Managing Program Income Desk Procedures Page 1 of 49

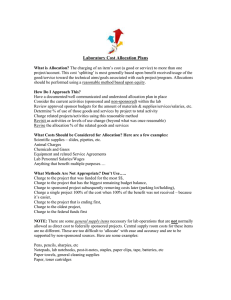

advertisement

Managing Program Income Desk Procedures Page 1 of 49 Table of Contents Overview ........................................................................................................................................................ 3 Roles and Responsibilities Applicable to Business Process .......................................................................... 4 Financial Policies and Procedures ................................................................................................................. 5 Program Income Oversight Reports Review ................................................................................................. 6 Roles Applicable to Sub Process ............................................................................................................... 6 Run the Program Income Oversight Report UM_FAR_PROG_INCOME_DEPT_DEP and review ... 7 Run Program Income Oversight Report UM_FAR_PROG_INCOME_BI and review ........................ 9 Run Program Income Oversight Report UM_FAR_PROG_INCOME_JRNL_ENT and Review ..... 11 Review Terms and Conditions for Program Income ................................................................................... 13 Roles Applicable to Sub Process ............................................................................................................. 13 Review Grants for Program Income Terms and Conditions ................................................................ 14 Notify GA of Missing Grants Terms and Conditions for Program Income ........................................ 15 Update Grants Terms and Conditions for Program Income ................................................................ 15 Determine if Program Income is Reportable or Non-Reportable ........................................................ 15 Processing Non-Reportable Program Income .............................................................................................. 16 Roles Applicable to Sub Process ............................................................................................................. 16 Create GL Journal to move Program Income to Non-Sponsored Program ......................................... 17 Notification to Department of GL Journal to Non-Sponsored Program .............................................. 21 Processing Reportable Program Income ...................................................................................................... 22 Roles Applicable to Sub Process ............................................................................................................. 22 Add Award Modification Notes for Program Income ......................................................................... 23 Processing Program Income Match Method ........................................................................................ 26 Processing Program Income Additional Method (Add/Deduct) .......................................................... 29 Processing Program Income Deduct Method ...................................................................................... 36 Understanding the Program Income Process as it applies to Rate Based Contracts .................................... 44 Rate Based Contracts - Pricing of Program Income Revenue transactions ......................................... 44 Rate Based Contracts – Invoicing billable rows including Prog Income ............................................ 45 Rate Based Contracts – Budget Adjustments: When and Why ........................................................... 46 Rate Based Contracts – Billing Limit Adjustments: When and Why................................................. 46 Rate Based Contracts – Reporting Program Income ........................................................................... 46 Rate Based Contracts – Accounting and Revenue Recognition Prog Income..................................... 47 Understanding the Program Income Process as it applies to Amount Based Contracts .............................. 48 Amount Based Contracts – Invoicing/Billing Event Adjustments Prog Income ................................. 48 Amount Based Contracts – Budget adjustments: When and Why ...................................................... 49 Amount Based Contracts – Reporting Program Income...................................................................... 49 Amount Based Contracts – Revenue Recognition w/Prog Income ..................................................... 49 Page 2 of 49 Overview The Program Income Business Process incorporates delivered Financial System functionality in order to create and collect Program Income revenue transactions into the Project Costing Proj_Resource table for reporting, revenue recognition and, when needed, to utilize billable transactions during invoicing (spend out Program Income prior to invoicing Sponsor). Depending on the Contract product used, (Rate Based vs. Amount Based) will determine the effect these revenue transactions will have on revenue recognition and invoicing. This document will walk the user through all of the sub-processes that are associated with the Managing Program Income Business Process. Program Income Oversight Reports Review Review Grants Terms and Conditions for Program Income Update Grants Terms and Conditions for Program Income Processing Non-Reportable Program Income Processing Reportable Program Income Understanding the Program Income Business Process as it relates to Rate Based Contracts Understanding the Program Income Business Process as it relates to Amount Based Contracts Frequency Module/Tables Documents Used Approval Points Daily Grants and General Ledger NOA and Program Income Oversight Reports NA Page 3 of 49 Roles and Responsibilities Applicable to Business Process Program Income Oversight Reports Review – AR Accountant Review Grants Terms and Conditions for Program Income – AR Accountant Update Grants Terms and Conditions for Program Income – Grant Administrator/AR Accountant Processing Non-Reportable Program Income – AR Accountant Processing Reportable Program Income – AR Accountant Understanding the Program Income Business Process as it relates to Rate Based Contracts – AR Accountant Understanding the Program Income Business Process as it relates to Amount Based Contracts – AR Accountant Page 4 of 49 Financial Policies and Procedures TBD Page 5 of 49 Program Income Oversight Reports Review Program Income will be deposited to the Sponsored Program Income Unapplied Cash Account. This account will be reconciled and cleared by Sponsored Financial Reporting (SFR). Three specific Program Income Oversight queries will be used to monitor the activity of this account. Portion of Business Process Flow covered in this section Roles Applicable to Sub Process AR Accountant Page 6 of 49 Run the Program Income Oversight Report UM_FAR_PROG_INCOME_DEPT_DEP and review Detailed description: This report will be used by Sponsored Financial Reporting (SFR) to identify department deposit activity that was recorded against the Sponsored Program Income Unapplied Cash account. After determining what type of program income the deposit represents, SFR will create a GL Journal to apply the program income deposits to a Sponsored Project (if, applicable) and credit the program income revenue account. This report deals exclusively with program income that originates in Financial System as departmental deposits. The report will contain the fund, deptid, project number, deposit number, preparer name and phone number. This process is accomplished by accessing the Financial System Query Manager page, selecting and running the query UM_FAR_PROG_INCOME_DEPT_DEP. Navigation: Reporting Tools > Query > Query Manager Query Manager Search Page Field Values and Search Criteria Descriptions for the Query Manager Search Page Field Query Name Values Entered Description UM_FAR_PROG_INCOME_DEPT_DEP This field is the name given to the query. User can enter the first portion of the name to display the query in a list. Page 7 of 49 1. Enter the Search Criteria then click the “Search” pushbutton. If a portion of the query name is used then a list of queries meeting the criteria will display, run from list query UM_FAR_PROG_INCOME_DEPT_DEP. 2. Click the Run to HTML OR the Run to Excel hyperlink to run the query. 3. Enter the date prompts for the query – From Date: and To Date: and then click the “view results” pushbutton. 4. At the Excel Pop up to open file, click “Open”. 5. Print/Review query results for continued processing in later steps. In review, make sure a Project Number is displayed for each Deposit ID in the query. If a Project number is missing contact the Preparer for the Project Number. Query Results Note: Query will also return Fund and DeptID (Query not updated at time of completing this document. Page 8 of 49 Run Program Income Oversight Report UM_FAR_PROG_INCOME_BI and review Detailed description: This report will be used by Sponsored Financial Reporting (SFR) to identify non-sponsored billing activity against the Sponsored Program Income Unapplied Cash account. After determining what type of program income the invoice represents, SFR will create a GL Journal to apply the program income to a Sponsored Project (if, applicable) and credit the program income revenue account. This report deals exclusively with program income that originates in the Financial System Billing module. The report will contain the fund, deptid, project number, project description, invoice number and user name. This process is accomplished by accessing the Financial System Query Manager page, selecting and running the query UM_FAR_PROG_INCOME_BI. Navigation: Reporting Tools > Query > Query Manager Query Manager Search Page Field Values and Search Criteria Descriptions for the Query Manager Search Page Field Query Name Values Entered Description UM_FAR_PROG_INCOME_BI Page 9 of 49 This field is the name given to the query. User can enter the first portion of the name to display the query in a list. 1. Enter the Search Criteria then click the “Search” pushbutton. If a portion of the query name is used then a list of queries meeting the criteria will display, run from list query UM_FAR_PROG_INCOME_BI. 2. Click the Run to HTML OR the Run to Excel hyperlink to run the query. 3. Enter the date prompts for the query – From Date: and To Date: and then click the “view results” pushbutton. 4. At the Excel Pop up to open file, click “Open”. 5. Print/Review query results for continued processing in later steps. In review, make sure a Project number is displayed for each Invoice number in the query. If a Project number is missing, research using the Invoice number to determine the preparer of the invoice and contact the preparer for the Project number. Note: Query will also return Fund and DeptID (Query not updated at time of completing this document. Query Results Page 10 of 49 Run Program Income Oversight Report UM_FAR_PROG_INCOME_JRNL_ENT and Review Detailed description: This report will be used by Sponsored Financial Reporting (SFR) to identify on-line journal entries against the Sponsored Program Income Unapplied Cash account. After determining what type of program income the entry represents, SFR will create a GL Journal to apply the program income to a Sponsored Project (if, applicable) and credit the program income revenue account. This report deals exclusively with program income that originates in General Ledger on-line journal entry. The report will contain the journal id, user id, project id, fund, deptID, project description, journal amount, journal line reference and journal date. This process is accomplished by accessing the Financial System Query Manager page, selecting and running the query UM_FAR_PROG_INCOME_JRNL_ENT. Navigation: Reporting Tools > Query > Query Manager Query Manager Search Page Field Values and Search Criteria Descriptions for the Query Manager Search Page Field Query Name Values Entered Description UM_FAR_PROG_INCOME_JRNL_ENT Page 11 of 49 This field is the name given to the query. User can enter the first portion of the name to display the query in a list. 1. Enter the Search Criteria then click the “Search” pushbutton. If a portion of the query name is used then a list of queries meeting the criteria will display, run from list query UM_FAR_PROG_INCOME_JRNL_ENT. 2. Click the Run to HTML OR the Run to Excel hyperlink to run the query. 3. Enter the date prompts for the query – From Date: and To Date: and then click the “view results” pushbutton. 4. At the Excel Pop up to open file, click “Open”. 5. Print/Review query results for continued processing in later steps. In review, make sure a Project number is displayed for each Journal ID in the query. If a Project number is missing contact the “user” for the Project number. Note: Query will also return Fund and DeptID (Query not updated at time of completing this document. Query Results Page 12 of 49 Review Terms and Conditions for Program Income Using the Project number from the Program Income queries, the SFR AR Accountant role will review the Award Profile page – Terms Tab for the Program Income Terms and Conditions; request assistance from the Grant Administrator (GA) when the Program Income Terms are missing the Terms, update the Terms per GA’s direction and determine if the program Income is Reportable vs. Non-Reportable. Portion of Business Process Flow covered in this section Roles Applicable to Sub Process AR Accountant Grant Administrator Page 13 of 49 Review Grants for Program Income Terms and Conditions Detailed description: The AR Accountant role will access the Award Profile Terms Tab to obtain details of the Program Income Terms and Conditions for the project. The Program Income Terms and Conditions, include the following: (NOTE: A Non-Reportable Program Income Term and Condition will be added to list of terms) Navigation: Grants > Awards > Award Profile 1. Enter the Project number from the Program Income Oversight into the selection criteria of the Award Profile Search Page to access the Award for which the project is related and click the “Search” pushbutton. 2. At the Award Profile Page, select the Terms Tab, and then click “View All” on the header of the Detail section. 3. Search for Terms and Conditions that begin with a “PIN...” and note the details on the print out of the Program Income Oversight queries for continued processing in later steps. Page 14 of 49 Notify GA of Missing Grants Terms and Conditions for Program Income Detailed description: If the Terms and Conditions for Program Income are missing per the review of the Award Profile Terms Tab, the AR Accountant role will contact (via email) the Grant Administrator of the Award, to provide the missing Program Income Terms and Conditions. 1. Make a note on the print out of the Program Income Oversight queries that an email has been sent to the Grant Administrator to provide the Program Income Terms. Update Grants Terms and Conditions for Program Income Detailed description: The Grant Administrator will review the Notice of Award (NOA) for the Program Income Terms and Conditions and will communicate these terms to the AR Accountant role (via email). The AR Accountant role will then update these Terms and Conditions on the Award Profile – Terms Tab. See the Award Setup Desk Procedures “Define Terms and Conditions” to update the Program Income Terms and Conditions. Determine if Program Income is Reportable or Non-Reportable Detailed description: The Terms and Conditions for the Award will indicate if the Program Income is Reportable or Non-Reportable. Continue as follows: If the Terms and Conditions indicate that the Program income is “Non-Reportable”, refer to the “Processing Non-Reportable Program Income” sub process within these Desk Procedures. If the Terms and Conditions indicate that the Program income is “Reportable”, refer to the “Processing Reportable Program Income” sub process within these Desk Procedures. Page 15 of 49 Processing Non-Reportable Program Income Since Financial Reporting is not required for Non-reportable program income, the income is deposited to a Non-Sponsored account; it therefore loses its tie to the project. Non-reportable Program Income is handled by External Sales or PTM. If Program Income is Non-Federal and award terms are silent regarding program income, it is considered non-reportable. Portion of Business Process Flow covered in this section Roles Applicable to Sub Process AR Accountant Page 16 of 49 Create GL Journal to move Program Income to Non-Sponsored Program Detailed description: The AR Accountant role will contact the department for a valid NonSponsored Chart of Account (COA) string to record the Non- Reportable Program Income. This COA string will consist of the Fund, Dept, and Program. The AR Accountant role will then create a GL Journal to debit the Sponsored Program Income Unapplied Cash account and credit a program income revenue account using the Non-Sponsored chartfields. Navigation: General Ledger > Journals > Create/Update Journal Entries Add A New Value Tab Field Values and Description for the Create/Update Journal Entries – Add a New Value Field Values Entered Description Business Unit Enter UMN01 This field is the Business Unit value for General Ledger This field is required. The U of M General Ledger Business Unit is “UMN01”. Journal ID Defaults “Next” This is the Journal ID that will be assigned to the Journal; keep the default of “Next” and the system will assign the next available Journal ID. Journal Date Defaults with This is the date of the Journal; keep default of Today’s Today’s Date Date. 1. Enter the “Add a New Value” values then click the “Add” pushbutton and the Journal Header page will be displayed. Page 17 of 49 Journal Header Field Values and Description for the Journal Header page Field Values Entered Description Ledger Group Actuals This field is the Ledger Group for which the entry will be recorded. Source ONN This is the source of the Journal Entry – ONN – Using this Source will not require a Certified Approver. Journal Class 10010 This is the Sponsored Financial Reporting DeptID. 1. Enter the “Journal Header” values then click the “Lines” tab and the Journal Lines page will be displayed. Page 18 of 49 Journal Lines Field Values and Description for the Journal Lines page Field Values Entered Description Fund Enter valid Fund This is the Fund value for the Journal Line; Sponsored Fund values begin with 3XXX. This is required. DeptID Enter DeptID This is the DeptID value for the Journal Line. This is required Program Enter Program; if This is the Program value for the Journal Line; required applicable for Non-Sponsored or Cost Share Journal Lines. PC Bus Unit Blank This is the PC Bus Unit value for the Journal Line; This is required for Sponsored Journal Lines (UMSPR) Project Blank This is the Project value for the Journal Line; This is required for Sponsored Journal Lines. Activity Blank This is the “Project” Activity value; this value will always be “1” for Sponsored Journal Lines ONLY or Blank for Non-Sponsored Journal lines. Analysis Type Blank This is the Analysis Type value and is required for Sponsored Journal Lines ONLY. Account Enter Account This is the Account value for the Journal Line; this is the COA Level 3 Actuals account value. Amount Enter Amount This is the Amount of the Journal Line. Reference Project ID – Do This is the Journal Line Reference field – enter the not enter on Non- Project Number – Only on the Journal Line for the Sponsored line Sponsored Program Income Unapplied Cash account. Page 19 of 49 1. Enter Journal Line 1; enter values to debit the Sponsored Program Income Unapplied Cash account using an appropriate chartfield string. The required chartfields string is Fund, DeptID, and Account. (Include the Project ID in the Journal Line Ref Field) 2. Enter Journal Line 2; enter values to credit a Program Income Revenue account using an appropriate Non-Sponsored chartfield string. The required chartfields string is Fund, DeptID, Program and Account. 3. In the “Process” drop down box at the top of page select “Edit Journal”; then click the process pushbutton to edit the journal. 4. Once the edit process is complete, verify that the Journal Status and Budget Status is “V”. 5. In the “Process” drop down box at the top of page select “Submit Journal”; then click the process pushbutton to submit the journal for SFR workflow approval. Click “OK” at the warning. Page 20 of 49 Notification to Department of GL Journal to Non-Sponsored Program Detailed description: The AR Accountant role will notify the department via email that the program income was booked to a program income revenue account using Non-Sponsored chartfield values; External Sales/PTM will be cc: on the email. Page 21 of 49 Processing Reportable Program Income In processing Reportable Program Income, the AR Accountant role will determine the steps to complete within this sub process based on the Program Income Method obtained during the review of the Award Profile Terms and Conditions. The Program Income Methods are as follows: Match (Cost Share) Additional Add/Deduct Deduct The “Add Modification Notes” step will be completed for all Program Income Methods (excluding Non-Reportable Program Income). Portion of Business Process Flow covered in this section Roles Applicable to Sub Process AR Accountant Page 22 of 49 Add Award Modification Notes for Program Income Detailed description: The AR Accountant role will record the Reportable Program Income earned as an Award Modification note to the Award. This is specifically important for any additional type program income as the sponsored budget will be increased for additional program income and included in the Award Funded amount. With the program income amount recorded here in Award Modifications, it will be easier to determine, of the Total Award Funded, what portion is program income vs. Sponsored Funded. Other details will be recorded here as well. The Award Modifications page will also aid in determining the amount of additional program income “earned to date” to determine if the sponsor limit has been reached for the Add/Deduct Method. Once the limit is reached for the Award, then the subsequent program income will be recorded as Deduct. Navigation: Grants > Awards > Award Profile 1. Enter the Project number from the Program Income Oversight into the selection criteria of the Award Profile Search Page to access the Award for which the project is related and click the “Search” pushbutton. 2. At the Award Profile Page, select the “Award Modifications” hyperlink at the bottom of the page; this will display the Award Modifications page. Award Profile Page Page 23 of 49 Award Modifications Page 3. At the Award Modifications page, select the “period” icon to access the “Award Modifications for Period” page. Note: Each Budget Period will have a separate line on this page; make sure the correct period is selected based on when the program income was earned. Award Modifications for Period 4. Use the (+) plus sign to add an Award Modification sequence and enter below fields. Field Values and Descriptions for the Award Modifications for Period Page Field Values Entered Description Modification Type Program Income This is the Program Income Method for the amount Method that is being recorded. Use drop down and select value. Reference Award Enter Deposit ID, Use this field to record the Program Income source Number Invoice Number or document number. Use the specific Program Journal ID. Oversight query to obtain the source document number – Deposit ID, Invoice Num or Journal ID. Page 24 of 49 Issue Date Enter Date on Source Document Begin Date Defaults End Date Defaults Amount Amount of Additional ONLY Comments Icon Select Icon and enter Project ID and amounts for Match or Deduct Award Modifications This field is the date of the source document. Refer to the specific Program Oversight query to obtain the date of the source document. This is the Begin Date of the Budget Period; keep default. This is the End Date of the Budget Period; keep default. This Amount field records the amount of program income earned – Only the Additional program income amounts will be recorded here as this amount will be added to the Total Period Amount. Deduct and Match Program Income amounts will be recorded in the Comments box. This comments box will be used to record the Project ID that earned the Program income and if the Program Income Method is Match or Deduct, enter the method and amount. 1. Once all values have been entered, click the “Ok” pushbutton. 2. At the Award Modifications page, click the “Save” pushbutton. 3. Continue to the next step based on the Program Income Method for the Award. Important Notes: For the Add/Deduct method, determine the amount of program income “earned to date” to verify if the Sponsor Limit has been reached. It may be necessary to record two Award Modification sequence rows here, one to represent the amount of additional up to Sponsored Limit and one to record remaining balance of program income as the deduct. Page 25 of 49 Processing Program Income Match Method Detailed description: The Program Income Match method is a form of Cost Share as this Program Income will be used by the Academic Department to match some of the research expenses. The AR Accountant role will create a GL Journal to reclass the Match method program Income to a Program Income Revenue account with Non-Sponsored chartfield values and this income will be used to fund Cost Share expenditures. In addition, a review of the Project Budget will be completed to determine if a Cost Share Budget has been created during Award Setup for the Match Method program income, if not then a cost share budget adjustment will be created. 1. Create the GL Journal to reclass the Program Income. See the “Create GL Journal to move Program Income to NonSponsored Program” step to create this GL Journal. 2. Review the Project Activity page and write down the funded F&A rate to calculate the Direct and Indirect amounts for the Cost Share Budget Adjustment. Navigation: Grants > Awards > Project Activity – F&A Rates Tab Page 26 of 49 3. If not already established during Award Setup, create a Cost Share Budget adjustment for the total amount of the anticipated Match Method program income per the Terms and Conditions, if specified, OR for the amount that is currently being recorded. Navigation: Grants > Awards > Project Budgets The Analysis Type CBU denotes that this budget row is a Cost Share Budget row. Page 27 of 49 Field Values and Description for the Budget Details page Field Values Entered Description Fund Enter valid Fund This is the Fund value for the Budget row; Sponsored Funds begin in the 3XXX range. If the budget row is for Cost Share a Non-Sponsored Fund must be used. This field is required. DeptID Enter DeptID This is the DeptID value for the Budget row. This field is required. Program Enter Program; if This is the Program value for the Budget row; applicable Sponsored budget rows do not required this field value. If the budget row is for Cost Share a Non-Sponsored Program must be used. Activity Enter “1” This is the “Project” Activity value for the Budget row. This field is required. The value in this field will always be “1”. Analysis Type BUD or CBU This is the Analysis Type value for the Budget row; Sponsored budget rows will have the value of “BUD” and Cost Share budget rows the value of “CBU. This field is required. Account Defaults This is the Account value for the Budget row. This value will default when the Budget Item is selected. This Account value is the Level 2 COA Budget Account value. This field is required. Cost Share (CS) Blank or “CS” This is the Cost Share value for the Budget row; for Sponsored budget rows this field is Blank. If the budget row is for Cost Share this field must be “CS”. Budget Item Select from list This is the Budget Item value for the Budget row; select the appropriate budget category for the budget row. This field will default the Level 2 Account value. This field is required. Quantity Enter 1.00 This is the quantity value for the Budget row. This field is not required. Amount Enter Amount This is the Amount of the Budget row. 4. Once all values have been entered, click the “Save” button. 5. To launch the PC_WRAPPER budget finalization process, click the “ ” push button. This will post the budget to Commitment Control and Project Costing. 6. Select the Process Monitor hyperlink to monitor PC_WRAPPER for completion. 7. Once PC_WRAPPER has completed, verify that the Budget Finalization process has no errors by accessing the Budget Detail General Page after finalization. See “Award Setup – Finalize Project Budget” Desk procedures on how to complete this verification. 8. Send email notification to the department (cc: SFR Accountant/Billing Specialist) that the Match Method Program Income has been recorded and a Cost Share Budget has been established (if applicable). Page 28 of 49 Processing Program Income Additional Method (Add/Deduct) Detailed description: The Program Income Additional (Add/Deduct) Method is when the program income earned will be added to the amount allowable for project costs. The AR Accountant role will create a GL Journal to reclass the Additional program Income to a Program Income Revenue account with Sponsored chartfield values. The Program Income revenue side of the Journal Entry will include the ProjectID and a GPA analysis type to indicate the Program Income Method (GPA = Additional). In addition, the Project Budget will be increased for the amount of the program income earned. 1. Create the GL Journal to reclass the Program Income from the Sponsored Program Income Unapplied Cash account to the Program Income Revenue account. Navigation: General Ledger > Journals > Create/Update Journal Entries Add A New Value Tab Field Values and Description for the Create/Update Journal Entries – Add a New Value Field Values Entered Description Business Unit Enter UMN01 This field is the Business Unit value for General Ledger This field is required. The U of M General Ledger Business Unit is “UMN01”. Journal ID Defaults “Next” This is the Journal ID that will be assigned to the Journal; keep the default of “Next” and the system will assign the next available Journal ID. Journal Date Defaults with This is the date of the Journal; keep default of Today’s Today’s Date Date. 2. Enter the “Add a New Value” values then click the “Add” pushbutton and the Journal Header page will be displayed. Page 29 of 49 Journal Header Field Values and Description for the Journal Header page Field Values Entered Description Ledger Group Actuals This field is the Ledger Group for which the entry will be recorded. Source ONN This is the source of the Journal Entry – ONN – Using this Source will not require a Certified Approver. Journal Class 10010 This is the Sponsored Financial Reporting DeptID. 3. Enter the “Journal Header” values then click the “Lines” tab and the Journal Lines page will be displayed. Page 30 of 49 Journal Lines Note: The Analysis Types will identify Program Income Method for the Program Income Revenue Journal line. GPA = Additional GPD = Deduct TIP – TIP income Field Values and Description for the Journal Lines page Field Values Entered Description Fund Enter valid Fund This is the Fund value for the Journal Line; Sponsored Fund values begin with 3XXX. This is required. DeptID This is the DeptID value for the Journal Line. This is required Enter DeptID Program Enter Program; if This is the Program value for the Journal Line; required for Non-Sponsored or Cost Share applicable Journal Lines. PC Bus Unit UMSPR This is the PC Bus Unit value for the Journal Line; This is required for Sponsored Journal Lines and the value will always be “UMSPR” Project Project ID for This is the Project value for the Journal Line; This is required for Sponsored Journal Lines. oversight query Activity “1” This is the “Project” Activity value; this value will always be “1” for Sponsored Journal Lines ONLY or Blank for Non-Sponsored Journal lines. Analysis Type Per Program This is the Analysis Type value and is required for Sponsored Journal Lines ONLY, available Income Method values includes the following but in not limited to this list: GPA = Additional GPD = Deduct TIP = TIP Income Account Enter Account This is the Account value for the Journal Line; this is the COA Level 3 Actuals account value. Amount Enter Amount This is the Amount of the Journal Line. Reference Enter Project ID This is the Journal Line Reference Field; enter on the Journal Line with the Sponsored Program Income Unapplied Cash Account. Page 31 of 49 4. Enter Journal Line 1; enter values to debit the Sponsored Program Income Unapplied Cash account using an appropriate chartfield string. The required chartfields string is Fund, DeptID, and Account. (Include the Project ID in the Journal Line Ref Field) 5. Enter Journal Line 2; enter values to credit a Program Income Revenue account using an appropriate Sponsored chartfield string. The required chartfields string is Fund, DeptID, PC Bus Unit, Project ID, Activity, Analysis Type and Account 6. Click the “Save” pushbutton. 7. In the “Process” drop down box at the top of page select “Edit Journal”; then click the process pushbutton to edit the journal. 8. Once the edit process is complete, verify that the Journal Status and Budget Status is “V”. 9. In the “Process” drop down box at the top of page select “Submit Journal”; then click the process pushbutton to submit the journal for SFR workflow approval. Click “OK” at the warning. Page 32 of 49 10. Review the Project Activity page and write down the funded F&A rate to calculate the Direct and Indirect amounts for the Budget Adjustment. Navigation: Grants > Awards > Project Activity – F&A Rates Tab 11. Write down the funded F&A rate and calculate the Direct and Indirect amounts for the Budget Adjustment. Page 33 of 49 12. Create a Budget Adjustment to increase the Project Budget for the amount of Program Income earned. Navigation: Grants > Awards > Project Budgets Page 34 of 49 Field Values and Description for the Budget Details page Field Values Entered Description Fund Enter valid Fund This is the Fund value for the Budget row; Sponsored Funds begin in the 3XXX range. If the budget row is for Cost Share a Non-Sponsored Fund must be used. This field is required. DeptID Enter DeptID This is the DeptID value for the Budget row. This field is required. Program Enter Program; if This is the Program value for the Budget row; Sponsored applicable budget rows do not required this field value. If the budget row is for Cost Share a Non-Sponsored Program must be used. Activity Enter “1” This is the “Project” Activity value for the Budget row. This field is required. The value in this field will always be “1”. Analysis Type BUD or CBU This is the Analysis Type value for the Budget row; Sponsored budget rows will have the value of “BUD” and Cost Share budget rows the value of “CBU. This field is required. Account Defaults This is the Account value for the Budget row. This value will default when the Budget Item is selected. This Account value is the Level 2 COA Budget Account value. This field is required. Cost Share (CS) Blank or “CS” This is the Cost Share value for the Budget row; for Sponsored budget rows this field is Blank. If the budget row is for Cost Share this field must be “CS”. Budget Item Select from list This is the Budget Item value for the Budget row; select the appropriate budget category for the budget row. This field will default the Level 2 Account value. This field is required. Quantity Enter 1.00 This is the quantity value for the Budget row. This field is not required. Amount Enter Amount This is the Amount of the Budget row. 13. Once all values have been entered, click the “Save” button. 14. To launch the PC_WRAPPER budget finalization process, click the “Finalize” push button. This will post the budget to Commitment Control and Project Costing. 15. Select the Process Monitor hyperlink to monitor PC_WRAPPER for completion. 16. Once PC_WRAPPER has completed, verify that the Budget Finalization process has no errors by accessing the Budget Detail General Page after finalization. See “Award Setup” Desk procedures on how to complete this verification. 17. Send email notification to the department (cc: SFR Accountant/Billing Specialist) that the Additional Program Income has been recorded and the Project Budget has been increased for the Amount of the Additional Program Income. Important Note: If the Program Income Method is Add/Deduct, follow the Additional Program Income steps for the portion that is Additional and follow the Deduct Program Income steps for the portion that is Deduct. Page 35 of 49 Processing Program Income Deduct Method Detailed description: The Program Income Deduct Method is when the program income earned will be deducted from the amount reimbursed by the sponsor. The AR Accountant role will create a GL Journal to reclass the Deduct program Income to a Program Income Revenue account with Sponsored chartfield values. The Program Income revenue side of the Journal Entry will include the ProjectID and a GPD analysis type to indicate the Program Income Method (GPD = Deduct). Also, a contract amendment will be process to lower the Billing Limit for the amount of the Deduct Program Income. This will ensure that invoicing will not exceed the authorized amount. NOTE: The Project Budget will NOT be changed as the Program Income is deducted from the amount reimbursed by the sponsor. 1. Create the GL Journal to reclass the Program Income from the Sponsored Program Income Unapplied Cash account to the Program Income Revenue account. Navigation: General Ledger > Journals > Create/Update Journal Entries Add A New Value Tab Field Values and Description for the Create/Update Journal Entries – Add a New Value Field Values Entered Description Business Unit Enter UMN01 This field is the Business Unit value for General Ledger This field is required. The U of M General Ledger Business Unit is “UMN01”. Journal ID Defaults “Next” This is the Journal ID that will be assigned to the Journal; keep the default of “Next” and the system will assign the next available Journal ID. Journal Date Defaults with This is the date of the Journal; keep default of Today’s Today’s Date Date. 2. Enter the “Add a New Value” values then click the “Add” pushbutton and the Journal Header page will be displayed. Page 36 of 49 Journal Header Field Values and Description for the Journal Header page Field Values Entered Description Ledger Group Actuals This field is the Ledger Group for which the entry will be recorded. Source ONN This is the source of the Journal Entry – ONN – Using this Source will not require a Certified Approver. Journal Class 10010 This is the Sponsored Financial Reporting DeptID. 3. Enter the “Journal Header” values then click the “Lines” tab and the Journal Lines page will be displayed. Page 37 of 49 Journal Lines Note: The Analysis Types will identify Program Income Method for the Program Income Revenue Journal line. GPA = Additional GPD = Deduct TIP – TIP income Field Values and Description for the Journal Lines page Field Values Entered Description Fund Enter valid Fund This is the Fund value for the Journal Line; Sponsored Fund values begin with 3XXX. This is required. DeptID This is the DeptID value for the Journal Line. This is required Enter DeptID Program Enter Program; if This is the Program value for the Journal Line; required for Non-Sponsored or Cost Share applicable Journal Lines. PC Bus Unit UMSPR This is the PC Bus Unit value for the Journal Line; This is required for Sponsored Journal Lines and the value will always be “UMSPR” Project Project ID for This is the Project value for the Journal Line; This is required for Sponsored Journal Lines. oversight query Activity “1” This is the “Project” Activity value; this value will always be “1” for Sponsored Journal Lines ONLY or Blank for Non-Sponsored Journal lines. Analysis Type Per Program This is the Analysis Type value and is required for Sponsored Journal Lines ONLY, available Income Method values includes the following but in not limited to this list: GPA = Additional GPD = Deduct TIP = TIP Income Account Enter Account This is the Account value for the Journal Line; this is the COA Level 3 Actuals account value. Amount Enter Amount This is the Amount of the Journal Line. Reference Enter Project ID This is the Journal Line Reference Field; enter on the Journal Line with the Sponsored Program Income Unapplied Cash Account. Page 38 of 49 4. Enter Journal Line 1; enter values to debit the Sponsored Program Income Unapplied Cash account using an appropriate chartfield string. The required chartfields string is Fund, DeptID, and Account. (Include the Project ID in the Journal Line Ref Field) 5. Enter Journal Line 2; enter values to credit a Program Income Revenue account using an appropriate Sponsored chartfield string. The required chartfields string is Fund, DeptID, PC Bus Unit, Project ID, Activity, Analysis Type and Account 6. Click the “Save” pushbutton. 7. In the “Process” drop down box at the top of page select “Edit Journal”; then click the process pushbutton to edit the journal. 8. Once the edit process is complete, verify that the Journal Status and Budget Status is “V”. 9. In the “Process” drop down box at the top of page select “Submit Journal”; then click the process pushbutton to submit the journal for SFR workflow. Page 39 of 49 Complete a contract amendment to lower the Billing Limit. 1. Navigate to the Contracts Header General Information Page – Navigational Path: Customer Contracts > Create and Amend > General Information – use Search page to the access Contract 2. Then navigate to the Contract Terms Page by clicking on the “Lines” tab, then the “Details” tab in the Contract Lines section, and then select the “Contract Terms” hyperlink. Related Projects Page 3. Select the Amend Contract pushbutton (this will take you to the Contract Amendment page). 4. Click on the “Related Projects” tab to navigate back to the contract terms page and the Billing Limit amount field will be open. Decrease the amount of the Billing Limit by the amount of the Deduct Program Income. 5. Click Save 6. Navigate back to the Contract Amendment Page by clicking on the “Contract Amendment” tab. 7. Complete the Contract Amendment page; see below: Page 40 of 49 Contract Amendment Page New Amendment Field Values and Descriptions for the Contract Amendment Page Field Values Entered Description Amendment Defaults (display Displays an amendment number. Upon the initial only) entry of a new amendment, the system automatically assigns the amendment a value. Amendment Type Select Type Displays an amendment type, which is a high-level category of amendments. Reason Select Reason Displays an amendment reason, which provides viewers with a quick reference as to why an amendment was initiated. Processing Date Defaults Current Displays the date on which the amendment is Date eligible for processing. Amendment Status Defaults (display Displays the Amendment's processing status; only) available values are: Pending, Ready, Completed and Cancelled. Detail hyperlink Select and add Opens the Amendment Details Page. Click to enter detail if necessary details, such as the negotiated amount and discount per Modification change of the contract attributes that are being amended. This page is where the “Amend Status” is changed and the Amendment in Processed. Review notes Add Notes (if Click to review notes attached to this amendment. hyperlink necessary) These notes can be standard notes or custom. 8. Click on the “Details” hyperlink (this will open the Amendment Details Page) Page 41 of 49 Amendment Details Page – Amendment Status Pending Change Amendment status to Ready Note the old and new value for the Billing Limit 9. Change “Amend Status” to “Ready” (“Process Amendment” pushbutton will appear) 10. Click the “Save” pushbutton. Amendment Details Page – Amendment Status Ready 11. Click on the “Process Amendment” Page 42 of 49 pushbutton. Amendment Details Page – Amendment Status is now Complete Contract Amendment Page – Amendment 12. Send email notification to the department (cc: SFR Accountant/Billing Specialist) that the Deduct Program Income has been recorded for the project. Page 43 of 49 Understanding the Program Income Process as it applies to Rate Based Contracts The intent of this section is to highlight how the Managing Program Income Business process affects Rate Based Contracts in other Sponsored Business processes. Rate Based Contracts - Pricing of Program Income Revenue transactions The Project Costing Cost Collection job, which includes the PC_PRICING job, will collect Program Income Revenue transactions just like it collects other expense transactions that are collected for Rate Based Contracts. An actuals transaction will be inserted into the PROJ_RESOURCE table; then these transactions will be “Priced” which will create and insert a billable transaction. A billable transaction is a transaction with a “BIL” analysis type and is used in the billing process. Since revenue transactions are credits, the PC_PRICING job will create a negative billable transaction. See query results below: Query of PROJ_RESOURCE for selected fields: Page 44 of 49 Rate Based Contracts – Invoicing billable rows including Prog Income The negative billable transactions created from program income transaction will offset positive billable transaction created from expense transactions, therefore, spending out the program income prior to billing the sponsor. The Sponsor invoice will reflect a credit and lower the amount due. See below an Invoice reflecting the negative Program Income billable transaction: RATE BASED Invoice Expense details listed and the Indirect Cost rate can be verified. Program Income will be a reflected as a credit on the Invoice lowering the total amount due. Page 45 of 49 Rate Based Contracts – Budget Adjustments: When and Why Only the Program Income Additional or Match Method will require a budget adjustment. In the case of Additional, the income is added to the amount allowable for project costs, therefore an increase to the project budget is needed. For Match, it is the Cost Share Budget that is increased to allow for Cost Share expenses to be collected and reported for the Sponsored Project. Rate Based Contracts – Billing Limit Adjustments: When and Why Only the Program Income Deduct Method will require a billing limit adjustment. Since there will be a reduction in the amount the Sponsor is required to fund, lower the Billing Limit for the amount of the Deduct Program income. Rate Based Contracts – Reporting Program Income For Reporting, a query will be used to query the PROJ_RESOURCE table and collect the program income revenue transactions for a specified project. The analysis types of GPA, GPD or TIP on the program income revenue transactions will reflect the Program Income Method for reporting purposes. Analysis will be completed to identify the amount to report and this amount will be entered (Plugged In) on the Report form template. Page 46 of 49 Rate Based Contracts – Accounting and Revenue Recognition Prog Income The revenue recognition process will recognize revenue on all “Billable” transactions stored in the PROJ_RESOURCE table. Billable transactions are transaction with a “BIL” Analysis Type. The revenue recognition process will update the GL Distribution flag for these transactions to indicate revenue has been recognized. Since the program income revenue transactions created “Billable” transactions, the revenue recognition process will create accounting entries for these transactions. The result is a negative debit to unbilled AR and a negative credit to revenue. This will offset revenue recognition for the related positive billable transactions created for expenses. See below “T” Accounts illustrating the accounting entries created per the Managing Program Income Process as it relates to Rate Based Contracts. Page 47 of 49 Understanding the Program Income Process as it applies to Amount Based Contracts The intent of this section is to highlight how the Managing Program Income Business process affects Amount Based Contracts in other Sponsored Business processes. Important Note: During the Project Costing Cost Collection job for Amount Based Contracts the expense transactions collected will not be priced and a billable transaction will not be created. Amount Based Contracts – Invoicing/Billing Event Adjustments Prog Income The amount to bill for Amount Based Contracts is on the Billing Event in Contracts module. Specify only the amount to be billed to the sponsor. Adjust Billing Events for the “Deduct” portion of Program Income ONLY. The Program Income Amount will be displayed in the comments section of the Invoice Form Template. See below for Invoice example: AMOUNT BASED Invoice Page 48 of 49 Amount Based Contracts – Budget adjustments: When and Why Same as Rate Based - Only the Program Income Additional or Match Method will require a budget adjustment. In the case of Additional, the income is added to the amount allowable for project costs, therefore an increase to the project budget is needed. For Match, it is the Cost Share Budget that is increased to allow for Cost Share expenses to be collected and reported for the Sponsored Project. Amount Based Contracts – Reporting Program Income Same as Rate Based - For Reporting, a query will be used to query the PROJ_RESOURCE table and collect the program income revenue transactions for a specified project. The analysis types of GPA, GPD or TIP on the program income revenue transactions will reflect the Program Income Method for reporting purposes. Analysis will be completed to identify the amount to report and this amount will be entered (Plugged In) on the Report form template. Amount Based Contracts – Revenue Recognition w/Prog Income Amount Based Contracts will recognize revenue based on the Invoice Creation and for the Amount of the Invoice. This revenue recognition process is called “Billing Manages Revenue”. The accounting entries are a debit to Accounts Receivable and a credit to revenue. Page 49 of 49