

Student loans

College Cost Inflation in US

Unemployment of BAs

The Market for Student Loans

Fig 1

Private Student Loan in

Billions

Student Loans

Danny Weil on student debt

http://www.dailycensored.com/student-loans-the-financialized-economy-of-indentured-servitude/

•

“The financialization of the student loan debt occurs when

student loan debt is transformed into asset-backed securities

(ABS). The value and income payments from the ABS’s are

‘collateralized’ (“backed”) by a specified pool of underlying

assets. None of the ABS can be sold individually. This is why

they are sold to large institutional investors. By ‘pooling’ the

assets into ABS, this allows them to be sold to general

institutional investors. This process is called securitization.”

•

“Student Loan Asset Backed Securities (SLABS) are a major

sector of the ABS market. There are more than $400 billion in

assets backing various student loan deals that are issued in the

market. SLABS, like the sub-prime loans, are traditionally a

favorite for fixed income investors”.

(2)

• Now that student loan debt has reached a milestone —

$1 trillion on April 25, 2012, many investors realize

there are many other variables, which affect the timing

and realization of cash flows of student loan

securities. One such factor that was not accounted for

when investors originally invested in SLABS is the

massive student default rates that are sweeping the

country. This coupled with bleak employment

opportunities have forecasters already talking about the

next financial bubble to burst.

“The new prudentialism in education: Actuarial

rationality and the entrepreneurial self”

Peters (2005) Educational Theory

In this essay I examine the ways in which enterprise culture has

been promoted as a style of governance through the market. I

argue that a ‘‘new prudentialism’’ in education rests on the concept

of the entrepreneurial self that ‘‘responsibilizes’’ the self to make

welfare choices based on an actuarial rationality as a form of social

security that insures the individual against risk. This represents a

new welfare regime — one that is no longer focused on the rights of

the citizen, but that is based on the model of the citizen-consumer

who makes investments in the self at critical points in the life cycle. I

begin by providing a brief analysis of the risk society and outlining a

theoretical approach drawn from Michel Foucault. Then in the latter

part of the essay I develop the notion of actuarial rationality in

relation to an ethics of self-constitution and the new prudentialism in

education.

The Literature on

"Responsibilization"

Pat O'Malley, 2009

•

‘Responsibilization’ is a term developed in the governmentality literature

to refer to the process whereby subjects are rendered individually

responsible for a task which previously would have been the duty of

another – usually a state agency – or would not have been recognized

as a responsibility at all. The process is strongly associated with neoliberal political discourses, where it takes on the implication that the

subject being responsibilized has avoided this duty or the responsibility

has been taken away from them in the welfare state era and managed by

an expert or government agency. The term ‘responsibilization’ first

appears in the governmentality literature in the mid-1990s where it refers

to a neo-liberal strategy associated with the assumption that under the

governance of the welfare state, liberal subjects had sloughed off or

been divested of the responsibility for governing themselves or assisting

others reliant on them.

•

http://knowledge.sagepub.com/view/the-sage-dictionary-ofpolicing/n111.xml

"The age of responsibilization: on

market-embedded morality"

Ronen Shamir, Economy & Society 2008

•

This article explores emerging discursive formations concerning the

relationship of business and morality. It suggests that contemporary

tendencies to economize public domains and methods of government

also dialectically produce tendencies to moralize markets in general and

business enterprises in particular. The article invokes the concept of

‘responsibilization’ as means of accounting for the epistemological and

practical consequences of such processes. Looking at the underlying

‘market rationality’ of governance, and critically examining the notion of

‘corporate social responsibility’, it concludes that the moralization of

markets further sustains, rather than undermining, neo-liberal

governmentalities and neo-liberal visions of civil society, citizenship and

responsible social action

•

http://www.tandfonline.com/doi/abs/10.1080/03085140701760833#.UeX

Ndo4rTfA

Financialisation & subjectformation

• Financialisation is understood as emerging out of

conditions which force people to weigh up the market

performance of their financial assets when making

everyday decisions between saving and consuming

(Boyer 2000a, Froud et al. 2002). Financialisation

should therefore also be understood in terms of

subject-formation. It is, indeed, very much about how

financial investment becomes a ‘life-strategy’ (Martin

2002).

• Towards ‘universal financialisation’ in Sweden?, Claes

Belfrage (2009),

http://www.tandfonline.com/doi/abs/10.1080/13569770

802396337#.UeXQho4rTfA

The financialization of the university

Notes from Danny Weil, http://www.projectcensored.org/topstories/articles/the-financialization-of-education-and-sonoma-stateuniversity-part-ii/

The university must be understood as turned over to private capital

markets and thus is a “borrower”, “lender” and “investor”

Debt plays a prominent if not central role in the life of the university

education, like all institutions, cannot be understood divorced from

the economic system that underlies it and which it reflects.

Financialization of education

When we speak specifically about the ‘financialization of

education’, we are addressing how financial motives, markets,

specific powerful individuals, corporations and financial

institutions impact all of public education. In grades K-12 we

can see the financialization of education through the power of

private textbook companies, publicly traded companies like

K12 Inc., Educational Management Corporations that manage

charter schools and that trade on the NY Stock Exchange,

testing corporations that also trade on Wall Street, charter

schools, charter school construction fueled by venture capital,

for-profit services for such thing as school lunch programs and

the corporate financial management of public pension funds, to

name just a few financial activities.

John Bellamy Foster

• “Changes in capitalism over the last three decades have

been commonly characterized using a trio of terms: neoliberalism, globalization, and financialization. Although a lot

has been written on the first two of these, much less

attention has been given to the third. Yet, financialization is

now increasingly seen as the dominant force in this triad.

The financialization of capitalism—the shift in gravity of

economic activity from production (and even from much of

the growing service sector) to finance—is thus one of the

key issues of our time. More than any other phenomenon it

raises the question: has capitalism entered a new stage?”

http://monthlyreview.org/2007/04/01/the-financialization-ofcapitalism

GlobalHigherEd

• “…universities are proving to be appealing investments for

government stimulus efforts due to the sector’s stabilizing,

countercyclical nature in the short term as well as its

potential to stimulate long term economic growth”

(http://globalhighered.wordpress.com/2009/07/07/moodysspecial-comment-report-on-the-global-recession/).

• Moody’s …states in their 2009 report, Global Recession and

Universities: Funding Strains to Keep Up with Rising

Demand that:

• “the global public university’s’ ‘credit quality’ is “steadier”

than that of private universities” (ibid).

At the Campaign for the

Public University

• At the Campaign for the Public University, we have

argued strongly against the financialization of the public

university. We have argued that this is not the same as

the commodification of higher education (which we can

confront as individuals in our pedagogic practices), but

represents a series of measures designed to open

universities to for-profit income streams. This includes

creating a means by which tuition fees can be raised

and the income diverted towards other academic

activities.

The Global Financial Crisis and the

Restructuring of Education

Michael A. Peters, Joao

Paraskeva and Tina BesleyPeter Lang 2014

"Financialization" is a term that describes an economic

system or process that attempts to reduce all value that is

exchanged (whether tangible, intangible, future or present

promises, etc.) either into a financial instrument or a derivative

of a financial instrument. The original intent of financialization

is to be able to reduce any work product or service to an

exchangeable financial instrument. It is an aspect of

increased symbolization, mathematization and

computerization of financial markets that are trends within

knowledge capitalism. Neoliberalism is an expression of the

power of finance that has gathered pace with the

internationalization of capital and the globalization of markets.

(2)

Some scholars suggest that neoliberalism and globalization are themselves

expressions of finance, closely tied to the development of derivatives markets

and the evolution of an international financial system where the international

rentiers have managed to significantly increase their share of national income

often on the basis of systematic fraud, corruption and widespread

criminalisation of financial practices. The current financial crisis is a systemic

crisis of the entire capitalistic system based on interconnected global financial

markets. This is a fundamental shift that represents the financialization of the

reproductive sphere of life itself. Under this regime the monopolization and

privatization of knowledge and education has proceeded rapidly. One of the

effects of financialisation and the economic crisis has been to popularize a

debate on budget cuts and "austerity politics" across the board for public

services provided at the state level with massive cuts to education in all

aspects, attacks on collective bargaining, and the sacking of thousands of

teachers. This collection provides a an introduction and analysis of

"financialisation" and the fate of public education under "austerity politics”.

References on Neoliberalism

•

•

•

•

•

Dumenil, G. & Levy, D. (2004) Capital Resurgent: Roots of the Neoliberal

Revolution. Cambridge and London: Harvard University Press.

Foucault, M. The Birth of Biopolitics. Lectures at the college de France

1978-79, http://asounder.org/resources/foucault_biopolitics.pdf

American Neoliberalism: Michel Foucault's Birth of Biopolitics Lectures,

http://vimeo.com/43984248

Harvey, D. (2005) A Brief History of Neoliberalism. Oxford: Oxford

University Press.

http://www2.warwick.ac.uk/fac/soc/sociology/rsw/research_centres/theor

y/conf/rg/harvey_a_brief_history_of_neoliberalism.pdf

Peters, M. (2011) Neoliberalism and After?

http://www.amazon.com/dp/1433112051

Some references on Finance

Capitalism

•

•

•

Hilferding, R.(1981) Finance Capital: A study of the

Latest Phase of Capitalist Development. London and

Boston: Routledge and Kegan Paul.

http://www.marxists.org/archive/hilferding/1910/finkap/

Kotz, D. M. (2008) Neoliberalism and Financialization,

http://people.umass.edu/dmkotz/Neolib_and_Fin_08_0

3.pdf

Luiz Carlos Bresser-Pereira: The Global Financial

Crisis and a New Capitalism? Levy Economics Institute

Working Paper No. 592. Mai 2010.