Trade and integration in the Caribbean: trends and prospects

advertisement

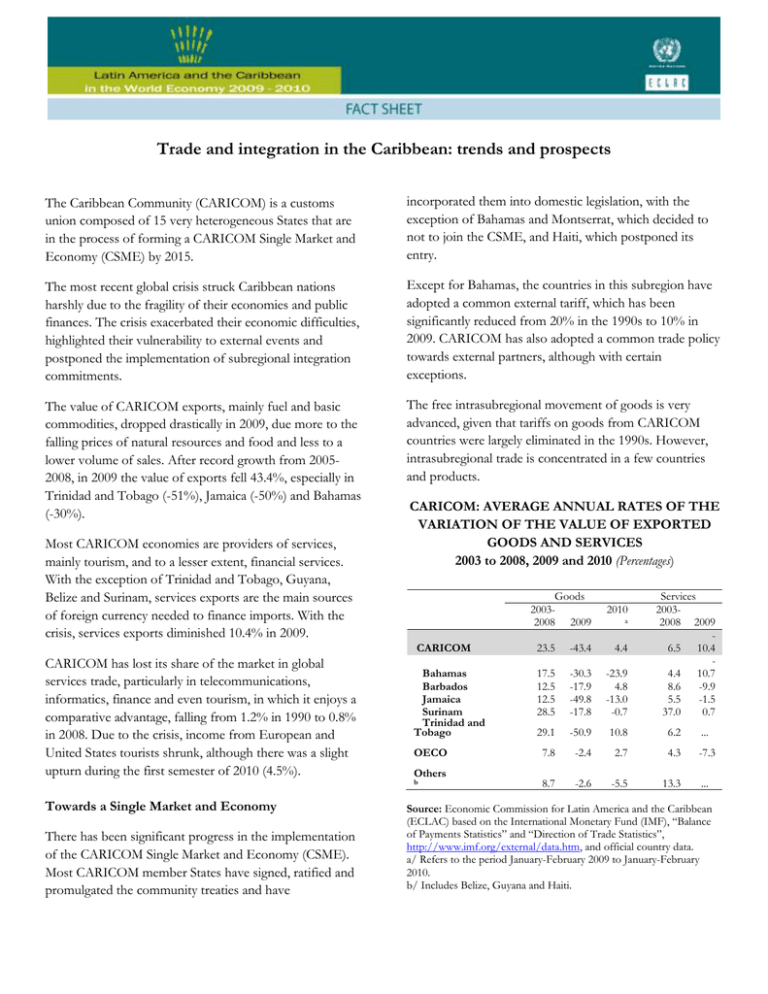

Trade and integration in the Caribbean: trends and prospects The Caribbean Community (CARICOM) is a customs union composed of 15 very heterogeneous States that are in the process of forming a CARICOM Single Market and Economy (CSME) by 2015. incorporated them into domestic legislation, with the exception of Bahamas and Montserrat, which decided to not to join the CSME, and Haiti, which postponed its entry. The most recent global crisis struck Caribbean nations harshly due to the fragility of their economies and public finances. The crisis exacerbated their economic difficulties, highlighted their vulnerability to external events and postponed the implementation of subregional integration commitments. Except for Bahamas, the countries in this subregion have adopted a common external tariff, which has been significantly reduced from 20% in the 1990s to 10% in 2009. CARICOM has also adopted a common trade policy towards external partners, although with certain exceptions. The value of CARICOM exports, mainly fuel and basic commodities, dropped drastically in 2009, due more to the falling prices of natural resources and food and less to a lower volume of sales. After record growth from 20052008, in 2009 the value of exports fell 43.4%, especially in Trinidad and Tobago (-51%), Jamaica (-50%) and Bahamas (-30%). The free intrasubregional movement of goods is very advanced, given that tariffs on goods from CARICOM countries were largely eliminated in the 1990s. However, intrasubregional trade is concentrated in a few countries and products. Most CARICOM economies are providers of services, mainly tourism, and to a lesser extent, financial services. With the exception of Trinidad and Tobago, Guyana, Belize and Surinam, services exports are the main sources of foreign currency needed to finance imports. With the crisis, services exports diminished 10.4% in 2009. CARICOM has lost its share of the market in global services trade, particularly in telecommunications, informatics, finance and even tourism, in which it enjoys a comparative advantage, falling from 1.2% in 1990 to 0.8% in 2008. Due to the crisis, income from European and United States tourists shrunk, although there was a slight upturn during the first semester of 2010 (4.5%). Towards a Single Market and Economy There has been significant progress in the implementation of the CARICOM Single Market and Economy (CSME). Most CARICOM member States have signed, ratified and promulgated the community treaties and have CARICOM: AVERAGE ANNUAL RATES OF THE VARIATION OF THE VALUE OF EXPORTED GOODS AND SERVICES 2003 to 2008, 2009 and 2010 (Percentages) Goods 20032008 2009 2010 a Services 20032008 2009 6.5 10.4 4.4 10.7 8.6 -9.9 5.5 -1.5 37.0 0.7 CARICOM 23.5 -43.4 4.4 Bahamas Barbados Jamaica Surinam Trinidad and Tobago 17.5 12.5 12.5 28.5 -30.3 -17.9 -49.8 -17.8 -23.9 4.8 -13.0 -0.7 29.1 -50.9 10.8 6.2 ... 7.8 -2.4 2.7 4.3 -7.3 8.7 -2.6 -5.5 13.3 ... OECO Others b Source: Economic Commission for Latin America and the Caribbean (ECLAC) based on the International Monetary Fund (IMF), “Balance of Payments Statistics” and “Direction of Trade Statistics”, http://www.imf.org/external/data.htm, and official country data. a/ Refers to the period January-February 2009 to January-February 2010. b/ Includes Belize, Guyana and Haiti. The participation of exports to other CARICOM members as part of total exports grew from 11% in 1995 to 16% in 2008. Trinidad and Tobago has an increasingly greater share of intrasubregional exports, representing 80% of total intrasubregional exports in 2008, compared to 55% in 1990. The creation of the Regional Development Fund to assist some countries in the transition towards an integrated market of goods and services has been an important achievement. However, the lack of secure funding, inadequate capital fund and the temporary nature of the assistance could hinder reaching its goals. Despite the progress made towards a single market and economy, several obstacles remain: Lack of coordination and harmonization of fiscal and monetary policies Wide use of tariff suspensions and reductions and national exceptions to the common external tariff Obstacles to the full free movement of goods through non-tariff barriers Incomplete free movement of capital and skilled labour The non-binding nature of decisions adopted by CARICOM bodies Failure to define and apply common sectoral policies Slow progress in the harmonization of competition policies and consumer protection regulations Weak technical and administrative capacities of member governments Agreement with the European Union An Economic Partnership Agreement (EPA) with the European Union has been in effect since 2008, providing opportunities for diversifying exports and increasing investment inflows and financial and technical assistance to promote regional integration. CARICOM member countries need to position themselves better to capitalize on the market access provided by the agreement in order to diversify their exports. This repositioning will require taking the fullest advantage of the financial and technical assistance available under the agreement in the aim of developing production capacity, strengthening institutions and improving competitiveness. Export diversification efforts are moving in the right direction, but the process needs to be accelerated. The constraints to export diversification that demand urgent attention are deficient infrastructure, weak institutions and private sector and inadequate expertise. In order to attract foreign direct investment from the European Union, CARICOM needs to improve the business environment through the promotion of macroeconomic stability, the creation of a skilled labour force, the provision of adequate infrastructure and the development of strong and independent institutions.