World economic crises, scarce economic resources and the concentration of wealth

advertisement

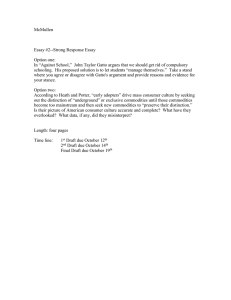

World economic crises, scarce economic resources and the concentration of wealth Summary of article published in CEPAL Review N° 102, December 2010 Author: Ramón López There are three new structural factors underlying the most recent world crisis: i) the fact that many large countries experienced a rapid process of economic growth; ii) the growing shortage of environmental and natural resources (which for the first time is being observed in both poor and rich countries), and iii) the exceptional concentration of wealth and income observed in advanced economies over the past 20 years. As a result of the first two factors, the price of raw materials and commodities has become very sensitive to economic growth. The increasing economic clout of the largest countries that are still at an early stage of development, such as China and India, has led to world economic growth based on the intensive use of commodities and energy. Owing to the second factor (the growing shortage of natural resources worldwide), the supply of commodities continues to become less flexible and less able to meet demand at times when world growth is generating an increasing demand for such products. Consequently, rapid economic world growth is now closely linked to rising commodity prices. Due to the third structural factor (the increasing concentration of wealth), the real economy has become much more sensitive to contractionary monetary and financial policy. This has considerably reduced the opportunity for stable economic growth in periods of contractionary monetary policies. imbalances created by efforts to tackle the crisis, the moderate recovery of the world economy has already retriggered pressure on the demand for commodities and price of some has doubled in the last few quarters. If the world economy continues to recover, commodities may again generate inflationary pressure, which would probably prompt governments to reverse monetary policy and reduce fiscal deficits by raising taxes. These necessary future tax rises will almost definitely affect mainly the middle classes, which will only accentuate the concentration of wealth even further. The net effect of all this is that the initial recovery of growth will probably be smothered. Basic structural factors must be addressed in order to reactivate sustained economic growth: making aggregate demand less dependent on credit, reversing the concentration of wealth and income, promoting rapid environmentally friendly technological change and ensuring that growth relies less on the intensive use of commodities and environmental resources. __________________ The CEPAL Review was created in 1976 under the leadership of Raúl Prebisch. The publication has been a vehicle for the ideas that emerge from ECLAC and the efforts of researchers analysing Latin American and Caribbean reality and discussing approaches, strategies and policies aimed at driving equitable development in the region’s countries. Available online: http://www.eclac.cl/revista/ The author concludes that the combination of these factors could make the world economy very vulnerable to crises, and that this could even hamper the recovery following the current crisis. The crisis did temporarily bring down commodity prices and inflation. However, as the above-mentioned structural factors remain, and given the major fiscal and monetary For questions, please contact ECLAC’s Public Information and Web Services Section. E-mail: dpisantiago@cepal.org ; telephone: (56 2) 210 2040/2149.