2009 Job Summit World Recession & How We Cope Alan Bollard, Governor

advertisement

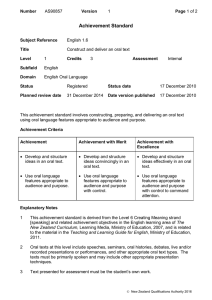

2009 Job Summit World Recession & How We Cope Alan Bollard, Governor Reserve Bank of New Zealand 27 February 2009 The biggest destruction of global wealth ever? Value loss (est. $US) Credit-related losses $2 trillion Equity Markets $30 trillion Housing $4 trillion Lost output $3 trillion THE RESERVE BANK OF NEW ZEALAND Trading partner growth slows QPC 2.0 Asian Crisis 1.5 Financial Crisis Tech Sars Bubble 1.0 0.5 0.0 97 98 99 00 01 02 03 04 05 06 07 08 09 -0.5 -1.0 -1.5 THE RESERVE BANK OF NEW ZEALAND Trading partner growth slows QPC 2.0 Asian Crisis 1.5 Financial Crisis Tech Sars Bubble 1.0 0.5 0.0 97 98 99 00 01 02 03 04 05 06 07 08 09 -0.5 -1.0 -1.5 THE RESERVE BANK OF NEW ZEALAND Lower growth world must adjust Consumption, currencies Reserves Savings, exports Currencies THE RESERVE BANK OF NEW ZEALAND New Zealand has strengths… • • • • • • Past strong growth, low unemployment Flexible product and labour markets Floating exchange rate & hedging Responsive monetary policy Strong government accounts Sound banking system THE RESERVE BANK OF NEW ZEALAND …but we don’t escape unscathed GDP 104 102 Australia 100 US 98 UK 96 Japan 94 Dec-07 Dec-08 Dec-09 Dec-10 THE RESERVE BANK OF NEW ZEALAND …but we don’t escape unscathed GDP 104 102 Australia 100 New Zealand US 98 UK 96 Japan 94 Dec-07 Dec-08 Dec-09 Dec-10 THE RESERVE BANK OF NEW ZEALAND Domestic credit growth APC 25 20 Agriculture Business 15 10 Household 5 0 2004 2005 2006 2007 2008 THE RESERVE BANK OF NEW ZEALAND 2009 Intended Investment & Employment Net % 30 Employment 20 10 0 Investment -10 -20 -30 -40 -50 00 01 02 03 04 05 06 07 08 THE RESERVE BANK OF NEW ZEALAND How we cope • New Zealand has some strengths but also vulnerabilities • We will play our role • Banks must also play a key role • You will all be affected. We want to hear your ideas…. THE RESERVE BANK OF NEW ZEALAND