– Test #2 MAKE-UP EXAM PART I. SHORT ANSWER 1

advertisement

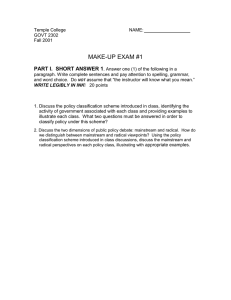

Temple College GOVT 2301/2302 NAME:_______________ Spring, 2000 MAKE-UP EXAM – Test #2 PART I. SHORT ANSWER 1. Answer the following question in a paragraph. Write complete sentences and pay attention to spelling, grammar, and word choice. Do NOT assume that “the instructor will know what you mean.” WRITE LEGIBLY IN INK! 1. Explain why markets generally produce more efficient outcomes than alternative means of allocating resources. PART II. SHORT ANSWER 2. Answer one (1) of the following in a paragraph. Write complete sentences and pay attention to spelling, grammar, and word choice. Do NOT assume that “the instructor will know what you mean.” WRITE LEGIBLY IN INK! 1. Identify and discuss four (4) different types of real-world economies. Give examples of countries representing each type. 2. What are the three (3) fundamental questions that must be answered by any economy? Using a straight-line continuum, explain how laissez-faire economies, centrally-planned economies, and mixed economies answer these three questions. PART III. SHORT ANSWER 3. Answer one (1) of the following in a paragraph. Write complete sentences and pay attention to spelling, grammar, and word choice. Do NOT assume that “the instructor will know what you mean.” WRITE LEGIBLY IN INK! 1. List and discuss the basic tenets (assumptions) of capitalism. 2. Identify and briefly discuss two types of economic functions that government in the U.S. performs. Provide examples to illustrate. PART IV. SHORT ANSWER 4. Answer one (1) of the following in a paragraph. Write complete sentences and pay attention to spelling, grammar, and word choice. Do NOT assume that “the instructor will know what you mean.” WRITE LEGIBLY IN INK! 1. Who pays the excise tax on cigarettes? Answer this question by discussing the distinction between the statutory incidence and the economic incidence of the tax. 2. Explain what is meant by “tax shifting.” Give at least four (4) examples f taxes that may be shifted, explaining how they might be shifted. 3. Explain why taxes are bad using concepts discussed in class. PART V. SHORT ANSWER 5 Answer one (1) of the following in a paragraph. Write complete sentences and pay attention to spelling, grammar, and word choice. Do NOT assume that “the instructor will know what you mean.” WRITE LEGIBLY IN INK! 1. Discuss the likely effects of a government policy of intercepting drug sales and imposing stiff penalties (fines and prison time) on drug dealers. To be specific, how will the policy affect the “street price” of drugs, the number of “units” of drugs sold, the costs of the dealers, and the behavior of addicts and casual users? 2. Discuss alternatives to government anti-drug policies that punish drug dealers. That is, discuss “demand-side” anti-drug abuse policies. Give examples. How will such policies affect the “street price” of the drug, the number of “units” of the drug that are sold, and the behavior of addicts and casual users? PART VI. Graphical Analysis 1. Answer the following questions based on the graph below. WRITE LEGIBLY IN INK! Who pays the statutory incidence of this tax? Briefly explain how you know this. What is the tax rate? Identify the area representing the tax revenue to government. Who bears more of the economic incidence of the tax: consumers or sellers? Identify the area representing the excess burden of this tax. Is demand relatively price elastic or relatively price inelastic? Briefly explain. PART VII. Graphical Analysis 2. Answer the following questions based on the graph below. WRITE LEGIBLY IN INK! Calculate: the tax rate the tax revenue portion of the tax revenue paid by consumers portion of the tax revenue paid by sellers the excess burden of this tax PART VIII. IDENTIFICATION. Define and identify the importance of any ten (10) of the following items in a sentence or two for each. Continue your answers on the back of this page. market efficiency rational behavior equilibrium price equilibrium quantity consumer’s surplus producer’s (seller’s) profits MWTP MWTS welfare loss (efficiency loss) centrally-planned economy laissez-faire economy market capitalism head tax excise tax general sales tax statutory incidence of a tax economic incidence of a tax subsidy price elastic demand price inelastic demand tax shifting prohibited market