Using the Iowa Electronic Markets in Macroeconomics Predicting Federal Reserve Policy

advertisement

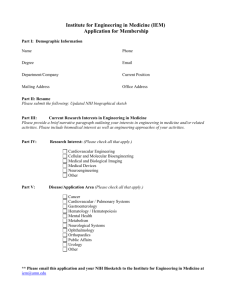

Using the Iowa Electronic Markets in Macroeconomics Predicting Federal Reserve Policy Developed by: Scott Simkins - North Carolina A&T State University Vineeta Hingorani - Southern University at Baton Rouge Jonathan Ikoba - Scott Community College FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 1 Economic Policy and the Economy: Policy Goals Maintain low inflation Maintain low unemployment rates Promote steady economic growth Maintain stable interest rates How? Through monetary policy FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 2 Economic Policy and the Economy: Economic Growth with Low Inflation By using its monetary policy tools, the Federal Reserve strives to keep the economy growing with low inflation. To do this, it must offset “economic shocks” that affect the economy. FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 3 Economic Policy and the Economy: Offsetting Shifts in AD Event: increase in aggregate demand Economic response – price level rises and real GDP rises Federal Reserve policy response: – Raise interest rate to maintain price stability – Result: output back to original level, price level remains stable FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 4 Economic Policy and the Economy: Offsetting Shifts in AD 1. Increase in AD FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 5 Economic Policy and the Economy: Offsetting Shifts in AD 1. Increase in AD 2. Federal Reserve Raises Interest Rates FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 6 Economic Policy and the Economy: Offsetting Shifts in AD Event: decrease in aggregate demand Economic response – price level falls and real GDP falls Federal Reserve policy response: – Reduce interest rate to maintain full employment – Result: output and price level back to original level FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 7 Economic Policy and the Economy: Offsetting Shifts in AD 1. Decrease in AD 2. Federal Reserve Lowers Interest Rates FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 8 Economic Policy and the Economy: Offsetting Shifts in SRAS Event: decrease in aggregate supply Economic response – price level rises and real GDP falls Federal Reserve policy response: – Reduce interest rate to maintain full employment – Result: output returns to potential GDP but price level rises further FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 9 Economic Policy and the Economy: Offsetting Shifts in SRAS 1. Decrease in SRAS 2. Federal Reserve lowers interest rate FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 10 Economic Policy and the Economy: Offsetting Shifts in SRAS Event: decrease in aggregate supply Economic response – price level rises and real GDP falls Federal Reserve policy response: – Raise interest rate to maintain price stability – Result: price level returns to original level but output falls further FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 11 Economic Policy and the Economy: Offsetting Shifts in SRAS 1. Decrease in SRAS 2. Federal Reserve raises interest rate FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 12 Economic Policy and the Economy: Self-regulating economy? Event: increase in aggregate demand Economic response – price level rises and real GDP rises Federal Reserve policy response: – Do nothing – Result: output returns to original level but price level rises further FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 13 Economic Policy and the Economy: Self-Regulating Economy? 1. Increase in AD 2. Federal Reserve does nothing FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 14 Economic Policy and the Economy: Self-regulating economy? Questions: What happens when AD falls and the Federal Reserve responds by doing nothing? What happens when SRAS falls and the Federal Reserve responds by doing nothing? Summary: when should the Federal Reserve actively intervene in the economy? FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 15 Economic Policy and the Economy: The “New Economy” In recent years, labor productivity has been increasing, helping to keep inflation low and generating economic growth. What is the role of the Federal Reserve in an economy experiencing significant increases in productivity? FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 16 Role of the Federal Reserve: Policy Goals and Objectives Maintain low inflation Maintain low unemployment rates Promote steady economic growth Maintain stable interest rates To meet its policy goals, the Federal Reserve uses changes in the federal funds rate as its primary monetary policy tool. FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 17 Role of the Federal Reserve: Policy Instrument: The Fed Funds Rate The fed funds (interest) rate is determined in the federal funds market The Federal Reserve affects the supply of reserves in the federal funds market through open market operations, changes in the discount rate, and changes in the reserve requirement. FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 18 Role of the Federal Reserve: FOMC Meetings FOMC consists of the Board of Governors of the Federal Res. and 5 Fed. Reserve district bank presidents Led by Federal Reserve Chairman (Greenspan) Meets approximately every 6 weeks Determines changes in monetary policy; in particular, changes in the “target level” of the federal funds rate. FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 19 Role of the Federal Reserve: Effects of Federal Reserve Policy Changes in the fed funds rate affect a wide variety of interest rates in the economy. In turn, changes in interest rates affect business and consumer spending. Aggregate spending levels affect inflation, unemployment, and output growth. In addition, changes in interest rates also affect stock market growth, which in turn can affect consumer and business spending. FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 20 Role of the Federal Reserve: What can Fed Policy Do? Some economists argue that the Fed’s goal should simply be to keep inflation low; that in the long run, real rather than monetary factors, will determine output and employment levels. In reality, the Federal Reserve currently looks at a wide variety of economic data before implementing changes in monetary policy. FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 21 Predicting Federal Reserve Policy: Summarizing Current Economic Conditions Federal Reserve Beige Book – Summary of economic conditions around the country; published just prior to FOMC meetings http://www.bog.frb.fed.us/FOMC/BeigeBook/2000/ Other Web sources – The Dismal Scientist http://www.dismal.com/ – BLS Economy at a Glance http://stats.bls.gov/eag/eag.map.htm – Economic Statistics Briefing Room http://www.whitehouse.gov/fsbr/esbr.html FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 22 Predicting Federal Reserve Policy: Recent Federal Reserve Behavior Main policy objective: keep inflation low Over the past year (Aug., 1999 - August, 2000), Federal Reserve has been raising the target fed funds rate due to concerns about tight labor markets and future inflation. Unemployment rate hit 30-year record low in early 2000, productivity is increasing, and output is rising, but inflation remains low. FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 23 Predicting Federal Reserve Policy: Forecasting Strategies When predicting future Federal Reserve policy, you must ask: – What are the Fed’s objectives? – What is current state of the economy? – What must the Fed do to achieve its objectives, given the current state of the economy? Requires: constant monitoring of economic activity in the economy FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 24 Predicting Federal Reserve Policy: An Example Using the IEM Example: November, 1999 FedPolicy market Daily IEM contract prices are used to illustrate the relationship among economic conditions, Fed policy objectives, and IEM contract prices Contracts in this market and their associated payoff rules are: Contract Name Contract Description / Liquidation Value Payoff Rules FRup1199 FRsame1199 FRdown1199 $1.00 if the fed-funds rate target rises; $0 otherwise $1.00 if the fed-funds rate target remains unchanged; $0 otherwise $1.00 if the fed-funds rate target falls; $0 otherwise FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 25 IEM FedPolicy Contract Prices - Nov. 1999 1.00 Contract Price ($) 0.80 0.60 FRup1199 0.40 0.20 FRsame1199 FRdown1199 25-Oct 26-Oct 27-Oct 28-Oct 29-Oct 30-Oct 31-Oct 1-Nov 2-Nov 3-Nov 4-Nov 5-Nov 6-Nov 7-Nov 8-Nov 9-Nov 10-Nov 11-Nov 12-Nov 13-Nov 14-Nov 15-Nov 16-Nov 0.00 Date FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 26 IEM FedPolicy Contract Prices - Nov. 1999 1.00 Contract Price ($) 0.80 0.60 November 5 Employment Report Released Unemployment rate declines to 29year low but pressure on wages remains tame. The price of FRsame1199 rose with the new economic information. FRup1199 0.40 0.20 FRsame1199 FRdown1199 25-Oct 26-Oct 27-Oct 28-Oct 29-Oct 30-Oct 31-Oct 1-Nov 2-Nov 3-Nov 4-Nov 5-Nov 6-Nov 7-Nov 8-Nov 9-Nov 10-Nov 11-Nov 12-Nov 13-Nov 14-Nov 15-Nov 16-Nov 0.00 Date FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 27 IEM FedPolicy Contract Prices - Nov. 1999 November 10 Producer Price Index Report Released Overall producer prices fall by 0.1% but core rate of inflation was up 0.3%, higher than expected. 1.00 Contract Price ($) 0.80 0.60 FRup1199 Notice how the price of FRsame1199 dropped with the new economic information. 0.40 0.20 FRsame1199 FRdown1199 25-Oct 26-Oct 27-Oct 28-Oct 29-Oct 30-Oct 31-Oct 1-Nov 2-Nov 3-Nov 4-Nov 5-Nov 6-Nov 7-Nov 8-Nov 9-Nov 10-Nov 11-Nov 12-Nov 13-Nov 14-Nov 15-Nov 16-Nov 0.00 Date FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 28 IEM FedPolicy Contract Prices - Nov. 1999 1.00 Contract Price ($) 0.80 0.60 FRup1199 The FRsame1199 and FRup1199 contracts remained near $.50 until the FOMC announced its rate hike on Nov. 16 0.40 0.20 November 12 Mixed economic signals makes predicting Fed policy at upcoming FOMC meeting a "tough call" FRsame1199 FRdown1199 25-Oct 26-Oct 27-Oct 28-Oct 29-Oct 30-Oct 31-Oct 1-Nov 2-Nov 3-Nov 4-Nov 5-Nov 6-Nov 7-Nov 8-Nov 9-Nov 10-Nov 11-Nov 12-Nov 13-Nov 14-Nov 15-Nov 16-Nov 0.00 Date FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 29 IEM FedPolicy Contract Prices - Nov. 1999 1.00 Contract Price ($) 0.80 0.60 November 5 Employment Report Released Unemployment rate declines to 29year low but pressure on wages remains tame. November 10 Producer Price Index Report Released Overall producer prices fall by 0.1% but core rate of inflation was up 0.3%, higher than expected. FRup1199 0.40 FRsame1199 November 12 Mixed economic signals makes predicting Fed policy at upcoming FOMC meeting a "tough call" 25-Oct 26-Oct 27-Oct 28-Oct 29-Oct 30-Oct 31-Oct 1-Nov 2-Nov 3-Nov 4-Nov 5-Nov 6-Nov 7-Nov 8-Nov 9-Nov 10-Nov 11-Nov 12-Nov 13-Nov 14-Nov 15-Nov 16-Nov 0.20 IEM contract prices respond as FRdown1199 new economic information is 0.00 released. The contract prices reflect the probability that the Fed will change its policy stance at the specified FOMC Date FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM meeting. www.biz.uiowa.edu/iem/assignments 30 Predicting Federal Reserve Policy: Summary The FOMC uses changes in the federal funds target rate to promote its policy goals of low inflation, high employment, and steady economic growth. Accurately predicting Federal Reserve policy changes requires (1) understanding Fed monetary policy objectives, and (2) keeping abreast of current economic conditions. FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 31 Predicting Federal Reserve Policy: Summary - continued Contract prices in the IEM FedPolicy market react quickly to new information about the state of the economy. FALL 2000 EDITION LAST EDITED ON 9/00 Predicting Federal Reserve Policy using the IEM www.biz.uiowa.edu/iem/assignments 32