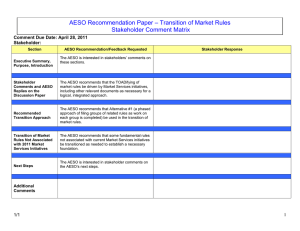

– AESO Response to Stakeholder Comments Comment Matrix Supply Surplus Discussion Paper

advertisement