Security Market Structures Markets and Participants Goals of Participants Basics of Portfolio Theory

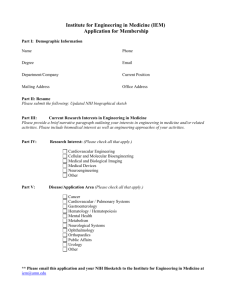

advertisement

Security Market Structures Markets and Participants Goals of Participants Basics of Portfolio Theory 1 FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Markets and Participants Overview Describe interactions of buyers and sellers within a securities market Identify different market structures and mechanisms for participant interaction FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Markets and Participants Security – Claim on issuer’s future income – Stocks vs. Bonds Securities Market – Group of entities trading securities – Traditional NYSE, CBOT, CME – Electronic NASDAQ, IEM FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Markets and Participants Securities Market Structure – Primary New securities issued – Secondary Previously issued securities – Auction vs Continuous – Central Exchange vs Over-the-Counter FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Markets and Participants Bid – Offer to buy – Quoted bid is best offer to buy Ask – Offer to sell – Quoted ask is best offer to sell FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Markets and Participants Market Orders – Market Bid Immediate purchase at lowest ask price – Market Ask Immediate sale at highest bid price FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Markets and Participants Limit Orders – Limit Bid Offer to purchase security at a specified price for a specified time period. Trade is executed only if an equal or lower ask price is offered. – Limit Ask Offer to sell security at a specified price for a specified time period. Trade is executed only if an equal or higher bid price is offered. FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Markets and Participants IEM Example NYSE Continuous - 7 hours/5 days Secondary Market Centralized Exchange IEM Continuous - 24 hours/7 days Primary and Secondary Market Centralized Exchange FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Markets and Participants IEM Example Iowa Electronic Markets STOCK PRICE CHANGE Contract Bid$ Ask$ MS090bH 0.335 0.354 MS090bL 0.635 0.665 Trader: Mishkin Cash$ 4.294 | PORTFOLIO Last$ | Holdings #Bids #Asks 0.354 | 15 1 2 0.635 | 12 1 2 The “market” consists of all traders with accounts on the IEM FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Goals of Participants Overview Borrow or Loan (Invest) Funds Speculate on Price Movements Hedge Arbitrage FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Goals of Participants Securities markets channel funds from lenders to borrowers Securities markets are a source of funds for borrowers Securities markets provide an opportunity to invest for lenders FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Goals of Participants Some traders try to earn profits based on short-term fluctuations in securities prices FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Goals of Participants Arbitrage – Profit from price differentials from two securities with the same stream of payoffs. Arbitrageurs seek profits – “Exploit” arbitrage opportunities Arbitrageurs help force prices “into line” FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Goals of Participants Hedge (v) – To protect against risk Hedge (n) – Purchase of a security to offset the potential loss of another security FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Goals of Participants Example: Arbitrage Iowa Electronic Markets STOCK PRICE CHANGE Contract Bid$ Ask$ MS090bH 0.315 0.325 MS090bL 0.645 0.665 Trader: Fred Cash: $ 4.294 | PORTFOLIO Last$ | Holdings #Bids #Asks 0.354 | 15 0 0 0.635 | 12 0 0 1. Purchase both contracts at market (ask prices of $0.325 + $0.665 = $0.99) 2. Sell bundle for $1.00 3. Purchases will drive up price FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Goals of Participants Example: Hedge Iowa Electronic Markets STOCK PRICE CHANGE Contract Bid$ Ask$ MS090bH 0.315 0.325 MS090bL 0.645 0.665 1. Trader: Fred Cash: $ 4.294 | PORTFOLIO Last$ | Holdings #Bids #Asks 0.354 | 1 0 0 0.635 | 1 0 0 No exposure Buy both contracts, hold to payoff Payoff = $1.00 either outcome FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Goals of Participants Example: Hedge Iowa Electronic Markets STOCK PRICE CHANGE Contract Bid$ Ask$ MS090bH 0.315 0.325 MS090bL 0.645 0.665 2. Trader: Fred Cash: $ 4.294 | PORTFOLIO Last$ | Holdings #Bids #Asks 0.354 | 0 0 0 0.635 | 1 0 0 Exposure - holdings 1 MS090bL Payoff if low = $1.00 Payoff if high = $0 Hedge by purchasing 1 MS090bH for $0.325 Payoff if low = $0.675 Payoff if high = $0.675 FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Factors affecting asset demand – – – – Relative return Relative risk Liquidity Income FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Basic Calculations Capital Gain Percentage Change (%) Selling price (V1) less purchase price (V0) [(V1 - V0) / V0] 100 Return Sum of capital gains and other payments (P) during holding period as fraction of purchase price V0 [(V1 - V0) / V0 + P/ V0] 100 FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Risk Uncertainty of future return Liquidity Ease and cost of selling asset for cash FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Relative Return – http://www.biz.uiowa.edu/iem/markets/compd ata/compfund.html Average Return Std. Dev AAPL 2.42% 14.84% IBM 3.64% 10.31% MSFT SP500 T-Bills 4.72% 1.75% 0.35% 8.22% 3.82% 0.06% FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Liquidity – Ease and cost of selling asset for cash – Example: compare two assets 3-month certificate of deposit (CD) Savings deposit held for 3 months – The CD is less liquid because must pay a penalty to withdraw money early FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Evaluating Uncertain Returns Pool example – 100 people each pay $1 to participate in a pool. Each places their name in the hat. A single name is drawn. That person receives the pool of $100. Possible outcomes – win $100 – win $0 FALL 2000 Probabilities of outcomes – win $100 - 1/100 – win $0 - 99/100 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Evaluating Uncertain Returns Pool example (continued) – Expected Value, EV EV = (P$100 × $100) + (P$0 × $0) EV = (1/100 × $100) + (99/100 × $0) EV = $1 – Fair bet EV = price – To participate in pool, pay $1. EV of participation = $1. Fair bet. Would you participate? FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Evaluating Uncertain Returns Expected Value is a way to evaluate an uncertain payoff. How much would you be willing to pay for a 1/100 chance to win $1000? – Expected value is $10. How much would you be willing to pay for a 1/100 chance of winning $100,000? – Expected value is $1,000 FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Evaluating Uncertain Returns Why were fewer willing to play for $100,000 than for $100? – Both were fair bets in that the price equaled the expected value. Risk Averse - weigh losses more heavily than gains. Risk averse traders must be compensated to take on risk (pay less than expected return). FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Evaluating Uncertain Returns Risk averse traders must be compensated to take on risk. The expected return is the expected value of uncertain returns Because traders are risk averse, they will pay less for an asset than its expected return. FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Evaluating Uncertain Returns Suppose two assets with same expected value of $25 – Asset 1 pays $50 with probability 1/2 $0 with probability 1/2 – Asset 2 pays $30 with probability 1/2 $20 with probability 1/2 Which would you prefer? FALL 2000 EDITIONis LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Which more risky? Basics of Portfolio Theory Evaluating Uncertain Returns Risk concerns the variation in outcomes. Demand for assets decreases with risk. FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Basics of Portfolio Theory Evaluating Uncertain Returns Standard Deviation is a measure of risk. – Measures how close the returns are to the expected returns. Data are monthly returns and standard deviations from April 1995 to October 1999 Average Return Std. Dev AAPL IBM MSFT SP500 T-Bills 2.42% 3.64% 4.72% 1.75% 0.35% 14.84% 10.31% 8.22% 3.82% 0.06% FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Monthly Returns for Apple and IBM, Jan. 1997 to Oct. 1999 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% -10.00% -20.00% -30.00% -40.00% FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/ Apple IBM Summary Markets come in many shapes and sizes Trading strategies vary Demand for an asset is related to return, risk, liquidity and income FALL 2000 EDITION LAST EDITED ON 9/00 WWW.BIZ.UIOWA.EDU/IEM/ASSIGNMENTS/