The impact of the crisis on Monetary policy Credit Suisse Asian Investment Conference

advertisement

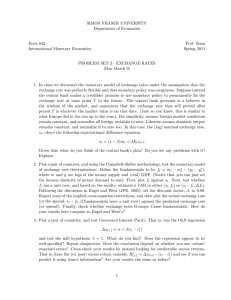

The impact of the crisis on Monetary policy Credit Suisse Asian Investment Conference Hong Kong 25 March 2010 Grant Spencer Reserve Bank of New Zealand Impact of the Crisis on Monetary Policy • Pre-crisis monetary policy • Post-crisis monetary policy • Role of prudential policy The pre-crisis experience • NZ monetary policy tighter than overseas • Domestic impact reduced by inverse yield curve • Pressure on exchange rate through carry trade NZ borrowers took advantage of inverse yield curve Percent As at March 2007 8.5 8.0 NZ 7.5 7.0 6.5 6.0 5.5 US 5.0 4.5 4.0 90 day 1y 2y 3y 4y 5y 7y 10y NZD pressured by carry trade Foreign holdings of NZD securities grew rapidly pre-crisis NZD (Billions) Breakdown of net outstanding NZ dollar fixed income securities held offshore 80 70 Financial Crisis Eurokiwi Bonds Uridashi Bonds 60 50 Corporate Debt (Bonds and CP) Kauris Govt Securities 40 30 20 10 0 Jan-93 Jan-95 Jan-97 Jan-99 Jan-01 Jan-03 Jan-05 Jan-07 Jan-09 Impact of the Crisis on Monetary Policy • Pre-crisis monetary policy • Post-crisis monetary policy • Role of prudential policy Post-crisis expectation • Price stability still the appropriate target • Monetary policy to have more kick • Likely to be reinforced by Prudential policy “Flexible inflation targeting” passed the oil shock test in 2008 Annual % % 6 9 8 5 7 4 6 5 3 4 Policy Target Band 2 3 2 1 Annual CPI inflation 1 Official Cash Rate (RHS) 0 Mar-06 0 Sep-06 Mar-07 Sep-07 Mar-08 Sep-08 Mar-09 Sep-09 Monetary policy impact will be enhanced • Higher bank cost of funds • Reduced asset price expectations • Positive yield curve Bank funding costs up 120-130bp Percent Indicative marginal funding costs relative to the OCR 9 8 7 Cost of funds 20-30 bps over OCR 6 'Extra' deposit costs (55%) 5 Cost of funds 150 bps over OCR Long-term wholesale (15%) Short-term wholesale (30%) 4 3 OCR Note: Weights assume banks are raising funds in proportion to the existing structure of their liabilities. The composition of funding at any particular time will vary from these weights. 2 Aug-07 Nov-07 Feb-08 May-08 Aug-08 Nov-08 Feb-09 May-09 Aug-09 Nov-09 Feb-10 Pushing up lending margins over OCR Demand side factors have also reduced the “neutral” OCR level • Lower house price inflation • Reduced debt appetite • Tax measures mooted on housing NZ yield curve now positive (borrowers have nowhere to hide) Percent 8 March 2007 7 6 5 Current 4 3 2 90 day 180 day Bank bill rates 1yr 2yr 3yr 4yr Swap rates 5yr 7yr 10yr Impact of the Crisis on Monetary Policy • Pre-crisis monetary policy • Post-crisis monetary policy • Role of prudential policy Monetary policy to be reinforced by prudential • New prudential liquidity policy a stabilising force • RB exploring other macro-prudential options • Caution warranted on macro-prudential New prudential liquidity policy (starts 1 April 2010) Liquid assets Stable funding • One week mismatch ratio to • Core funding ratio: at least be met by primary liquids 65%, moving up to 75% by mid 2012 • One month mismatch ratio to be met by primary and secondary liquids • Secondary liquids include bank paper up to specified limits • Core funding = customer funding (weighted by deposit size) plus market funding > 1 year to maturity Core funding ratio has been cyclical Core funding ratio (% of loans and advances) A cautious approach to macro-prudential • Few realistic options for active management • Need to keep prime purpose clear: Financial system stability • Potential to reinforce monetary policy on upcycle (asymmetric) • Potential efficiency costs if pursued too aggressively End of presentation