Figure 1. Employers Provide Health Benefits to More than

advertisement

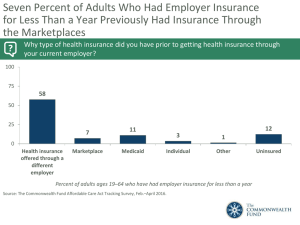

Figure 1. Employers Provide Health Benefits to More than 160 Million Working Americans and Family Members Numbers in millions, 2006 Military 3.4 (1%) Uninsured 47.0 (16%) Employer 163.3 (55%) Individual 16.0 (5%) Uninsured 46.4 (18%) Military 3.4 (1%) Employer 160.8 (62%) Individual 15.8 (6%) Medicaid 27.9 (9%) Medicaid 27.9 (11%) Medicare 39.1 (13%) Total population = 296.7 Medicare 6.4 (2%) Under-65 population = 260.7 Source: S. R. Collins, C. White, and J. L. Kriss, Whither Employer-Based Health Insurance? The Current and Future Role of U.S. Companies in the Provision and Financing of Health Insurance (New York: The Commonwealth Fund, Sept. 2007). Data: Current Population Survey, Mar. 2007. Figure 2. Individual Market Insurance Is Not an Affordable Option for Many People Adults ages 19–64 with individual coverage or who thought about or tried to buy it in past three years who: Total Health problem No health problem <200% poverty 200%+ poverty 34% 48% 24% 43% 29% Found it very difficult or impossible to find affordable coverage 58 71 48 72 50 Were turned down or charged a higher price because of a pre-existing condition 21 33 12 26 18 Never bought a plan 89 92 86 93 86 Found it very difficult or impossible to find coverage they needed Source: S. R. Collins, J. L. Kriss, K. Davis, M. M. Doty, and A. L. Holmgren, Squeezed: Why Rising Exposure to Health Care Costs Threatens the Health and Financial Well-Being of American Families (New York: The Commonwealth Fund, Sept. 2006). Figure 3. People with Employer Insurance Have More Stable Coverage than Those with Individual Market Insurance Retention of initial insurance over a two-year period, 1998–2000 Retained initial insurance status One or more spells uninsured Other transition 2% 12% 26% 53% 86% 21% Employer insurance Individual insurance Source: K. Klein, S. A. Glied, and D. Ferry, Entrances and Exits: Health Insurance Churning, 1998–2000 (New York: The Commonwealth Fund, Sept. 2005). Data: Authors’ analysis of the 1998–2000 Medical Expenditure Panel Survey. Figure 4. Percent of Uninsured Children Declined Since Implementation of SCHIP, But Gaps Remain 1999–2000 2005–2006 U.S. Average: 12.0% U.S. Average: 11.3% WA VT NH ME NH WA ND MT VT MT MN OR ID NY WI SD MI WY PA IA NE CA OH IN NV UT IL CO MA KS MO WV VA KY NJ RI CT MN OR ID MI PA IA NE CA IL CO KS MO AZ NM MS TX AL NC AZ GA NM OK LA TX GA FL AK 16% or more 10%–15.9% AL LA FL HI SC AR MS AK VA TN SC AR WV KY TN OK OH IN NV UT MA RI NY WI SD WY DE MD DC NC ME ND HI 7%–9.9% Less than 7% Source: J. C. Cantor, C. Schoen, D. Belloff, S. K. H. How, and D. McCarthy, Aiming Higher: Results from a State Scorecard on Health System Performance (New York: The Commonwealth Fund, June 2007). Updated data: Two-year averages 1999–2000, updated with 2007 CPS correction, and 2005–2006 from the Census Bureau’s March 2000, 2001 and 2006, 2007 Current Population Surveys. NJ CT DE MD DC Figure 5. Number of States with 23 Percent or More Uninsured Nonelderly Adults Rose from 2 to 9 in Last Six Years 1999–2000 2005–2006 U.S. Average: 17.3% U.S. Average: 20.1% WA VT NH ME NH WA ND MT VT MT MN OR ID NY WI SD MI WY PA IA NE CA OH IN NV UT IL CO MA KS MO WV VA KY NJ RI CT MN OR ID MI PA IA NE CA IL CO KS MO AZ NM MS TX AL NC AZ GA NM OK LA TX GA FL AK 23% or more 19%–22.9% AL LA FL HI SC AR MS AK VA TN SC AR WV KY TN OK OH IN NV UT MA NY WI SD WY DE MD DC NC ME ND HI 14%–18.9% Less than 14% Source: J. C. Cantor, C. Schoen, D. Belloff, S. K. H. How, and D. McCarthy, Aiming Higher: Results from a State Scorecard on Health System Performance (New York: The Commonwealth Fund, June 2007). Updated data: Two-year averages 1999–2000, updated with 2007 CPS correction, and 2005–2006 from the Census Bureau’s March 2000, 2001 and 2006, 2007 Current Population Surveys. NJ RI CT DE MD DC Figure 6. The Majority of Uninsured Adults Are in Working Families Adults ages 19–64 with any time uninsured Not currently employed 36% Full-time 49% No worker in family 21% At least one full-time worker 67% Only part-time worker(s) 11% Part-time 15% Adult work status Family work status Note: Percentages may not sum to 100% because of rounding. Source: S. R. Collins, K. Davis, M. M. Doty, J. L. Kriss, and A. L. Holmgren, Gaps in Health Insurance: An All-American Problem (New York: The Commonwealth Fund, Apr. 2006). Figure 7. Employer-Provided Health Insurance, by Income Quintile, 2000–2006 Percent of population under age 65 with health benefits from employer 100% 90% 88% 88% 87% 80% 86% 85% 84% 70% 77% 77% 62% 60% 60% 50% 75% 57% 87% 84% 74% 87% 83% 74% 87% 82% 72% 86% 82% Highest Quintile Fourth 72% Third 55% 54% 54% 53% 40% 30% 29% 26% 25% 23% 23% 20% 22% 22% 10% Second Lowest quintile 0% 2000 2001 2002 2003 2004 2005 2006 Source: E. Gould, The Erosion of Employment-Based Insurance: More Working Families Left Uninsured, EPI Briefing Paper No. 203 (Washington, D.C.: Economic Policy Institute, Nov. 2007). Figure 8. Uninsured Rates High Among Adults with Low and Moderate Incomes, 2001–2005 Percent of adults ages 19–64 Insured now, time uninsured in past year 75 Uninsured now 49 50 16 25 28 24 26 9 9 9 52 53 15 16 28 33 37 37 15 17 18 0 2001 2003 2005 Total 35 Low income 13 11 17 2001 2003 2005 11 41 24 28 2001 2003 2005 Moderate income 13 7 6 16 18 9 9 7 9 4 3 4 2 7 3 2001 2003 2005 2001 2003 2005 Middle income High income Note: Income refers to annual income. In 2001 and 2003, low income is <$20,000, moderate income is $20,000–$34,999, middle income is $35,000–$59,999, and high income is $60,000 or more. In 2005, low income is <$20,000, moderate income is $20,000–$39,999, middle income is $40,000–$59,999, and high income is $60,000 or more. Source: The Commonwealth Fund Health Insurance Surveys (2001, 2003, and 2005). Figure 9. Workers Who Are Offered, Eligible for, and Participate in Their Employer’s Health Plan, by Firm Size and Hourly Wage Percent of working adults^ ages 19–64 100 Employer offers a plan Eligible for employer plan Covered through own employer 75 50 51 42 50 98 89 95 83 75 57 45 34 25 21 0 Less than $15/hr More than $20/hr Small employer (fewer than 50 employees) Less than $15/hr More than $20/hr Medium to large employer (50 or more employees) ^ Includes both part-time and full-time workers. Source: S. R. Collins, C. Schoen, D. Colasanto, and D. A. Downey, On the Edge: Low-Wage Workers and Their Health Insurance Coverage (New York: The Commonwealth Fund, Apr. 2003). Updated data from The Commonwealth Fund Biennial Health Insurance Survey (2005). Figure 10. Percent Uninsured Workers by Firm Size and Hourly Wage Percent of working adults^ ages 19–64 who are uninsured 75 50 39 25 15 17 1 0 Less than $15/hr More than $20/hr Small employer (fewer than 50 employees) Less than $15/hr More than $20/hr Medium to large employer (50 or more employees) ^ Includes both part-time and full-time workers. Source: S. R. Collins, C. Schoen, D. Colasanto, and D. A. Downey, On the Edge: Low-Wage Workers and Their Health Insurance Coverage (New York: The Commonwealth Fund, Apr. 2003). Updated data from The Commonwealth Fund Biennial Health Insurance Survey (2005). Figure 11. Nonstandard Workers Are Less Likely to Have Health Insurance Coverage Through Their Own Job, 2001 100% 80% 12% 3% 11% 60% 40% 74% Uninsured 1% 24% 5% 10% 39% 20% 21% 0% Standard All nonstandard workers workers Medicare/Medicaid/ other government source Other source of health insurance Spouse/family member plan Own employer's health insurance Notes: Self-employed independent contractors are excluded from analysis. “Other source of health insurance” includes insurance from the individual market, from another job, from a previous job, or from an association, school, or other unidentified source. Source: E. Ditsler, P. Fisher, and C. Gordon, On the Fringe: The Substandard Benefits of Workers in Part-Time, Temporary, and Contract Jobs (New York: The Commonwealth Fund, Dec. 2005). Data: Authors’ analysis of the 2001 Contingent Work Supplement to the Current Population Survey. Figure 12. Distribution of Uninsured Young Adults Ages 19–29, by Poverty Status and Race/Ethnicity, 2005 Other 7% 200% FPL or more 28% Less than 100% FPL 41% 100%– 199% FPL 31% Hispanic 32% White 46% African American 15% Uninsured young adults = 13.3 million Source: S. R. Collins, C. Schoen, J. L. Kriss, M. M. Doty, and B. Mahato, Rite of Passage? Why Young Adults Become Uninsured and How New Policies Can Help (New York: The Commonwealth Fund, updated Aug. 8, 2007). Data: Analysis of the March 2006 Current Population Survey by S. Glied and B. Mahato for The Commonwealth Fund. Figure 13. Percent Uninsured, Children and Young Adults, by Poverty Level, 2005 Percent Uninsured Children Age 18 and Under Young Adults Ages 19–29 Total 11% 30% <100% FPL 20 51 100%–199% FPL 16 42 7 16 >200% FPL Source: S. R. Collins, C. Schoen, J. L. Kriss, M. M. Doty, and B. Mahato, Rite of Passage? Why Young Adults Become Uninsured and How New Policies Can Help (New York: The Commonwealth Fund, updated Aug. 8, 2007). Data: Analysis of the March 2006 Current Population Survey by S. Glied and B. Mahato for The Commonwealth Fund. Figure 14. Uninsured Rates Are High Among Hispanics and African Americans, 2005 Percent of adults ages 19–64 75 Insured now, time uninsured in past year Uninsured now 14 50 28 25 62 9 33 20 8 18 13 Total White 0 13 48 19 African Hispanic American Note: Because of rounding, totals above stacked bars may not reflect the sum of each insurance category. Source: M. M. Doty and A. L. Holmgren, Health Care Disconnect: Gaps in Coverage and Care for Minority Adults (New York: The Commonwealth Fund, Aug. 2006). Figure 15. More Than Half of Unemployed Adults Are Uninsured Percent uninsured, 2005 100 80 52 60 40 20 18 15 All nonelderly adults Employed nonelderly Unemployed adults nonelderly adults 0 Source: J.L. Lambrew, How the Slowing U.S. Economy Threatens Employer-Based Health Insurance (New York: The Commonwealth Fund, Nov. 2001). Updated with data from the Commonwealth Fund Biennial Health Insurance Survey (2005). Figure 16. Lower Income Workers Are Least Likely to Be Eligible for COBRA* Other insurance 20% Uninsured 6% COBRAeligible 40% Other insurance 8% ESI** small firm 11% COBRA-eligible 75% Uninsured 32% ESI** small firm 8% Below 200% poverty 200% poverty or more * The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers with 20 or more employees to offer continuation of health insurance coverage to former employees. ** Employer-sponsored insurance coverage. Source: L. Duchon, C. Schoen, M. M. Doty, K. Davis, E. Strumpf, and S. Bruegman, Security Matters: How Instability in Health Insurance Puts U.S. Workers at Risk (New York: The Commonwealth Fund, Dec. 2001). Figure 17. People with Disabilities in the Waiting Period for Medicare in 2007, by Source of Coverage Uninsured 264,504 (15%) Non-Group 150,121 (9%) Employer 567,501 (33%) Medicaid 644,520 (37%) CHAMPUS 106,697 (6%) Total people currently in waiting period = 1,733,343 Note: Number of people in the waiting period was estimated using the number of SSDI awards to disabled workers, widowers, and adult children in 2004 and 2005 from the Social Security Administration Annual Statistical Supplement (2005 and 2006). Source: S. R. Collins, K. Davis, and J. L. Kriss, An Analysis of Leading Congressional Health Care Bills, 2005-2007: Part I, Insurance Coverage (New York: The Commonwealth Fund, Mar. 2007). Figure 18. Nearly One-Quarter of Medicare Beneficiaries Were Uninsured Just Before Enrolling Percent of Medicare beneficiaries ages 50–70 75 50 25 41 24 38 18 11 0 All on Medicare Ages 65–70 Ages 50–64, Less than 200% poverty disabled 200% poverty or more Source: S. R. Collins, K. Davis, C. Schoen, M. M. Doty, S. K. H. How, and A. L. Holmgren, Will You Still Need Me? The Health and Financial Security of Older Americans (New York: The Commonwealth Fund, June 2005). Data from the Commonwealth Fund Survey of Older Adults, 2004. Figure 19. Lacking Health Insurance for Any Period Threatens Access to Care Percent of adults ages 19–64 reporting the following problems in past year because of cost: Insured all year Insured now, time uninsured in past year Uninsured now 75 60 59 50 25 39 43 18 33 36 39 37 10 44 13 49 28 15 0 Did not fill a Did not see Skipped Had medical Any of the four prescription specialist when medical test, problem, did access needed treatment, or not see doctor problems follow-up or clinic Source: S. R. Collins, K. Davis, M. M. Doty, J. L. Kriss, and A. L. Holmgren, Gaps in Health Insurance: An All-American Problem (New York: The Commonwealth Fund, Apr. 2006). Figure 20. Adults Without Insurance Are Less Likely to Be Able to Manage Chronic Conditions Percent of adults ages 19–64 with at least one chronic condition* Insured all year Insured now, time uninsured in past year Uninsured now 75 58 59 50 27 25 18 35 16 0 Skipped doses or did not fill Visited ER, hospital, or both for chronic prescription for chronic condition condition because of cost * Hypertension, high blood pressure, or stroke; heart attack or heart disease; diabetes; asthma, emphysema, or lung disease. Source: S. R. Collins, K. Davis, M. M. Doty, J. L. Kriss, and A. L. Holmgren, Gaps in Health Insurance: An All-American Problem (New York: The Commonwealth Fund, Apr. 2006). Figure 21. Many Americans Have Problems Paying Medical Bills or Are Paying Off Medical Debt Percent of adults ages 19–64 who had the following problems in past year: Uninsured during the year Insured all year Total 75 53 50 25 42 23 26 26 16 13 8 14 29 21 18 34 26 9 0 Not able to pay Contacted by medical bills collection agency* Had to change Medical bills/ way of life to pay debt being paid medical bills off over time * Includes only those who had a bill sent to a collection agency when they were unable to pay it. Source: S. R. Collins, K. Davis, M. M. Doty, J. L. Kriss, and A. L. Holmgren, Gaps in Health Insurance: An All-American Problem (New York: The Commonwealth Fund, Apr. 2006). Any medical bill problem or outstanding debt Figure 22. One-Quarter of Adults with Medical Bill Burdens and Debt Were Unable to Pay for Basic Necessities Percent of adults ages 19–64 with medical bill problems or accrued medical debt: Percent of adults reporting: Total Insured all year Insured now, time uninsured during year Uninsured now 19% 28% 40% Unable to pay for basic necessities (food, heat or rent) because of medical bills 26% Used up all of savings 39 33 42 49 Took out a mortgage against your home or took out a loan 11 10 12 11 Took on credit card debt 26 27 31 23 Source: S. R. Collins, K. Davis, M. M. Doty, J. L. Kriss, and A. L. Holmgren, Gaps in Health Insurance: An All-American Problem (New York: The Commonwealth Fund, Apr. 2006).