Policy Options

advertisement

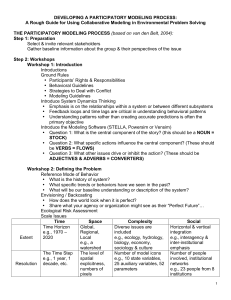

Policy Options Topics Political issues: how do we overcome political barriers? General design principles Policy sequence Policy tools Places to intervene: leverage points Opening Policy Windows Problem stream Policy Stream Defining existing condition as a problem Getting policy makers to accept definition Develop consensus around policies necessary to solve problem Politics stream National mood; leading politicians accept gravity of problem and willing to implement necessary policies General design principles for policy 1. Every independent policy goal must have an independent policy instrument 2. Attain necessary degree of macro control with minimum sacrifice of microlevel freedom and variability Market mechanisms General design principles for policy 3. Uncertainty and irreversibility requires considerable safety margin Precautionary principle Which is more precautionary: quotas or taxes? How does this relate to positive feedback loops? 4. Start from historical conditions Market economy and market mechanisms General design principles for policy (cont.) 5. Adaptive management How can we adjust feedback loops to cope with increasing strength of impacts? How does this relate to quotas? 6. Principle of subsidiarity: Institutions at the scale of the problem Who should be making policy decisions? How does this relate to feedback loops? Policy sequence Scale Distribution Determines how much there is to be distributed/allocated Pareto optimal outcome possible from any initial distribution Decided before allocation Allocation Policy Tools Prescription Payments Penalties Property rights Persuasion Power How Can we Change Complex Systems Leverage points Where can we have the most impact? See Meadows, Donella. 1997. “Places to Intervene in a System,” Whole Earth, winter issue. Where should we intervene? Where can our interventions have the most impact? We need to understand how the ecological, social and economic objectives influence one another Where is intervention the most feasible? “the minimum that is ecologically necessary is greater than the maximum that is politically feasible” GORE Candidates for intervention Critical variables (strong influence on others, strongly influenced by others) Active variables (influence others, but are not influenced by others) Buffer variables (absorb impacts without passing them on) 10 Leverage Points 10. Numbers (subsidies, taxes, standards). 9. Buffering capacity Standard economists stuff Can still be powerful E.g. acid rain and calcium carbonate 8. Material stocks and flows. E.g. replacing transportation system, 10 Leverage Points 7. Regulating negative feedback loops 6. Driving positive feedback loops. Feedback has to be proportional to problem Markets and feedback loops Slow them down, let negative feedbacks do their thing E.g. Financial crisis 5. Information flows. E.g. publicizing pollution, labeling, etc. Feedback loops as leverage points Can we increase the strength of negative feedback loops? Can we slow down/halt positive feedback loops? Can we create appropriate feedback loops where none exist? Can we increase the strength of negative feedback loops? Strength of loop has to correspond to strength of impacts they are designed to correct What has happened to strength of impacts in the system over time? How have external factors affected this? Can we increase the strength of negative feedback loops? Time lag must be appropriate How could we reduce the time lag? Can we speed up information flows? Role of communication/education How could we improve information flows? Can we create information flows that are more direct? Slowing/breaking positive feedback loops Slowing the loop Breaking the loop Information and feedback loops Electric meter example Unique to human systems Creating appropriate feedback loops Role of education Price mechanism as a feedback loop Community values as a feedback loop Taxes Subsidies Quotas Relationship with price signals Regulations as feedback loops What characteristics should key indicators have? Minimal time lag Key indicators of change in the system Passive variables (weak influence on others, strongly influenced by others) Critical variables (strong influence on others, strongly influenced by others) Change is a constant. We need to adapt. 10 Leverage Points 4. The rules of the system Democratic control over the commons, the media, and the problem of macroallocation Cooperative provision/management of nonrival resources, including information Return the right to seigniorage to government Just distribution of resources provided by nature and society 3. The power of self-organization. Maintain diversity 10 Leverage Points 2. The goals of the system. What is socially and psychologically desirable? Shared vision of a sustainable and desirable future. Continuous economic growth is undesirable Doom and gloom doesn’t win converts 10 Leverage Points 1. The mindset or paradigm out of which the goals, rules, feedback structure arise. What is biophysically possible? Economy is sustained and contained by the global ecosystem Continuous economic growth is impossible Macroallocation is central problem Humans are social animals, not homogenous globules of desire, etc. 10 Leverage Points 0. The ability to transcend paradigms Policy and property rights Excludability and property rights Property rights as a bundle Changing conditions and the need for changing property rights Command and control regulations (standard setting) for negative externalities Typical approach to pollution control Adequate agricultural practices, BAT Setting effluent level/limiting channelization Political factors involved in setting standards Economically inefficient Does not respond to economic conditions, i.e. increases or decreases in abatement costs Command and control (cont.) Not cost effective Different marginal abatement costs for different polluters No incentive to reduce emissions below standard no incentive not to increase pollution in attainment areas little incentive to develop new technologies Marginal restoration cost First 20% Landowner 1 Landowner 2 Landowner 3 $5000 $1000 $2500 2nd 20% $20,000 $2500 $5000 3rd 20% $40,000 $5000 $10,000 4th 20% $80,000 $10,000 $17,500 Final 20% $160,000 $50,000 $20,000 Marginal costs of restoring floodplains. Channelization with smooth cost curves Pigouvian tax tax Marginal restoration cost First 20% Landowner 1 Landowner 2 Landowner 3 $5000 $1000 $2500 2nd 20% $20,000 $2500 $5000 3rd 20% $40,000 $5000 $10,000 4th 20% $80,000 $10,000 $17,500 Final 20% $160,000 $50,000 $20,000 Marginal costs of restoring floodplains. Pigouvian taxes and subsidies Cost effective Efficiency requires full knowledge of costs and benefits Issues with taxes Politically difficult May be higher cost to farmers than alternatives, though cost effective for society Not possible for international problems Pigouvian taxes and subsidies Issues with subsidy May lead to more entrants into industry Ignores polluter pays principle (negative externalities) Excellent for activities with positive public good externalities May be most feasible alternative for some international problems Addresses allocation first, scale and distribution only indirectly Channelization quotas quota Marginal restoration cost First 20% Landowner 1 Landowner 2 Landowner 3 $5000 $1000 $2500 2nd 20% $20,000 $2500 $5000 3rd 20% $40,000 $5000 $10,000 4th 20% $80,000 $10,000 $17,500 Final 20% $160,000 $50,000 $20,000 Marginal costs of restoring floodplains. Tradable channelization quotas Cost effective Distribution of permits Grandfather Auction Equity based Tradable channelization quotas Purchase of permits by downstream communities Problems with market thinness Spatial issues public goods problem Erosion damage: local problem--impacts on downstream farm Flood damage: Lewis creek watershed problem Phosphorous emissions: Lake Champlain watershed problem Pollution quotas: CO2, SO2, Mercury Tradable quotas Addresses scale first, distribution second, allocation third Actual results SOx permits in US CBA financed by industry vs. actual costs Fisheries quotas Kyoto protocol Problems with distribution What should quota be? Renewables (forests, fisheries, etc.) Cannot exceed rate of renewal In general, balance between structure and function, raw materials and ecosystem services, stock-flow and fund-service Waste absorption capacity Cannot exceed ecological constraints Must also focus on human impacts Non-renewables What would be a just distribution across generations? set quota so that price stimulates creation of substitutes before resource is exhausted Must not leave future worse off than it would have been in absence of resource Tax or quota? Tax or quota? With a tax, you can theoretically get right amount, but amount will change with economic change Is it better to let prices vary (economic) than amount of resource to be used (ecological) Impacts of shift in MNPB under taxes and quotas tax quota Impacts of shift in MNPB under taxes and quotas Shift in MNPB quota Distribution issues Increasing price of resources leads to increase in price of consumer goods, so regressive. But, rich consume more than poor, so receive a higher subsidy from the future gov’t gets more money, can get rid of more regressive taxes. If resource prices are kept low, resources must inevitably run out. Who will this affect more, the rich or poor? Other policies Financial assurance bonds Polluter pays precautionary principle Potential forms: Why is this needed? Can these handle uncertainty? Bonding Insurance Uncertain outcomes Uncertainty regarding cause and effect Could there be any role for these in Lewis Creek? ICMS Ecologico Ecological value added tax Municipalities (counties/townships) are rewarded for their provision of ecosystem services Promotes competition for resources Helps address subsidiarity problem Could this work for Lewis Creek? Conservation easements Separating the property rights bundle into individual sticks Are these similar to a tax, quota or neither? Net present value of an annual subsidy Impact on land values Tax implications Legal costs Strictness and cost Macro Precautionary Starting Adaptive Subsidiarity goals, principle from managem micro historic ent freedo al m conditio ns Taxes/ subsidies Strong OK OK Weak Local, state and federal Tradable quotas Strong Strong OK Strong Depends Conservation OK easements OK Strong OK Depends Financial bonding Strong OK OK Depends OK Strong OK Strong OK ICMS Strong ecologico Summary Scale Distribution Efficiency Taxes/ subsidies OK Polluter pays, OK strong Tradable quotas Conservation easements Strong Can be strong Strong Can be strong OK depends Financial bonding ICMS ecologico OK Polluter pays OK Can be Strong beneficiary pays, OK Strong The Macro-allocation problem How many resources should be devoted to market goods, and how many to public goods? Can translate into quotas for ecosystem goods/services Decision cannot be made by market How can this decision be made? Distribution policies 4 sources of income human capital (wage) built and financial capital (interest) natural capital (rent) entrepreneurship (profit) Human capital (wages) Minimum wage Job training Maximum wage? Built capital ESOPs: building a capitalist society CSOPs: building capitalism while internalizing negative externalities Financial transaction taxes Stock taxes Natural capital Capturing rent: eliminating perverse subsidies land rent royalties (non-renewables) natural dividend (renewables) Social capital Land rent Patents Luxury tax? Wealth tax? Slowing/breaking positive feedback loops Positive feedback in the news What happens when positive feedback loops run their course?